Automotive Intake Manifold Market Outlook:

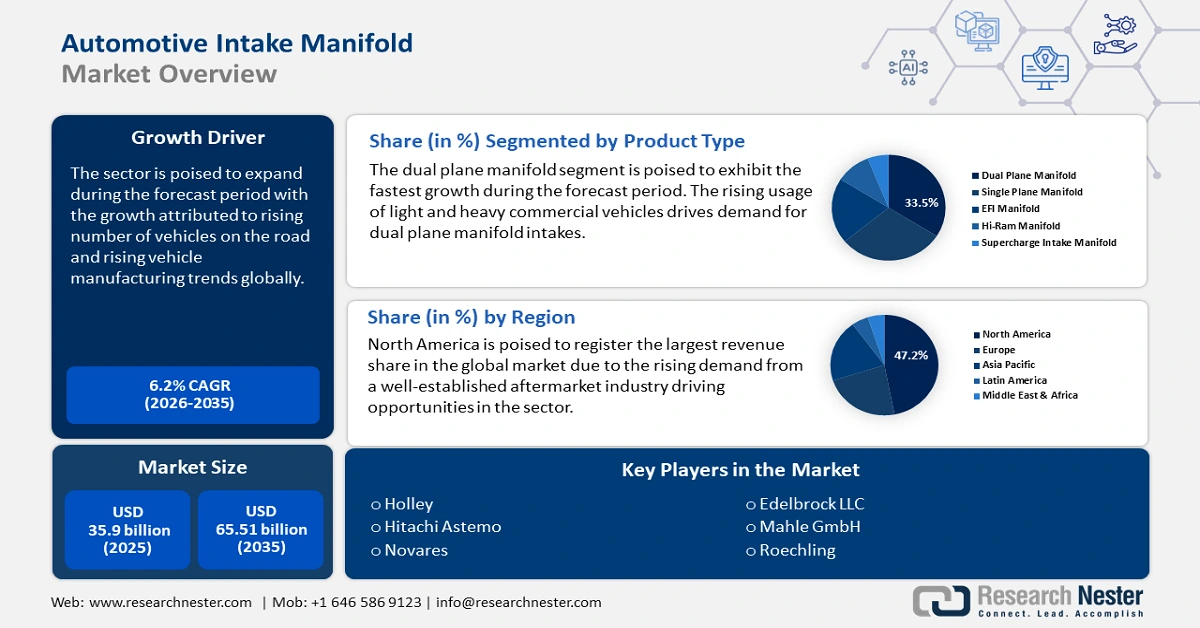

Automotive Intake Manifold Market size was over USD 35.9 billion in 2025 and is poised to exceed USD 65.51 billion by 2035, witnessing over 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive intake manifold is estimated at USD 37.9 billion.

A major trend in the growth of the automotive intake manifold market is the rising demand for lightweight and fuel-efficient vehicles which has driven advancements in the sector. Countries are investing heavily to create a robust fuel economy and the U.S. Department of Energy states that a 10% reduction in vehicle weight can lead to a 6% to 8% improvement in fuel economy. Furthermore, a sustained push by high-income countries such as the U.S. to improve the fuel economy is poised to create a sustained demand for intake manifolds in automobiles. For instance, in June 2024, the U.S. Department of Transportation’s National Highway Traffic Safety Administration (USDOT) issued new automotive fuel economy standards which will save more than USD 23 billion in fuel costs while curbing pollution. The trends are favorable to create a heightened demand for optimized automotive intake manifolds with improved air-fuel mixture capabilities.

The automotive intake manifold market is poised to benefit from the rising production of automobiles worldwide coupled with the growing number of cars on the road. The World Economic Forum (WEF) estimated that the global number of cars on the road will double by 2040 and estimated the number to hit 2 billion. WEF’s report indicated that the largest increase in automobile numbers will be in APAC, with China and India driving the numbers owing to large-scale population numbers in the two countries. The increase in automobile numbers bodes well for intake manifold manufacturers by creating revenue streams in emerging automotive intake manifold markets to supply intake manifolds by collaboration with engine manufacturers for various engine designs.

