Automotive Starter Motor Market Outlook:

Automotive Starter Motor Market size was valued at USD 20.89 billion in 2025 and is likely to cross USD 40.71 billion by 2035, expanding at more than 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive starter motor is assessed at USD 22.19 billion.

The automotive starter motor market has been experiencing significant growth owing to the mounting customer requirements for better fuel efficiency and higher vehicle performance. Automakers are investing in advancing the starter motors, which are leading to the development of high-quality lightweight components with enhanced performance as well as minimal emissions. Improved technological development in starter motors stems from efficiency requirements to achieve rapid and smooth engine boot-ups, lowering vehicle fuel usage, along with enhancing operational efficiency. The popularity of start-stop technology is leading to an increased requirement for starter motors, that execute several start-stop sequences efficiently, and maintaining vehicle performance levels.

Starter motors have become widespread throughout passenger cars as well as commercial vehicles attributed to the requirements from manufacturers to enhance fuel economy and decrease environmental pollutant production. The automotive starter motor market is witnessing increased demand, owing to the increasing global automobile production, substantially to 94 million vehicles in 2023, from 85 million vehicles in 2022, and automakers are seeking enhanced, reliable, and efficient solutions to power the rising number of road vehicles.

Key Automotive Starter Motor Market Insights Summary:

Regional Highlights:

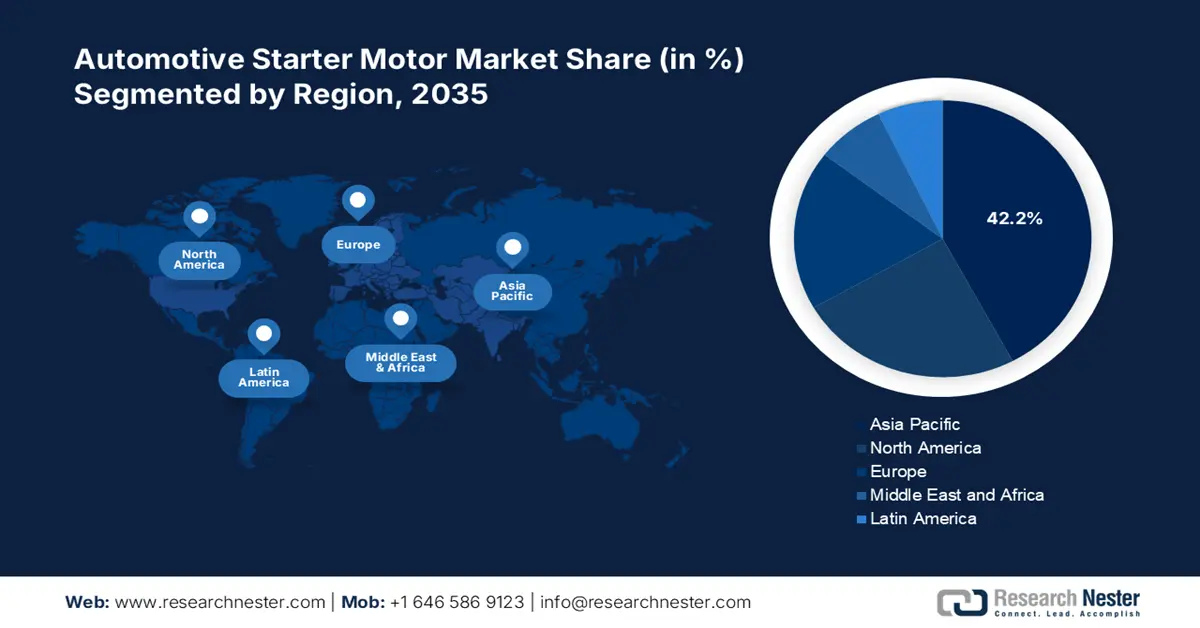

- Asia Pacific dominates the Automotive Starter Motor Market with a 42.2% share, driven by increasing vehicle production and expansion of the automotive industry, fueling strong growth through 2026–2035.

Segment Insights:

- Commercial Vehicles segment are anticipated to capture over 66% market share by 2035, fueled by rising demand for transportation and energy-efficient starter motors.

Key Growth Trends:

- Expansion of electric and hybrid vehicles

- Rise in vehicle electrification

Major Challenges:

- Adoption of advanced start-stop systems

- Consolidation of automotive suppliers

- Key Players: Hella KgaA Hueck & Co., BorgWarner Inc., Mahle GmbH, Prestolite Electric, and Lucas Electrical.

