Automotive Solenoid Market Outlook:

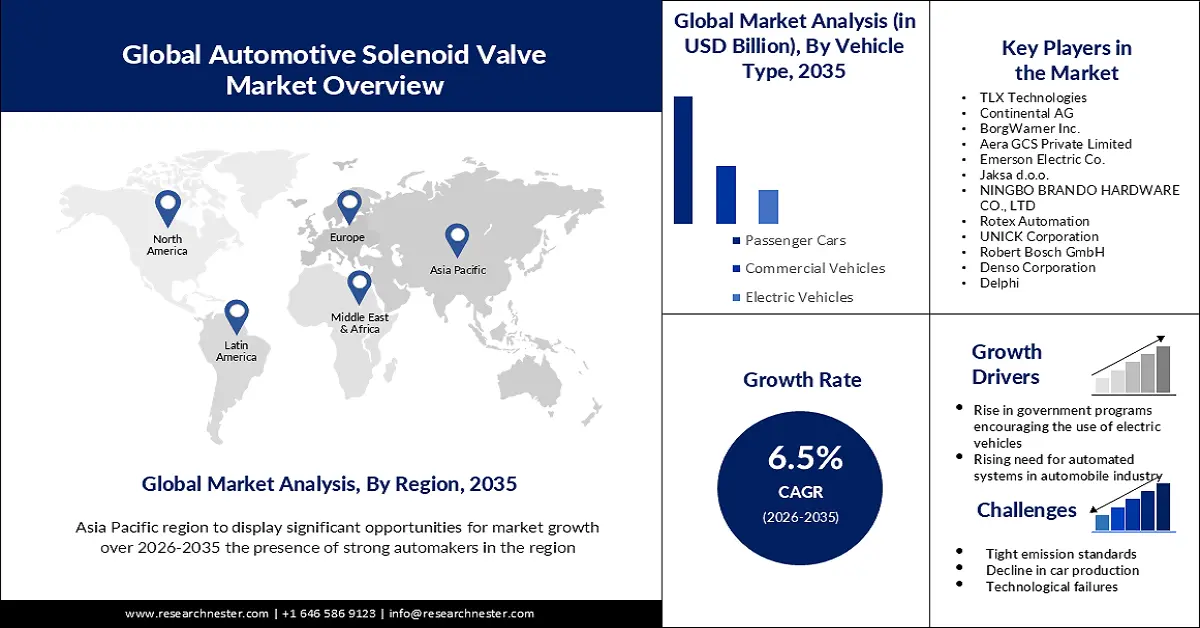

Automotive Solenoid Market size was valued at USD 5.62 billion in 2025 and is set to exceed USD 10.55 billion by 2035, registering over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive solenoid is estimated at USD 5.95 billion.

The major factor contributing to the global increase in the use of automotive solenoids is the expansion of government programmes for fuel-efficient automobiles. For example, in March 2023, the European Union recommended the Net Zero Industry Act, which aims to meet the goals of the European Battery Alliance by having domestic producers meet nearly 90% of the EU's annual battery demand by 2030, with a paired production capacity of no less than 550 GWh. Aiming to achieve a total of 50 GWh in local manufacture, the Indian Production Linked Incentive Scheme on Advanced Chemistry Cell Battery Storage was also established in late 2021. The need for automotive solenoids rises as a result of all these measures, which increase the manufacturing of electric cars worldwide.

In addition to these, the functionality and dependability of solenoid valves are improved by the integration of sensors and electronics. Solenoid valves may now offer real-time data, enhanced control capabilities, and diagnostics thanks to this connection. Manufacturers can take advantage of this by creating novel solenoid valves that incorporate sensors and electronics.

Key Automotive Solenoid Market Insights Summary:

Regional Highlights:

