Automotive Plastics Market Outlook:

Automotive Plastics Market size was valued at USD 31.58 Billion in 2025 and is expected to reach USD 54.97 Billion by 2035, expanding at around 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive plastics is evaluated at USD 33.2 Billion.

The primary factor that is attributed to fuel the market growth in the forecast period is the rapid expansion in the automotive industry. Recent calculation stated that the revenue generation by global automotive industry is anticipated to stand at almost USD 9 trillion by 2030.

Car manufacturers are highly focusing on building improved designs to reduce the weight of vehicles. Plastics are easy to produce which can be sourced from renewable materials are easy to handle for improved designs. As a result, automotive plastics are preferred over the rest in the automotive industry. This rapid growth of automotive industry has also propelled the employment rate to increase in the sector considerably. In fiscal year 2018, the Indian automotive industry employed approximately 2 million people.

Key Automotive Plastics Market Insights Summary:

Regional Highlights:

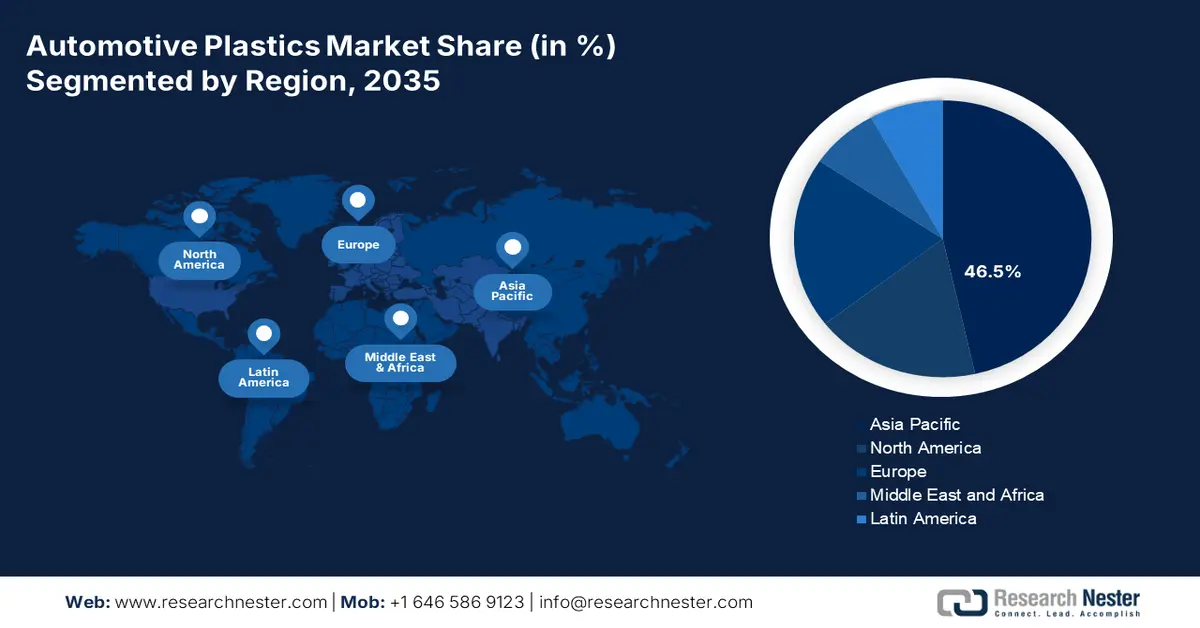

- Asia Pacific automotive plastics market is predicted to capture 46.5% share by 2035, fueled by the rising population, increasing income levels, and high vehicle production and sales in the region.

Segment Insights:

- The conventional cars segment in the automotive plastics market is projected to hold the highest market share by 2035, driven by the rising demand for passenger cars globally.

Key Growth Trends:

- Rising Middle Income of Population

- Escalation of Vehicles Production

Major Challenges:

- High Cost of Capital and Infrastructure

- Increasing Concerns Regarding Plastic Recyclability

Key Players: Arkema, BASF, Saudi Basic Industries Corporation, LyondellBasell Industries N.V., LG Chem, DuPont de Nemours, Inc., Covestro AG, Evonik Industries AG, Solvay Group, Borealis AG.

