Automotive Infotainment SoCs Market Outlook:

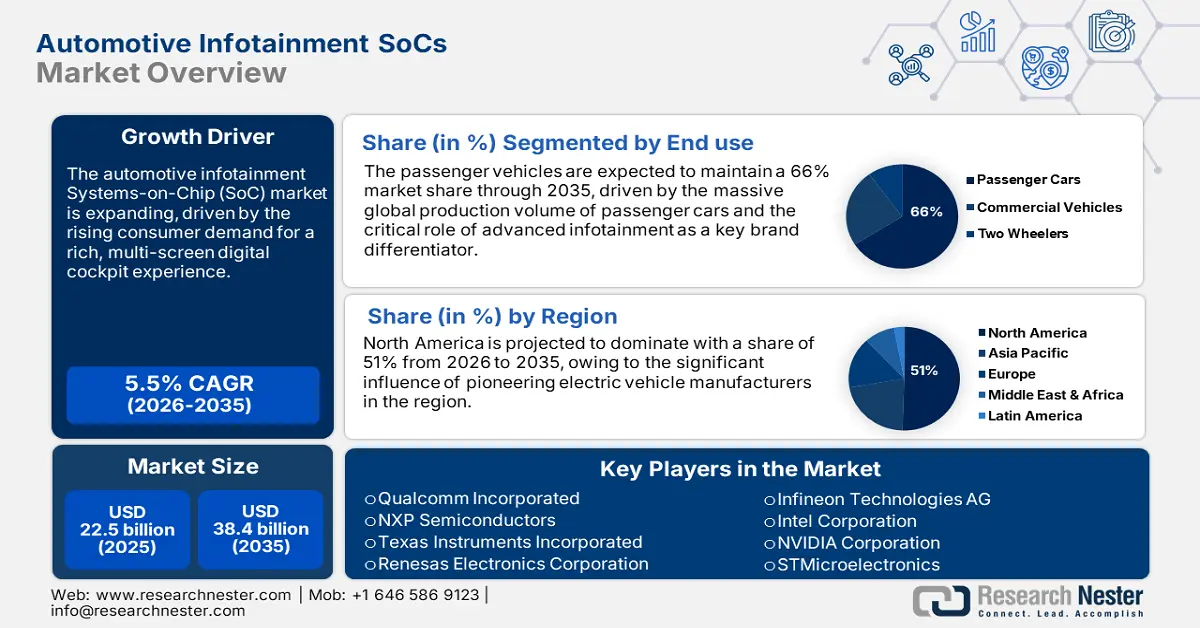

Automotive Infotainment SoCs Market size is valued at USD 22.5 billion in 2025 and is projected to reach a valuation of USD 38.4 billion by the end of 2035, rising at a CAGR of 5.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive infotainment SoCs is evaluated at USD 23.7 billion.

The automotive infotainment SoCs market is expanding as the automotives are being transformed into a connected, AI-powered living room on wheels. A lucrative opportunity for manufacturers is to develop high-performance yet low-power SoCs supporting generative AI, high-end graphics, and end-to-end connectivity for an immersive in-cabin experience. Producers are also pushing hard after it, with Qualcomm Technologies in January 2024 reporting that a dozen auto model designs will be outfitted with its high-end Snapdragon Cockpit SoCs in the coming years, which represents rapid adoption of feature-rich high-end infotainment platforms by leading auto manufacturers.

Governments around the world are also taking the lead in this shift by creating national plans to promote their local semiconductor industry and supply chains, understanding the strategic importance of automotive chips. This government support provides a secure atmosphere for long-term investment and innovation for next-generation infotainment SoCs. For instance, in May 2023, the UK Government launched its National Semiconductor Strategy with up to £1 billion to be committed over the next decade. It is a 20-year strategy to ensure national leadership in leading-edge chip design, including those for autonomous vehicles and future telecoms.

Key Automotive Infotainment SoCs Market Insights Summary:

Regional Insights:

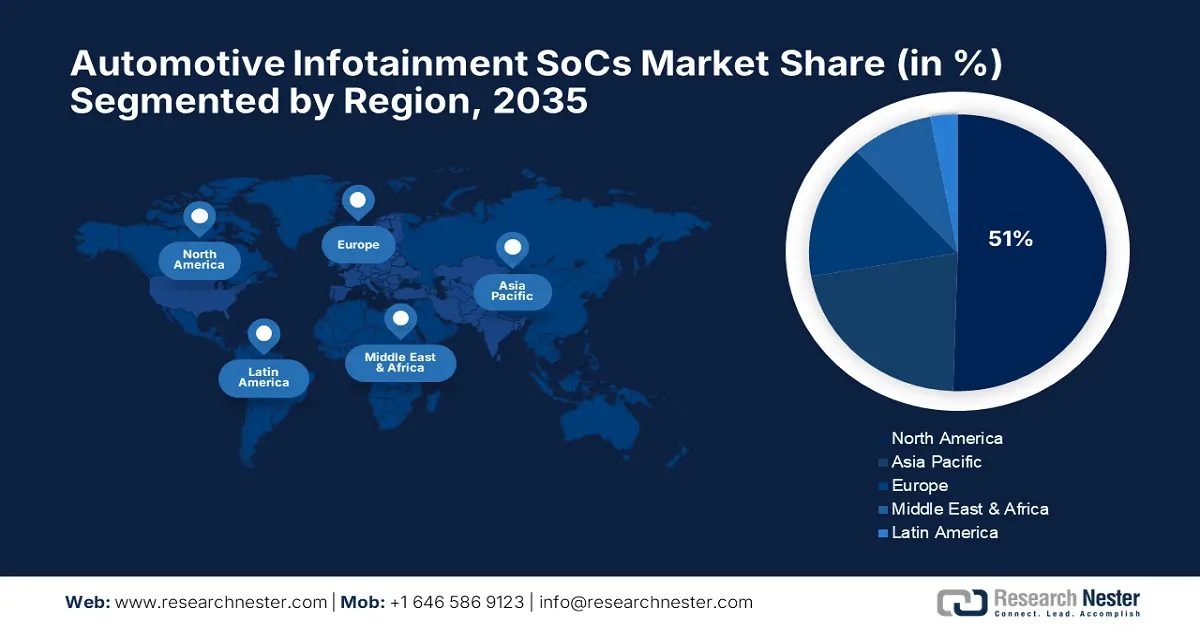

- North America is projected to command a leading 51% share by 2035 in the Automotive Infotainment SoCs Market, underpinned by its strong semiconductor innovation base and extensive investment across critical supply chains owing to its advanced technology ecosystem.

- Europe is expected to secure a substantial share by 2035, supported by its powerful automotive manufacturing cluster and regulatory emphasis on next-generation digital cockpit technologies resulting from its push toward premium in-vehicle innovation.

Segment Insights:

- The embedded technology segment is set to capture a 44.5% share by 2035 in the Automotive Infotainment SoCs Market, upheld by its foundational role in delivering secure, high-reliability in-vehicle computing energized by the industry's transition toward software-centric architectures.

- The passenger vehicles segment is projected to hold a dominant 66% share by 2035, reinforced by global production scale and OEM competition to enhance in-cabin digital experiences encouraged by rising SoC complexity in next-generation automobiles.

Key Growth Trends:

- Emergence of the software-defined vehicle (SDV)

- Demand for AI-powered, immersive in-cabin experience

Major Challenges:

- Geopolitical tensions and supply chain disaggregation

- Increasing sophistication of chip design and manufacturing

Key Players: Qualcomm Incorporated, NXP Semiconductors, Texas Instruments Incorporated, Renesas Electronics Corporation, Infineon Technologies AG, Intel Corporation, NVIDIA Corporation, STMicroelectronics, ON Semiconductor, Samsung Electronics Co., Ltd., Broadcom Inc., Mediatek Inc.

Global Automotive Infotainment SoCs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.5 billion

- 2026 Market Size: USD 23.7 billion

- Projected Market Size: USD 38.4 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (51% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Mexico, Brazil, Thailand, Vietnam

Last updated on : 5 September, 2025

Automotive Infotainment SoCs Market - Growth Drivers and Challenges

Growth Drivers

- Emergence of the software-defined vehicle (SDV): The shift to the software-defined vehicle is a powerful catalyst for the infotainment automotive infotainment SoCs market. With automobiles serving as software-driven upgrade platforms, the demand for high-performance, centralized computer hardware to run advanced applications grows exponentially. This is fueling the need for advanced SoCs that will manage several in-car domains. In January 2024, Panasonic Automotive introduced its Neuron High-Performance Compute (HPC) architecture at CES. This platform is specifically designed to bring infotainment, ADAS, and other automotive functions onto a single, high-performance device to facilitate the next generation of SDVs.

- Demand for AI-powered, immersive in-cabin experience: Increased consumer interest in a convenient, smartphone-like experience within the vehicle is leading to demands for infotainment SoCs with top-level AI and graphics capabilities. Car manufacturers are competing to bring generative AI assistants, high-definition multimedia streaming, and interactive gaming, all of which require high-performance, dedicated silicon. For example, Intel launched a new generation of AI-powered automotive SoCs in January 2024, with Zeekr being the inaugural OEM to employ the technology. The collaboration will result in a generative AI-enabled living room experience in the next-generation cars, a new standard in in-cabin tech.