Emerging opportunities in the automotive intake manifold sector are largely tied to the shift toward localized production. Numerous countries are seeking to reduce dependence on imports and expand domestic production lines, creating opportunities for manufacturers to create region-specific solutions. Additionally, consumer preferences differ from one automotive intake manifold market to another, which provides opportunities for manufacturers to produce region-specific intake manifold solutions. For instance, the U.S. accounts for the largest sale of sports cars globally while China accounts for the highest sale of light vehicles. Furthermore, expanding avenues to offer aftermarket services is poised to benefit the sector’s growth. The automotive intake manifold industry is projected to leverage favorable trends and maintain its robust expansion by the end of the forecast period.

Key Automotive Intake Manifold Market Insights Summary:

Regional Highlights:

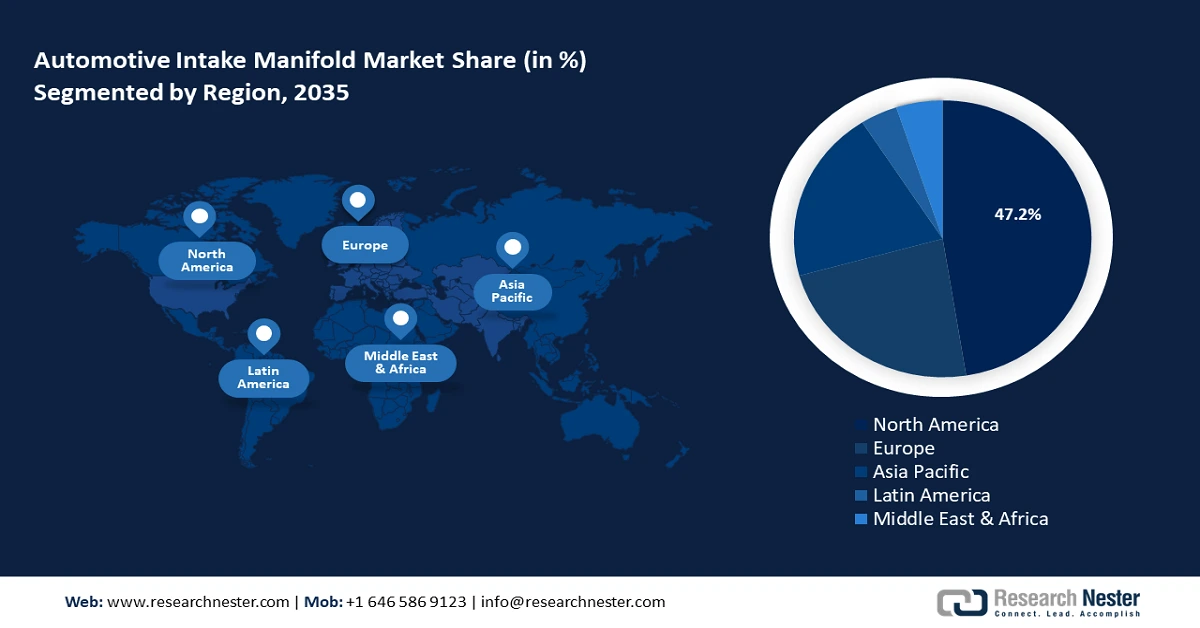

- The North America automotive intake manifold market is projected to capture a 47.20% share by 2035, driven by investments to improve fuel economy and minimize energy losses.

- The Europe market is expected to experience robust growth over the forecast period 2026–2035, driven by stringent emission regulations and the presence of major auto manufacturers.

Segment Insights:

- The dual plane manifold segment in the automotive intake manifold market is forecasted to achieve a 33.50% share by 2035, driven by growing demand to enhance engine performance.

- The light commercial vehicle segment in the automotive intake manifold market is forecasted to exhibit robust growth over 2026-2035, fueled by increasing use of LCVs globally and rising ride-sharing adoption.

