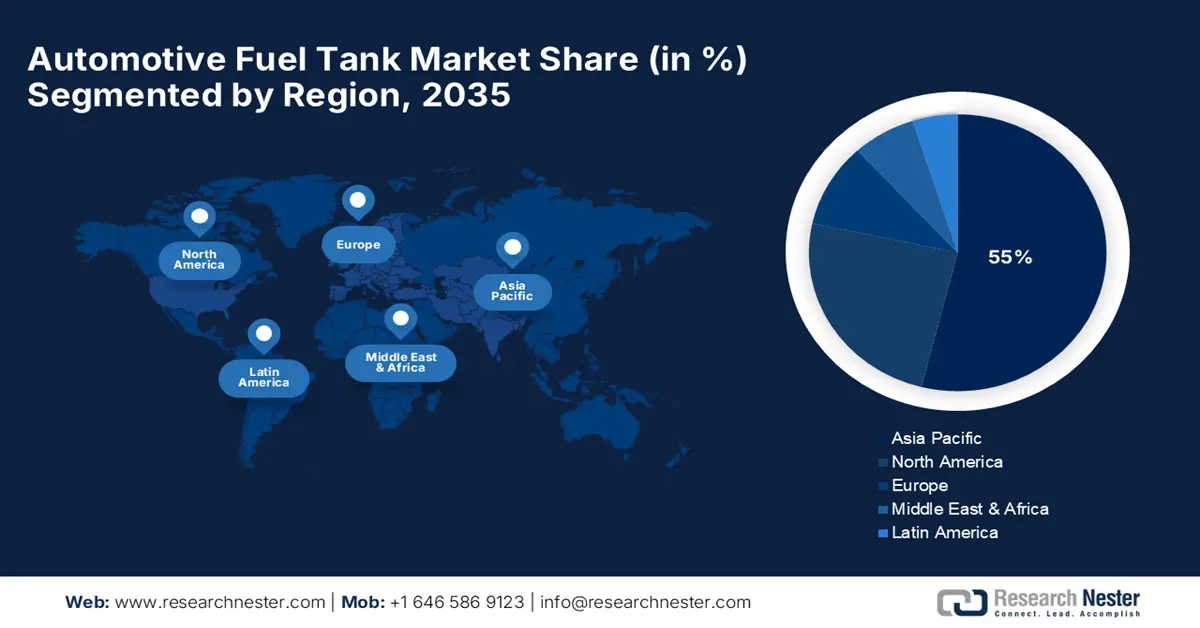

Automotive Fuel Tank Market - Regional Analysis

APAC Market Insights

Asia Pacific is anticipated to lead the automotive fuel tank industry, commanding an estimated 55% share during the forecast period. This is driven by the region's massive car manufacturing volumes, a developing middle class, and a growing focus on adopting cutting-edge automotive technologies. Regional part producers are rapidly expanding their capacity to produce quality parts to international standards, thereby aiding the industry's shift to alternative fuels. In February 2025, India-based INOX India Limited became the country's first manufacturer of cryogenic equipment to obtain the highly prized IATF 16949 certification for manufacturing cryogenic fuel tanks for LNG-fueled vehicles.

China is spending heavily to become the hub for hydrogen mobility, as local and international companies build massive manufacturing facilities to serve its burgeoning market for hydrogen-powered vehicles. This government-backed industrial policy is generating enormous demand for high-pressure hydrogen storage vessels. A historic investment was made in January 2025, when Plastic Omnium, via its joint venture company, broke ground to build a Shanghai-based high-pressure hydrogen vessel mega-plant. The plant, which is due to be on stream in 2026, will produce up to 60,000 hydrogen vessels every year.

India market is undergoing a dynamic transformation, with the government and industry both promoting the usage of cleaner vehicle technologies such as hybrids and alternative fuels. The transformation is creating new opportunities for component suppliers who are advanced fuel storage technology specialists. For instance, in March 2025, Jio-bp, a joint venture between Reliance and bp, staged a public showcase in Mumbai for its innovative split-fuel tank technology. This two-compartment fuel vehicle, with a special design, allows for real-time comparison testing of different fuel qualities, in response to the increasingly complex fuel system technology in India.

Europe Market Insights

Europe automotive fuel tank market is going through a profound transformation via the region's bold push for alternative fuels and the circular economy. Component suppliers are at the forefront of creating innovation to make this happen, developing cutting-edge fuel systems for a wide range of non-fossil fuels to help automakers achieve Europe's bold decarbonization strategies. In May 2025, PHINIA Inc. showcased its cutting-edge technology at the Vienna Motor Symposium. The company emphasized its latest technology in fuel systems specifically designed for alternative fuels, including hydrogen, ethanol, methanol, and compressed natural gas.

Germany is at the forefront here, with the federal government actively amending national law to make way for the introduction of new types of fuel and their accompanying infrastructure. These legislative reforms also intend to offer for a harmonious and secure market entry of alternative fuels, thereby guaranteeing transparency for both consumers and industry. In March 2025, the German government tabled a new ordinance to apply EU law on fuel quality. This amendment officially introduces B10 diesel to the German market and offers for standardized labeling requirements on vehicle and fuel compatibility under the Alternative Fuels Infrastructure Regulation.

The UK competitive landscape is being characterized by widespread strategic consolidations, leading to the emergence of more powerful and diversified Tier 1 suppliers. These Tier 1 suppliers are now in an ideal position to fulfill the evolving needs of international OEMs. This trend is particularly relevant to the UK, which remains a critical automotive market. One remarkable example was seen in July 2025, as TI Automotive marked its arrival in Europe at IAA Mobility 2025 by presenting an entire range of products for the first time across Europe. This reflects a broader industry trend towards integrated and holistic solutions. This merger not only advances supplier strength but also consolidates the UK's position in the international automotive supply base.

North America Market Insights

North America automotive fuel tank market is likely to rise at a steady CAGR of 4% from 2026 to 2035, driven by a robust regulatory framework and high customer demand for large vehicles like pickup trucks and SUVs. The region boasts a mature auto market that is rapidly transitioning to the electrification age, while also improving its capabilities in traditional combustion and hybrid technology. This dual challenge creates a complex but opportunity-rich environment for fuel tank manufacturers with solutions as varied as lightweight plastics to high-pressure hydrogen vessels.

The U.S. is actively constructing an integrated regulatory framework for emerging fuel technologies to advance public safety and allow alternative fuel vehicles to be introduced into the market. Federal authorities are developing new standards for hydrogen-powered vehicles in particular, offering manufacturers and component suppliers a clear and stable means of marketing. In January 2025, the U.S. National Highway Traffic Safety Administration (NHTSA) published a Final Rule that adopted two new Federal Motor Vehicle Safety Standards, FMVSS 307 and 308. These rules specify strict performance requirements for fuel system and storage integrity on hydrogen fuel vehicles.

Canada is also committed to preserving the safety and security of all vehicle systems, including conventional and alternative fuel tanks, through a national approach. The government is investing in research and strengthening its safety frameworks to keep up with the new challenges posed by new car technologies, such that Canadian regulations keep pace with innovation. As stated in its 2024-2025 Departmental Plan, published in July 2025, Transport Canada continues working on developing national vehicle safety strategies. One focus among these efforts is fuel system integrity requirements for conventional and alternative fuel vehicles.