Automotive Seat Control Module Market Outlook:

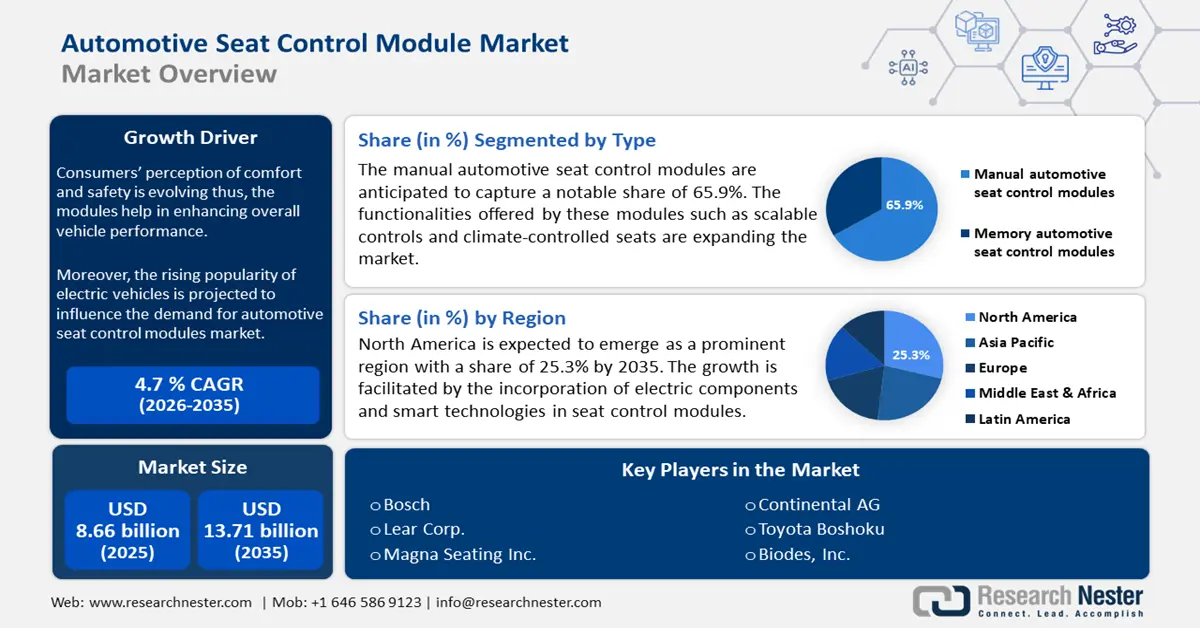

Automotive Seat Control Module Market size was over USD 8.66 billion in 2025 and is poised to exceed USD 13.71 billion by 2035, growing at over 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive seat control module is evaluated at USD 9.03 billion.

The growing demand for automotive seat control modules in the global market is fueled by the surging demand for advanced comfort, safety, and convenience features in vehicles. As consumers prefer more innovative driving experiences, auto manufacturers have been incorporating seat control systems with adjustable seating positions, memory functions, and lumbar support.

The market is also being driven by technological advancements in the interiors of luxury and electric cars for experiencing better comfort and convenience. For instance, in October 2023, a collaboration between Infineon Technologies AG and Eatron Technologies was established to provide cutting-edge machine-learning algorithms and solutions to the AURIXTM TC4x microcontroller (MCU). It aimed to improve vehicle battery management systems (BMS). Demand from buyers for automobiles with advanced features pushes automobile manufacturers to implement state-of-the-art modules for the control of seats, further aiding automotive seat control module market expansion.

Key Automotive Seat Control Module Market Insights Summary:

Regional Highlights:

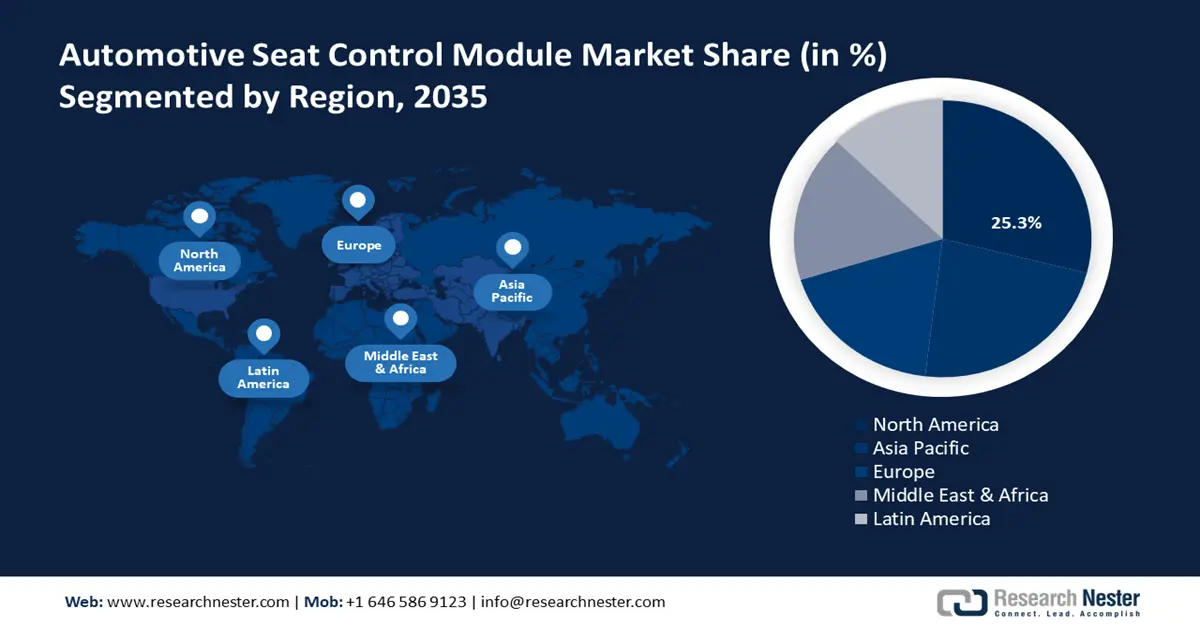

- North America holds a 25.3% share in the Automotive Seat Control Module Market, driven by technological improvements, strengthening its position through 2026–2035.

- The Automotive Seat Control Module Market in Asia Pacific is poised for exponential growth from 2026–2035, attributed to the huge production of automobiles and rising demand for advanced technology and vehicle comfort features in the region.

Segment Insights:

- The Passenger Vehicles segment is poised for substantial growth through 2035, driven by consumer preference for comfort, ergonomic improvements, and technological advancements.

- Manual Automotive Seat Control Modules segment are projected to capture a 65.9% share by 2035, driven by cost benefits and suitability for entry-level to mid-range vehicles.

Key Growth Trends:

- Expansion in vehicle production

- Rising disposable income

Major Challenges:

- Global supply chain disruption

- Elevated development and integration costs

- Key Players: Texas Instruments, APTIV, Toyota Boshoku, NXP Semiconductors NV, Dorman Products Inc., Biodes Inc.

Global Automotive Seat Control Module Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.66 billion

- 2026 Market Size: USD 9.03 billion

- Projected Market Size: USD 13.71 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (25.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, South Korea

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 14 August, 2025

Automotive Seat Control Module Market Growth Drivers and Challenges:

Growth Drivers

- Expansion in vehicle production: The automotive seat control module market is driven by the constant increase in the level of sophistication in seating technology. To reap benefits from the strong macroeconomic factors in the nation, demand in the domestic automotive sector has risen. For instance, in February 2024, Continental Automotive India planned to grow by 12% annually in CY2024. It intended to increase production capacity at its plants in Bengaluru and Manesar with an airbag control unit, telematics control unit, and tire pressure monitoring system sensors. Thus, companies through their contributions strive to change the landscape of the market.

- Rising disposable income: With the advent of enhanced purchasing power, mainly through emerging economies, buyers have begun to shift their demand towards premium and luxury cars, thus driving the automotive seat control module market. For instance, in July 2022, it was revealed that rising disposable income gives thrust to demand for premium vehicles. Every 1% rise in income corresponds to 1.5% rise in advanced seat control modules in luxury cars. The latest automobile offers comfort-oriented seat functionalities in terms of memory settings, warming, and massaging functions.

Challenges

- Global supply chain disruption: The critical shortages of semiconductors pose a significant challenge for the automotive seat control module market. Electronic components are an integral part of seat control systems. Owing to its limited supplies, the car industry has thus significantly slowed down its production pace. Disruptions to the supply and logistics of raw materials are further entrenching delays and pushing up costs, as geopolitical tension and regulatory restrictions feed into these concerns. These challenges strain the automakers' ability to meet demand for advanced seat control modules and result in delayed deliveries of vehicles.

- Elevated development and integration costs: Advanced electronics, sophisticated software, and sophisticated integration with the vehicle's electrical architecture add to research and development and production costs extensively. The cost incurred by the auto manufacturer becomes challenging to balance out for profitability, especially for budget and mid-range vehicles. This may slow down the adoption of advanced seat control, making it possible only for high-end models and also limiting mass-market penetration. High developmental and integration costs pose a major challenge in the automotive seat control module market due to the complexity of designing advanced features.

Automotive Seat Control Module Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 8.66 billion |

|

Forecast Year Market Size (2035) |

USD 13.71 billion |

|

Regional Scope |

|

Automotive Seat Control Module Market Segmentation:

Type (Manual Automotive Seat Control Module, Memory Automotive Seat Control Module)

Manual seat control modules segment is expected to hold over 65.9% automotive seat control module market share by the end of 2035. The manual seat control modules when compared with the cost benefits and utilities of their counterpart modules in entry-level to mid-range vehicles, prove to be the go-to choice for manufacturers. Furthermore, manual seat control modules are the choice of automakers targeting markets where its penetration is cost-effective. In addition, manual seat control systems contain levers and knobs that are durable and dependable attracting customers who consider simple functions. Furthermore, the relatively low cost of manual modules allows automakers to cope with the demand for comfort features.

