Automotive Electronic Control Unit Market Outlook:

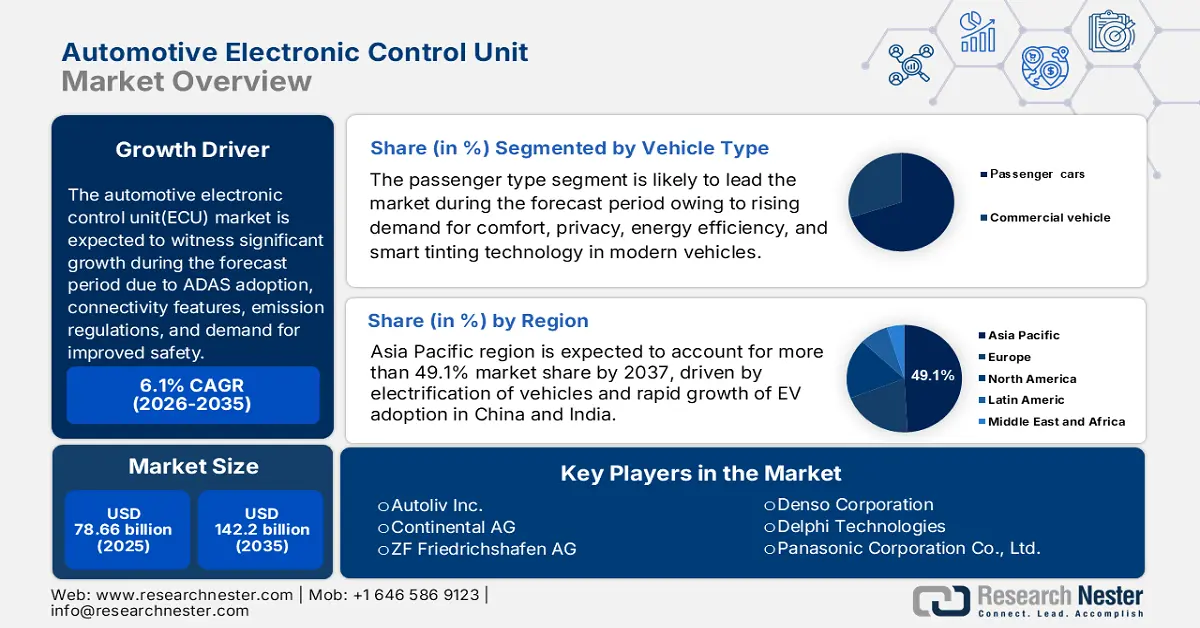

Automotive Electronic Control Unit Market size was valued at USD 78.66 billion in 2025 and is expected to reach USD 142.2 billion by 2035, registering around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive electronic control unit is evaluated at USD 82.98 billion.

Rapid innovations in autonomous driving technologies are driving an increasing need for advanced automotive electronic control units (ECUs). These ECUs are critical processors that receive sensor data from cameras, radar systems, and other sensing technologies, which aid in enabling real-time decisions for navigation, sensor fusion automation, and driving functions. The autonomous driving technology companies are implementing advanced ECUS to address the requirements for AI processing capabilities alongside real-time information handling and advanced vehicle safety solutions. For instance, in March 2024, NVIDIA introduced the DRIVE Thor system-on-chip (SoC) for managing autonomous driving requirements, AI functions, and in-car experiences. Such developments of AI-driven autonomous driving are crossing a significant threshold in their integration process.

Increasing advanced driving automation features lead to growing complexity in ECUs that handle essential vehicle operations, including safety functions, environment detection, and vehicle dynamics control. Companies such as NVIDIA, Qualcomm, and Intel are implementing advanced ECUS in self-driving system technology through their development of high-performance chips and platforms. Joint operations between technology companies and automaker firms are offering next-generation vehicles with advanced safety and efficiency features, which are directly boosting their revenue shares.

