Automotive Finance Market Outlook:

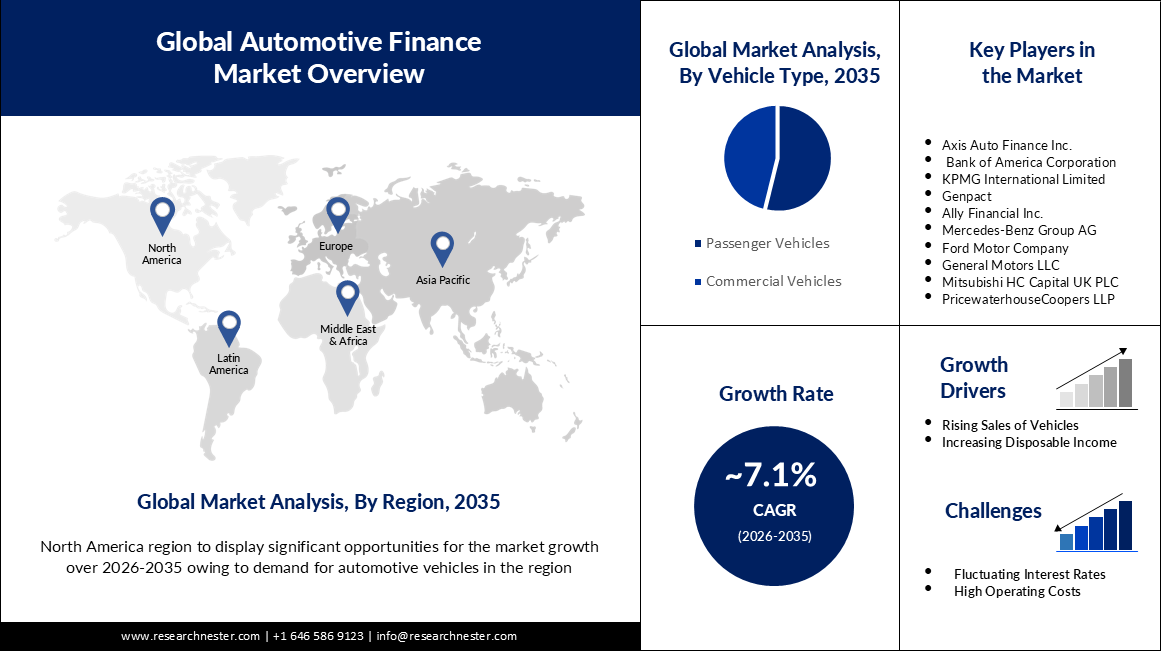

Automotive Finance Market size was valued at USD 311.76 billion in 2025 and is likely to cross USD 619.03 billion by 2035, registering more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive finance is assessed at USD 331.68 billion.

The growth of the market can primarily be attributed to the growing demand for vehicles by the burgeoning population. As automotive finance has allowed consumers to buy a car by borrowing a loan in case they don’t have the money, it is propelling the trend of adopting automotive financing worldwide to own a vehicle for convenience. For instance, as per statistics, more than 80% of new vehicles added to the road in the United States were financed with a lease or a loan in 2019.

Automotive finance has now become fast, convenient, flexible, and transparent. The process for obtaining a loan is simple, digital, and involves minimal documentation. Most of the giant automotive manufacturers have marked their presence in the loan market with the rising demand for vehicles. They provide loans to customers for in-house car models facilitating the buyers to purchase the vehicles at affordable costs. With the rising number of vehicles being financed as well as the average amount borrowed, the demand for automotive finance is on the rise amongst the auto finance service providers, which in turn, is expected to create massive revenue generation opportunities for the key players operating in the global automotive finance during the forecast period. According to a 2019 report, the average amount borrowed to buy a new vehicle was over USD 32,000, and that for the used-vehicle loan was USD 20,000.

