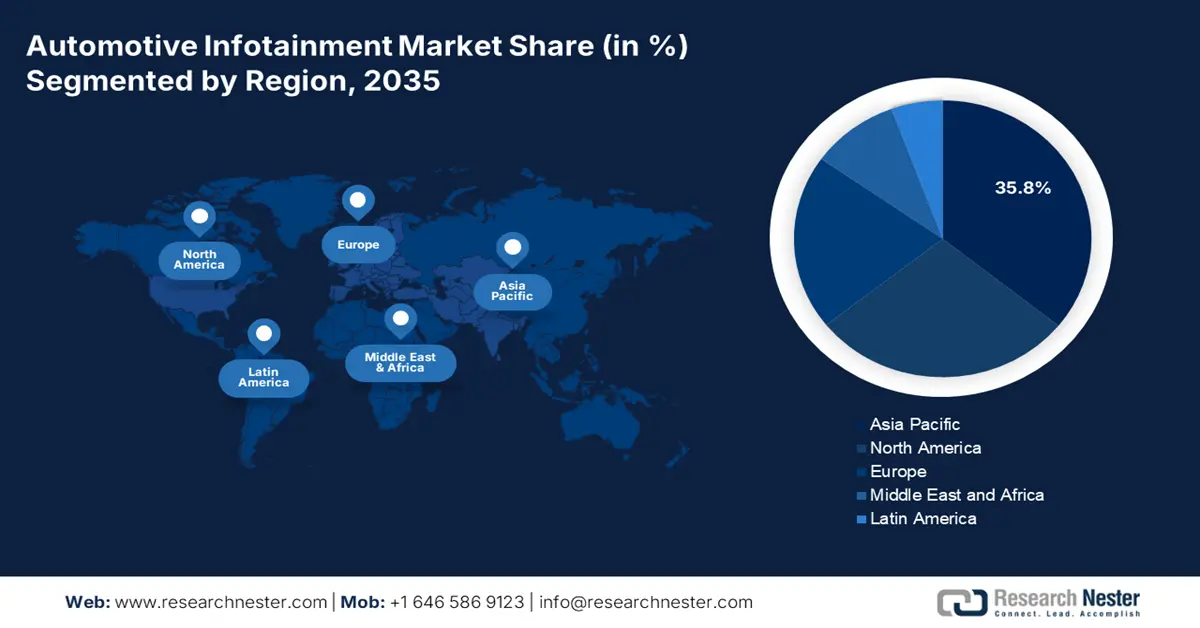

Automotive Infotainment Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific automotive infotainment market is projected to register staggering growth with a 35.8% revenue share by 2035. Rising disposable incomes and demand for seamless smartphone integration boost OEM installations. The growth of the market can be attributed to the rising sales of the IoT-enabled vehicles. China is offering lucrative opportunities for the market players with the rise in ICT investments and the boom in EV sales. The foundation for a digital panopticon is being laid by the Chinese Communist Party's 2020 deployment of 626 million video cameras, the growing use of artificial intelligence, and the absence of meaningful civil rights protections.

China continues to be the largest infotainment marketplace in the Asia Pacific, with the strongest demand being generated from its automotive passenger-car production and growing electric vehicle (EV) sector. The government’s Intelligent Connected Vehicle (ICV) strategy has promoted and enabled advanced connected services to suppliers such as Huawei and Baidu. Increasing consumer preference for voice-activated navigation and entertainment services will help drive increased adoption.

The expansion of India’s automotive infotainment system market is due to the continued increase in the sale of passenger vehicles, improvement in smartphone integration, and increasing consumer interest in navigation, entertainment, and telematics. The Union Government has endorsed connected-car technology and electric vehicles (EVs) with initiatives such as FAME-II and the Automotive Mission Plan 2026. The International Telecommunication Union reports that there were 5.4 billion Internet users in 2023, up from 1 billion in 2005. Estimates of yearly smartphone shipments more than doubled, from 500 million to over 1.2 billion, between 2010 and 2023. According to certain market projections, the percentage of people with fifth-generation (5G) mobile broadband is predicted to increase from 25% in 2021 to 85% in 2028.

North America Market Insights

The North America automotive infotainment market is anticipated to hold 28.5% revenue share by 2037, owing to a surge in 5G adoption and exponentially rising consumer demand for advanced car technology. Widespread 5G adoption, strong electric vehicle (EV) acceptance, and the proliferation of Artificial Intelligence (AI) voice assistants are expected to support growth. Automotive companies are collaborating with technology companies to develop seamless smartphone integration, subscription services, and over-the-air (OTA) updates for passenger and commercial vehicles, where market growth should be steadily adopted.

The U.S. automotive infotainment sector is driven by consumer demand for smart features, such as voice recognition, real-time navigation, and streaming services. Federal incentives for EVs and 5G infrastructure will help drive the adoption of connected car services. Telecommunications equipment imports increased by $16.4 billion, or 17.3%, to $111.3 billion. The main cause of the increase was the rise in imports of switches, routers, and cell phones as the demand for fifth-generation (5G) infrastructure and technologies increased globally in 2021. Cell phones saw the biggest gain in this breakdown, rising $12.0 billion (24.8%) to $60.7 billion. As manufacturers released more 5G smartphones onto the market, pent-up customer demand for these devices was partially satisfied, leading to an increase in cell phone imports. Switches and routers saw the second-largest gain in this breakdown, rising $3.7 billion (9.6%) to $42.3 billion.

The automotive infotainment market in Canada is expected to grow steadily, driven by increased adoption of electric vehicles and growing interest from consumers in connected services such as cloud-based navigation, music streaming, and driver-assistance displays. Federal and provincial incentives for purchasing electric vehicles (EVs) will encourage consumers to adopt smart infotainment technologies, aided by the substantial expansion of 5G networks. Collaboration between automotive and technology companies has led to devices utilizing next-generation connected infotainment technology features. The bilingual interface (English-French) demand among Canadian drivers is also helping drive customized infotainment solutions.

Europe Market Insights

The European automotive infotainment market is anticipated to hold 20.5% revenue share by 2037, owing to a growing demand for more EVs being sold, related connectivity is improving, and safety regulations are becoming stricter, all of which encourage the growth of telematics integration and navigation. As consumers increasingly choose connected cars, the rollout of 5G, coupled with government sponsorship of intelligent transport systems, promotes market growth. Leading auto brands are investing in embedded intelligent interfaces that apply AI and voice assistants for conversational dialog, and the EU is also pushing in-vehicle cybersecurity and over-the-air software updates to support demand, and you can see this in premium or midline car sales.

The German automotive infotainment market is the leader of the general European market based on the volume of auto OEMs with strong automotive manufacturing and rapid digitalization. The premium automotive OEMs such as BMW, Mercedes-Benz, and Volkswagen have embedded heads-up displays, voice recognition capabilities based on AI, and connected vehicle capabilities with smartphones as well. In 2024, more than 17 million electric cars were sold worldwide, accounting for more than 20% of total sales. Just the 3.5 million more electric vehicles sold in 2024 than the year before surpasses the global amount of electric vehicles sold in 2020. It is anticipated that more than 20 million electric vehicles will be sold globally in 2025, making up more than 25% of all automobile sales. The first three months of 2025 saw a 35% increase in global sales of electric vehicles.