Key Growth Trends:

- Technological advancements in manufacturing & design

- Rising demand from hydrogen fuel cell and internal combustion engine vehicles

Major Challenges:

- Technological advancements in manufacturing & design

- Rising demand from hydrogen fuel cell and internal combustion engine vehicles

Key Players: Edelbrock LLC, Roechling, Mahle GmbH, Holley, Aisin Seiki Co., Ltd., Hitachi Astemo Indiana, Novares.

Global Automotive Intake Manifold Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 35.9 billion

- 2026 Market Size: USD 37.9 billion

- Projected Market Size: USD 65.51 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 8 September, 2025

Automotive Intake Manifold Market Growth Drivers and Challenges:

Growth Driver:

- Technological advancements in manufacturing & design: The automotive intake manifold sector is poised to benefit from advancements in the design and manufacturing of the components. Advancements in variable geometry intake manifolds and tuning boost the engine performance of vehicles which drives demand. Furthermore, the advent of advanced materials such as composites and lightweight plastics is enabling the reduced weight of intake manifolds. Additionally, the adoption of 3D printing enables manufacturers to produce custom-designed manifolds to cater to rising demand and mitigate production times.

Manufacturers across the world are positioned to expand revenue shares by keeping pace with automotive engine advancements. For instance, in April 2024, Ahlstrom introduced a new dual-layer filtration technology for a longer lifetime and reduced size of air filters. Efficient air intake filtration prevents particulate contaminants from entering the engine and such advancements drive demand for intake manifolds. - Rising demand from hydrogen fuel cell and internal combustion engine vehicles: The growing production hydrogen fuel cell vehicles is poised to provide a steady stream of opportunities in the automotive intake sector. For instance, in October 2024, Alpine presented the Alpenglow Hy6 with a 6-cylinder hydrogen engine designed for optimum hydrogen combustion, which requires a modified intake manifold to ensure the supply of hydrogen gas to the fuel cell stack. Furthermore, the government investments to prioritize green technologies and transition to alternative powertrains have driven demand for intake manifolds to meet demands in hydrogen fuel cell vehicle engines.

Additionally, despite the growth in focus on alternative powertrains, internal combustion engine (ICE) vehicles remain dominant in the global automotive sector. Modern ICE vehicles drive demand for efficient manifolds capable of achieving precise air-fuel ratios while minimizing emissions. The rising production of ICE engines is poised to ensure continued demand for sustainable and durable intake manifolds. - Expansion of aftermarket services: The automotive intake manifold market is poised to benefit from the expansion of aftermarket services driven by rising demand for vehicle performance upgrades and maintenance. Consumers are investing heavily in vehicle upgrades, creating a premium segment for aftermarket services to offer horsepower gains. Furthermore, aftermarket intake manifolds can offer improved airflow driving demand from consumers.

Additionally, the automotive intake manifold market trends indicate a growing demand for vehicle customization and personalization. The advent of drag racing has driven demand for aftermarket intake manifolds that can support the robust demand for drag racing vehicle engines. In November 2024, CPC Manufacturing announced the release of the RB26 Billet Drag Intake Manifold which is designed for extreme drag racing for builds pushing over 2000-wheel horsepower. The automotive intake manifold market is poised to benefit from aftermarket services for customized vehicles and expand its revenue share.

Challenges

- Rising shift toward EVs: The growing adoption of electric vehicles (EVs) is a major challenge for the automotive intake manifold market. Rising EV production and adoption can lead to a potential decline in the demand for the component as EVs do not have an internal combustion engine. Furthermore, government support in EV adoption has created a pressing need for key market players to adapt their business models to remain relevant in EV-dominated regional automotive intake manifold markets.

- Impact of engine downsizing trends: The shift toward turbocharged engines to meet stringent emission norms can create challenges for the automotive manifold sector. The trend can impact revenue streams as small manifolds have comparatively lesser profit margins. Additionally, it impacts economies of scale for manufacturers owing to production challenges of customized intake designs in downsized engines.

