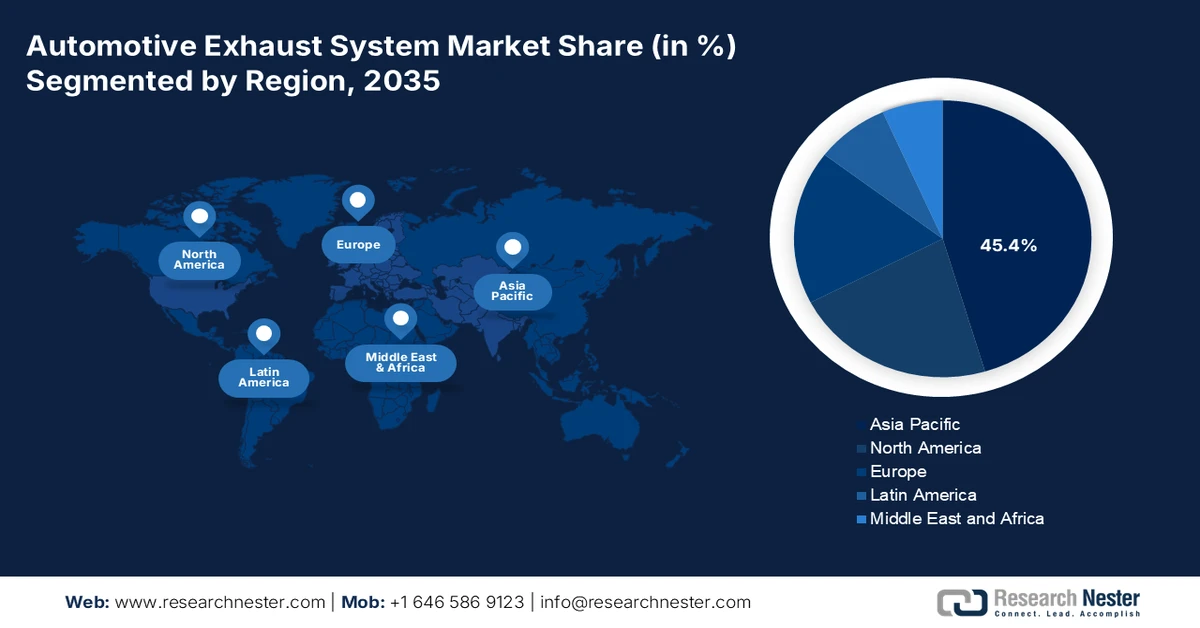

Automotive Exhaust System Market - Regional Analysis

APAC Market Insights

The Asia Pacific automotive exhaust system market is dominating and is expected to hold a revenue share of 45.4% by 2035. The market is driven by the immense vehicle production volume and stringent national emission standards. The primary demand driver is the implementation of the advanced regulations, such as the China 6 India BS-VI and Japan’s Post-Post New Long Term Regulations, which mandate advanced after-treatment, such as the Gasoline Particulate Filters and enhanced selective catalytic reduction systems. A major trend is the rapid concurrent growth of hybrid electric vehicles and internal combustion engine production, creating a dual demand stream. China leads in electric vehicle adoption; its sheer scale of ICE production is growing, and the vehicle parc ensures sustained exhaust system demand. The aggressive EV policies are pushing the suppliers to adapt products for hybrid platforms and invest in components for electrified powertrains.

China automotive exhaust system market is undergoing a structural transition as EV penetration is projected to reach 90% by 2030, significantly reducing the long term exhaust demand from new vehicle sales. However, near to medium term demand remains supported by the existing internal combustion and hybrid vehicle parc and China’s dominant position across the automotive material value chains. According to the World Economic Forum's January 2025 report, China accounts for over 50% of the global downstream steel consumption, 57.5% of aluminum consumption, and 56% of global tyre consumption, underscoring its scale in conventional vehicle manufacturing. While the battery electric vehicles are accelerating, the sheer size of China’s installed ICE fleet sustains aftermarket exhaust demand. For suppliers, China remains strategically important for volume-driven production material sourcing and transitional platform programs despite declining long term exhaust intensity in new vehicles.

EV Sales Volume and Penetration

|

Year |

Sales (10,000 units) |

Penetration Rate |

|

2019 |

121 |

5% |

|

2020 |

137 |

5% |

|

2021 |

352 |

13% |

|

2022 |

689 |

26% |

|

2023 |

950 |

32% |

|

2030 |

3,200 |

90% |

Source: World Economic Forum January 2025

A vast active vehicle base and regulatory enforcement mechanisms are supporting the India market. As per the PIB December 2024 report, approximately 38.41 crore motor vehicles were registered under the Vahan 4.0 system, creating a substantial installed base requiring emissions-compliant exhaust systems. Regulatory oversight is reinforced via the Pollution Under Control Certificate regime, with over 53.4 million valid PUCCs issued, directly linking vehicle operation to exhaust performance. While battery-operated vehicles are newly registered vehicles, the majority of in-use internal combustion vehicles remain subject to compliance. Additionally, over 175 million insured vehicles indicate sustained on-road usage supporting replacement and maintenance demand. These dynamics position India as a volume-driven market where exhaust demand remains robust despite gradual electrification.