AI-Powered Immersive In-Cabin Experiences

|

Company / Automaker |

Innovation / Feature |

|

LG Electronics |

AI in-cabin sensing (health, emotion, adaptive environment) |

|

BMW (Neue Klasse) |

Panoramic iDrive across windshield + AR HUD navigation, edge AI learning |

|

Volvo |

First cars with Google Gemini AI assistant (natural dialogue for GPS, manuals, etc.) |

|

Sony Honda Mobility |

Afeela 1 EV with AISMO OS, AI voice agent, panoramic infotainment |

|

SoundHound + Lucid |

“Lucid Assistant” with generative AI + in-vehicle food ordering via voice commerce |

|

Hyundai Mobis |

Full-windshield holographic head-up display for immersive AR driving data |

|

Continental |

“Emotional Cockpit” with E Ink Prism ultra-wide display |

Source: LG Electronics, Continental, Volvo, Afeela

- Adoption of multiple in-vehicle screens: The modern auto cockpit is increasingly filled with various large, high-resolution displays for the driver, front passenger, and rear-seat occupants. This presents a significant technical challenge and a vast opportunity for SoCs that can drive multiple displays and applications simultaneously from a single chip. In April 2025, LG Electronics and MediaTek showcased a revolutionary Android-based Concurrent Multi-User (CMU) system. This technology allows various passengers to employ different displays and applications independently on a single OS, reducing the hardware requirements and system load for multi-screen infotainment systems.

Global EV Market Growth & Infotainment SoC Demand Drivers

|

Metric |

2023 Data & Trend |

Implication for Infotainment SoC Market |

|

Global EV Sales |

14 million new units (18% of all car sales) |

Directly increases the addressable market for advanced, digital cockpit SoCs, as EVs are a key segment for high-tech features. |

|

YoY Growth |

35% increase from 2022 |

Rapid market expansion requires SoC manufacturers to scale production and innovate quickly to meet rising OEM demand. |

|

Market Concentration |

95% of sales in China, Europe, and the United States |

SoC development can be focused on the specific connectivity standards, UI preferences, and app ecosystems (e.g., Android Automotive, CarPlay) dominant in these three key regions. |

|

Weekly Registrations |

Over 250,000 per week |

Highlights the massive, continuous production scale required for SoC suppliers to keep pace with automotive manufacturing lines. |

Source: IEA

Regional EV Sales Analysis & Infotainment SoC Requirements

|

Region |

2023 EV Sales & Market Share |

Key Infotainment SoC Considerations |

|

China |

8.1 million sales (>35% of local market). Leader in exports (1.2M EVs). |

High demand for integrated, immersive digital cockpits with local apps, video, and connectivity. SoCs must support domestic ecosystems and fierce cost competition. |

|

Europe |

3.2 million sales (>20% of local market). High penetration in Nordic countries. |

SoCs must support stringent performance and safety standards. Growth in BEVs favors powerful SoCs for range data, charging maps, and premium user experiences. |

|

United States |

1.4 million sales (~10% of local market). Growth driven by tax incentives. |

Demand for large, multiple displays, gaming, and high-performance graphics. SoCs need to handle complex vehicle data and integrate seamlessly with major tech platforms. |

|

Rest of World |

Limited sales, but a key future growth area. |

Presents an opportunity for cost-optimized, scalable SoC platforms to bring advanced infotainment to emerging EV markets. |

Source: IEA

Challenges

- Geopolitical tensions and supply chain disaggregation: The infotainment automotive infotainment SoCs market is facing massive headwinds from escalating geopolitical tensions, which are bringing about supply chain disaggregation and a global push towards semiconductor self-reliance. This complex geography poses a threat to companies that rely on global supply chains and forces them to navigate a mosaic of national rules and barriers to trade. This test was put in stark relief in October 2024, when China launched its first onshore car-grade chip certification system. This initiative is in response to the country's over 90% reliance on overseas importation of auto chips, and it constitutes a major move towards reducing reliance on worldwide suppliers.

- Increasing sophistication of chip design and manufacturing: As infotainment SoCs become more powerful and integrated, their design, testing, and manufacturing complexity will reach unprecedented levels. Stretching the boundaries of Moore's Law requires engineering- and capital-hungry solutions like advanced packaging and chiplet architectures that represent insurmountable technical hurdles. This was highlighted in December 2024, when Broadcom delivered the world's first 3.5D Face-to-Face XPU. This highly advanced chip integrates several compute dies and memory modules using advanced packaging, showing the immense engineering effort required to produce next-generation silicon for AI automotive applications.

