Automotive Relay Market Outlook:

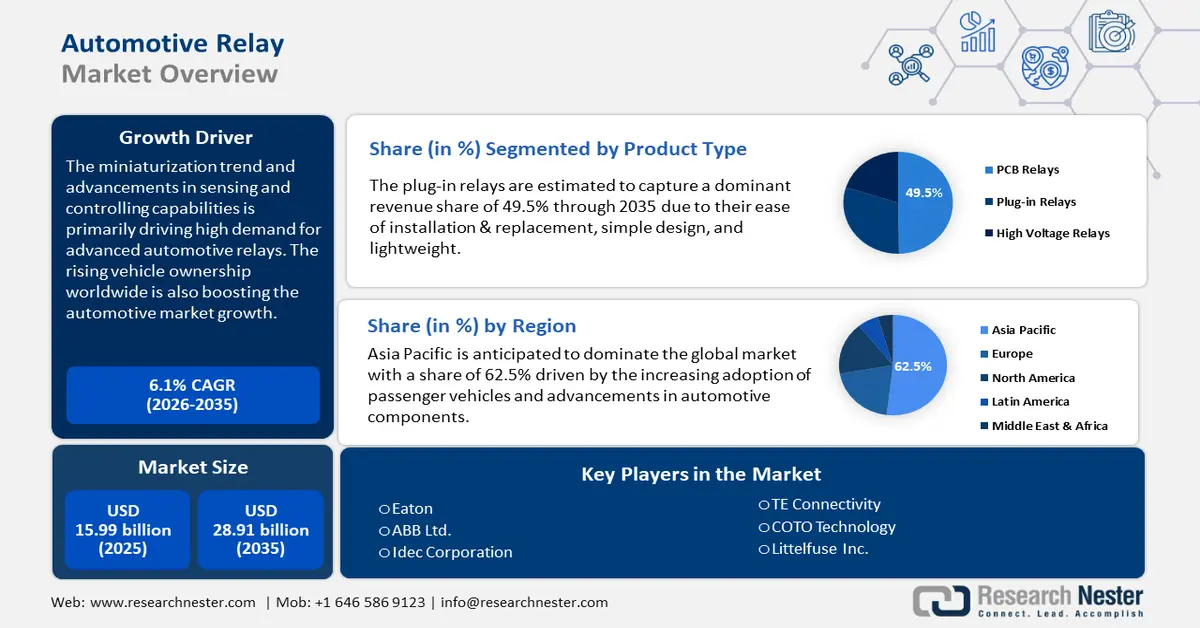

Automotive Relay Market size was valued at USD 15.99 billion in 2025 and is expected to reach USD 28.91 billion by 2035, registering around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive relay is evaluated at USD 16.87 billion.

The growing popularity of electric and hybrid vehicles is driving a substantial expansion in the automotive relay market. Automotive relays act as switches for power supply and control signals and are essential to the functioning of electrical systems in automobiles. Furthermore, the market for automotive relays is expanding due to the increased complexity of electrical systems in automobiles. According to a report by International Energy Agency (IEA) around 14 million new electric vehicles were registered globally in 2023, bringing the total number of vehicles on the road to 40 million.

Throughout the projected period, it is expected that the average number of relays fitted per automobile will climb due to the rising utilization of complex electronic equipment and the increased attention on safety and security. The switching of auxiliary devices for safety, security, communications, and entertainment requires additional relays along with the conventional ones used in powertrain systems. Increased developments in PCB relays to lower overall vehicle weight for better fuel economy are predicted to spur market expansion throughout the projected period.

Key Automotive Relay Market Insights Summary:

Regional Highlights:

