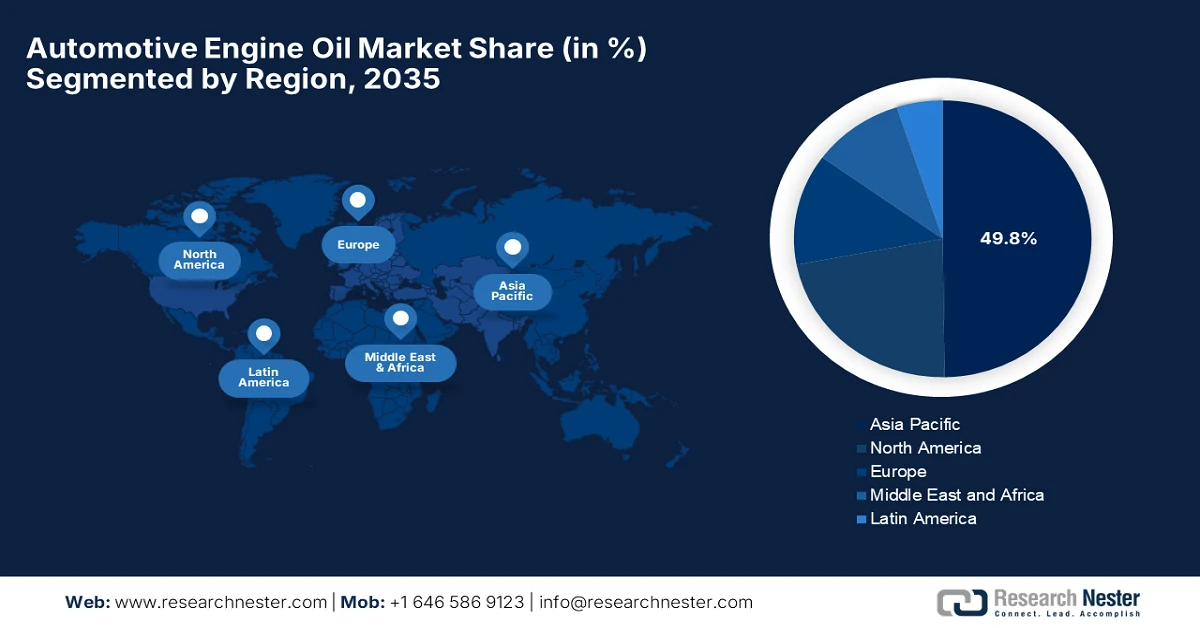

Automotive Engine Oil Market - Regional Analysis

APAC Market Insights

The Asia Pacific automotive engine oil market is predicted to dominate the entire global landscape, capturing the largest revenue stake of 49.8% by the end of 2035. The region’s dominance in this field is mainly fueled by the presence of major pioneers, each with distinct developmental strategies. In July 2025, Shell Lubricants reported that it had completed its acquisition of Raj Petro Specialities Pvt. Ltd., enhancing its lubricants portfolio and expanding its customer base in India, which is a key growth market. Therefore, this acquisition strengthens Shell’s presence across sectors such as automotive, power transmission, and pharmaceutical, while enabling new synergies and economies of scale within the lubricants value chain. In addition, Shell aims to leverage this complementary product range to drive further growth and maximize value in line with its strategic focus on performance and simplification.

China market is growing at a rapid pace on account of heightened demand for passenger and commercial vehicles. The country’s market also benefits from strict government regulations and the continuously rising vehicle population. In this regard, Tuhu and FUCHS China in March 2025 reported that they have signed a strategic cooperation agreement to jointly develop and launch the PENTOSIN series of engine and transmission oils that are suitable for the country’s market. The collaboration emphasizes product innovation, technology R&D, and service upgrades, introducing the precision oil change concept that provides car owners with customized maintenance plans and high-quality service guarantees. Additionally, the partnership launched the HYLUBS standard for hybrid vehicles to make sure that oils meet strict requirements for environmental protection, durability, and compatibility.

India automotive engine oil market has gained increased exposure over recent times owing to the strong economic expansion and shifting demographic trends. Additionally, increasing urbanization and a rising population with a growing preference for motorcycles, cars, SUVs, and other passenger vehicles are also fueling demand in the country. In this context, the Ministry of Commerce & Industry, in March 2025, reported that India’s automobile sector contributed approximately 6% to the national GDP, with vehicle production growing from 2 million in 1991-92 to 28 million in 2023-24. The report also underscored that passenger vehicles and two-wheelers contributed to production, wherein the exports reached 4.5 million units in 2023-24. It also noted that 4.4 million electric vehicles were registered, achieving 6.6% market penetration, supported by government schemes such as PLI & PM E-DRIVE.

