Automotive PCB Market Outlook:

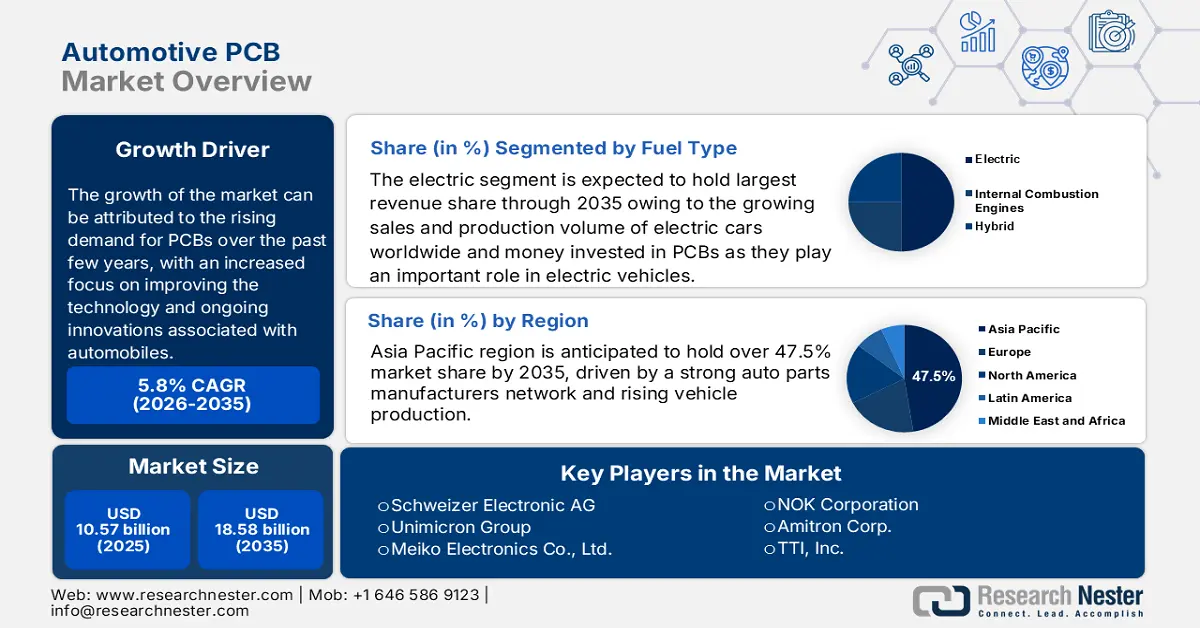

Automotive PCB Market size was valued at USD 10.57 billion in 2025 and is expected to reach USD 18.58 billion by 2035, registering around 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive PCB is evaluated at USD 11.12 billion.

The growth of the market can be attributed to the rising demand for PCBs over the past few years, with an increased focus on improving the technology and ongoing innovations associated with automobiles. In modern cars, a user can find several new features compared to the model which is 10 years older, since technology is developing and competition among key-manufacturers is escalating. Hence, a large gap appears in the automotive industry for PCBs to fill, and it is projected to increase the market’s growth in the upcoming years. It was found that the global sales of PCBs amounted to more than 80 billion in 2018.

Global Automotive PCB Market trends such as, strict government regulations regarding CO2 emissions and emission standards, backed by the fact that electric vehicles are becoming more and more popular in developed nations are anticipated to hike the market growth over the forecast period. Hence, a demand for the market is expected to be generated by the increasing demand for electronic systems and IoT in automobiles. Also, there has been an increase in government measures in order to encourage the sales of electric vehicles. For instance, the Government of Japan (GOJ) was proposing to subsidize a part of the cost of purchasing CEVs, such as Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs). The maximum CEV subsidies awarded per vehicle in 2021 were around USD 7,200 Dollars. Furthermore, the needs of the customer are becoming more important to automotive manufacturers around the world, and regional trends are evolving to reflect consumer preferences.