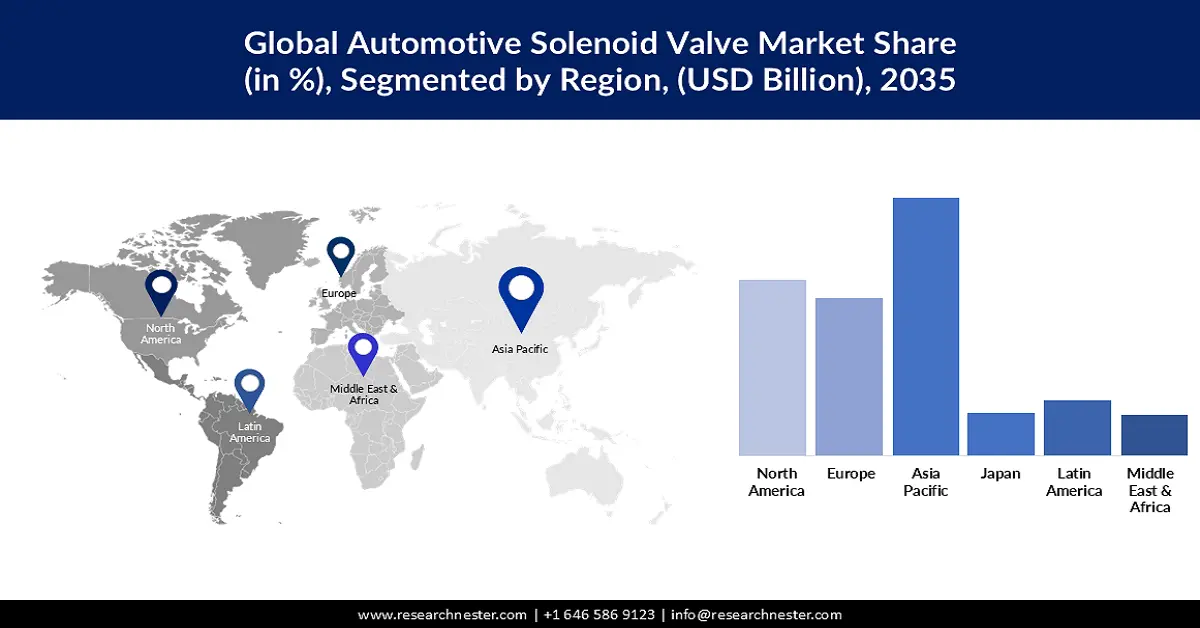

- Asia Pacific automotive solenoid market is projected to capture a 37% share by 2035, driven by the strong presence of significant automakers like China, India, and others.

- North America market is expected to secure a 24% share by 2035, driven by major OEMs investing more in vehicle production and rising car demand in North America.

Segment Insights:

- The passenger cars segment in the automotive solenoid market is forecasted to secure a 57% share by 2035, influenced by the uptake of luxury and inexpensive cars and rising electronic components usage.

- The fluid control segment in the automotive solenoid market is expected to hold a 45% share by 2035, influenced by diverse applications in industries like automotive, healthcare, and manufacturing.

Key Growth Trends:

- Growing Electric Vehicle Usage Fuels Market Expansion

- Growth in the Market is Supported by the Automobile Industry's Growing Need for Automated Systems

Major Challenges:

- Tight emission standards could prevent the market from expanding.

- The recent decline in car production could hinder the market's expansion.

Key Players: TLX Technologies, Continental AG, BorgWarner Inc., Aera GCS Private Limited, Emerson Electric Co., Jaksa d.o.o., NINGBO BRANDO HARDWARE CO., LTD, Rotex Automation, UNICK Corporation Robert Bosch GmbH, Denso Corporation, Delph.

Global Automotive Solenoid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.62 billion

- 2026 Market Size: USD 5.95 billion

- Projected Market Size: USD 10.55 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Thailand, South Korea, Mexico

Last updated on : 11 September, 2025

Automotive Solenoid Market Growth Drivers and Challenges:

Growth Drivers

- Growing Electric Vehicle Usage Fuels Market Expansion- Electric Vehicles in particular need solenoids that optimize every possible joule. Solenoids are widely used in in-vehicle systems. The technology that is most needed to decarbonize road transportation, which is responsible for about 15% of global energy-related emissions is electric automobiles. Due to improved economy, wider model availability, and longer range, sales of electric cars have increased dramatically in recent years. The IEA predicts that over 18% of new cars sold in 2023 will be electric, a sign of the growing popularity of passenger electric vehicles. The need for automotive solenoids is anticipated to rise as electric vehicles gain popularity.

- Growth in the Market is Supported by the Automobile Industry's Growing Need for Automated Systems- Solenoids are used in the automotive industry for a number of purposes, such as gearbox shifting and engine starting. Solenoids have been utilized to secure the vehicle's doors, turn on the four-wheel drive and combustion systems, and control the airflow in the air conditioning system. In addition, solenoids regulate a large number of the vehicle's valves. Pneumatic solenoid valves are widely employed in the automotive sector as an automated system. An internal piston or actuator receives the linear motion generated by a solenoid through the use of a pneumatic control valve. Electronic liquid or gas flow control is made possible by this. Since the electromagnetic field diminishes and the valve returns to its starting position in the absence of current, pneumatic solenoid valves require a steady flow of current in order to remain open. This suggests that scenarios needing automated valve operation, quick valve response, or fail-safe systems can benefit from the use of pneumatic control valves.