Global Automotive Starter Motor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.89 billion

- 2026 Market Size: USD 22.19 billion

- Projected Market Size: USD 40.71 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, India, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Automotive Starter Motor Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of electric and hybrid vehicles: The rapid expansion of hybrid and electric vehicles is anticipated to create lucrative opportunities for the growth of the automotive starter motor market. Specialized starter motors that serve electric and hybrid powertrains have become essential, owing to the growing demand for electric vehicles. Traditionally operated starter motors require modification to work with electric-powered and hybrid vehicles, therefore enabling a smooth connection between internal combustion engines and electrical motors. Businesses have been making major investments to produce starter motors that perform under hybrid and electric vehicle conditions.

- Rise in vehicle electrification: There has been an increasing demand for efficient and high-performance starter motors owing to the modern vehicle shift toward electric-power assisted components. Advanced starter motors offer reliable performance to meet the emerging demand for electrified vehicles, due to the increasing adoption of electrified systems by automakers. At present, the starter motors experience adaptations to meet the specific power requirements and distinctive operational needs of electric and hybrid vehicles, to control electric motor and internal combustion engine power transitions efficiently.

Automotive suppliers together with manufacturers are working on producing advanced starter motors, designed for electrified vehicles. German startup DeepDrive secured an investment of USD 33.5 million in September 2024 to expand their new electric motor production for better efficiency at reduced cost. The new motor offers advanced capabilities to manage rising electrical consumption in vehicles by operating electric power steering systems and other electrical components while pushing automotive starter technology development.

Challenges

- Adoption of advanced start-stop systems: The advanced start-stop system automatically powers down the engine of the vehicle, when it is idle, before restarting it when needed. This reduces the frequency of engine starts, and the implementation of start-stop systems makes a direct impact on traditional starter motors, as these systems rely on alternative technologies including the integrated starter generators. These generators provide improved efficiency as well as space savings and accomplish smoother operation and superior fuel economy, hampering the growth of the starter motors industry.

- Consolidation of automotive suppliers: The development of starter motors and its technological progress is limited due to decreased market competition following the automotive parts suppliers' consolidation. Larger suppliers in the automotive starter motor market restrict smaller companies from entering with their distinctive or more economical starter motor solutions. The market consolidation between suppliers is expected to innovate speed as it restricts automotive manufacturers from pursuing advanced efficient starter motor solutions.

Automotive Starter Motor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 20.89 billion |

|

Forecast Year Market Size (2035) |

USD 40.71 billion |

|

Regional Scope |

|

Automotive Starter Motor Market Segmentation:

Vehicle Type (Passenger Cars, Commercial Vehicles)

Commercial vehicles segment is set to capture automotive starter motor market share of over 66% by 2035, attributed to the increasing demand for transportation and logistics services. Trucks, buses, and delivery trucks, for instance, are significant for global supply chains and e-commerce. As industries increase their activities, the number of vehicles per unit of population or industrial output tends to increase. In addition, the need for robust and dependable starter motors for these vehicles has increased.

In addition, urbanization and the development of new roads are expected to fuel the demand for heavy-duty vehicles, therefore, increasing automotive starter motor market growth. These policies are anticipated to affect commercial vehicles’ starter motor technology, owing to a higher focus on fuel efficiency as well as the ecological effects of fuel. To comply with strict emission standards and lower fuel consumption in commercial vehicles, manufacturers are all set to make starter motors more durable and energy efficient.

Application Type (Internal Combustion Engine, Hybrid/Micro-Hybrid Powertrain)

The internal combustion engine segment in automotive starter motor market is expected to account for a significant revenue during the forecast period, attributed to the continual demand for conventional vehicles, particularly in developing economies. Even though electric vehicles are gaining popularity, ICE vehicles are still the most popular vehicle type globally, as they are cost-effective, accessible, and have a long-established infrastructure. As vehicle sales continue to increase, especially in regions with emerging automotive starter motor markets, the demand for reliable and efficient starter motors to support ICE vehicles remains strong.

The automobile manufacturers are looking to enhance the engine performance and efficiency in consuming fuel. In turn, this is raising the demand for more advanced starter motors. Companies are introducing high-efficiency starter motors, which target modern ICE vehicles, focusing particularly on energy efficiency with high-performance. Such innovations help improve engine startup performance, reduce emissions, and provide higher reliability in ICE vehicles, further fueling the demand for starter motors.