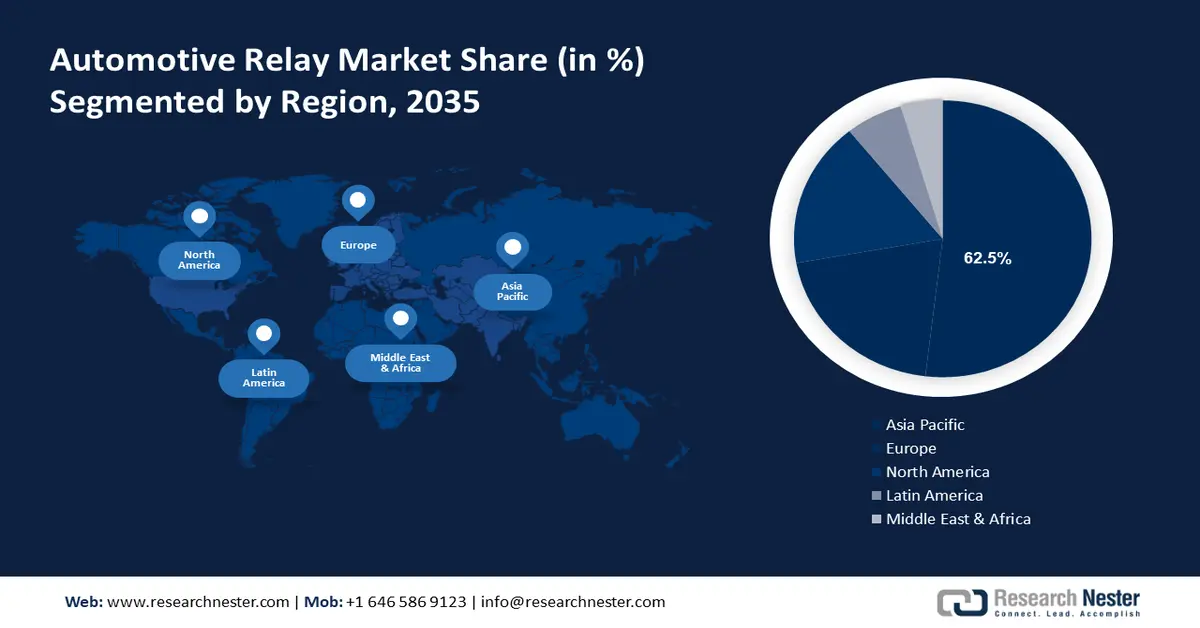

- Asia Pacific automotive relay market will account for 62.50% share by 2035, driven by widespread automobile use and adoption of safety regulations in countries like China and India.

- North America market will register stable CAGR during 2026-2035, driven by rising connectivity demand, vehicle digitization, and growth of small car markets.

Segment Insights:

- The passenger vehicle segment in the automotive relay market is projected to attain a 59.10% share by 2035, fueled by growing preference for e-fuses and integration of electronic systems.

- The pcb relays segment in the automotive relay market is poised for rapid growth over 2026-2035, fueled by rising demand for hybrid/electric vehicles using electronic components.

Key Growth Trends:

- Increasing consumer demand for more convenient and safe vehicles

- Demand for electric, hybrid, and driverless vehicles will raise the requirement for relays with higher switching capabilities

Major Challenges:

- Insufficient uniformity in relay design

- Quick changes in technology

Key Players: ABB, American Zettler, Inc., BETA ELECTRIC INDUSTRY CO., LTD, COTO TECHNOLOGY, Sensata Technologies, Inc., HELLA GmbH & Co. KGaA, Littelfuse, Inc., LS Automotive India Pvt Ltd., and Megatone Electronics Corp.

Global Automotive Relay Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.99 billion

- 2026 Market Size: USD 16.87 billion

- Projected Market Size: USD 28.91 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (62.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Automotive Relay Market Growth Drivers and Challenges:

Growth Drivers

- Increasing consumer demand for more convenient and safe vehicles: The demand for automobiles with additional safety and convenience features has significantly increased in recent years. In response to consumer demand for enhanced comfort and safety features, automakers are providing cutting-edge technologies and amenities. As a result, relays are now utilized more often in these electrical devices. For instance, the number of electronic components in automobiles has increased due to the addition of advanced driver-aid systems (ADAS). Advances in deep learning, artificial intelligence, and cloud mobility have greatly helped the complex processors found in electronic car systems.

- Demand for electric, hybrid, and driverless vehicles will raise the requirement for relays with higher switching capabilities: The increasing trend of engine electrification in passenger cars and commercial vehicles has increased the need for high-voltage DC switches for switching applications. Relays must have an appropriate design to turn them on or off for a variety of electric vehicle (EV) functions, such as HVAC, power steering, battery management systems, and others. For electric cars, relays are utilized for the main, pre-charging, and DC charging connections.

- New auto relay businesses to obtain funding to increase commercial & R&D Capabilities: The goal of new players in the automotive relay market is to provide cutting-edge technologies that will enable automakers to produce higher-quality electronic components. In 2022, Menlo Micro, an American company headquartered in California, completed a Series C financing round, raising USD 150 million. The company creates a 99% reduction in important variables including size, weight, power consumption, and costs compared to typical electromechanical relays using electromechanical and solid-state technology.

Challenges

- Insufficient uniformity in relay design: With the development of electronic systems, automobiles have changed in terms of performance, comfort, safety, and other areas. Automotive relays come in varieties for use by automakers. Compact relays, for example, are tiny versions with a large current carrying capability. For electric vehicles, arc-proof DC power relays guarantee high-voltage DC switching without creating an arc. The standardization of automobile relays is still a source of worry despite the introduction of a wider range of relays. Automotive relays can often be divided into groups based on their various functions and terminal configurations. This adaptability enables the design of a relay based on its usage.

