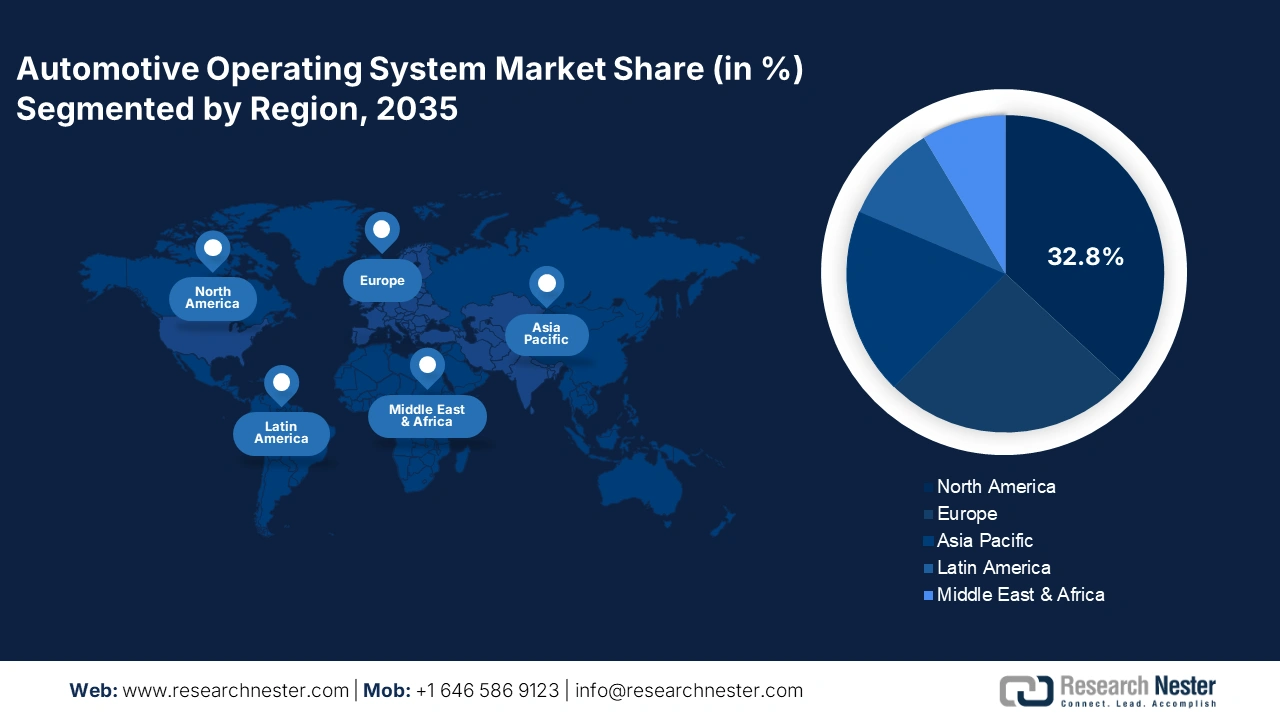

Automotive Operating System Market - Regional Analysis

North America Market Insights

The North America market is predicted to have robust growth, accounting for 32.8% of the revenue share by 2035 due to a rise in demand for AI-based navigation, driven by the growing need for enhanced driving experiences, efficiency, and safety in vehicles. Technology companies across the region are investing in relevant technological research and development. Automotive manufacturers are also consistently taking measures to strengthen OS capabilities in their vehicles. For instance, in January 2023, Hyundai Motor Group revealed its strategic collaboration with NVIDIA to boost AI development to drive future mobility. Enhancing the application of intelligence to the core mobility products, including software-defined vehicles and robotics, was the aim of the automotive business.

The exponentially surging penetration of connected vehicles fuels the automotive operating system market in the U.S. As reported by the Alliance for Automotive Innovation in June 2025, the automotive company sold 374,841 connected electric vehicles in the U.S., which accounts for 9.6% of the sold light-duty vehicles. In addition, growing concerns about cybersecurity among the users of connected vehicles are fuelling the need for automotive operating systems associated with robust security frameworks. Companies based in the U.S. are also taking measures to enhance the security of automotive operating systems. In April 2025, Intel unveiled the second-generation Intel AI-enhanced software-defined vehicle (SDV) system-on-chip (SoC) at Auto Shanghai 2025. The SoC offers scalable performance, optimized cost-efficacy, and advanced AI capabilities to the automakers so that they can fulfil the rising demands for intelligent and connected vehicles.

