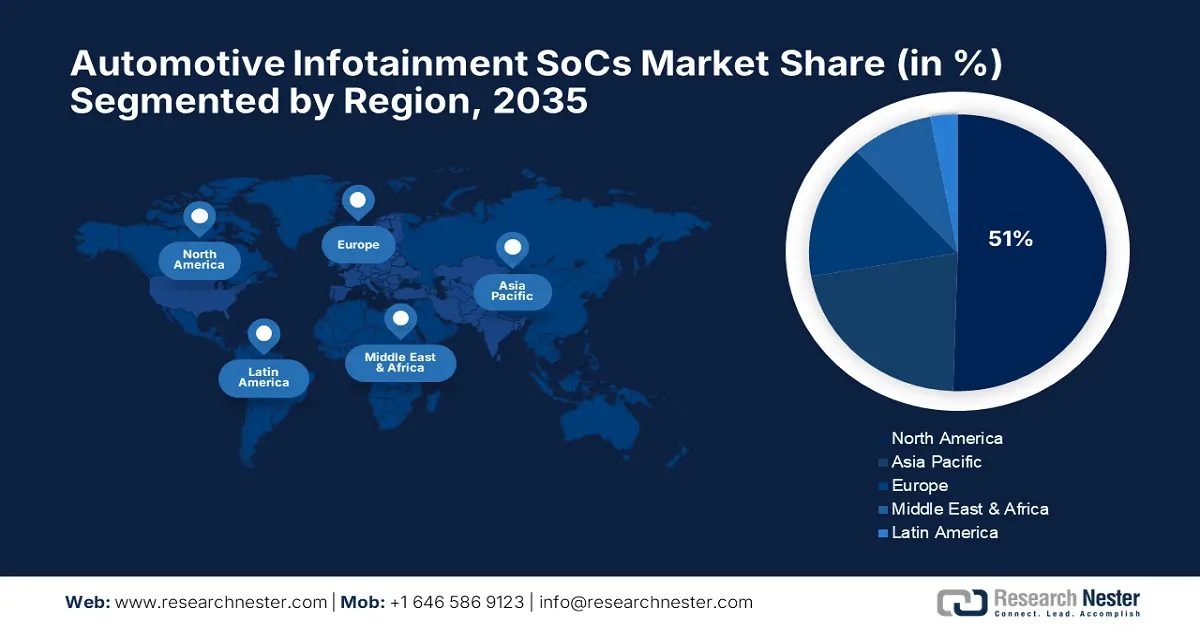

Automotive Infotainment SoCs Market - Regional Analysis

North America Market Insights

North America automotive infotainment SoCs market is projected to hold a leading 51% market share through the forecast period, driven by an incredibly innovative technology ecosystem and huge government investment in critical supply chains. The region is a global semiconductor design hub and major automotive manufacturing center, with the resultant strong synergy fueling innovation in next-generation in-cabin experiences. This industry is stretching the boundaries of what is possible in car connectivity, AI, and human-machine interface technology.

The U.S. is at the center, with its leading tech companies rapidly moving toward developing high-performance networking chips essential to the massive data processing demands of modern infotainment and autonomous vehicle systems. These cutting-edge chips are necessary to enable the scale-up of AI clusters in next-generation cars. For instance, Broadcom Inc. announced in June 2025 that it was shipping its Tomahawk 6 switch series. This revolutionary chip delivers the world's first 102.4 Terabits/second of switching capacity, double the bandwidth of any other Ethernet switch, and natively supports automotive AI applications.

Canada is strategically investing to build a competitive and robust domestic semiconductor industry, with the focus on strengthening its position in the North American automotive supply chain. The government is investing in creating a pan-Canadian network of manufacturing and design of semiconductors to stimulate innovation and create highly skilled jobs. In July 2024, the Government of Canada pledged USD 120 million of investment under the Strategic Innovation Fund to support CMC Microsystems. The project is expected to create the FABrIC network to build on Canada's leadership in semiconductor technologies needed in the auto and other sectors.

Europe Market Insights

Europe automotive infotainment SoCs market is poised for significant growth, owing to the continent's robust automotive production cluster and a regulatory climate that promotes future-oriented technological advancements. European automobile manufacturers are leading the drive to install advanced digital cockpits into cars, and this creates an ongoing need for high-performance SoCs to deliver a better user experience. This innovation and quality emphasis assures that Europe is expected to remain a leading market for premium semiconductor solutions through 2035.

The UK automotive infotainment SoCs market is taking decisive steps to make it a global leader in the semiconductor industry through a consistent national strategy and major government investment. The UK is focused on compound semiconductors and leading-edge chip design, both of which are critical for near-term automobile applications, including autonomous driving and state-of-the-art connectivity. In July 2025, the UK established a strategic partnership with Canada under a Memorandum of Understanding between the prime research facilities. The collaboration will solidify semiconductor supply chains and standardize design, fabrication, and packaging capacities.

Germany is actively propelling its domestic industry's development with a comprehensive program of initiatives to boost its competitiveness in the digital era. Special public funding for innovative production technologies, including highly sophisticated automotive electronics and semiconductor devices on which advanced infotainment and control systems are based, is being provided by the German government. In February 2025, the Federal Ministry for Economic Affairs and Climate Action of Germany released a package of measures to revive and enhance the automotive industry, including fresh regulations for semiconductor components.

APAC Market Insights

The Asia Pacific automotive infotainment SoCs market is anticipated to expand at an 8% CAGR during the forecast period. This growth is driven by the region's massive vehicle production volumes, a growing middle-class population, and powerful government initiatives to build semiconductor ecosystems that are self-sustaining. The size of the APAC market makes it the focus for SoC manufacturers globally, vying with the world's leading automakers for design wins.

China is pursuing technological independence in the car semiconductor industry aggressively, crafting an end-to-end national program to counter its heavy dependence on foreign suppliers. The government is mandating more local buying and has put its own domestic certification program in place to accelerate the development and rollout of locally designed chips. China's Ministry of Industry and Information Technology released the Guidelines for the Construction of the National Automotive Chip Standard System in January 2024, which aims to develop over 70 local standards by 2030 and become increasingly independent.

India is rapidly emerging as a key global hub for semiconductor design, alongside automotive manufacturing, and is establishing a synergy in the infotainment SoC market. The government's Semicon India Programme is providing substantial financial support to attract investment and build a robust domestic ecosystem. With prominent foreign companies looking to expand their presence in India, the country's efforts are yielding results. In August 2025, Qualcomm Technologies revealed its strategic initiative to shift a portion of its automobile module production to India, aiming to double its car revenue by 2029, driven by a rapidly growing market.