Automotive Radiator Fan Market Outlook:

Automotive Radiator Fan Market size was valued at USD 5.72 billion in 2025 and is likely to cross USD 9.32 billion by 2035, expanding at more than 5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive radiator fan is assessed at USD 5.98 billion.

The growing automotive industry is fueling the expansion of the automotive radiator fan market due to the crucial role of these components in vehicle performance. Radiator fans are an essential part of vehicle cooling systems which are now in high demand. With the rise in production and sales in the automotive industry, the need for component electronics is rising.

The push from governing bodies to reduce energy wastage is also propelling demand in the automotive radiator fan market. Efforts from automakers to obtain compliance with strict regulatory emission norms have inspired global suppliers to innovate more energy-efficient electric fans and smart cooling systems, driving development in this sector. For instance, in December 2023, Johnson Electric launched a 48-volt Cooling Fan Module with power up to 1.5kW to deliver higher cooling performance and efficiency while reducing carbon emissions, and increasing lifespan. With a customizable cooling fan and shroud, it features sealed electronic (IP69K), PWM-LIN-CAN electrical interface, full diagnosis, self-protection functions, and galvanic insulation.

Key Automotive Radiator Fan Market Insights Summary:

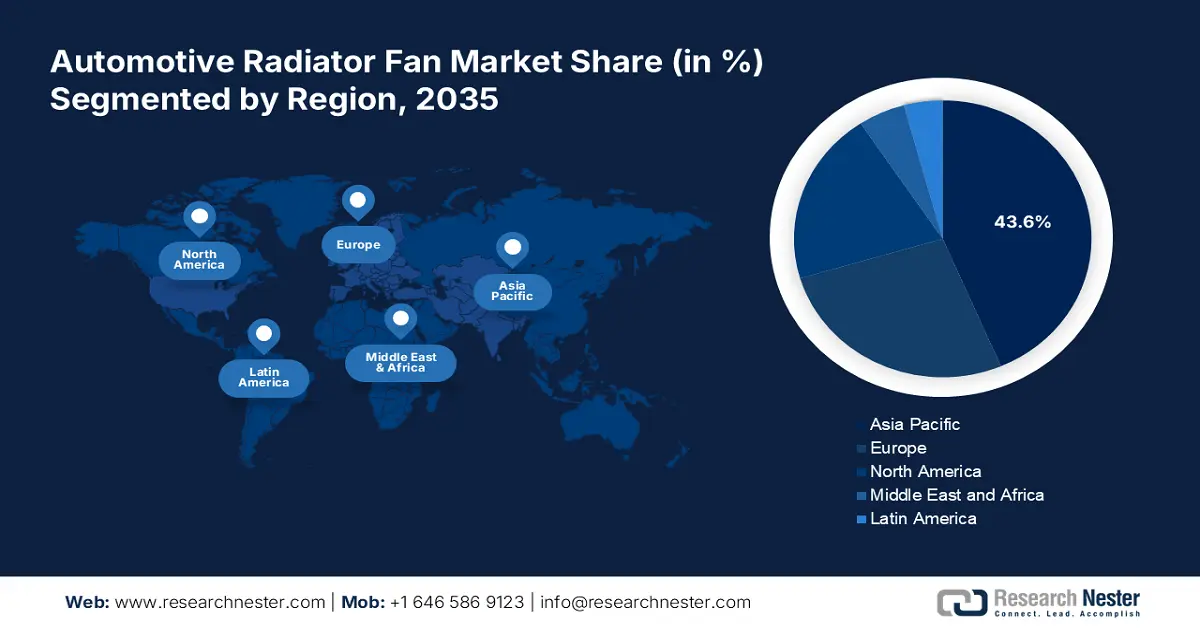

Regional Highlights:

- Asia Pacific leads the Automotive Radiator Fan Market with a 43.6% share, propelled by rapid growth in the automotive industry and efforts for maximum EV adoption, positioning it as a key market hub through 2026–2035.

- North America's automotive radiator fan market is projected to grow rapidly through 2035, fueled by extensive consumer expenditure on vehicles and aftermarket investments.

Segment Insights:

- The Direct Fit segment is anticipated to capture 67.2% market share by 2035, driven by its high vehicle compatibility and ease of installation.

