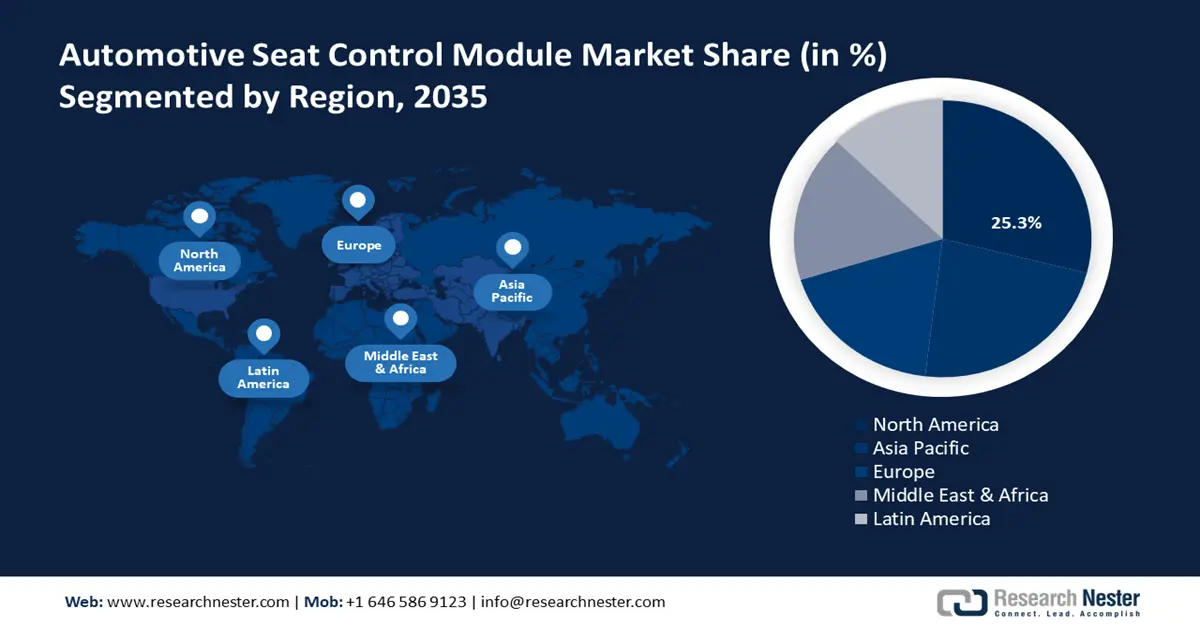

Automotive Seat Control Module Market Regional Analysis:

North America Market Statistics

North America in automotive seat control module market is expected to capture largest revenue share by the end of 2035. It is spurred by technological improvements, consumers' demand for comfort features, and rapid growth in electric vehicles. In today’s era, more power control modules are in demand than traditional manual systems. The key players include Johnson Controls and Lear Corporation, focusing on R&D, strategic partnerships, and innovations by AI and IoT integration to address evolving consumer expectations and compete in the ever-changing landscape.

The landscape for the automotive seat control module market in the U.S. is witnessing substantial growth attributable to the gradual transition to an electrified future that proceeded unabated. For instance, in January 2024, estimates from Kelley Blue Book indicate that in 2023, EVs accounted for 7.6% of the total vehicle market in the U.S. This statistic has risen compared with the growth of EVs from 5.9% in 2022. Evidently, consumers are demanding more lightweight vehicles to experience exceptional driving clubbed with advanced features.

Canada concentrates on fortifying its ties to reputable organizations in the automotive sector. Thus, this action elicits beneficial expertise and achieves the desired profitability, thus driving the automotive seat control module market in the country. For instance, in December 2023, Woodbridge and TM Automotive Seating Systems formed a joint venture (JV) known as TMWB Foam Private Limited. Moreover, it delivered cutting-edge seating systems to bus and commercial vehicle manufacturers. It assisted in accomplishing the essence of the joint venture of further strengthening the competitive position.

Asia Pacific Market Analysis

Asia Pacific automotive seat control module market size is exponentially growing due to the huge production of automobiles and rising demand for comfort features of advanced technology. The local manufacturers have also been integrating smart technologies into their seat control modules, enhancing their functionality. With an increasingly strong middle-class presence in Asia Pacific, vehicle comfort and technology requirements are likely to escalate further, making the Asia Pacific a potential market for innovations in automotive seat control module technologies.

In India, the policy structure for lightweight is experiencing a favorable preference in the automotive industry attributable to the reduction in weight that often features aluminum or magnesium. It improves fuel efficiency. For instance, in December 2022, Global EV sales soared up to 8.6% in 2021, doubling their share from 2020. In addition, Net Zero by 2050, demands that for the global economy to be on track for net-zero emissions by the middle of the century, sales of new passenger vehicles (cars, SUVs, and vans) must reach 31% in 2025, 64% in 2030, and 100% by 2035.

China is strategizing to leverage proficiency through the integration of tech-savvy seat control module systems in its businesses to boost the automotive seat control module market economy. For instance, in June 2024, China imported a reconfigurable seating system advanced in traditional in-cabin vehicle design by Magna. With its fully rotating front seats and long rails, this cutting-edge technology allows for a flexible configuration that maximizes the amount of space inside the cabin. Additionally, this arrangement lengthens the front and rear seats' seat track articulation distance, making the seating arrangement more flexible and adaptable.