Automotive Intake Manifold Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 35.9 billion |

|

Forecast Year Market Size (2035) |

USD 65.51 billion |

|

Regional Scope |

|

Automotive Intake Manifold Market Segmentation:

Product Type Segment Analysis

Dual plane manifold segment is set to dominate automotive intake manifold market share of over 33.5% by 2035. The growing demand to enhance engine performance is a key driver of the segment’s growth. Furthermore, the rising production of passenger cars and light commercial vehicles creates a steady demand for dual-plane manifolds.

The growing adoption of lightweight composite materials is expected to create more efficient and durable plane intake manifolds, driving further adoption. In September 2022, research published in Materials & Design indicated that the growing push to improve fuel economy and curb greenhouse gas emissions are driving forces for automotive component manufacturers to adopt lightweight materials in production. Additionally, the rising demand for dual-plane manifolds in pickup trucks to improve engine power has benefited manufacturers in launching new manifold solutions. For instance, in October 2023, AFR launched the magnum intake manifold for the big block Chevy engine to improve the performance of street vehicles.

Single plane manifold segment of the automotive intake manifold sector is poised to expand during the forecast period. The growing demand owing to the rising production of high-rpm race engines is a major driver of the segment. The global automotive sector is experiencing rising demand for performance-oriented vehicles which augurs well for the growth of the single plane manifold segment.

Additionally, automotive manufacturers are launching high-revving performance-oriented vehicles in emerging markets which is poised to create heightened demand for single-plane manifold intake solutions. In March 2024, Holley announced a new single-plane intake manifold for Gen III Hemi that is designed to provide a broad torque curve. The advanced single-plane manifold solutions designed and launched by manufacturers are indicative of the rising demand.

Application Segment Analysis

The light commercial vehicle segment of the automotive intake manifold market is poised to exhibit robust growth during the forecast period. The growing use of light commercial vehicles on the streets globally drives demand for intake manifolds as production increases to keep pace with the demand. Furthermore, the use of light commercial vehicles as passenger carriers with the growth of ride-sharing services has driven the production of automobiles necessitating a steady supply of intake manifolds of various designs.

Additionally, the aftermarket components for light commercial vehicles provide lucrative opportunities for intake manifold manufacturers. In July 2024, Dorman Products Inc. announced the release of more than a hundred automotive components and assemblies creating new sales opportunities for automotive components distributors and repair shops providing intake manifold repair and upgrade solutions for light commercial vehicles.

Our in-depth analysis of the global automotive intake manifold market includes the following segments:

|

Product Type |

|

|

Application |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Intake Manifold Market Regional Analysis:

North America Market Insights

North America in automotive intake manifold market is estimated to capture around 47.2% revenue share by the end of 2035. The investments to improve fuel economy in North America have created profitable revenue segments for automotive manifold manufacturers to forward intake manifold solutions that focus on minimizing energy losses. The automotive intake manifold market dynamics in North America are poised to drive demand for variable geometry intake manifolds and for intake manifold tuning and optimization. Furthermore, the growth of the ride-hailing service sector in North America is positioned to create sustained demand for intake manifold components in commercial vehicles.

The U.S. automotive intake manifold industry is projected to register the largest revenue share in North America. A key driver of the automotive intake manifold market in the U.S. is the vibrant automotive aftermarket sector creating sustained opportunities for intake manifold manufacturers. Additionally, stringent environmental regulations on vehicle emissions drive R&D investment in intake manifolds that enhance engine performance and assist in emission reduction. For instance, in March 2024, the U.S. Environmental Protection Agency finalized emission standards for passenger cars and trucks in model years 2027 to 2032 which is positioned to create demand for intake manifold solutions.