Global Automotive Plastics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.58 Billion

- 2026 Market Size: USD 33.2 Billion

- Projected Market Size: USD 54.97 Billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Automotive Plastics Market Growth Drivers and Challenges:

Growth Drivers

- Rising Middle Income of Population - With the increase of middle income, people are turning towards adopting upgraded version of vehicles for more comfort. Automotive plastics which are useful component for manufacturing lightweight vehicles with fuel-efficient properties and enhanced on-road performance are preferred option for the population. Thus, with the rising income levels, the adoption rate of automotive plastics is anticipated with the expansion of the automotive plastics market. According to World Bank, the total population with middle income in the world rose from 5.51 Billion in 2015 to 5.86 Billion in 2021.

- Escalation of Vehicles Production - As per Organization of Motor Vehicle Manufacturers, the global production of vehicles was 80 million units in 2021. This is a rise from 77 million units in 2020.

- High Demand of Electric Cars by Population - A latest report by the International Energy Agency stated the number of electric cars on the road was 16.5 million in 2021.

- Increased Number of Vehicles on the Worldwide Roads – A recent report estimated that there were approximately 2 billion vehicles on roads across the globe by the end of first quarter of 2022.

Challenges

- High Cost of Capital and Infrastructure

- Increasing Concerns Regarding Plastic Recyclability

- Rising Governmental Policies Regarding Pollutants Emission

Automotive Plastics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 31.58 Billion |

|

Forecast Year Market Size (2035) |

USD 54.97 Billion |

|

Regional Scope |

|

Automotive Plastics Market Segmentation:

Vehicle Type Segment Analysis

The automotive plastics market is segmented and analyzed for demand and supply by vehicle type into conventional cars and electric cars. Out of these, the conventional cars segment is anticipated to garner the highest market share by 2035, owing to rising demand of passenger cars around the world. vehicles by the burgeoning population. International Organization of Motor Vehicle Manufacturers (OICA) revealed the sales of global passenger vehicles to be 53 million in 2020 and the production to be 55 million in the same time period.

Major Macro-Economic Indicators Impacting the Market Growth

The chemical industry is a major component of the economy. According to the U.S. Bureau of Economic Analysis, in 2020, for the U.S., the value added by chemical products as a percentage of GDP was around 1.9%. Additionally, according to the World Bank, Chemical industry in the U.S. accounted for 16.43% to manufacturing value-added in 2018. With the growing demand from end-users, the market for chemical products is expected to grow in future. According to UNEP (United Nations Environment Program), the sales of chemicals are projected to almost double from 2017 to 2030. In the current scenario, Asia Pacific is the largest chemical producing and consuming region. China has the world’s largest chemical industry, that accounted for annual sales of approximately more than USD 1.5 trillion, or about more than one-third of global sales, in recent years. Additionally, a vast consumer base and favorable government policies have boosted investment in China’s chemical industry. Easy availability of low-cost raw material & labor as well as government subsidies and relaxed environmental norms have served as a production base for key vendors globally. On the other hand, according to the FICCI (Federation of Indian Chambers of Commerce & Industry), the chemical industry in India was valued at 163 billion in 2019 and it contributed 3.4% to the global chemical industry. It ranks 6th in global chemical production. This statistic shows the lucrative opportunity for the investment in businesses in Asia Pacific countries in the upcoming years.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Application |

|

|

By Process |

|

|

By Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Plastics Market Regional Analysis:

Asia Pacific region is poised to dominate around 46.5% market share by 2035, fueled by the rising population, increasing income levels, and high vehicle production and sales in the region. The total production of vehicles in the region was 46 million in 2021, whereas, the total sales in the region was 42 million in 2021 as per statistics released by International Organization of Motor Vehicles (OICA). Also, the presence of leading key players and exporters in the region is another factor that is expected to affect the automotive plastics market positively. China, a country of Asia Pacific is estimated to have exported around 402,000 commercial vehicles and around 2 million passenger vehicles in the year 2021.

Automotive Plastics Market Players:

- Arkema

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF

- Saudi Basic Industries Corporation

- LyondellBasell Industries N.V.

- LG Chem

- DuPont de Nemours, Inc.

- Covestro AG

- Evonik Industries AG

- Solvay Group

- Borealis AG

Recent Developments

-

BASF has launched styling polymer Luviset 360 that offers strong, flexible and long-lasting hold as well as low flaking along with anti-pollution properties and allows for new textures.

-

Arkema has decided to acquire Agiplast, a leader of high performance polymersspecialty polyamides and fluoropolymers. This acquisition is expected to bolster the company’s capacity to offer a full service to customers in terms of materials circularity.

- Report ID: 4501

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Plastics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.