Key Automotive Finance Market Insights Summary:

Regional Highlights:

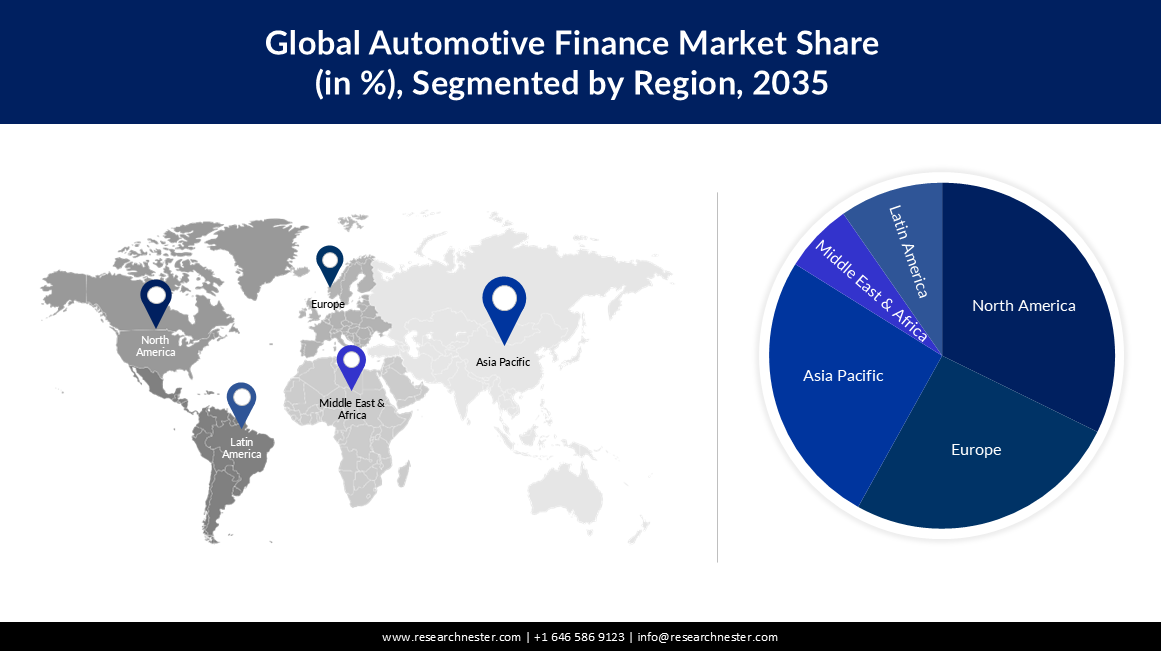

- North America automotive finance market holds the largest share by 2035, driven by rising vehicle production and presence of key finance providers.

- Asia Pacific market will achieve significant growth during the forecast timeline, driven by expanding automotive industry and favorable car purchase policies.

Segment Insights:

- The banks segment in the automotive finance market is projected to hold the largest share by 2035, fueled by lower interest rates, digital finance adoption, and hassle-free loan processing.

Key Growth Trends:

- Growing Demand for Automotive Loans

- Increasing Global Sales of Automobiles

Major Challenges:

- Fluctuating Interest Rates

- High Cost of Operations

Key Players: Axis Auto Finance Inc., Bank of America Corporation, KPMG International Limited, Genpact, Ally Financial Inc., Mercedes-Benz Group AG, Ford Motor Company, General Motors LLC, Mitsubishi HC Capital UK PLC, PricewaterhouseCoopers LLP.

Global Automotive Finance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 311.76 billion

- 2026 Market Size: USD 331.68 billion

- Projected Market Size: USD 619.03 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Automotive Finance Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Automotive Loans – With the rising population, the demand for vehicles has also been increasing every year. As a result, more and more people are now opting for car loans to buy a new vehicle. Owing to the ease of opting for automotive finance with easy EMI options and digital approvals, the automotive finance market is expected to escalate in the forecasted period. For instance, it was found that in the United States, auto loans reached around USD 1 trillion in 2019, an increase of 6.5% over 2018.

- Increasing Global Sales of Automobiles – International Organization of Motor Vehicle Manufacturers (OICA), released global sales of vehicle statistics which revealed that it rose to 56 million in 2021 from 53 million in 2020. Whereas, the global production of vehicles was calculated to be 57 million in 2021.

- Rising Share of Financial Services – Latest statistics reveal that with global GDP touching USD 96 trillion in 2021, financial services were found to comprise almost 24% of the world's economy 2021.

- Upsurge in the Financing of Used Cars – A recent report stated that in the United States, nearly 55% of used cars on the country roads in 2019 were financed with a lease or a loan.

