Automotive Glass Market Outlook:

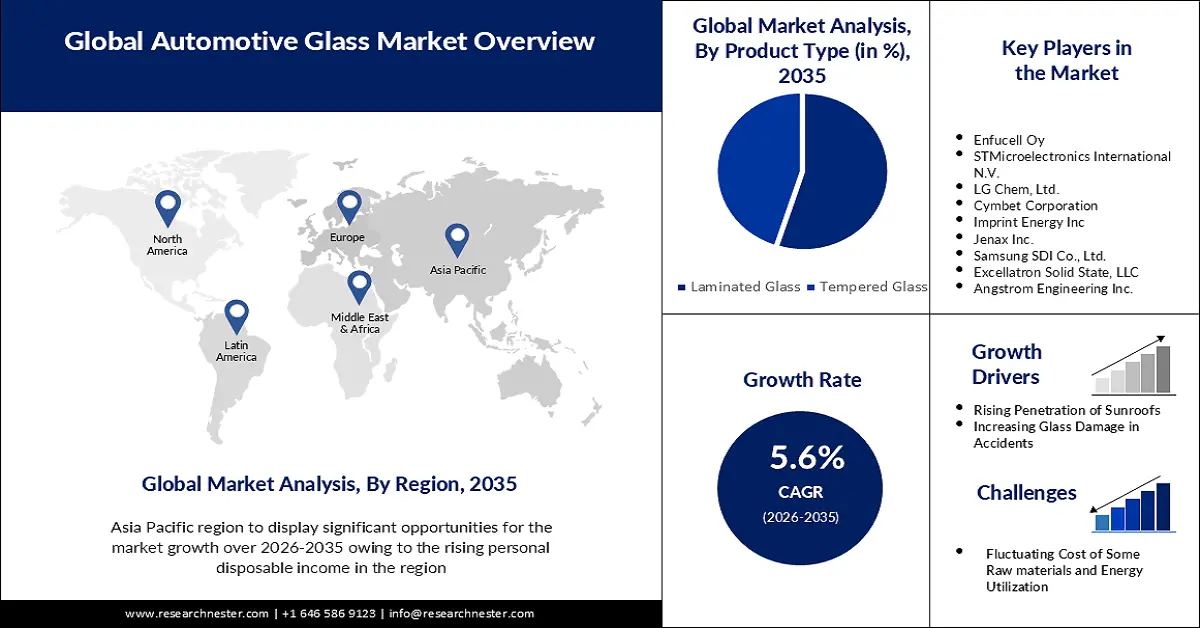

Automotive Glass Market size was over USD 28.73 Billion in 2025 and is poised to exceed USD 49.54 Billion by 2035, growing at over 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive glass is estimated at USD 30.18 Billion.

The reason behind the growth is impelled by growing automobile industry across the globe. While buying a vehicle, everyone ensures that the vehicle is equipped with high-quality automotive glass. The use of automotive glass has significantly enhanced safety on all parameters which is thoroughly considered in the manufacturing of windscreens, side windows, and rear car glass. According to estimates, the global motorcycle market is expected to increase by more than 6% by 2027, resulting in a market volume of around USD 168 billion in 2027.

The recent advancements in automotive technology are believed to fuel the market growth. For instance, many windscreens are now made of Gorilla Glass that is a particular type of windscreen made with specific chemicals, it is more durable than conventional windscreens as it can take sharp and blunt stone hits, is scratch resistant, and helps guard against frequent windscreen fractures.