Vehicle Type (Passengers Vehicles, Commercial Vehicles)

Passenger vehicles are witnessing a steady growth in the automotive seat control module market and demand will continue to surge over the forecast period. For instance, it was reported by the Federation of Automotive Dealers Association (FADA) in August 2024 that, compared to the number of units consumers purchased in July 2023, the adoption of passenger vehicles in India increased by 10% by July 2024. Moreover, this shift in comfort and ergonomics of improvement would go hand in hand. Consumer preferences and technological advancement will further drive the trend of adoption of passenger vehicles.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Vehicle Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Seat Control Module Market Regional Analysis:

North America Market Statistics

North America in automotive seat control module market is expected to capture largest revenue share by the end of 2035. It is spurred by technological improvements, consumers' demand for comfort features, and rapid growth in electric vehicles. In today’s era, more power control modules are in demand than traditional manual systems. The key players include Johnson Controls and Lear Corporation, focusing on R&D, strategic partnerships, and innovations by AI and IoT integration to address evolving consumer expectations and compete in the ever-changing landscape.

The landscape for the automotive seat control module market in the U.S. is witnessing substantial growth attributable to the gradual transition to an electrified future that proceeded unabated. For instance, in January 2024, estimates from Kelley Blue Book indicate that in 2023, EVs accounted for 7.6% of the total vehicle market in the U.S. This statistic has risen compared with the growth of EVs from 5.9% in 2022. Evidently, consumers are demanding more lightweight vehicles to experience exceptional driving clubbed with advanced features.

Canada concentrates on fortifying its ties to reputable organizations in the automotive sector. Thus, this action elicits beneficial expertise and achieves the desired profitability, thus driving the automotive seat control module market in the country. For instance, in December 2023, Woodbridge and TM Automotive Seating Systems formed a joint venture (JV) known as TMWB Foam Private Limited. Moreover, it delivered cutting-edge seating systems to bus and commercial vehicle manufacturers. It assisted in accomplishing the essence of the joint venture of further strengthening the competitive position.

Asia Pacific Market Analysis

Asia Pacific automotive seat control module market size is exponentially growing due to the huge production of automobiles and rising demand for comfort features of advanced technology. The local manufacturers have also been integrating smart technologies into their seat control modules, enhancing their functionality. With an increasingly strong middle-class presence in Asia Pacific, vehicle comfort and technology requirements are likely to escalate further, making the Asia Pacific a potential market for innovations in automotive seat control module technologies.

In India, the policy structure for lightweight is experiencing a favorable preference in the automotive industry attributable to the reduction in weight that often features aluminum or magnesium. It improves fuel efficiency. For instance, in December 2022, Global EV sales soared up to 8.6% in 2021, doubling their share from 2020. In addition, Net Zero by 2050, demands that for the global economy to be on track for net-zero emissions by the middle of the century, sales of new passenger vehicles (cars, SUVs, and vans) must reach 31% in 2025, 64% in 2030, and 100% by 2035.

China is strategizing to leverage proficiency through the integration of tech-savvy seat control module systems in its businesses to boost the automotive seat control module market economy. For instance, in June 2024, China imported a reconfigurable seating system advanced in traditional in-cabin vehicle design by Magna. With its fully rotating front seats and long rails, this cutting-edge technology allows for a flexible configuration that maximizes the amount of space inside the cabin. Additionally, this arrangement lengthens the front and rear seats' seat track articulation distance, making the seating arrangement more flexible and adaptable.

Key Automotive Seat Control Module Market Players:

- Magna Seating Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bosch

- Continental AG

- Hyundai Mobic Co. Ltd.

- Infineon Technologies AG

- HELLA GmBH & Co. KGaA

- Lear Corp.

- ZF Friedrichshafen

- Texas Instruments

- APTIV

- Toyota Boshoku

- NXP Semiconductors NV

- Dorman Products Inc.

- Biodes Inc.

The automotive seat control module market players drive innovation to widen research and development in seat comfort and functionality. These companies use advanced technology and connectivity features that discover integrated solutions to meet dynamic consumer demands. For instance, in January 2023, Infineon Technologies AG and Green Hills Software entered into a partnership. Their collaboration aimed at integrating, Infineon's cutting-edge TRAVEOTM T2G body and cluster microcontrollers with Green Hills' comprehensive field-proven software solutions. Thus, rendered a holistic ecosystem for the deployment of innovative safety applications for the automotive industry.

Companies that are shaping the landscape of the automotive seat control module market are:

Recent Developments

- In October 2024, Lexus unveiled an enhancement to its LX Series, the New LX 700h with a highly advanced hybrid system. The quest for electrification fit for an LX while maintaining its off-road capability, dependability, and durability has been accomplished.

- In July 2024, Hyundai Mobis unveiled its fifth-generation integrated driver system, M.VICS 5.0. It is a 27-inch main screen for dashboard, navigation, and media content featuring a panoramic multi-display.

- Report ID: 6595

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.