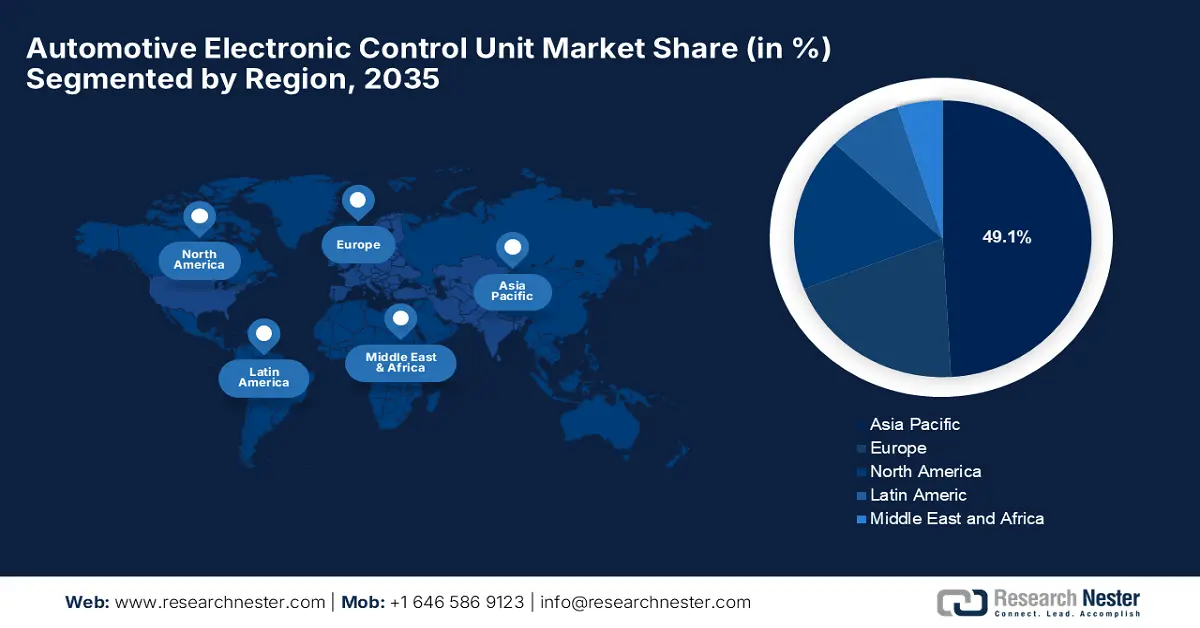

Automotive Electronic Control Unit Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific region is anticipated to capture a lucrative automotive electronic control unit market share of 49.1% through 2035. Electrification of the vehicle sector is fueling the requirement for automotive electronic control units. Automakers are integrating ECUs into electric powertrains, battery management systems (BMS), and charging infrastructure due to the rising focus on sustainable mobility from consumers and governments. Advancements in ECU technology are resulting from this industry trend, which contributes to EV performance improvements, safety measures, and better energy efficiency. The expansion of electric and hybrid-compatible electronic control units is also gaining momentum from the rapid growth of EV adoption in China and India.

Autonomous and semi-autonomous driving technologies are experiencing rapid development across the region. Automakers throughout Japan, South Korea, China, and other Asian countries are continually investing in lidar, radar, and artificial intelligence technologies, which is driving the need for advanced ECUs in their automotive production. ECUs play an essential role in sensor information processing, system control operations, and safety management during autonomous vehicle procedures. The governments, along with the private sectors, are boosting their investment in autonomous mobility, propelling the market expansion.

Strong government support for smart mobility functions as the primary force behind increased demand for automotive electronic control units in China. The government supports next-generation automotive technology production through its Made in China 2025 initiative. Modern cars feature ECUs that cater to electric, connected, and autonomous functions. The local government’s investment in smart infrastructure and V2X communication systems is resulting in a high demand for advanced ECUs, which handle these technological innovations.

The local companies, including Geely, BYD, and NIO, are enhancing their production volumes through the adoption of modern ECU technologies for worldwide safety mandates as well as performance quality and connectivity requirements. There is an increased adoption of ECUs as automakers are integrating these devices for enhanced vehicle control systems, entertainment features, and driver assistance functions. The emphasis on global expansion, combined with advanced vehicle development initiatives, is resulting in rising consumer demand for highly developed ECU systems.

North America Market Insights

The demand from consumers for improved vehicle safety elements is resulting in the expansion of the North America automotive electronic control unit market. The market is experiencing rising road safety concerns that drive manufacturers to install ADAS systems, including features such as lane-keeping assistance, adaptive cruise control, and automatic emergency braking. The operation of these advanced features depends on complex ECUs that process and control system functions immediately. Advanced ECUs, which enable safety systems, maintain increasing demand throughout the region as car manufacturers work to address consumer and regulatory criteria.

The region is marking a substantial rise in ECU demand as connected vehicle technologies are expanding their integration rates. The implementation of V2X communication, infotainment systems, and OTA updates is driving automakers to increase their vehicle ECU count. The implementation of ECU systems is resulting in the development of a link between vehicles and real-time processing abilities that provide better user interfaces. The escalating demand for smarter connected vehicles is further fueling ECU production. The rising adoption of 5G technologies and cloud-based applications is also likely to increase ECU sales in the automotive sector.

Automotive manufacturers are adopting over-the-air (OTA) software updates, which are positively contributing to the U.S. electronic control unit market growth. The rising adoption of OTA is accelerating the demand for ECU systems with such capabilities. The local automakers are prioritizing vehicle cybersecurity as cars and their digital components are increasingly connected. Vehicle connectivity through infotainment systems, V2X communication, autonomous features, and vehicle safety systems is making automobiles vulnerable to cyber threats. Automakers solve their security challenges by adding advanced ECUs built with strong security features to stop unauthorized access to vehicle systems. Vehicle control systems with modern ECUs are performing secure communication alongside the verification of computer software and the analysis of unauthorized access attempts. All the above aspects are uplifting the importance of electronic control units in automobiles and driving their sales growth.