Automotive Infotainment SoCs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 22.5 billion |

|

Forecast Year Market Size (2035) |

USD 38.4 billion |

|

Regional Scope |

|

Automotive Infotainment SoCs Market Segmentation:

Technology Segment Analysis

The embedded technology segment is projected to maintain its dominance with a 44.5% automotive infotainment SoCs market share during the forecast period, as it forms the foundational layer of modern in-vehicle infotainment systems. Embedded applications, where the SoC is deeply integrated inside the electronic control unit (ECU) of the vehicle, ensure high reliability, security, and performance compared to tethered or integrated smartphone-based applications. This approach is required for performing safety-critical tasks and ensuring an error-free user experience. The role of embedded systems was reasserted in May 2023 with the expanded partnership between NVIDIA and MediaTek, with NVIDIA DRIVE AGX being integrated into the Dimensity Auto platform for future embedded solutions. The continued embedded market dominance is also driven by the industry's trend towards a software-first design model, which oddly relies on rock-solid, standard embedded hardware. End Use Segment Analysis

End use Segment Analysis

The passenger vehicles segment is expected to maintain a dominant 66% automotive infotainment SoCs market share through 2035, driven by the massive scale of worldwide manufacturing of consumer vehicles and price wars between automakers to differentiate their offerings through the use of pioneering in-cabin technology. Infotainment systems have become a key marketing feature in new vehicles, prompting producers to equip even entry-level models with cutting-edge SoCs. For instance, Sony Honda Mobility's January 2023 launch of the AFEELA prototype is a prime example of this trend, where a fresh vision that has the in-car experience, led by Sony's sensor and entertainment technologies, is central to the vehicle's identity. Growth in the passenger car segment is also being fueled by the increasing complexity and transistor density of the SoCs required by next-generation automobiles.

Functionality Segment Analysis

The navigation segment is predicted to hold a massive 40% automotive infotainment SoCs market share through 2035 as better navigation and mapping are a basic, non-discernible component of any modern infotainment system. Its long-term dominance is also assured by its position as a basic enabling technology for the overall phenomenon of car electrification and energy management. For EVs, intelligent navigation with the capability to accurately estimate range and optimize driving based on charging station proximity is required for mitigating range anxiety. With a further attempt to consolidate itself in this space, Intel Corporation revealed in January 2024 that it was acquiring Silicon Mobility. This fabless silicon vendor designs SoCs for intelligent EV energy management, a function that is inherently interlinked with navigation.

Our in-depth analysis of the automotive infotainment SoCs market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Component |

|

|

End use |

|

|

Functionality |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Infotainment SoCs Market - Regional Analysis

North America Market Insights

North America automotive infotainment SoCs market is projected to hold a leading 51% market share through the forecast period, driven by an incredibly innovative technology ecosystem and huge government investment in critical supply chains. The region is a global semiconductor design hub and major automotive manufacturing center, with the resultant strong synergy fueling innovation in next-generation in-cabin experiences. This industry is stretching the boundaries of what is possible in car connectivity, AI, and human-machine interface technology.

The U.S. is at the center, with its leading tech companies rapidly moving toward developing high-performance networking chips essential to the massive data processing demands of modern infotainment and autonomous vehicle systems. These cutting-edge chips are necessary to enable the scale-up of AI clusters in next-generation cars. For instance, Broadcom Inc. announced in June 2025 that it was shipping its Tomahawk 6 switch series. This revolutionary chip delivers the world's first 102.4 Terabits/second of switching capacity, double the bandwidth of any other Ethernet switch, and natively supports automotive AI applications.

Canada is strategically investing to build a competitive and robust domestic semiconductor industry, with the focus on strengthening its position in the North American automotive supply chain. The government is investing in creating a pan-Canadian network of manufacturing and design of semiconductors to stimulate innovation and create highly skilled jobs. In July 2024, the Government of Canada pledged USD 120 million of investment under the Strategic Innovation Fund to support CMC Microsystems. The project is expected to create the FABrIC network to build on Canada's leadership in semiconductor technologies needed in the auto and other sectors.

Europe Market Insights

Europe automotive infotainment SoCs market is poised for significant growth, owing to the continent's robust automotive production cluster and a regulatory climate that promotes future-oriented technological advancements. European automobile manufacturers are leading the drive to install advanced digital cockpits into cars, and this creates an ongoing need for high-performance SoCs to deliver a better user experience. This innovation and quality emphasis assures that Europe is expected to remain a leading market for premium semiconductor solutions through 2035.