Key Automotive Electronic Control Unit Market Insights Summary:

Regional Highlights:

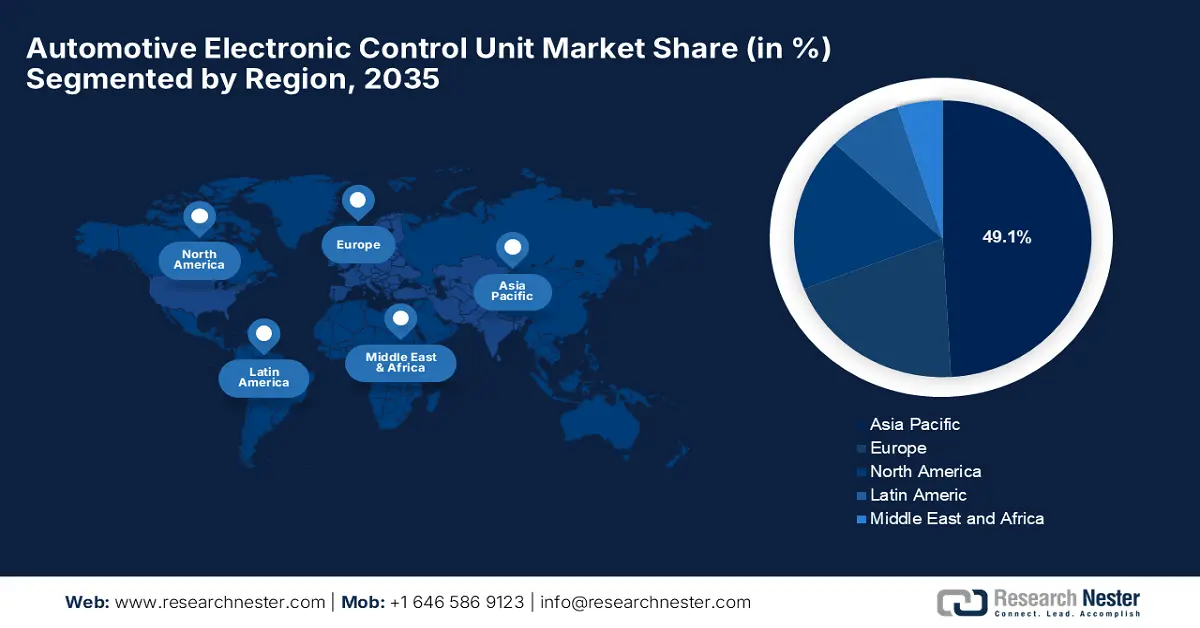

- Asia Pacific automotive electronic control unit market will secure around 49.1% share by 2035, driven by electrification of vehicles and rapid growth of EV adoption in China and India.

Segment Insights:

- The passenger cars segment in the automotive electronic control unit market is anticipated to secure the largest share by 2035, driven by rising global car sales and demand for in-vehicle automation and connectivity.

- The infotainment segment in the automotive electronic control unit market is projected to hold a significant share by 2035, driven by the integration of AI and voice assistants in automotive infotainment systems.

Key Growth Trends:

- Battery-powered engines

- ADAS and safety systems

Major Challenges:

- High cost of advanced ECUs

Key Players: Robert Bosch GmbH, Autoliv Inc., Continental AG, ZF Friedrichshafen AG, Denso Corporation, Delphi Technologies, Panasonic Corporation Co., Ltd., HELLA GmbH & Co. KGaA, Hitachi Astemo Americas, Inc., Hyundai Mobis.

Global Automotive Electronic Control Unit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 78.66 billion

- 2026 Market Size: USD 82.98 billion

- Projected Market Size: USD 142.2 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Automotive Electronic Control Unit Market - Growth Drivers and Challenges

Growth Drivers

-

Battery-powered engines: The global shift for electric vehicles is fueling the demand for sophisticated electronic control units in automobiles as these units manage fundamental EV processes, including battery monitoring, thermal management, and power efficiency optimization. According to a report from the International Energy Agency (IEA), battery electric vehicles (BEVs) achieved more than 70% of total electric car purchases in 2023, as lithium iron phosphate (LFP) batteries represented about 37% of the global battery market.

Consumers demonstrated their preference for enhanced driving capability by increasing their demand for substantially larger battery sizes in BEVs by 7% from 2018 to 2023. The global electric car market reached 14 million sold units in 2023 as China brought in more than 60% of those sales while recording a 35% growth rate. The advancement of EV systems is driving vehicle manufacturers to install multiple ECUs, as it provides them with better control of critical vehicle systems, which is eventually resulting in electric mobility with increased efficiency and safety - ADAS and safety systems: The increasing focus on road safety and accident prevention is driving manufacturers to use advanced driver-assistance systems (ADAS) for parallel growth in automotive electronic control units. The integration of these ECUs enables to making of instantaneous decision processing needed to run automatic emergency braking and other safety systems, including lane departure warnings, blind-spot monitoring, and adaptive cruise control. As per the report from the National Safety Council (NSC), the vehicles with forward collision warning systems experienced a 27.0% reduction in front-to-rear crashes, but systems with automatic emergency braking capabilities demonstrated a 50.0% reduction in these incidents.