Key Growth Trends:

- Rising focus on fuel efficiency

- Growing demand for electric and hybrid vehicles

Major Challenges:

- High pricing of advanced vehicles

- Volatility in component availability

Key Players: Johnson Electric Holdings Limited, Hella KGaA Hueck & Co., Mahle GmbH, Standard Motor Products, Robert Bosch GmbH., Valeo, BorgWarner Inc, Brose Fahrzeugteile SE & Co. KG, Delta Radiator Fan LTD.

Global Automotive Radiator Fan Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.72 billion

- 2026 Market Size: USD 5.98 billion

- Projected Market Size: USD 9.32 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Automotive Radiator Fan Market Growth Drivers and Challenges:

Growth Drivers

- Rising focus on fuel efficiency: Alongside the regulatory pressure, shifting consumer behavior is pushing automakers to invest in the automotive radiator fan market. These advanced cooling systems act as an economic cushion for drivers by reducing fuel consumption. This has also dragged the focus of governments to intervene by implementing fuel economy standards. For instance, in 2020 the University of Chicago published an article stating the benefits and impacts of NHTSA and EPA standards, mentioning the government’s tendency to subsidize high fuel-economy vehicles. Moreover, changing fuel prices are forcing consumers to seek cost-effective ways to control vehicle ownership expenditures, driving growth in this sector.

- Growing demand for electric and hybrid vehicles: Collaborative efforts from both private and government authorities for complete electrification of transportation are propelling demand in the automotive radiator fan market. According to a report published by the Center for Automotive Research, in August 2024, around USD 160 billion of investments from automakers were accounted for since 2020 for electrification. In addition, the increased engine efficiency and lower environmental impact of these tools are attracting automakers to implement them in EVs and hybrid vehicles. Thus, the expansion of the EV industry is subsequently causing growth in this sector.

Challenges

- High pricing of advanced vehicles: A significant profit margin of the automotive radiator fan market is dependent on the sales of advanced EVs and hybrid vehicles. On the other hand, consumers and business fleets often hesitate or refrain from adopting due to the high cost of EVs. This may disrupt investments in this sector. The economic barrier may also dilute the interest of automakers to penetrate advanced technologies due to affordability issues, hampering the market progress.

- Volatility in component availability: The fluctuation in prices and availability of raw materials such as metals and polymers may impact the supply chain of the automotive radiator fan market. Issues such as geographical tensions or natural disasters can cause the production budget to fail, hindering profit margins. This may further discourage manufacturers from investing or participating in this sector, limiting global expansion and development.

Automotive Radiator Fan Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 5.72 billion |

|

Forecast Year Market Size (2035) |

USD 9.32 billion |

|

Regional Scope |

|

Automotive Radiator Fan Market Segmentation:

Fit Type (Direct Fit, Universal Fit)

Based on the fit type, the direct fit segment is set to hold automotive radiator fan market share of more than 67.2% by 2035. The growth in this segment is driven by its high vehicle compatibility and ease of installation. These specifically designed fans come with a ready-to-install ability, making the whole process more convenient and cost-efficient by eliminating the need for modifications in the engine or body. According to a Research Nester report, the global automotive OEM industry is estimated to hold significant revenue share by the end of 2035. Thus, the growing demand for such OEM products in the automotive, particularly aftermarket and customization sector is inflating the need in this segment.

Material Type (Steel, Aluminum, Composite)

In terms of material type, the aluminum segment is projected to register a significant value in the automotive radiator fan market by the end of 2035. Due to the characteristics such as being lightweight, durable, and corrosion-resistant, this segment has become the primary material for production. The continuous push for maintaining fuel economy can be served with the extensive offerings of its remarkable contribution to engine efficiency and vehicle performance, particularly in EVs.

In addition, the extended lifespan of components due to the usage of aluminum has further helped the segment to retain its leadership among other materials. In April 2023, the Aluminum Association published a report stating, that the adoption of EVs may increase the market share of aluminum content by 100 net PPV during 2020-2030 timeline.

Our in-depth analysis of the global market includes the following segments:

|

Fit Type |

|

|

Material Type |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Radiator Fan Market Regional Analysis:

APAC Market Statistics

Asia Pacific automotive radiator fan market is poised to account for revenue share of more than 43.6% by the end of 2035. Rapid growth in the automotive industry and efforts for maximum EV adoption are the major driving factors of this region’s leadership. In 2023, it was published that the APAC vehicle market value reached USD 229.3 billion in 2021 and is expected to hold USD 777.6 billion by 2027. The shift towards green transportation in developing countries such as Japan, India, China, and South Korea has dragged the focus of automotive component manufacturers. They are now investing to create a sustainable ecosystem for this industry, fostering opportunities to generate great profit margins.

