Automotive Ethernet Market Outlook:

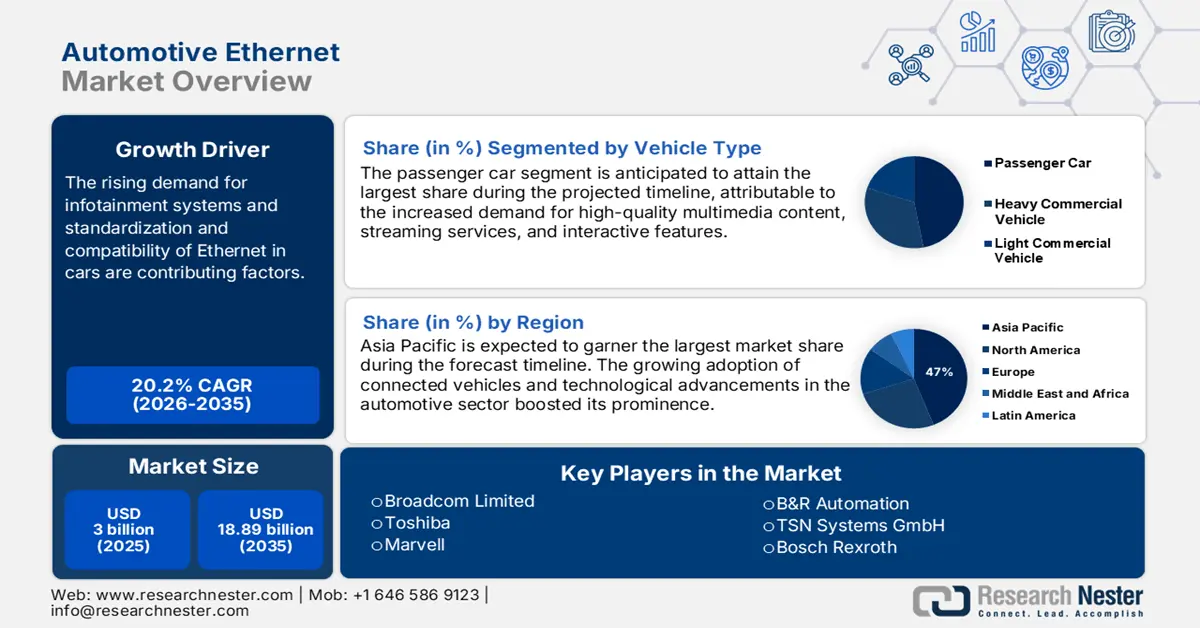

Automotive Ethernet Market size was over USD 3 billion in 2025 and is anticipated to cross USD 18.89 billion by 2035, witnessing more than 20.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive ethernet is assessed at USD 3.55 billion.

The increasing investments by many major automakers across the globe have made multiple investments in smart vehicle integration. According to the World Internet Conference and CSIS report, through February 2020, 30 of the biggest AV businesses had spent USD 16 billion on creating entirely autonomous technology. In January 2024, China’s top automaker, BYD announced its plan to invest USD 14 billion in smart vehicle technology, including driver assistance systems and software. The company plans to remold and design smart energy vehicles and improve its ADAS.

The growing demand for communication technology in smart cars is a key factor expected to fuel automotive ethernet market growth in the coming years. Ethernet currently offers 100 Mbps and is expected to increase to 150 Mbps compared to media-oriented systems transport. This network has been used mostly for infotainment and media systems. Modern cars use high-tech components that serve as a foundation for in-vehicle communication. Also, through ethernet technology, customers can benefit from better bandwidth, scalability, speed, and reduced latency. To ensure a seamless operation of the vehicle system and infotainment, ethernet technology offers a variety of functions and functionalities.

Key Automotive Ethernet Market Insights Summary:

Regional Highlights:

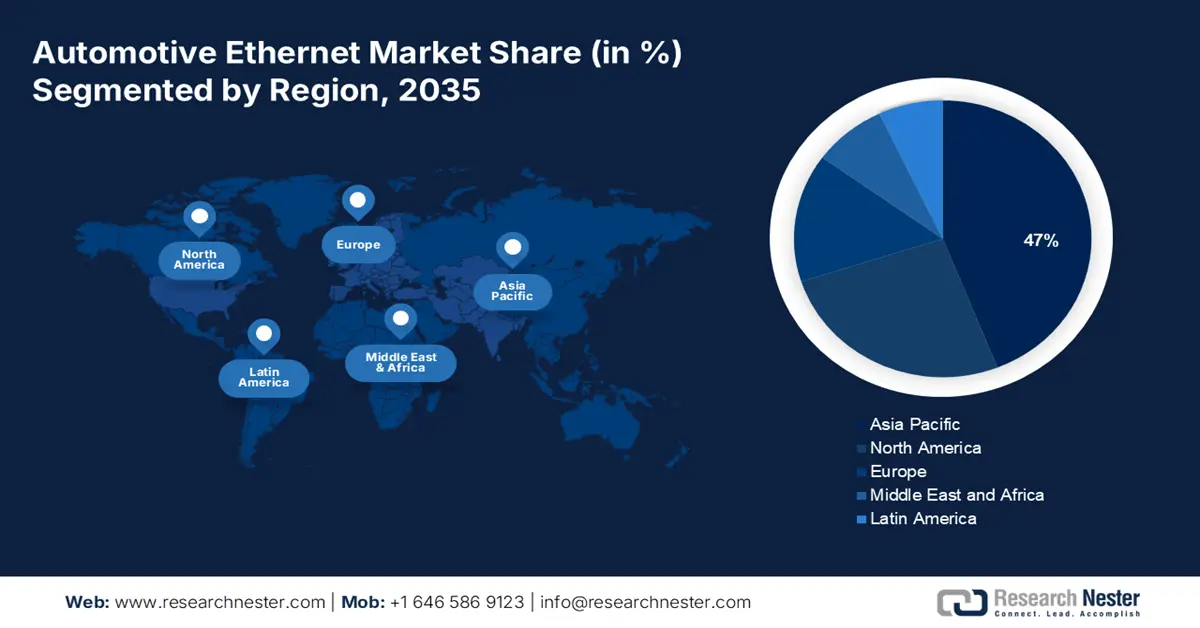

- The Asia Pacific automotive ethernet market will hold over 47% share by 2035, fueled by the expansion of passenger car production and rising adoption of advanced technologies in the automotive sector.

- The North America market will grow rapidly by 2035, driven by increasing vehicle production and rising investments in developing advanced technologies.

Segment Insights:

- The passenger car segment in the automotive ethernet market is expected to command a 68.40% share by 2035, driven by increasing passenger car sales and integration of ADAS and entertainment systems.

- The one-pair ethernet (automotive ethernet type) segment in the automotive ethernet market is anticipated to achieve a 38% share by 2035, influenced by the demand for cost-effective, high-speed, and space-efficient vehicle networks.

Key Growth Trends:

- Increasing demand for Advanced Driver Assistance Systems (ADAS)

- Rising demand for automobiles

Major Challenges:

- Rising issues with latency and real-time performance

Key Players: Microchip Technology, Inc., Broadcom Limited, Vector Informatik GmbH, RUETZ SYSTEM SOLUTIONS GMBH, DASAN Network Solutions, Bosch Rexroth, B&R Automation., TSN Systems GmbH, TE Connectivity., Marvell, Toshiba, Texas Instruments Incorporated.

Global Automotive Ethernet Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3 billion

- 2026 Market Size: USD 3.55 billion

- Projected Market Size: USD 18.89 billion by 2035

- Growth Forecasts: 20.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Automotive Ethernet Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for Advanced Driver Assistance Systems (ADAS): ADAS systems require high-speed and reliable communication networks to enable real-time data processing and decision-making. Automotive ethernet provides the necessary bandwidth and low latency for these systems to operate effectively. The rising adoption of vehicles with ADAS is expected to necessitate more standardized cables and connectors to support the higher data rates. According to the Highway Loss Data Institute, by 2027, 73% of registered cars are expected to have rear cameras, 51% with front crash prevention, and 63% with rear parking sensors. This is expected to support automotive ethernet market growth going ahead.

- Rising demand for automobiles: The demand for automotive ethernet solutions is further increased by incorporating cutting-edge solutions into connected automobiles such as connected devices, AI, and technology. According to a report by the European Automobile Manufacturers’ Association (ACEA) in 2022, around 85.4 million motor vehicles were produced globally, an increase of 5.7% in comparison to 2021.

- Growing use of Power Over Data Lines (PODL): PoDL can sustain up to 500 mA of power, sufficient for some sensors like an improved satellite camera. As a result, the design can be made simpler and lighter for vehicle manufacturers by only needing to run one pair of wires to select sensors. Since the IEEE standard complied with requirements for vehicle EMI due to its slower data transmission (27MHz transfer speed compared to 62.5MHz for 100BASE-T), Broadcom started promoting it to the automotive industry.

