Automotive Steering System Market Outlook:

Automotive Steering System Market size was over USD 29.37 billion in 2025 and is poised to exceed USD 53.1 billion by 2035, growing at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive steering system is estimated at USD 30.98 billion.

The growth of the market can be attributed to the growing number of autonomous cars along with the rising demand for power steering systems amongst automobile users worldwide. Autonomous cars are driven by themselves by using in-vehicle technologies and sensors. Nowadays, key manufacturers are investing huge amounts of money to enhance the features of such cars and the trend of owning autonomous cars is notably prevalent in the global population. For instance, it was found that there were more than 30 million autonomous cars being driven on road globally in 2019 globally.

Global automotive steering system market trends such as recent advancements in power steering technology and electronic control units (ECUs), the demand for power steering systems is on the rise amongst automotive users, which in turn, is expected to create massive revenue generation opportunities for the key players operating in the global automotive steering system market during the forecast period. It is estimated that some modern motor vehicles have up to 150 ECUs. Also, the electric power steering electronic control unit (ECU) calculates the need for assisting power based on the torque being applied to the steering wheel, the steering wheel position, and the vehicle's speed. Hence, such factors are anticipated to boost market growth over the forecast period.

Key Automotive Steering System Market Insights Summary:

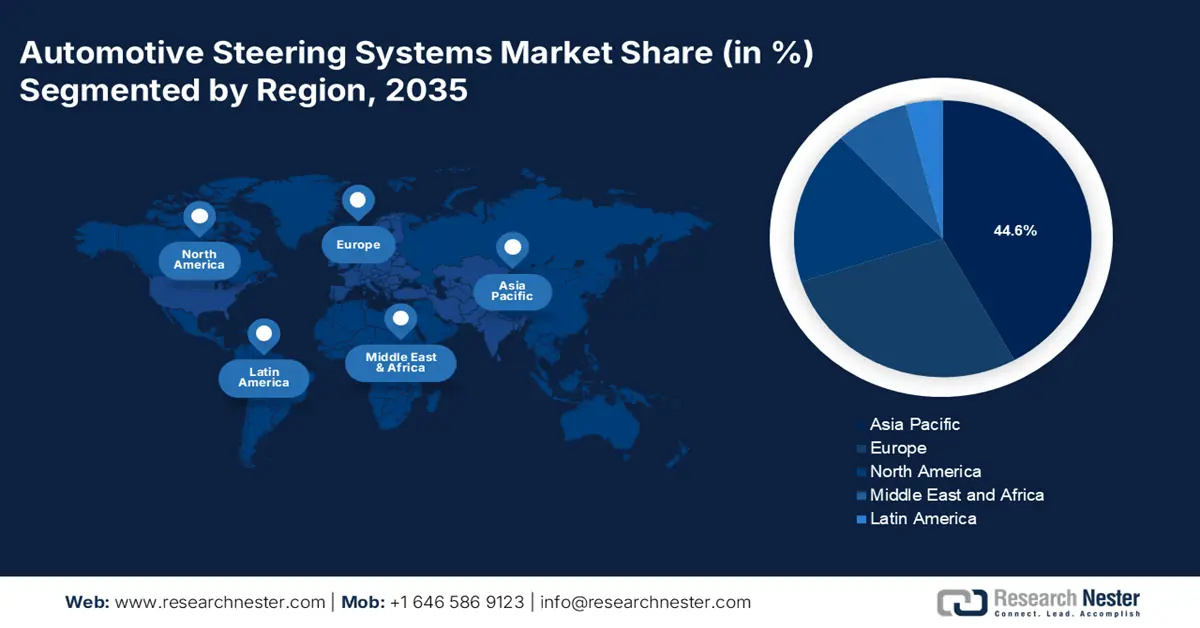

Regional Highlights:

- Asia Pacific automotive steering system market is predicted to capture 44.6% share by 2035, driven by rising smart driving-assist tech and increasing vehicle demand.

- North America market will achieve significant growth during the forecast timeline, driven by high EV production volume and strong manufacturer presence.

Segment Insights:

- The electronic steering segment in the automotive steering system market is expected to hold the largest share by 2035, driven by rising demand for EPS technology in passenger cars.

Key Growth Trends:

- Growing Demand for Steering Wheels

- Increasing Demand for Fuel-Efficient Cars owing to High Carbon Emission

Major Challenges:

- Possibility of Failing Steering Rack Mount

- Concern about Power Steering Fluid Leaks

Key Players: JTEKT Corporation, Hella KGaA Hueck & Co., Nexteer Automotive Corporation, ZF Friedrichshafen AG, Robert Bosch GmbH, NSK Steering Systems Co., Ltd., Mando Corp., Mitsubishi Electric Corporation, China Automotive Systems, Inc., ThyssenKrupp AG.

Global Automotive Steering System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.37 billion

- 2026 Market Size: USD 30.98 billion

- Projected Market Size: USD 53.1 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Automotive Steering System Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Steering Wheels – It is estimated that by 2025, the revenue of steering wheels, bars, or boxes for motor vehicles in Brazil will account for more than USD 1 billion across the globe.

- A motor vehicle's steering system comprises some basic parts such as the steering wheel, steering shaft, column, and others. In modern times, where automated technology is spreading in every industry, the automotive industry isn’t left untouched. Investors and key manufacturers are spending large capital in the development of more enhanced autonomous cars to win over their competitors in the market. The rising demand for the steering wheel is expected to boost the growth of the automotive steering system market in the forecasted period.