In Canada, the automotive operating system market is expected to experience remarkable expansion, owing to rising government support to strengthen the adoption of connected and automated vehicles, expected to fuel the demand for automotive operating systems. In February 2025, Transport Canada unveiled its efforts to modernize the transportation system across the country. The government also works actively to establish a regulatory environment supporting the integration of new and merging connected and automated vehicles. National and international regulations in Canada are also pushing automotive companies in Canada to invest in the development of robust automotive operating systems.

Asia Pacific Market Insights

The Asia Pacific is anticipated to account for a significant revenue share by 2035 due to rising demand for vehicles integrated with AI. The growth in the region can be ascribed to the 5G rollouts in various nations and the presence of a robust OEM base. As reported by the Global System for Mobile Communications Association in July 2023, China, South Korea, and Japan lead in 5G deployment, and with the continued rollout of the networks in other regional areas, the Asia Pacific is expected to emerge as the largest 5G market worldwide. This is expected to allow the automobile manufacturers to make the operating systems in the vehicles function in an environment of high bandwidth and low latency. With the rapid integration of AI and ML into vehicles, the demand for sophisticated automotive operating systems increases.

China is projected to hold the largest share in the Asia Pacific AOS market due to rapid electrification and large-scale government subsidies for the adoption of EVs, increasing the scope of integrating sophisticated operating systems into vehicles. As disclosed by the Information Technology & Innovation Foundation in July 2024, in the development and launch of new car models, EV companies in China are faster compared to companies based in Europe, America, and Japan. China has also launched programs highly dependent on the AOS, including the National Smart Vehicle Innovation Development Strategy.

Japan is expected to register a rapid CAGR during the forecast timeline, as a consequence of rising government spending in research and development activities, fuelling the scope of enabling new features in automotive operating systems. As revealed by the Institute of Geoeconomics in July 2025, the government raised USD 7.4 billion of funding in research and development on next-generation semiconductor and quantum computing. The growing focus of the automobile sector on vehicle safety, reliability, and quality is expected to boost the demand for automotive operating systems.

Europe Market Insights

Europe automotive operating system market is anticipated to account for a lucrative revenue share by the end of 2035, due to stricter environmental regulations obligating emissions reduction in vehicles. The regulations are pushing the population to adopt electric and software-defined vehicles, boosting the demand for automotive operating systems. For instance, amendments to Regulation (EU) 2019/1242 were initiated as part of the 'Fit for 55' legislative package. The revised regulation came into force in Jun 2024 and obligated emissions reduction in heavy-duty vehicles, including lorries, city buses, trailers, and coaches. The fueling demand for personalized in-car experiences across the region is anticipated to accelerate the deployment of automotive operating systems into vehicles.

Germany is anticipated to register a significant CAGR during the forecast period, on account of the government incentives, including pilot project funding and tax breaks in the production and promotion of autonomous vehicles. As reported by the World Economic Forum in April 2025, the government incentivized severe AV programs, which included a funding of USD 342.2 million distributed across 70 AV projects. Companies in Germany are focusing on innovation in the ways of using automotive operating systems. In March 2023, BMW revealed its milestone in the latest development of the iDrive system. The operating system was integrated with a new home screen, allowing the vehicle users to get wider ease of utilization on the Curved Display.

The automotive operating system market in France is poised to expand at a high CAGR between 2026 and 2035, attributed to the rising popularity of ADAS. This is expected to increase the need for appropriate, real-time, and standardized vehicle data, which can fuel the demand for automotive OS. The involvement of the France-based companies in producing software-defined vehicles also accelerates the use of the AOS. For example, in April 2024, the joint venture between Renault Group and Volvo Group received regulatory approval for the creation of a new company, Flexis SAS. The company is involved in the production of the next generation of completely electric vans that were developed adhering to a Software Defined Vehicle (SDV) platform and its dedicated services.