Research indicates that systems that warn about lane departures produce an 11% decrease in crashes involving single vehicles, sideswipe, and head-on incidents. The growing demand for innovative safety systems led by regulators and consumers is making ECU integration for ADAS functions the new standard.

Challenges

- High cost of advanced ECUs: The production costs of modern vehicles are rapidly increasing as advanced electronic control units are integrated into vehicles, including ADAS systems, autonomous driving capabilities, and electric vehicles. High-end ECUs need complicated hardware systems, software, and necessary testing and certification procedures, which also result in production costs for vehicles. Automakers experience hurdles when they attempt to balance premium technology advances with maintaining competitive vehicle prices, primarily in price-sensitive markets. The additional expenses lead to restrictions on high-tech features for mid- and lower-tier vehicle models, which is affecting the sales of automotive ECUs

Automotive Electronic Control Unit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 78.66 billion |

|

Forecast Year Market Size (2035) |

USD 142.2 billion |

|

Regional Scope |

|

Automotive Electronic Control Unit Market Segmentation:

Vehicle Type Segment Analysis

The passenger cars segment is estimated to gain the largest automotive electronic control unit market share by 2035. Passenger car sales in the global space have been experiencing notable growth throughout the last few years. According to a report from the International Organization of Motor Vehicle Manufacturers (OICA), the global passenger car sales reached 73.1 million units in 2023, with a 1.8% increase to 74.4 million units in 2024. The rising number of cars is resulting in a demand for advanced ECUs. Passenger cars are witnessing accelerated growth of their electronic control units as consumers prefer better in-vehicle connectivity and automation features with infotainment systems.

The automotive industry is aimed at integrating features such as real-time navigation, voice assistants, and smartphone integrations due to rising consumer demand for advanced automotive technologies. The surging adoption of advanced connected car systems is driving manufacturers to integrate ECUs that handle complex operations, including real-time traffic processing and improved user interface performance.

Application Segment Analysis

The infotainment segment is expected to garner a significant automotive electronic control unit market share throughout the projected period. The demand for ECUs is propelling due to the incorporation of advanced AI systems and voice assistance features in automotive infotainment platforms. The major companies focused on integrating advanced AI into automotive infotainment systems are implementing improvements to upgrade user experience capabilities. For instance, in June 2023, Mercedes-Benz enhanced the MBUX infotainment system with OpenAI's conversational AI agent as a premium addition for U.S. vehicle buyers. The expansion requires state-of-the-art ECUs that combine advanced abilities to process complex AI algorithms and manage real-time data information.

Car infotainment and connectivity experiences are witnessing a significant transformation due to the adoption of cloud-based management systems. Automakers deploy software-defined cockpits as they deliver ongoing updates and adaptive display features for users. Better integration is becoming possible for advanced features, with the availability of sophisticated ECUs. The advanced features include real-time data synchronization, personalized settings, and enhanced media capabilities. There is a rising need for electronic control units that provide cloud connectivity and handle data processing alongside device integration capabilities.

Our in-depth analysis of the global automotive electronic control unit market includes the following segments:

|

Vehicle |

|

|

Application

|

|

|

Engine |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Electronic Control Unit Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific region is anticipated to capture a lucrative automotive electronic control unit market share of 49.1% through 2035. Electrification of the vehicle sector is fueling the requirement for automotive electronic control units. Automakers are integrating ECUs into electric powertrains, battery management systems (BMS), and charging infrastructure due to the rising focus on sustainable mobility from consumers and governments. Advancements in ECU technology are resulting from this industry trend, which contributes to EV performance improvements, safety measures, and better energy efficiency. The expansion of electric and hybrid-compatible electronic control units is also gaining momentum from the rapid growth of EV adoption in China and India.