North America Market Insights

The North America automotive exhaust system market is the fastest-growing and is expected to grow at a CAGR of 6.3% during the forecast period, 2026 to 2035. The market is driven by the evolving federal emission standards from the U.S. Environmental Protection Agency and Environment and Climate Change Canada, particularly for heavy-duty vehicles. The EPA’s Clean Trucks Plan Phase 3 rule will necessitate advanced after-treatment systems, sustaining OEM demand. The key trend is the integration of exhaust systems with hybrid electric powertrains, as supported by U.S. Department of Energy investments in vehicle technologies prolonging ICE relevance. The government spending via programs such as Canada’s Zero Emission Vehicle incentive indirectly supports hybrid adoption, while U.S. infrastructure law funding for the clean school buses directly fuels the demand for modern diesel exhaust systems.

The U.S. is shaped by regulatory enforcement and targeted federal spending. The EPA’s finalized Heavy Duty Phase 3 rules will drastically lower the NOx limits, compelling the adoption of the next-gen selective catalytic reduction and enhanced thermal management systems starting in the model year. This regulatory push is amplified by direct federal procurement, notably the USD 5 billion Clean School Bus Program in the EPA in January 2026, which replaces the old diesel buses with the new compliant models, creating immediate OEM demand. Furthermore, the Department of Energy’s sustained R&D funding for advanced combustion and emission control, through its Vehicle Technologies Office, addresses the dual challenge of meeting stricter standards while improving the efficiency of both conventional and hybrid powertrains. This maintains the technological evolution of exhaust components despite a shifting powertrain landscape.

Canada automotive exhaust system market represents a stable and policy-aligned market supported by the sustained vehicle parc size, aftermarket activity, and cross-border supply integration. The Canada automotive aftermarket is valued at over USD 16 billion annually and remained relatively stable through 2022, indicating a consistent replacement demand for the emissions-related components. Although domestic vehicle manufacturing recovered to pre-pandemic levels in 2022, automotive parts and component imports totaled USD 15.4 billion, reflecting continued reliance on external suppliers. Passenger vehicle imports rose 12% to USD 31 billion in 2022, based on the ITA November 2023 report, reinforcing the integrated exhaust system sourcing. With 84% of the new light vehicle sales classified as light trucks and SUVs, per vehicle exhaust content remains structurally higher. Canada’s regulatory framework is closely harmonized with U.S. emissions and safety standards, supporting platform commonality and stable OEM demand.

Europe Market Insights

The Europe automotive exhaust system market is defined by the impending Euro 7 regulation setting the strictest ever real driving emission limits for pollutants such as NOx and particulate matter from both cars and vans for new types. This framework compels OEMs to integrate more advanced durable ad integrated after treatment solutions including advanced GPFs and electrically heater catalysts, sustaining the R&D and production demand. A parallel dominant trend is the accelarated transition to battery electric vehicles which erodess the long term addressable market for traditional exhausts. Consequently suppliers are strategically pivoting to components for electrified platforms such as thermal management systems and acoustic devices while the aftermarket remains robust due to the Europe aging vehicle fleet.

The Germany market is driven by its status as Europe’s premium vehicle manufacturing hub and the technical demands of the forthcoming Euro 7 regulation. This necessitates high-value complex after-treatment solutions from domestic suppliers serving OEMs like Volkswagen, BMW, and Mercedes-Benz. A key trend is the strategic pivot toward developing exhaust components for high-performance hybrid vehicles and hydrogen combustion engines, aligning with federal hydrogen strategy funding. According to the KBA 2023 data, the total passenger car registration in 2023 reached 2.84 million, and the registration of new gasoline content accounted for 34.4%, which requires advanced systems such as gasoline particulate filters, demonstrating the sustained volume for advanced exhaust technologies despite the rise of BEVs.

The continuous support by the dominant presence of internal combustion and hybrid vehicles is driving the UK automotive exhaust system market. The data from the UK Parliament in June 2025 depicts that as of June 2024, only 3% of the total UK car parc, which is 1.09 million vehicle was battery electric, while 8% were hybrid electric, indicating that over 89% of the vehicles in operation still relied on petrol or diesel powertrains. The petrol vehicles accounted for 57% of the parc and diesel for 32%, sustaining substantial installed base demand for exhaust systems and aftermarket replacements. Although battery electric vehicles represented 19% of new car registrations, fleet turnover remains gradual, preserving medium term OEM and aftermarket exhaust demand. This slow transition supports continued sourcing of compliant exhaust systems aligned with the UK and EU emissions regulations.