Key Automotive Glass Market Insights Summary:

Regional Highlights:

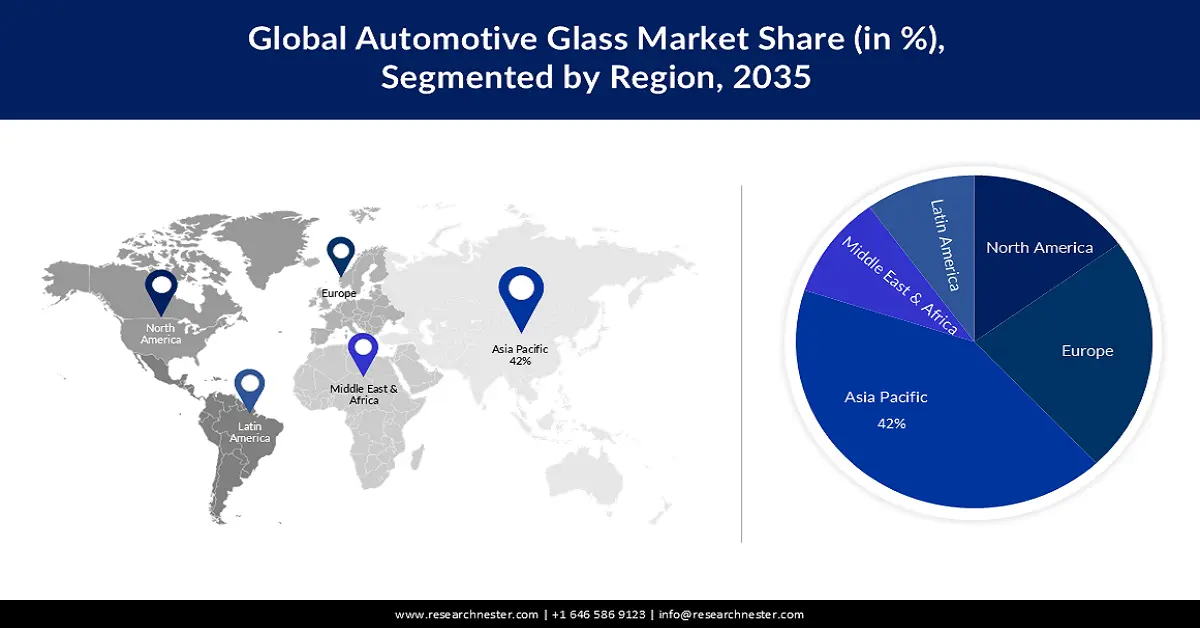

- Asia Pacific automotive glass market will hold over 42% share by 2035, fueled by rising disposable income and increasing vehicle ownership in the region.

Segment Insights:

- The laminated glass segment in the automotive glass market is forecasted to capture a 55% share by 2035, driven by the rising rate of road accidents requiring safety glass solutions.

Key Growth Trends:

- Rising Penetration of Sunroofs

- Increasing Glass Damage in Accidents

Major Challenges:

- Fluctuating Cost of Some Raw materials and Energy Utilization

- Concern about the Growing Shortage of Glass

Key Players: AGC Group, Fuyao Glass Industry Group Co., Ltd., Central Glass Co., Ltd., Nippon Sheet Glass Co., Ltd., Saint-Gobain Sekurit, Corning Incorporated, Guardian Industries Holdings, LLC (Koch Industries, Inc.), Taiwan Glass Industry Corporation, Xinyi Glass Holdings Limited, Magna International Inc.

Global Automotive Glass Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.73 Billion

- 2026 Market Size: USD 30.18 Billion

- Projected Market Size: USD 49.54 Billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, India, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Automotive Glass Market Growth Drivers and Challenges:

Growth Drivers

- Rising Penetration of Sunroofs – The majority of sunroofs are made of tempered glass, often known as safety glass which is four times stronger than regular glass and shatters into little, comparatively harmless shards rather than sharp shards. Automotive sunroofs, whether electrically or manually operated, have grown in popularity among consumers owing to glass's unique capacity to divide the vehicle's interior from the elements.

According to estimates, the global automotive sunroof sales were recorded at just less than 50 million units in 2021.

- Increasing Glass Damage in Accidents- Road accidents can be devastating and are one of the most common causes of auto windscreen glass damage that can be caused by the collision of rocks and stones. Moreover, the strong power of an impact in the accident can produce fractures or brakes in the glass, which necessitates the use of replacement and repairmen of windscreen glass at any garage/workstation.

As per estimation a global loss of USD 1.5 trillion is expected owing to road accidents between 2015 and 2030.

