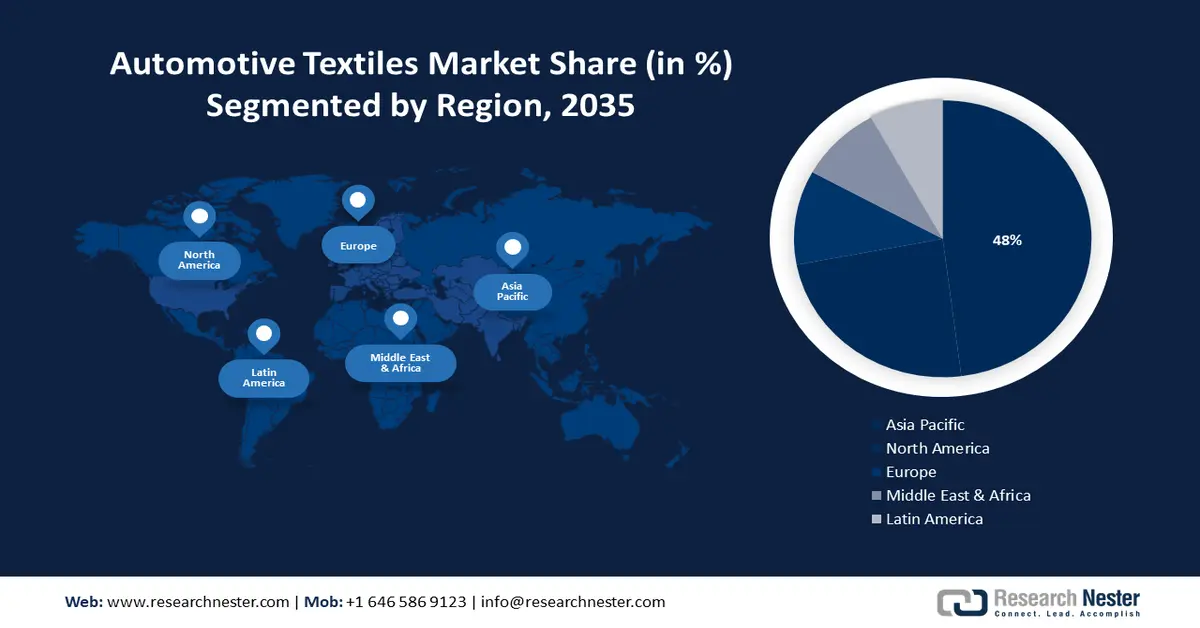

Automotive Textiles Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to dominate majority revenue share of 48% by 2035. Asia Pacific has benefited from demographic dividends and fast economic growth in the past two decades, with robust growth in auto sales in China. In 2023, the World Economic Forum confirmed that China was the world’s biggest auto exporter and BYD, a domestic manufacturer became the biggest single electric car maker by the end of 2022. The company’s overseas sales rose by 334% in 2023. The booming automobile manufacturing sector in the region is set to proliferate the overall market growth.

Attributed to Japan’s fourth position in the automotive & transportation market value, and the presence of several globally leading automobile manufacturers such as Suzuki, Mazda, and many more in this region. According to a report by the International Trade Administration in 2024, the automobile industry in Japan constitutes about 2.9% of its GDP while more than 13.9% of manufacturing GDP.

There is an increasing population in China that demands automobiles and technical textiles. The market is driven by the presence of a large number of local players comprising Changshu Automotive trim, China Shenma Industry, China New trend Group, Huamao Group, Jiangsu Hengli Group, Hebei Berger Phoenix tape Weaving, Jiangsu Yueda textile Group, Junma tyre Cord, Kuangda Group, and Hebei Berger Phoenix tape Weaving, among several others.

North America Market Insights

The automotive textiles market in North America will also encounter huge growth during the forecast period, accounting for the second-largest revenue share. This growth is led by the increase in vehicle production and sales. A recent report by Research Nester in 2024 estimated that more than 7 million automobiles were sold in the first 6 months of 2024. This registered a gain of 2.3% as compared to the previous year. Moreover, urbanization is also predicted to act as a growing factor for the market in this region. According to the UN-Habitat, it is predicted that in 2018, about 82% of the North American population lived in urban areas.

The growing sales of cars in the U.S. are expected to grow the automotive textiles market in this country. According to a report in 2024, auto sales in the U.S. are projected to grow 5% with sales of about 6 million in 2024 which is an increase of about 3.5% from 2023.

In Canada, there is a high demand for various vehicles such as electric and passenger vehicles which acts as a demand for the market in this country. A recent report in 2024, sales of light vehicles in Canada are expected to gain a growth rate of about 9.6% with more than 1.9 million unit sales.