The India automotive radiator fan market is highly influenced by the initiatives taken by the government to reduce emissions from vehicles. Governing authorities have created a good marketplace for global suppliers to captivate this emerging landscape by implementing supportive regulations and subsidies. According to a report published by USAID and INVEST INDIA, in March 2023, domestic EV start-ups secured around USD 1.6 billion in 2022, increasing by 117% from 2021. With the favorable policies and programs by the government, it is estimated to foster an investment opportunity of USD 200 billion. This further inspires companies to participate in the supplier chain for components such as radiator fans.

China is growing to be a large consumer base for the automotive radiator fan market with its extensive capabilities in the manufacturing and assembling industry. According to a report published by the Canada China Business Council, in June 2024, the manufacturing industry contributed to 31.7% of the country's GDP in 2023. It further states, that China maintained its position as a global powerhouse with a worldwide manufacturing output of 28.4% in the same year. Backed by the country’s strong emphasis on labor and facilities, both domestic and international leaders are now eager to captivate the leadership in this sector.

North America Market Analysis

North America is one of the fastest-growing regions in the automotive radiator fan market during the timeline of 2025-2035. The extensive consumer expenditure on vehicles is driving growth in this region. The growing trend of customizing cars and upgrading vehicle performance are some of the major contributors to this landscape. Thus, investments from the automotive aftermarket in this sector are enough capable to attract global leaders to participate. In addition, the region’s automotive manufacturing and pricing are a strong competitor of the global dominance of China. According to a report published by the USMCA, in July 2021, the automotive industry accounted for USD 700 billion in the U.S. and captured 11.4% manufacturing output of the country in 2021.

The U.S. is Situating itself at the forefront of the regional growth in the automotive radiator fan market with notable progress in automotive production. The country is marking its footprint through global expansion. According to the 2022 OEC report, the U.S. became the 3rd largest exporter of cars worth USD 57.5 billion. In the same year, cars were accounted to be the 4th most exported products having emerging countries such as Canada, China, Germany, South Korea, and Mexico being destinations.

Canada is fostering a good business environment for the automotive radiator fan market by investing in the auto parts manufacturing industry. The country aims to secure a reliable supply chain for its transition goals to achieve carbon neutrality. For instance, in May 2023, the Government of Canada announced an investment of USD 5 million to the leading steel manufacturer of lightweight auto parts, ArcelorMittal Tailored Blanks Americas Limited. This is further fueling the growth in this sector with such financial support.

Key Automotive Radiator Fan Market Players:

- Johnson Electric Holdings Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hella KGaA Hueck & Co.

- Mahle GmbH

- Standard Motor Products

- Robert Bosch GmbH.

- Valeo

- BorgWarner Inc.

- Brose Fahrzeugteile SE & Co. KG

- Delta Radiator Fan LTD.

The inclusion of smart features in the systems is now the prime focus of global leaders in the automotive radiator fan market. This is further encouraging automakers to implement these technologies in the upgraded vehicles to deliver improved performance and compliance. For instance, in November 2024, Toyota launched the partially upgraded model of the Supra (3.0-liter) and the special-edition Supra, A90 Final Edition. The new models are equipped with stronger radiator cooling fan, additional sub-radiator, and enlarged differential gear cover cooling fins, offering enhanced cooling performance. This is inspiring the leading component suppliers to introduce more innovative tools. Such key players include:

Recent Developments

- In August 2024, Johnson Electric launched an innovative high-voltage cooling fan module VOLTA for heavy-duty trucks, delivering robust and efficient cooling. The 10kW cooling system can enhance the performance and lifespan of fuel cell EVs, EVs, hybrid vehicles, heavy-duty trucks, off-road vehicles, and sports cars.

- In August 2024, Mahle unveiled a new bionic high-performance fan for commercial vehicles at the IAA Transportation 2024 in Hanover. AI-optimized design is inspired by the wings of an owl, giving the vehicle 50% less noise, 10% higher efficiency, and 10% less weight than the conventional fans.

- Report ID: 6890

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Radiator Fan Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.