Automotive Finance Market Outlook:

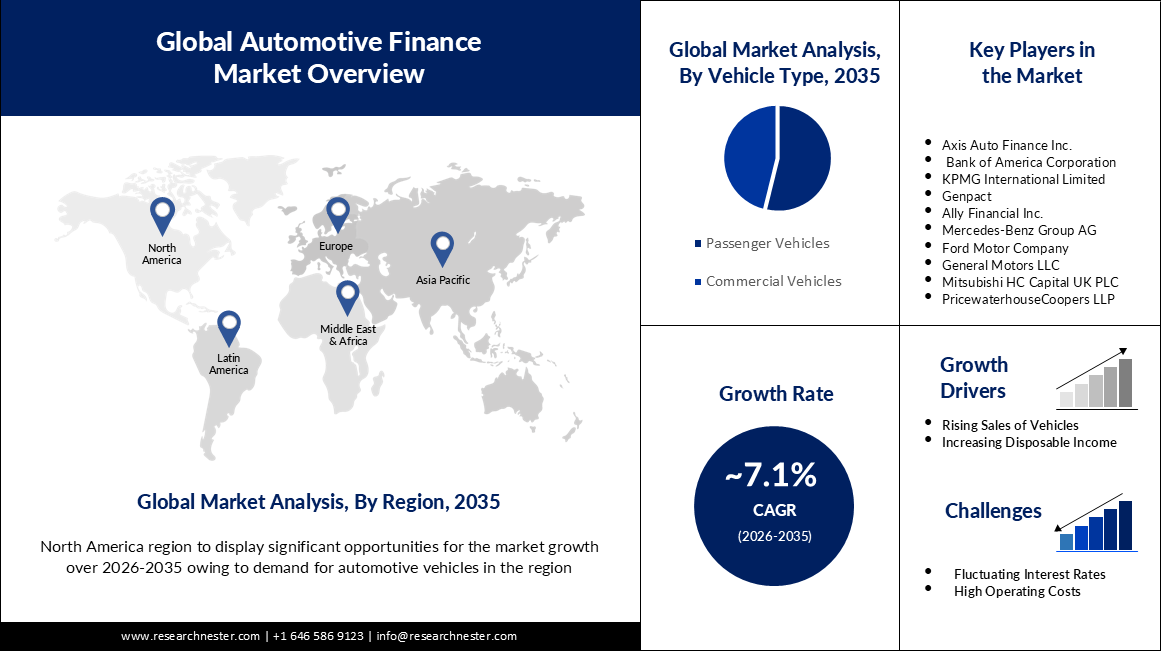

Automotive Finance Market size was valued at USD 311.76 billion in 2025 and is likely to cross USD 619.03 billion by 2035, registering more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive finance is assessed at USD 331.68 billion.

The growth of the market can primarily be attributed to the growing demand for vehicles by the burgeoning population. As automotive finance has allowed consumers to buy a car by borrowing a loan in case they don’t have the money, it is propelling the trend of adopting automotive financing worldwide to own a vehicle for convenience. For instance, as per statistics, more than 80% of new vehicles added to the road in the United States were financed with a lease or a loan in 2019.

Automotive finance has now become fast, convenient, flexible, and transparent. The process for obtaining a loan is simple, digital, and involves minimal documentation. Most of the giant automotive manufacturers have marked their presence in the loan market with the rising demand for vehicles. They provide loans to customers for in-house car models facilitating the buyers to purchase the vehicles at affordable costs. With the rising number of vehicles being financed as well as the average amount borrowed, the demand for automotive finance is on the rise amongst the auto finance service providers, which in turn, is expected to create massive revenue generation opportunities for the key players operating in the global automotive finance during the forecast period. According to a 2019 report, the average amount borrowed to buy a new vehicle was over USD 32,000, and that for the used-vehicle loan was USD 20,000.