Automotive Production and Component Statistics Driving India’s Automotive Engine Oil Sector (FY 2023-24 to 2026)

|

Parameter |

Value / Statistic |

|

Vehicle production (FY 2023-24) |

28 million units |

|

Passenger vehicles produced |

6.72 million units |

|

Two-wheelers produced |

3.45 million units |

|

FDI inflow in the auto sector (past 4 years) |

USD 36 billion |

|

Auto component sector turnover (FY24) |

₹6.14 lakh crore (USD 74.1 billion) |

|

Auto component exports (FY24) |

USD 21.2 billion (projected USD 30 billion by 2026) |

|

Jobs supported by the auto industry |

30 million (Direct: 4.2 million, Indirect: 26.5 million) |

Source: Ministry of Commerce & Industry

North America Market Insights

The North America market is anticipated to experience significant growth since it caters to diverse vehicle types such as passenger cars, light-duty trucks, heavy-duty vehicles, and off-road bikes, reflecting the varied maintenance needs in the region. In October 2025, LIQUI MOLY announced that it had begun local motor oil production in the U.S., marking a significant step in serving the U.S. aftermarket more efficiently. Besides, the new facility produces formulations that are suitable for heavy-duty vehicles as well as passenger cars, initially supplied in bulk containers with plans for smaller consumer packaging. This initiative has allowed the company to reduce delivery times, lower transportation costs, and respond more flexibly to local demand, all while maintaining the high German-quality standards that LIQUI MOLY is known for globally. Furthermore, the move also strengthens LIQUI MOLY’s footprint in North America and enhances its ability to support workshops and distributors with suitable solutions.

The U.S. automotive engine oil market is a major contributor for the regional growth influenced by continued technological advancements and innovations. The country’s market also benefits from the operational expansions, rise of high-performance engines, turbocharged systems which are requiring specialized oil formulations is driving demand and supporting overall market growth. In March 2023, Saudi Aramco reported that it completed the USD 2.65 billion acquisition of Valvoline Inc.’s global products business - Valvoline Global Operations, which is headquartered in Kentucky, U.S. This acquisition enables Aramco to expand its lubricants business internationally, leveraging its base oil production and R&D capabilities, whereas Valvoline Inc. continues to focus on its retail services business. The deal strengthens Aramco’s global footprint in automotive and industrial lubricants, enhances relationships with OEMs, and positions Valvoline Global operations as a key multinational lubricant brand under Aramco ownership.

Canada is growing in the automotive engine oil market on account of harsh climatic conditions, requiring oils that perform reliably across a wide temperature range. The increasing focus on fuel efficiency and adherence to environmental regulations promotes the adoption of advanced low-viscosity oils. TotalEnergies Marketing Canada Inc. in August 2025, announced the launch of Quartz 0W-12, which is a engine oil for the latest BMW engines. This very low viscosity formulation reduces internal friction, optimizes fuel consumption, and prolongs engine life, particularly in hybrid and electric vehicles. This product supports TotalEnergies’ broader strategy for sustainable mobility and carbon neutrality by the end of 2050, offering high performance under extreme operating conditions while remaining compatible with hybrid technologies, hence making it suitable for standard market growth.

Europe Market Insights

Europe automotive engine oil market has gained momentum positively influenced by strict emission regulations and fuel efficiency standards. Consumers and fleet operators in this region prefer premium and fully synthetic oils that ensure engine durability and comply with regulatory requirements. In July 2024, TotalEnergies reported that it had acquired Tecoil, which is a Finnish specialist in re-refined base oils, thereby enhancing its circular economy approach for lubricants in Europe. Tecoil’s facility in Hamina produces 50,000 tons of high-quality RRBOs on a yearly basis through an efficient used oil regeneration process, supplying sustainable base oils that reduce the carbon footprint of lubricants while also maintaining performance standards. Thus, this acquisition enables TotalEnergies to accelerate the integration of recycled base oils into its high-end lubricants, meeting growing customer demand for environmentally friendly products and advancing sustainability goals.

Germany automotive engine oil market is mainly driven by strong automotive manufacturing sector and high-performance vehicle ownership. OEMs and service networks in the country promote certified oils that support turbocharged and direct-injection engines. In November 2025, FUCHS SE announced that it has launched TITAN GT1 FLEX DE SAE 5W‑30, which an engine oil especially designed to meet the specifications of major German-based OEMs which includes BMW, Mercedes‑Benz, Opel, and Volkswagen. It also mentioned that the oil is universally applicable for both diesel and petrol engines, offering excellent cold-start performance, fuel efficiency, and protection for exhaust aftertreatment systems. In addition, it also supports selected hybrid vehicles, making it ideal for workshops servicing multiple Germany’s automotive brands, hence denoting a positive market outlook.

The UK automotive engine oil market has gained immense exposure over recent years, owing to both domestic passenger vehicle ownership and commercial transportation needs. The country’s market also benefits from growing awareness of engine maintenance and environmental sustainability, which drives heightened demand for fully synthetic and high-performance lubricants. In this regard, in June 2025, Castrol UK, in partnership with its distributor The Race Group, showcased its complete range of automotive lubricants and workshop services at Automechanika Birmingham by highlighting products for petrol, diesel, and hybrid vehicles, which includes the Castrol ON EV product line for electric vehicles. Furthermore, the event emphasized engine protection, fuel efficiency, and environmental sustainability, thereby offering technical guidance, digital solutions, and training opportunities to workshops across the UK.