Automotive Refinish Coating Market Outlook:

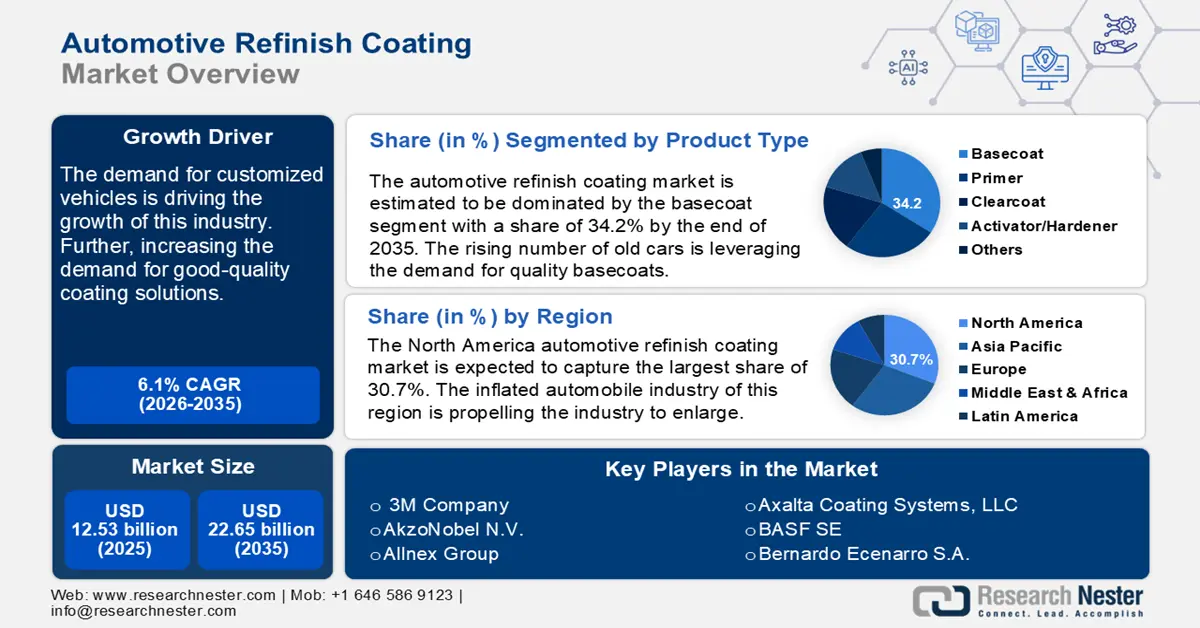

Automotive Refinish Coating Market size was valued at USD 12.53 billion in 2025 and is likely to cross USD 22.65 billion by 2035, registering more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive refinish coating is estimated at USD 13.22 billion.

The demand for customized vehicles is driving the growth of this industry. Custom paint jobs, sleek finishing, and unique graphic designs are heightening the surge for special formulations. This is further, increasing the demand for good-quality coating solutions. According to a 2022 American Coatings Association report, the global coating raw materials market was estimated to reach USD 63.5 billion by the end of the same year.

Participation in car shows to display statement pieces is also inspiring vehicle owners to opt for customization. Such competition is propelling the demand for specialized solutions in the automotive refinish coating market. Events are being held to gather the leading companies with an opportunity to showcase their portfolio. This is additionally, escalating the product’s reach to international consumers. In November 2024, AAPEX is scheduled to be held in Las Vegas. In this expo, the Autocare Association and U.S. Commercial Service will collaborate to offer new opportunities. The U.S. exhibitors, including refinish coating suppliers will be able to connect with international buyers for market expansion.

Key Automotive Refinish Coating Market Insights Summary:

Regional Highlights:

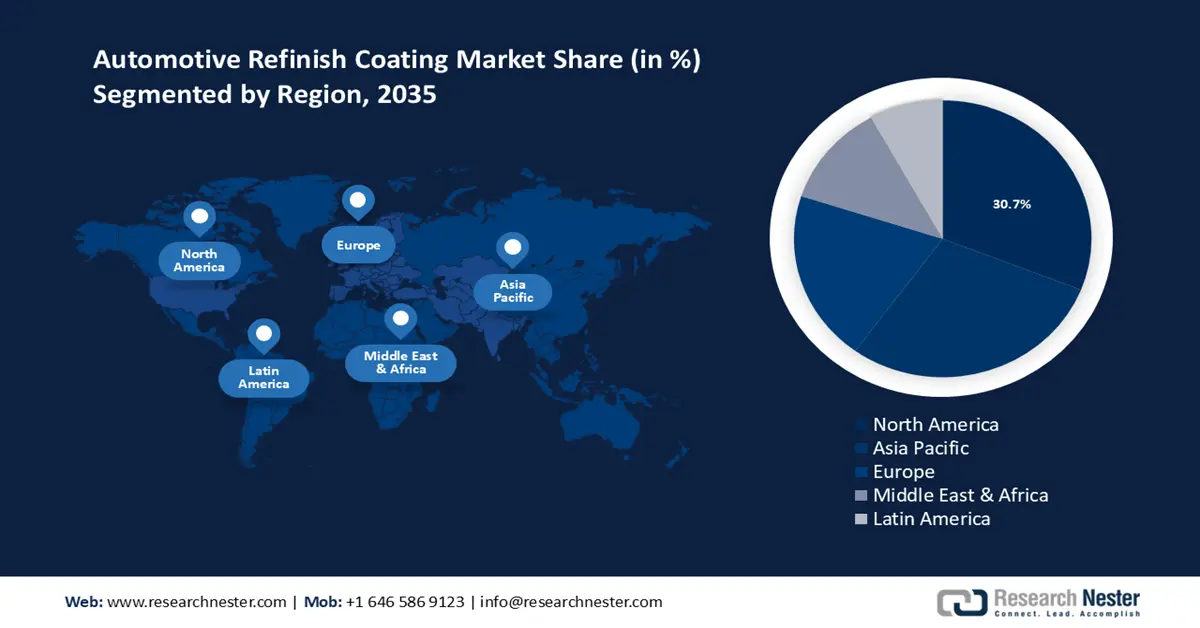

- North America leads the Automotive Refinish Coating Market with a 30.70% share, supported by an inflated automobile industry, increased vehicle ownership, and technical developments, fostering robust growth prospects by 2035.

Segment Insights:

- The Polyurethane segment is expected to experience lucrative CAGR growth from 2026 to 2035, fueled by its resistance to harsh conditions and compliance with environmental standards.

- The Basecoat segment of the Automotive Refinish Coating Market is expected to capture over 34.2% share by 2035, fueled by the increasing number of old cars and demand for durable, aesthetic coatings.

Key Growth Trends:

- Advancement in coating technology

- Rising demand for vehicle aftermarket services

Major Challenges:

- Uncertain pricing and availability of raw materials

- Limited consumer awareness

- Key Players: 3M Company, AkzoNobel N.V., Allnex Group, Axalta Coating Systems, LLC, BASF SE, Bernardo Ecenarro S.A., Cresta Paint Industries Ltd., Covestro AG, Dow Inc., DSM Coating Resins B.V..

Global Automotive Refinish Coating Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.53 billion

- 2026 Market Size: USD 13.22 billion

- Projected Market Size: USD 22.65 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 14 August, 2025

Automotive Refinish Coating Market Growth Drivers and Challenges:

Growth Drivers

- Advancement in coating technology: Innovation in the automotive refinish coating market is inspiring service providers to invest more. Advanced coating technologies such as waterborne and high-solid formulations are gaining traction. Growing emphasis on eco-friendly practices is penetrating research and development in this sector. Demand for low-VOC products is also encouraging leaders to participate in product development. In September 2024, BASF introduced ChemCycling technology to produce high-quality refinish products from scratch tires. Further, driving sustainability to align with environmental regulations.

- Rising demand for vehicle aftermarket services: The rise of automobile repair and maintenance services is influencing the market. Consumers are seeking accessible automobile refurbishing services to enhance the aesthetics of their vehicles. Advanced coating solutions can offer a range of colors, textures, and effects, appealing to the desire for distinctiveness. Manufacturers are introducing new formulations to supply the demand. In June 2024, 3M launched automotive films, offering a variety of styles and protection options. This customizable wrapping film can transform vehicles with its range of colors, textures, and finishings.

Challenges

- Uncertain pricing and availability of raw materials: Fluctuation in the price of raw materials may cause volatility in the automotive refinish coating market. The variation in the cost of materials such as pigments and resins can hinder pricing strategies. Additionally, it affects the production budget, forcing companies to rethink before investing. As a result, consumers may turn to alternative affordable options. The unavailability of resources forces manufacturers to import raw materials from external reservoirs, further, adding up to the production expenses.

- Limited consumer awareness: Lack of consciousness about the benefits of refinish coatings can prevent consumers from investing. Educating them to choose high-quality coating solutions can be difficult in case of economic barriers. Many car owners may fail to understand the difference between various coating types. Furthermore, this leads to partiality in choosing products based on price, rather than performance. Thus, refraining manufacturers from investing in research and development in the market.

Automotive Refinish Coating Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 12.53 billion |

|

Forecast Year Market Size (2035) |

USD 22.65 billion |

|

Regional Scope |

|

Automotive Refinish Coating Market Segmentation:

Type (Primer, Basecoat, Clearcoat, Activator/Hardener)

Basecoat segment is predicted to hold more than 34.2% automotive refinish coating market share by 2035. The rising number of old cars is leveraging the demand for quality basecoats. Variations in colors and finishing make this segment suitable for creating personalized vehicle aesthetics. Innovative formulations can improve its durability and application. Water-based and other sustainable basecoats can easily comply with strict environmental regulations, further, promoting expansion in research and development. In May 2023, 3M partnered with Svante Technologies to develop a science-based climate-friendly solution. The developed coating material is dedicated to capturing and removing atmospheric CO2.