Challenges

- Fluctuating Cost of Some Raw materials and Energy Utilization – Several raw materials including silica sand (SiO2), sodium oxide (Na2O), and feldspar (Al2O3) amongst which the Silica sand (SiO2) accounts for the majority of float glass' raw material inputs, with over 70% share are required to produce automotive glass. Moreover, Silica prices keep fluctuating as a result of uncertain demand situations and a slowing economy, and the principal source of silica (SiO2) in groundwater is water-rock interaction the cost of which depends on several factors including labor, and energy cost.

- Concern about the Growing Shortage of Glass

- Need for Huge Research & Development Expenditure

Automotive Glass Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 28.73 Billion |

|

Forecast Year Market Size (2035) |

USD 49.54 Billion |

|

Regional Scope |

|

Automotive Glass Market Segmentation:

Product Type Segment Analysis

The laminated glass segment is estimated to account for 55% share of the global automotive glass market in the coming years owing to the rising rate of road accidents. Automobile windscreens are often composed of laminated safety glass with a distinctive PVB interlayer that absorbs impact and prevents penetration to offer the best protection in the event of an accident, and if broken, laminated glass pieces link together to form a spider web pattern, considerably reducing the likelihood of any injury. According to the World Health Organization (WHO), every year, around 1.3 million people's lives globally are cut short as a result of a traffic accident.

Fuel Type Segment Analysis

Automotive glass market from the electric vehicles segment is set to garner a notable share shortly. The growing trend towards electric and hybrid vehicles is encouraging innovation in automotive glass which is necessary to suit both the aesthetic and practical demands of electric vehicles and also aids in minimizing the weight and boosting safety.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Vehicle Type |

|

|

Fuel Type |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Glass Market Regional Analysis:

APAC Market Insights

Automotive glass market in Asia Pacific is predicted to account for the largest share of 42% by 2035. impelled by the rising personal disposable income. More than 20% of the over 1,000 respondents in urban India showed a net rise in disposable income which together with the rise of the middle class, will transform India into a consumer powerhouse, and will lead to increased expenditure on leisure, entertainment, and a variety of vehicles including cars, and other automobiles. As a result, the region has the majority of car-owning households who also prefer to change their vehicles after only 5 years of ownership. This has led to an increase in demand for automotive glass as it is critical to a vehicle's ability to provide safety to the drivers. According to estimates, India's household disposable income is expected to reach over USD 2 trillion in 2023.

European Market Insights

The Europe automotive glass market is estimated to be the second largest, during the forecast period led by the presence stringent vehicle safety regulations. The European Commission's work on motor vehicle safety focuses on occupant safety and also includes severe measures to ensure that mass-produced vehicles maintain the same environmental performance. For instance, according to the EU's updated safety regulations all new vehicles sold in the EU must comply with the upgraded General Safety Regulations (GSR) beginning in 2024. This may drive the demand for automotive glass in the region as it is used in the side and rear windows of automobiles and is least likely to break or fracture.

Automotive Glass Market Players:

- AGC Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Enfucell Oy

- STMicroelectronics International N.V.

- LG Chem, Ltd.

- Cymbet Corporation

- Imprint Energy Inc

- Jenax Inc.

- Samsung SDI Co., Ltd.

- Excellatron Solid State, LLC

- Angstrom Engineering Inc.

- Asahi Glass Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- Central Glass Co., Ltd.

- Denso Corporation

- Hitachi Automotive Systems, Ltd.

- Bridgestone Corporation

- Toyoda Gosei Co., Ltd.

- Sumitomo Electric Industries, Ltd.

Recent Developments

- AGC Group joined forces with EyeLights to bring augmented reality capabilities to series vehicles for a safer and better in-car experience. The combined windshield and display technologies will add several benefits for the driver.

- Fuyao Glass Industry Group Co., Ltd. signed a strategic cooperation agreement with BASF to include the co-creation of new business development for the automotive industry into its existing scope of the partnership.

- Report ID: 4500

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Glass Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.