Key Automotive PCB Market Insights Summary:

Regional Highlights:

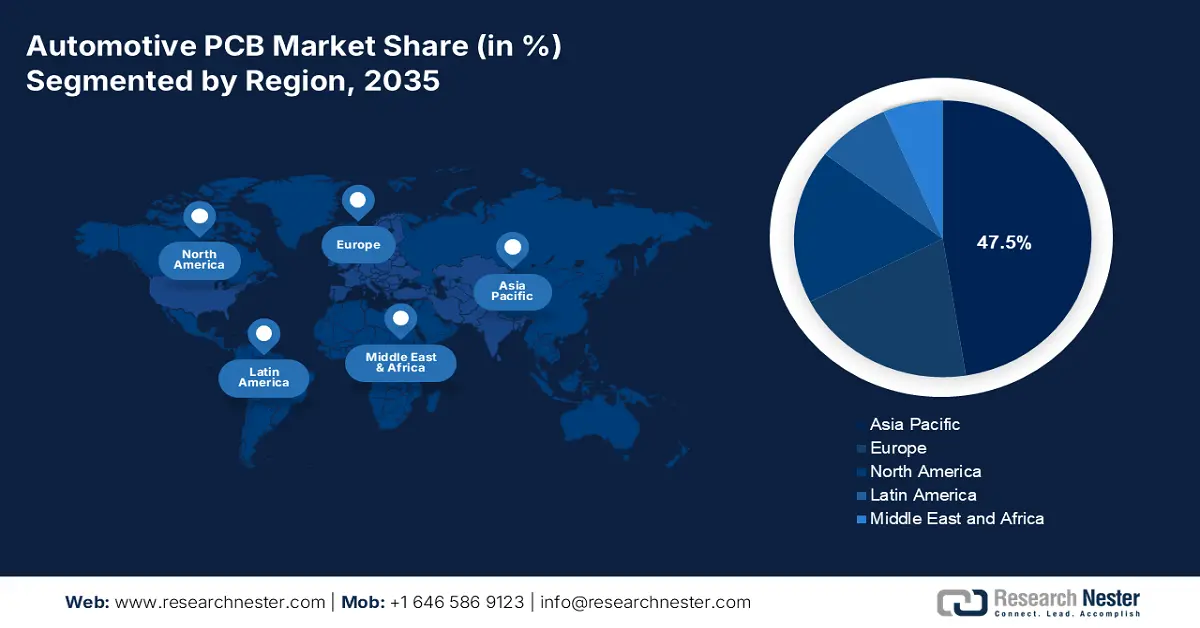

- Asia Pacific automotive pcb market will dominate more than 47.5% share by 2035, driven by a strong auto parts manufacturers network and rising vehicle production.

Segment Insights:

- The multi-layer pcb segment in the automotive pcb market is projected to capture a significant share by 2035, driven by its ability to support complex automotive electronics.

- The electric segment in the automotive pcb market will hold the largest share, fueled by the surge in electric vehicle sales and PCB demand, forecast year 2035.

Key Growth Trends:

- Growing Demand for Autonomous Vehicles

- Rising Demand for Advanced Driver Assistance Systems

Major Challenges:

- Complex Designing and Manufacturing Processes

- High Cost of Customized PCBs for Different Vehicles

Key Players: TTM Technologies Inc., Schweizer Electronic AG, Unimicron Group, Meiko Electronics Co., Ltd., Millennium Circuits Limited, KCE Electronics Public Company Limited, NOK Corporation, Amitron Corp., Samsung Electro-Mechanics Co., Ltd., TTI, Inc.

Global Automotive PCB Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.57 billion

- 2026 Market Size: USD 11.12 billion

- Projected Market Size: USD 18.58 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 10 September, 2025

Automotive PCB Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Autonomous Vehicles – It is estimated that autonomous vehicles will account for around 12% of car registrations worldwide by 2030.Innovation in printed circuit board (PCB) devices is responsible for advancements in driverless car sensor technologies. PCBs are highly used in autonomous vehicles as they meet hardware interface requirements, durability and reliability. Hence, the surge in demand for autonomous vehicles is expected to escalate the automotive PCB market in the forecasted period.

- Rising Demand for Advanced Driver Assistance Systems – it was found that the industry generated more than USD 25 billion globally in 2020. Also, it is projected that by 2030, electronic components in cars will make up approximately 50% of their overall cost. Moreover, there has been increasing installation of ADAS radar systems in the vehicles that provide drivers with safety alerts, and it is expected to boost the market’s growth.