The automobile manufacturers are looking to enhance the engine performance and efficiency in consuming fuel. In turn, this is raising the demand for more advanced starter motors. Companies are introducing high-efficiency starter motors, which target modern ICE vehicles, focusing particularly on energy efficiency with high performance. Such innovations help improve engine startup performance, reduce emissions, and provide higher reliability in ICE vehicles, further fueling the demand for starter motors.

Our in-depth analysis of the global market includes the following segments:

|

Vehicle Type |

|

|

Application Type |

|

|

Type |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Starter Motor Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific in automotive starter motor market is likely to dominate over 42.2% revenue share by 2035. The growth is attributed to the increasing vehicle production and expansion of the automotive industry in the region. Countries including China, India, and Japan are major manufacturing hubs, with rising demand for passenger and commercial vehicles. Given that the region’s automakers are increasing local and international sales, the requirements for reliable starters in these cars have increased considerably. In addition, rising per capita income as well as growth in the number of middle-class people in the India and China are accelerating vehicle sales that are expanding automotive starter motor markets.

The region is also witnessing significant investments in automotive technology and R&D, which will further lead to the development of more efficient and durable starter motors. There have been partnerships between the companies in the region, that are aimed at enhancing performance and energy efficiency, underscoring the region's focus on improving automotive components for better fuel economy and reduced emissions. These innovations are basic requirements to survive the highly competitive automobile.

The China automotive starter motor market is expected to propel, due to the local government's strong push for electric vehicles. Policies supporting green mobility, such as subsidies for electric vehicle manufacturers and infrastructural development, have rapidly transformed the automotive landscape in China. While EVs do not have traditional starters, an increased hybrid model with internal combustion engines (ICE) and electric powertrains requires a different type of starter to ensure the inclusion of both systems. Owing to this, the manufacturers are developing advanced starter motor solutions for hybrid models in China.

The market in India is expanding, as the automotive starter motor market in India is gaining pace due to the increasing production and sales of commercial vehicles, such as trucks and buses, which are indispensable for the rapidly growing infrastructure projects in the country. As India invests significantly in its road and logistics network, there has been a sharp increase in the demand for heavy-duty commercial vehicles. The country's industrial growth and increasing demand for goods have led to greater transportation needs, which directly boost the demand for durable and high-performance starter motors in these vehicles. As manufacturers strive to improve the reliability of their vehicles, they are also looking to develop starter motors that can withstand harsh environmental conditions.

North America Market

The North America automotive starter motor market is expected to witness a rapid expansion between 2025 and 2035, owing to the increasing demand for premium and luxury vehicles, which often require more advanced and high-performance starter motors. As consumers in this region are prioritizing sophisticated and feature-rich vehicles, automakers are incorporating high-end technologies, including more efficient and durable starter motors, to meet consumer expectations. This has culminated in the design of more specialized starter motors that provide higher performance and reliability, meeting the requirements of high-end car models.

The U.S. automotive starter motor market is increasing, owing to the increase in focus towards green environmentally friendly consumer trends, owing to the higher standards of fuel efficiency and the resulting regulatory pressures. The U.S. car manufacturers have improved their parts of vehicles to satisfy high-emission norms in cars.

The automotive starter motor market in Canada is growing, due to the increasing investments in electric vehicle infrastructure across the country. Canada is actively moving toward a low-carbon economy, supported by government incentives for EV manufacturers and buyers. This shift has created a demand for specialized starter motors that are compatible with electric vehicle systems. In addition, Canada's automobile aftermarkets are fueling the starter motor market. Due to a well-established repair and replacement market, vehicle owners are seeking reliable and economical starter motor solutions.

Key Automotive Starter Motor Market Players:

- Bosch

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Valeo

- Hella KgaA Hueck & Co.

- BorgWarner Inc.

- Mahle GmbH

- Prestolite Electric

- Lucas Electrical

- ASIMCO

- Remy International, Inc.

The competitive landscape of the automotive starter motor market is rapidly evolving, attributed to the integration of advanced technologies in energy management systems by key players. They are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global automotive starter motor market:

Recent Developments

- In November 2024, Siemens Smart Infrastructure unveiled the SIMATIC ET 200SP e-Starter, an innovative electronic starter utilizing silicon carbide MOSFETs. The starter offers ultra-fast, wear-free switching and provides short-circuit protection that is 1,000 times faster than traditional solutions.

- In September 2024, DeepDrive announced it raised USD 33.5 million to scale up the production of its efficient, lower-cost dual rotor electric vehicle motors. The company is collaborating with eight of the world's top ten automakers and expects major contracts soon.

- Report ID: 7187

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Starter Motor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.