- Rise in Government Programmes Encouraging the Use of Electric Vehicles- In the upcoming year, there was a rise in government programmes aimed at promoting the production of electric vehicles, which in turn raised the demand for automotive solenoids. Electric car sales continued to break records in 2022, reaching a 14% market share, despite supply chain disruptions, unstable financial and geopolitical conditions, and higher commodity and energy prices. The rise in electric vehicle sales happened against the backdrop of a global auto industry that was losing ground global car sales in 2022 fell 3% from 2021. Sales of electric vehicles, which comprise plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs), exceeded 10 million last year, a 55% increase from 2021.

Challenges

- Technological Failures- The issue of technological failure is one that major participants in the solenoid valves industry, particularly the direct acting solenoid valves market, frequently encounter. Its acceptance in the automobile sector has been hampered by the possibility of power outages or unequal pressure causing the direct solenoid valves to malfunction and cause serious automotive problems. The causes of malfunctions differ based on the application and kind of solenoid valve. Inadequate or excessive voltage, incorrect valve capacity, media contaminants, pressure drop, incorrect material, or even a poor installation can all be the cause.

- Tight emission standards could prevent the market from expanding.

- The recent decline in car production could hinder the market's expansion.

Automotive Solenoid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 5.62 billion |

|

Forecast Year Market Size (2035) |

USD 10.55 billion |

|

Regional Scope |

|

Automotive Solenoid Market Segmentation:

Vehicle Type Segment Analysis

The passenger cars segment share in the automotive solenoid market is expected to reach 57% by 2035. The market is fueled by a substantial uptake of inexpensive, and luxury automobiles. The growing number of electronic parts used in automobiles and the rising need for vehicle safety systems were the main factors driving the market. Over the course of the projection period, it is anticipated that the growing use of electrical components in the engine and gearbox compartment over the past few decades would enhance demand for automotive solenoids. This is particularly common in commercial vehicles, as the quantity of electronic components is increasing at a notable pace. Over 57 million passenger automobiles were produced globally in 2021.

Function Segment Analysis

Automotive solenoid market from the fluid control segment is expected to have a share of 45% by 2035. The growth of the segment is because of the various applications such as moving fluids and/or particles through a pipe across a system and can be found in the manufacturing, healthcare, or automotive industries. The medium could be commercial gas, compressed air, or other materials like fuel, alkalis, acids, or steam. Solenoids for fluid control are important devices that regulate fluid flow or activate pumps to generate pressure for many uses, including steering and braking. Aside from this, the motion control market is anticipated to grow as more people choose electric automobiles.

Our in-depth analysis of the global automotive solenoid market includes the following segments:

|

Type |

|

|

Protocol |

|

|

Function |

|

|

Vehicle Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Solenoid Market Regional Analysis:

APAC Market Insights

The automotive solenoid market share in APAC is projected to be 37% by 2035. The market's expansion is driven by the strong presence of significant automakers like China, India, and others. For example, China continues to be the world's largest automobile market in terms of annual sales and manufacturing capacity, by 2025, it is expected to produce more than 35 million vehicles domestically.

North American Market Insights

The North America automotive solenoid market is estimated to be the second-largest with 24% revenue share by 2035. The market is expanding as a result of major OEMs investing more in vehicle production and rising car demand in North America. Furthermore, the US has one of the largest automobile markets in the world. In 2020, 14.5 million light vehicles are anticipated to be sold in the US. By 2020, foreign automakers will reportedly create 5 million cars in the US, according to Autos Drive America. Consequently, there is a growing need for automotive solenoids due to the region's increasing vehicle sales. Additionally, North American manufacturers are investing more in the production of electric vehicles (EVs) and batteries, according to the Centre for Automotive Research.

Automotive Solenoid Market Players:

- Mitsubishi Electric Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TLX Technologies

- Continental AG

- BorgWarner Inc.

- Aera GCS Private Limited

- Emerson Electric Co.

- Jaksa d.o.o.

- NINGBO BRANDO HARDWARE CO., LTD

- Rotex Automation

- UNICK Corporation

- Robert Bosch GmbH

- Denso Corporation

- Delphi

Recent Developments

- February 2023: Mitsubishi Electric Corporation announced that it had acquired Scibreak AB, a Swedish company and a manufacturer of direct current circuit breakers (DCCBs). The main purpose of this acquisition is to innovate more advanced DCCB technologies for high voltage direct current systems to support the growth of renewable energy.

- February 2022: TLX Technologies, partnered with Dana to provide electromagnetic solutions for manufacturing an advanced thermal management system for e-Drive units. The design and technology provided by TLX Technologies will help Dana to make a more advanced thermal management system. TLX’s energy-efficient on-off valves and proportional valves will be integrated into Dana’s thermal management system.

- Report ID: 5412

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Solenoid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.