Autonomous and semi-autonomous driving technologies are experiencing rapid development across the region. Automakers throughout Japan, South Korea, China, and other Asian countries are continually investing in lidar, radar, and artificial intelligence technologies, which is driving the need for advanced ECUs in their automotive production. ECUs play an essential role in sensor information processing, system control operations, and safety management during autonomous vehicle procedures. The governments, along with the private sectors, are boosting their investment in autonomous mobility, propelling the market expansion.

Strong government support for smart mobility functions as the primary force behind increased demand for automotive electronic control units in China. The government supports next-generation automotive technology production through its Made in China 2025 initiative. Modern cars feature ECUs that cater to electric, connected, and autonomous functions. The local government’s investment in smart infrastructure and V2X communication systems is resulting in a high demand for advanced ECUs, which handle these technological innovations.

The local companies, including Geely, BYD, and NIO, are enhancing their production volumes through the adoption of modern ECU technologies for worldwide safety mandates as well as performance quality and connectivity requirements. There is an increased adoption of ECUs as automakers are integrating these devices for enhanced vehicle control systems, entertainment features, and driver assistance functions. The emphasis on global expansion, combined with advanced vehicle development initiatives, is resulting in rising consumer demand for highly developed ECU systems.

North America Market Insights

The demand from consumers for improved vehicle safety elements is resulting in the expansion of the North America automotive electronic control unit market. The market is experiencing rising road safety concerns that drive manufacturers to install ADAS systems, including features such as lane-keeping assistance, adaptive cruise control, and automatic emergency braking. The operation of these advanced features depends on complex ECUs that process and control system functions immediately. Advanced ECUs, which enable safety systems, maintain increasing demand throughout the region as car manufacturers work to address consumer and regulatory criteria.

The region is marking a substantial rise in ECU demand as connected vehicle technologies are expanding their integration rates. The implementation of V2X communication, infotainment systems, and OTA updates is driving automakers to increase their vehicle ECU count. The implementation of ECU systems is resulting in the development of a link between vehicles and real-time processing abilities that provide better user interfaces. The escalating demand for smarter connected vehicles is further fueling ECU production. The rising adoption of 5G technologies and cloud-based applications is also likely to increase ECU sales in the automotive sector.

Automotive manufacturers are adopting over-the-air (OTA) software updates, which are positively contributing to the U.S. electronic control unit market growth. The rising adoption of OTA is accelerating the demand for ECU systems with such capabilities. The local automakers are prioritizing vehicle cybersecurity as cars and their digital components are increasingly connected. Vehicle connectivity through infotainment systems, V2X communication, autonomous features, and vehicle safety systems is making automobiles vulnerable to cyber threats. Automakers solve their security challenges by adding advanced ECUs built with strong security features to stop unauthorized access to vehicle systems. Vehicle control systems with modern ECUs are performing secure communication alongside the verification of computer software and the analysis of unauthorized access attempts. All the above aspects are uplifting the importance of electronic control units in automobiles and driving their sales growth.

Automotive Electronic Control Unit Market Players:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Autoliv, Inc

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Delphi Technologies

- Panasonic Corporation Co., Ltd.

- HELLA GmbH & Co. KGaA

- Hitachi Astemo Americas, Inc.

- Hyundai Mobis

The competitive landscape of the automotive electronic control unit (ECU) market is characterized by a mix of established global players and emerging regional companies. Key players dominate the market through technological innovations and large-scale production capabilities. These companies are increasingly focusing on the integration of ECUs in electric vehicles, autonomous driving, and ADAS applications. Additionally, collaborations and strategic partnerships, such as those between automakers and technology firms, are enhancing product development. The market is also witnessing growth in smaller, specialized players focusing on specific ECU technologies, further intensifying competition.

Here are some key players operating in the global automotive electronic control unit market:

Recent Developments

- In April 2024, Continental introduced its Zone Control Units (ZCUs) for server-based vehicle architectures. These ZCUs serve as the middle tier in vehicle architectures, redistributing electronics and ensuring smooth interaction across domains.

- In March 2023, Continental collaborated with Infineon to develop a modular platform for server-based vehicle architectures. This platform utilizes Infineon's AURIX TC4 microcontroller to enhance the efficiency of zone control units (ZCUs), serving as interfaces between high-performance computers and sensors/actuators.

- Report ID: 3982

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Electronic Control Unit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.