- Increasing Demand for Fuel-Efficient Cars owing to High Carbon Emission – as the transport sector accounts for more than 20% of global carbon dioxide (CO2) emissions in 2020. Autonomous cars are fuel efficient and beneficial to decrease the utilization of fuel that makes more popular among the global population. Furthermore, it is also observed that nearly 23% of the fuel-efficient vehicles cost approximately 6% less compared to the other type of vehicles.

- Surge in the Penetration of Electromechanical Steering Systems – In 2022, electromechanical steering systems were estimated to be used in around 70% of the cars globally, as it consumes less fuel and provides new comfort and safety features. Furthermore, over 28% of the cars were observed to be using electromechanical steering systems currently, since is electrically controlled and required only when driver needs it.

- Rising Sales of Passenger Cars – For instance, it is forecasted that India will touch approximately 5 million car sales in 2023.

- Higher Utilization of Automated Steering System in Electric Vehicle (EVs) – For instance, in 2022, approximately 100,000 electric vehicles (EVs) were sold out across the globe which was estimated to witness significant growth of sales volume of around 500% from 2019.

Challenges

- Possibility of Failing Steering Rack Mount - Steering rack mount failure can be very dangerous since in this situation, the driver may lose control over car steering wheel that can lead to severe accidents. Furthermore, it takes excessive effort to move the steering wheel and a sound of clicking and clunking can be heard every time. Therefore, this factor may limit the growth of the market over the forecast period.

- Concern about Power Steering Fluid Leaks

- High-Cost Expenditure on Research & Development (R&D)

Automotive Steering System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 29.37 billion |

|

Forecast Year Market Size (2035) |

USD 53.1 billion |

|

Regional Scope |

|

Automotive Steering System Market Segmentation:

Technology Segment Analysis

The global automotive steering system market is segmented and analyzed for demand and supply by technology into manual steering, electronic steering, hydraulic steering, and electro-hydraulic steering. Out of these types of technologies, the electronic steering segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the growing demand for electronic power steering (EPS) along with the surge in the implementation in passenger cars worldwide. For instance, over 30% of passenger cars had EPS technology in India in 2020. Electronic steering system is becoming more common in the cars and replacing traditional power steering system. By installing electronic steering system, manufactures can save the cost of fluid drive belt, pump, pulley, hoses, and others. In modern cars, electric power steering (EPS) is almost mandatory.

Vehicle Type Segment Analysis

The global automotive steering system market is also segmented and analyzed for demand and supply by vehicle type into passenger cars, light commercial vehicles, and heavy commercial vehicles. Amongst these segments, the heavy commercial vehicles segment is expected to garner a significant share. The segment is expected to grow on the back of higher utilization of automotive steering system in trucks and utility vehicles globally. Automotive steering system in trucks and utility vehicles provides additional energy weather its electric or hydraulic. It decreases the manual effort in maneuvering and parking. Hence, growth in the industrialization coupled with remarkable demand for transportation within countries is projected to hike the growth of the segment over the forecast period. For instance, in 2021, approximately 4 million units of heavy commercial vehicles (HCVs) were sold out across the globe.

Our in-depth analysis of the global market includes the following segments:

|

By Technology |

|

|

By Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Steering System Market Regional Analysis:

APAC Market Insights

Asia Pacific region is poised to dominate around 44.6% market share by 2035, driven by rising smart driving-assist tech and increasing vehicle demand. For instance, it is projected that by 2025, nearly 70% of all new vehicles sold in China will have smart high-level driving-assist functions. Furthermore, growth in the regional automotive industry is baked by the higher manufacturing of automotive components and parts and escalating inclination of population to own luxury cars are further anticipated to expand the market size during the forecast period. For instance, nearly 34 million passenger cars were sold out in Asia Pacific in 2021 and around 6 million passenger cars were sold out in Japan alone in the similar year.

North America Market Insights

Furthermore, the global automotive steering system market is anticipated to witness significant growth in North America region as well. The growth of the market in this region can be ascribes to the higher production volume of electric vehicles and presence of many key manufacturers. For instance, approximately 15 million units of light electric vehicle were sold out in the United States in 2021. Therefore, all these factors are anticipated to boost the market growth in the region over the forecast period.

Automotive Steering System Market Players:

- JTEKT Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hella KGaA Hueck & Co.

- Nexteer Automotive Corporation

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- NSK Steering Systems Co., Ltd.

- Mando Corp.

- Mitsubishi Electric Corporation

- China Automotive Systems, Inc.

- ThyssenKrupp AG

Recent Developments

-

JTEKT Corporation has developed "Pairdriver", a human-centered automated steering control system, that realizes safe driving by sharing the steering of the vehicle between the driver and automation. Pairdriver is a remarkable response to the upcoming expansion of automated driving by making it seamless and providing an enhanced steering collaboration between driver and automation along with automated lane tracing.

-

Nexteer Automotive Corporation expanded the output capabilities of its pinion electric power steering (EPS) systems for meeting the needs of heavier electric vehicles (EVs) in segments B through D. The Dual Pinion-Assist EPS and Single Pinon-Assist EPS are new high output options that also joins the High-Out Rack Assist EPS system that was launched by the company before.

- Report ID: 4638

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Steering System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.