Challenges

- High implementation costs: One of the challenges in the industry is the need to add modern and luxurious elements to the car. Upgrading vehicle networks from traditional CAN, LIN, and FlexRay to Ethernet requires significant investment in hardware, software, testing along skilled labor.

- Rising issues with latency and real-time performance: While Ethernet offers high bandwidth, it is expected to meet strict real-time communication requirements for safety-critical applications such as ADAS and autonomous driving. This can add up to overall costs, hampering the overall automotive ethernet market growth.

Automotive Ethernet Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.2% |

|

Base Year Market Size (2025) |

USD 3 billion |

|

Forecast Year Market Size (2035) |

USD 18.89 billion |

|

Regional Scope |

|

Automotive Ethernet Market Segmentation:

Automotive Ethernet Type Segment Analysis

The one-pair ethernet segment in automotive ethernet market is anticipated to garner the largest revenue share of 38% by 2035 attributed to rising adoption of one-pair ethernet in the automotive sector for weight and cost reduction, high-speed transmission, and space efficiency. One-pair ethernet or single-pair ethernet is widely used in the automotive industry to cater to growing demand for reliable, high-speed communication networks. In November 2023, Harting announced the launch of single pair ethernet (SPE) switch with IP67 protection.

Vehicle Type Segment Analysis

The passenger car segment in automotive ethernet market is expected to garner a significant share during the forecast period owing to the rising sales of different types of passenger cars across the globe and rising integration of ADAS and in-vehicle entertainment systems in passenger vehicles. According to OICA, around 56.4 million passenger cars were sold across the globe in 2021, accounting for 68.4% of global car sales. This is expected to fuel segment growth going ahead.

Our in-depth analysis of the global automotive ethernet market includes the following segments:

|

Type |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Ethernet Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for a revenue share of 47% by the end of 2035 owing to the expansion of passenger car production and rising adoption of advanced technologies in the automotive sector. According to figures from the Organization Internationale des Constructeurs d'Automobiles (OICA), China, Indonesia, Malaysia, Taiwan, Thailand, Japan, India, and South Korea collectively produced more than 45 million automobiles in 2021. Moreover, the demand for in-car networking components is anticipated to rise throughout the projection period as vehicle manufacturing rises. By 2025, it is estimated that all automobiles will be connected, and 35% will be self-driving. This is also expected to boost the automotive ethernet market growth during the forecast period.

In India, the market is expected to expand at a rapid pace between 2026 and 2035 due to rapid adoption of advanced technologies, rising sales of different types of automobiles, and increasing demand for top-end models with advanced features such as infotainment and ADAS. In addition, several key players are focused on R&D investments and product launches. For instance, in November 2021, Elektrobit India announced the launch of Ethernet switch firmware for safe and secure in-vehicle communications.

North American Market Insights

The automotive ethernet market in North America is poised to register rapid growth during the forecast period owing to increasing vehicle production and rising investments in developing advanced technologies. In 2022, the vehicle industry produced around 10 million motor vehicles, it includes light commercial vehicles, passenger automobiles, big buses, trucks, and coaches. Moreover, stringent regulations and standards in North America have encouraged automotive giants to improve vehicle safety.

The automotive Ethernet market in the U.S. is expected to register significant growth during the forecast period owing to rising demand for ADAS, autonomous driving technologies, in-vehicle infotainment systems, and stringent safety regulations and standards in the U.S.

Automotive Ethernet Market Players:

- Microchip Technology, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Broadcom Limited

- Vector Informatik GmbH

- RUETZ SYSTEM SOLUTIONS GMBH

- DASAN Network Solutions

- Bosch Rexroth

- B&R Automation.

- TSN Systems GmbH

- TE Connectivity.

- Marvell

- Toshiba

- Texas Instruments Incorporated

The global automotive ethernet market is highly competitive with key players operating at global and regional levels. Key players in the market are investing in developing advanced automotive ethernet solutions to provide high bandwidth, cost-effective, and scalable in-vehicle communication networks. Company giants are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In February 2024, AVIVA Links, Inc. announced the launch of the industry’s 1st family of multi-gigabit asymmetrical Ethernet devices, including Ethernet PHYs, CSI-2 bridge ICs, Switches, and Zonal Aggregators.

- In June 2023, Marvell Technology, Inc. announced the launch of the Brightlane Q622x family of ethernet switches, one of the highest capacity switches in a new, emerging category of devices.

- In May 2022, Broadcom Inc., launched a high bandwidth monolithic automotive Ethernet switch device, BCM8958X, designed to address the rising bandwidth need for in-vehicle networking applications.

- Report ID: 5110

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Ethernet Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.