Material (Polyurethanes, Acrylics, Alkyd, Epoxy)

Based on material type, the polyurethane segment is presenting lucrative growth in the automotive refinish coating market. Its superior resistance to harsh chemicals, UV light, and extreme weather makes it preferable for professional customizers. The high-gloss finish provides a pleasing visual appeal to the vehicle. Various options for application methods such as spraying and brushing can be utilized for a range of substrates. The usage of waterborne polyurethane coatings over traditional solvent-based solutions is increasing. Further, being fit to operate along environmental regulations. In September 2020, BASF launched a waterborne basecoat product line for automobile paint. Such innovations are creating a developmental scope in the production of sustainable coating materials.

Our in-depth analysis of the market includes the following segments:

|

Product Type |

|

|

Material |

|

|

Vehicle |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Refinish Coating Market Regional Analysis:

North America Market Analysis

North America industry is predicted to hold largest revenue share of 30.7% by 2035. The inflated automobile industry of this region is propelling the industry to expand. Increased vehicle ownership is subsequently growing the number of collisions. Thus, the surge in refurbishing services, such as refinishing has also multiplied. The region owns global market leaders including PPG Industries, Axalta Coating Systems, BASF, and others, who are contributing to technical development. In May 2024, PPG announced an investment of USD 0.3 billion to build a new paint and coatings manufacturing facility in Tennessee. The facility will accommodate an advanced manufacturing plant to produce high-quality coating solutions.

The U.S. is augmenting the market to present significant growth. The rise of DIY automobile repair and refinishing projects is fueling the industry with lucrative opportunities. Evolving consumer preferences about old vehicle restorations are leveraging the demand for specialized refinish products. Cost-effective solutions are reshaping the growth dynamics. In April 2024, BASF launched the Glasurit 100 Line which can be a cost-effective option for car body shops. The usage of 100 Lines can reduce process timing by 40% and material input by 30%, resulting in expense reduction. The availability of such budget-efficient options are encouraging for more innovative solutions.

The Canada automotive refinish coating market is poised to generate remarkable revenue. Easy and high-performance applications have made coating solutions popular for DIY projects. Frequent need for vehicle repair due to harsh weather conditions, leading to increased demand for refinishing services. According to an AIA Canada report published in March 2023, the aftermarket, including repair of the automobile industry is worth over USD 37.8 billion. The country embarks on further development such as UV-cured coating in refinishing coating solutions. Enhanced efficiency for implementing coatings has influenced the market to grow more.

APAC Market Statistics

The Asia Pacific automotive refinish coating market is estimated to experience significant growth during the forecast period. The growing adoption of autonomous technologies in the automobile industry is fueling the sector. The shift of consumer trends and regulatory development toward sustainability has inspired the penetration of bio-based materials. The expanding distribution network of raw materials is also captivating foreign investments. Regulations on VOC emissions are pushing manufacturers to introduce eco-friendly refinish coatings. In April 2024, BASF launched eco-efficient clearcoats and undercoats in this region. The new product portfolio offers higher productivity, reducing CO2 emissions.

India is emerging to be one of the largest consumer bases for the market. Global leaders are opting to grasp the investment and expansion opportunities in this country. In October 2023, PPG Asian Paints launched Cartisan, a state-of-the-art car detailing service provider in India. The launch was a strategic move to expand the automotive refinish portfolio in India market. The booming automobile and aftermarket sector due to increasing disposable income is creating lucrative growth opportunities. Rapid urbanization is driving the automotive industry to expand, additionally, rising demand for personalized refinish solutions.

China is growing to become one of the biggest resources for production in the market. Overall economic growth is inspiring consumers to invest in personalized auto care products. Massive manufacturing facilities are also supporting local companies. Global leaders are also investing to serve the country's specific needs. In August 2024, BASF inaugurated the new application and technical center in Jiangmen, China. The expansion will focus on developing coating technologies to increase the energy efficiency of electric vehicles. This further, solidifies its portfolio by complying with the zero-emission target of China.

Key Automotive Refinish Coating Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AkzoNobel N.V.

- Allnex Group

- Axalta Coating Systems, LLC

- BASF SE

- Bernardo Ecenarro S.A.

- Cresta Paint Industries Ltd.

- Covestro AG

- Dow Inc.

- DSM Coating Resins B.V.

Prominent players are adopting various market expansion strategies including new product and site launches, collaborations, and R&D activities. Leaders in the market are focusing on producing more sustainable and affordable automobile painting solutions. In August 2022, Axalta launched a new basecoat technology, CromaxGen. This product helps to optimize productivity and cost for body shops. This product helped to consolidate and expand the company’s portfolio in Latin America. Some of the key players in the industry include:

Recent Developments

- In September 2024, Axalta Coating launched Axalta Irus Scan, a next-generation scanning technology. The spectrophotometer can provide accurate color matches in basecoat technology by measuring the paint on the vehicle.

- In February 2024, BASF partnered with INEOS Automotive to help in the global body and paint program. The collaboration will enable long-term partnerships, setting a standard in the global vehicle body refinish market

- Report ID: 6594

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Refinish Coating Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.