Additionally, a key feature of the U.S. automobile sector is the rising sales of sports cars and a growing demand for vehicle customization and upgrades that drive demand for high-performance intake manifolds. With a robust network of domestic manufacturers and international suppliers working closely in the U.S., the automotive intake manifold sector is projected to maintain its expansion by the end of the forecast period. For instance, in September 2024, General Motors and Hyundai signed an agreement to explore future collaboration across key strategic areas on co-development and production of passenger and commercial vehicles, internal combustion engines, and clean energy.

The Canada automotive intake manifold sector is projected to increase its revenue share during the forecast period. A key driver of the automotive intake manifold market is the growing domestic demand for light commercial vehicles and trucks that rely on ICEs. Furthermore, the extensive resource-based industries drive demand for rugged vehicles creating a steady necessity for intake manifolds. Additionally, opportunities arise in Canada’s position as a key exporter of automotive components to the U.S. ensuring a stable market for intake manifold manufacturers.

Despite the revenue growth, a key challenge in the Canada automotive intake manifold sector is the push to phase out ICE vehicles, necessitating domestic manufacturers to restructure their business structures. Despite the challenge, advancements in ICE engines have the potential to revolutionize small engines. For instance, in July 2024, Avadi leveraged the design of a Quebec-based inventor to develop a rotary piston ICE to enhance small engines which will require intake manifold supply.

Europe Market Insights

The Europe automotive intake manifold market is poised to account for robust growth during the forecast period. The stringent emission regulations of Europe and the presence of major automotive manufacturers are market features driving the industry’s growth. Additionally, the demand to improve engine performance in ICE vehicles creates a sustained demand for intake manifold solutions in the region.

In October 2024, the European Alliance for the Freedom of Car Repair (AFCAR), representing key stakeholders in the aftermarket sector, demanded open access to in-vehicle data with the advent of data-driven solutions in the automobile industry. The trends are poised to benefit the aftermarket automobile component sector in the region which augurs well for the intake manifold manufacturers.

The Germany automotive intake manifold industry is poised to register a dominant share in Europe owing to a well-established automobile industry known for precision manufacturing driving demand for intake manifold components. In April 2024, FUCHS SE and Mercedez-Benz announced a strategic business partnership for collaboration in automotive after-sales. The trends of such proactive collaborations are projected to be of major benefit to the German automotive intake manifold market with rising opportunities for intake manifold repair solutions, and upgradation. Additionally, the automotive industry in the country is strongly export-oriented ensuring manufacturers have a steady stream of opportunities to manufacture high-quality intake manifolds.

The France automotive intake manifold sector is projected to expand during the forecast period. The presence of leading automobile industry leaders such as Renault, Peugeot, Citroën, etc., boosts the automotive intake manifold production domestically. In November 2022, TotalEnergies announced the construction of a new production line of high-performance recycled polypropylene for automotive in its polymer plant in France which is poised to drive demand for the use of lightweight components in intake manifold manufacturing.

Automotive Intake Manifold Market Players:

- Edelbrock LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roechling

- Mahle GmbH

- Holley

- Aisin Seiki Co., Ltd.

- Hitachi Astemo Indiana

- Novares

The automotive intake manifold market is poised to exhibit robust growth during the forecast period. Key players in the sector are investing to increase the production of intake manifolds for various classes of vehicles, such as light commercial vehicles and heavy commercial vehicles. Additionally, collaborations between automotive manufacturers and component manufacturers are poised to advance the quality of intake manifolds. The rising demand in emerging markets in APAC and Africa offers lucrative opportunities to key players in the sector.

Here are some key players in the automotive intake manifold market:

Recent Developments

- In December 2024, Holley announced Hi-Ram intake manifolds for small block chevy. The new line joins existing Holley Hi-Ram offerings that cater to customers with Chevrolet LS and LT, Ford Coyote, 302 and 351 Windsor, and Gen III Hemi motors.

- In November 2024, MAHLE announced the securing of a contract in sustainable mobility. Commercial vehicle manufacturer MAN Truck & Bus commissioned MAHLE to supply components for the hydrogen engine of its MAN hTGX truck.

- Report ID: 963

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Intake Manifold Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.