- Increasing Number of Vehicles Being Financed – In the United Kingdom, the number of cars bought on finance in 2018 exceeded 2.2 million, a rise of about 2% from 2017.

Challenges

- Fluctuating Interest Rates – The inflation trend across the world has propelled financial institutions to charge a higher interest cost. In addition, some of the financial products of automotive financing are subject to fluctuation in interest rates. As a result, the adoption rate of automotive finance market is expected to be low in underdeveloped countries and among the population with middle income. This trend is thus anticipated to hamper the market growth in the forecast period.

- High Cost of Operations

- Lack of Faith & Transparency

Automotive Finance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 311.76 billion |

|

Forecast Year Market Size (2035) |

USD 619.03 billion |

|

Regional Scope |

|

Automotive Finance Market Segmentation:

Vehicle Type Segment Analysis

The global automotive finance market is segmented and analyzed for demand and supply by vehicle type segment into passenger vehicles and commercial vehicles. Amongst these segments, the passenger vehicles segment is anticipated to garner the largest revenue by the end of 2035, backed by the growing demand for passenger vehicles along with the surge in the sale of passenger cars worldwide. For instance, it was found that the global sales of passenger cars reached approximately 63 million cars in 2020. The lucrative financing solutions offered by various financial institutions are expected to attract individuals for buying/lease a vehicle for themselves very conveniently. Hence, even customers with limited sources of income are showing interest in buying a passenger car for their daily commute. All these factors add up to bring profitable opportunities for market growth.On the other hand, the commercial vehicle segment is also attributed to garner a significant share by the end of the forecast period. As the costs of commercial vehicles are higher as compared to passenger cars, people use automotive finance to buy these vehicles for commercial use. Also, the advantage of vehicle changes or vehicle upgradation in the leasing of a commercial vehicle through automotive financing is expected to fuel the segment growth.

Provider Segment Analysis

The global automotive finance market is also segmented and analyzed for demand and supply by the provider into original equipment manufacturers (OEMs), banks, and financial institutions. Out of these three segments, the banks’ segment is expected to hold the largest share in the upcoming years. The major factors that are attributed to the segment growth are the hassle-free documentation process along with the high-reliability features. In addition, the rising adoption of digital automotive finance methods in the banking sector has eased the process and elevated the adoption rate. Additionally, the lower interest rate compared to other providers is also forecasted to create a positive outlook in the future.

Our in-depth analysis of the global market includes the following segments:

|

By Finance |

|

|

By Provider |

|

|

By Purpose |

|

|

By Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Finance Market Regional Analysis:

North American Market Insights

The North America automotive finance market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The presence of major automotive finance providers along with the increased production of vehicles in the region is the major factor that is projected to fuel the market growth. As per the statistics released by the International Organization of Motor Vehicles (OICA), vehicle production in the American region rose from around 15 million vehicles in 2020 to 16 million vehicles in 2021. At the same time, the increasing population in the region, in addition to the rapid introduction of advanced technologies and increased demand for electric vehicles, connected cars, and autonomous cars, is anticipated to foster the demand for automotive finance to purchase a vehicle in the upcoming years.

APAC Market Insights

The automotive finance market in Asia Pacific is also expected to grow with a significant CAGR over the next few years, owing to the rapid expansion of the automotive industry in the region. Also, the other factors contributing to market growth are the favorable government policies for purchasing a car in economies such as India, Japan, and China, increasing disposable income leading to higher spending capacity, and rising Gross Domestic Product (GDP).

Automotive Finance Market Players:

-

·Axis Auto Finance Inc.

-

Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

-

- Bank of America Corporation

- KPMG International Limited

- Genpact

- Ally Financial Inc.

- Mercedes-Benz Group AG

- Ford Motor Company

- General Motors LLC

- Mitsubishi HC Capital UK PLC

- PricewaterhouseCoopers LLP

Recent Developments

-

Axis Auto Finance Inc.’s wholly owned subsidiary, Pivotal Capital Corp., secured an additional funding facility with Mitsubishi HC Capital Canada, Inc.

-

Bank of America Corporation announced that Lucid Group, Inc., in partnership with Bank of America, has launched Lucid Financial Services, an all-new digital platform that will provide Lucid Air consumers with an adaptable, quick, and convenient financing process, along with loan and lease purchase options.

- Report ID: 4653

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Finance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.