The UK automotive infotainment SoCs market is taking decisive steps to make it a global leader in the semiconductor industry through a consistent national strategy and major government investment. The UK is focused on compound semiconductors and leading-edge chip design, both of which are critical for near-term automobile applications, including autonomous driving and state-of-the-art connectivity. In July 2025, the UK established a strategic partnership with Canada under a Memorandum of Understanding between the prime research facilities. The collaboration will solidify semiconductor supply chains and standardize design, fabrication, and packaging capacities.

Germany is actively propelling its domestic industry's development with a comprehensive program of initiatives to boost its competitiveness in the digital era. Special public funding for innovative production technologies, including highly sophisticated automotive electronics and semiconductor devices on which advanced infotainment and control systems are based, is being provided by the German government. In February 2025, the Federal Ministry for Economic Affairs and Climate Action of Germany released a package of measures to revive and enhance the automotive industry, including fresh regulations for semiconductor components.

APAC Market Insights

The Asia Pacific automotive infotainment SoCs market is anticipated to expand at an 8% CAGR during the forecast period. This growth is driven by the region's massive vehicle production volumes, a growing middle-class population, and powerful government initiatives to build semiconductor ecosystems that are self-sustaining. The size of the APAC market makes it the focus for SoC manufacturers globally, vying with the world's leading automakers for design wins.

China is pursuing technological independence in the car semiconductor industry aggressively, crafting an end-to-end national program to counter its heavy dependence on foreign suppliers. The government is mandating more local buying and has put its own domestic certification program in place to accelerate the development and rollout of locally designed chips. China's Ministry of Industry and Information Technology released the Guidelines for the Construction of the National Automotive Chip Standard System in January 2024, which aims to develop over 70 local standards by 2030 and become increasingly independent.

India is rapidly emerging as a key global hub for semiconductor design, alongside automotive manufacturing, and is establishing a synergy in the infotainment SoC market. The government's Semicon India Programme is providing substantial financial support to attract investment and build a robust domestic ecosystem. With prominent foreign companies looking to expand their presence in India, the country's efforts are yielding results. In August 2025, Qualcomm Technologies revealed its strategic initiative to shift a portion of its automobile module production to India, aiming to double its car revenue by 2029, driven by a rapidly growing market.

Key Automotive Infotainment SoCs Market Players:

- Qualcomm Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NXP Semiconductors

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- Infineon Technologies AG

- Intel Corporation

- NVIDIA Corporation

- STMicroelectronics

- ON Semiconductor

- Samsung Electronics Co., Ltd.

- Broadcom Inc.

- Mediatek Inc.

The competitive landscape for automotive infotainment SoCs market is dominated by a few powerful semiconductor giants that possess the massive R&D resources, deep software expertise, and strong automaker connections needed to survive this demanding environment. These companies are locked in a fierce battle to provide the underlying brains for future generations of connected and software-defined vehicles, each vying for volume design wins.

The automotive infotainment SoCs market is also characterized by strategic partnerships and heading toward open ecosystems, because no company can provide the entire complex solution required in a modern infotainment configuration. Companies are collaborating to combine their technologies and advance open standards to accelerate development and provide automakers with greater flexibility. Panasonic Automotive is a good case in point, having a strong commitment to using open-source software. In May 2025, the company collaborated with Linux Foundation Japan Evangelist, which indicates the company's leadership in advancing the use of platforms like Automotive Grade Linux (AGL).

Here are some leading companies in the automotive infotainment SoCs market:

Recent Developments

- In April 2025, Dirac Research AB announced a strategic collaboration with MediaTek to enhance in-car audio performance through integration of Dirac's industry-leading digital audio software into MediaTek's automotive-grade systems-on-chips. The partnership focuses on integrating Dirac's advanced audio optimization technologies directly onto MediaTek's automotive platforms, enabling OEMs to deliver superior in-car sound quality with easier system integration and accelerated time-to-market.

- In March 2025, MediaTek Inc. unveiled its flagship Dimensity Auto Cockpit Platform C-X1 at GTC 2025, featuring state-of-the-art AI and multimedia technologies integrated into next-generation autonomous vehicles for comprehensive industry solutions. The platform utilizes the most advanced 3nm manufacturing process and is built on the latest Arm v9.2-A processor architecture, integrating NVIDIA Blackwell GPU and deep learning accelerator for end-to-end AI ecosystem acceleration.

- Report ID: 3839

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Infotainment SoCs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.