- Escalation in the Number of Connected Cars – for instance, it is estimated that by 2025, the global fleet of connected cars will be more than 400 million, up from some 237 million in 2021.

- Growing Production Volume of Vehicles - for instance, the aggregate global production of vehicles in 2021 touched 80 million.

- Increasing Production of Light Vehicles – which is projected to reach around 99 million light vehicles to be produced globally by 2025.

Challenges

- Complex Designing and Manufacturing Processes - The several complexities associated with PCB design and manufacturing processes may result in numerous instances where there is a failure while running the PCB. These failures are as a result of design oversights, such as incorrect measurements or insufficient clearances, which are known to have a negative impact on the functionality of the product.

- High Cost of Customized PCBs for Different Vehicles

- Effects of Fluctuating Temperature on PCB Performance

Automotive PCB Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 10.57 billion |

|

Forecast Year Market Size (2035) |

USD 18.58 billion |

|

Regional Scope |

|

Automotive PCB Market Segmentation:

Fuel Type Segment Analysis

The global Automotive PCB Market is segmented and analyzed for demand and supply by fuel type into internal combustion engines (ICEs), electric, and hybrid. Out of these types of segments, the electric segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the growing sales and production volume of electric cars worldwide and money invested in PCBs as they play an important role in electric vehicles. Electrical vehicles are highly advanced and use electricity to perform all the requisite tasks, which boosts the demand for PCBs. For instance, it was discovered that the sales of electric vehicles doubled globally in 2021, reaching approximately 7 billion units.

Type Segment Analysis

The global Automotive PCB Market is also segmented and analyzed for demand and supply by type into single-sided, double-sided, and multi-layer PCB. Amongst these segments, the multi-layer PCB segment is expected to garner a significant share. Multi-layer PCBs are 50 layers thicker than other types of PCBs and provide dual transmission. Such features of multi-layer PCBs make them quite suitable to handle a wide range of complicated electrical tasks. Multi-layer PCBs has around 10 to 48 conducting layers, which makes them nearly 1.5 mm thick. Automotive industry now relies on the use of electrical component with the launch of electric cars in the market. Since every feature such as headlights, GPS, interior screens, and others are completely controlled by electronics, therefore, automobile manufacturers prefer multi-layer PCBs.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Fuel Type |

|

|

By Vehicle Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive PCB Market Regional Analysis:

APAC Market Insights

Asia Pacific region is anticipated to hold over 47.5% market share by 2035, driven by a strong auto parts manufacturers network and rising vehicle production. For instance, the production volume of integrated circuits in China amounted to more than 350 billion pieces in 2021, with a 37% increase compared to 2020. Additionally, up-surged utilization of autonomous and electric vehicles baked by the higher implementation of government initiatives to control the emission of harmful gases by the vehicles on the road is estimated to enlarge the market size in the region over the forecast period. For instance, in 2021, the electric vehicle (EV) production in Asia Pacific was projected to hit approximately 180,000, which was an increase of around 50% compared to the previous year. In 2020, nearly 120,000 electrical vehicles were produced in the region. Therefore, all these factors are estimated to influence the regional market growth positively over the forecast period.

Automotive PCB Market Players:

- TTM Technologies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schweizer Electronic AG

- Unimicron Group

- Meiko Electronics Co., Ltd.

- Millennium Circuits Limited

- KCE Electronics Public Company Limited

- NOK Corporation

- Amitron Corp.

- Samsung Electro-Mechanics Co., Ltd.

- TTI, Inc.

Recent Developments

-

TTM Technologies Inc. to announce the opening of its new manufacturing plant in Penang, Malaysia. TTM Technologies Inc. is leading company in the manufacturing of RF and PCB components. Furthermore, the plant also expected to obtain an investment of nearly USD 130 million by 2025. The manufacturing plant will focus on the expansion of advanced technology PCB supply chain.

-

Schweizer Electronic AG opened its own sales company in the USA, located in Wilmington, Delaware, expanding its unit across the Atlantic. The company stated that it is planning to obtain lucrative access to the American market, especially in USA and Canada by addressing the market of aviation and automotive industry in particular.

- Report ID: 4619

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive PCB Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.