- Quick changes in technology: The quick advancements in technology within the automotive industry have presented several difficulties for the relay industry. Keeping up with the changing demands of the automobile sector is one of the biggest problems. The need for automotive relays is always evolving with the introduction of new technologies like autonomous driving and electric cars. This implies that to satisfy consumer demand, producers must modify their production procedures and create new goods.

Automotive Relay Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 15.99 billion |

|

Forecast Year Market Size (2035) |

USD 28.91 billion |

|

Regional Scope |

|

Automotive Relay Market Segmentation:

Product Type Segment Analysis

The PCB relay segment in automotive relay market is expected to register rapid revenue CAGR during the forecast period. The market for PCB relays is expanding due to the growing demand for hybrid and electric cars. For effective power management and control, these environmentally friendly cars significantly rely on electronic technologies. To ensure the safe and dependable operation of electric vehicles, PCB relays are essential components of motor control units, battery management systems, and charging systems. The majority of electronic devices, including doors, power steering, power windows, sunroof, ABS, and cruise control, employ it.

Vehicle Type Segment Analysis

Based on the vehicle type, the passenger vehicle segment is anticipated to account for more than 59.1% automotive relay market share by the end of 2035. A key factor fueling the segment's growth is consumers' increasing preference for electronic e-fuses over electromagnetic counterparts. The growing preference for electronic e-fuses over electromagnetic alternatives as a result of vehicle modernization is one of the driving forces behind the segment's rise. Furthermore, the incorporation of complex electronic features and systems in passenger cars is due to the ongoing developments in automotive technology.

Our in-depth analysis of the global automotive relay market includes the following segments:

|

Product Type |

|

|

Propulsion |

|

|

Application |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Relay Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is set to account for largest revenue share of 62.5% by 2035. It is projected that the market in various Asian countries including China, India, Japan, and South Korea will grow as safety regulations are adopted. The widespread use of automobiles in developing nations is boosting market growth. According to a report by Research Nester, the automobile industry produced a total of 28.43 million vehicles, comprising passenger cars, commercial vehicles, three-wheelers, two-wheelers, and quadricycles between April 2023 to March 2024.

China has great economic potential, driven by the expanding requirement for automobiles. As of 2022, 319 million cars were registered in China. Over the past ten years, China's parking lot has expanded significantly, increasing by more than 132%.

In India, rising demand for connection and the digitalization of cars will positively affect automotive relay market growth during the forecast period. Additionally, the small passenger car segment's growth potential has significantly pushed the demand for auto wire harnesses due to space constraints. There are opportunities for market expansion provided by strict government rules requiring specific electronic safety systems, including the Electronic Stability Program (ESP) and Anti-locking Braking System (ABS), to prevent dangerous fuel emissions.

North America Market Insights

North America automotive relay market is expected to experience a stable CAGR during the forecast period due to rising connectivity demand, vehicle digitization, and rising sales of all types of automobiles. Furthermore, the strong growth potential of the tiny car market due to space constraints has raised the demand for automotive relays dramatically.

In the U.S., insurance companies provide customers discounts on insurance contracts, and utility companies provide low energy costs. Furthermore, very few states compensate manufacturers and buyers of electric vehicles for their costs as well as the infrastructure costs associated with charging them. The federal government offers tax credits of up to USD 7,500 for plug-in electric cars.

Automotive Relay Market Players:

- Texas Instruments Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB

- American Zettler, Inc.

- BETA ELECTRIC INDUSTRY CO., LTD

- COTO TECHNOLOGY

- Sensata Technologies, Inc.

- HELLA GmbH & Co. KGaA

- Littelfuse, Inc.

- LS Automotive India Pvt Ltd.

- Megatone Electronics Corp.

Key players in the automotive relay market are adopting strategies such as product innovation and technology upgrades, expansion into emerging markets, strategic partnerships & collaborations, and mergers & acquisitions to earn more. Leading companies are focused on the production of advanced relays with enhanced features such as improved durability, efficient performance in extreme temperatures, and smooth integration with other automotive technologies to attract a wider consumer base.

Here are some leading players in the automotive relay market:

Recent Developments

- In May 2022, Texas Instruments introduced a new line of solid-state relays to improve the safety of electric vehicles (EVs). This range guarantees outstanding dependability with its separated drivers and switches that adhere to automotive regulations.

- In February 2023, ABB introduced the Relay Retrofit Program to substitute sophisticated REX610 protection and control technologies for some SPACOM protection relays. The all-in-one REX610 relay is a flexible, eco-friendly, and future-ready choice since it was created especially to meet the evolving needs of contemporary electricity networks.

- Report ID: 6438

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Relay Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.