Automotive Electric Water Pump Market Outlook:

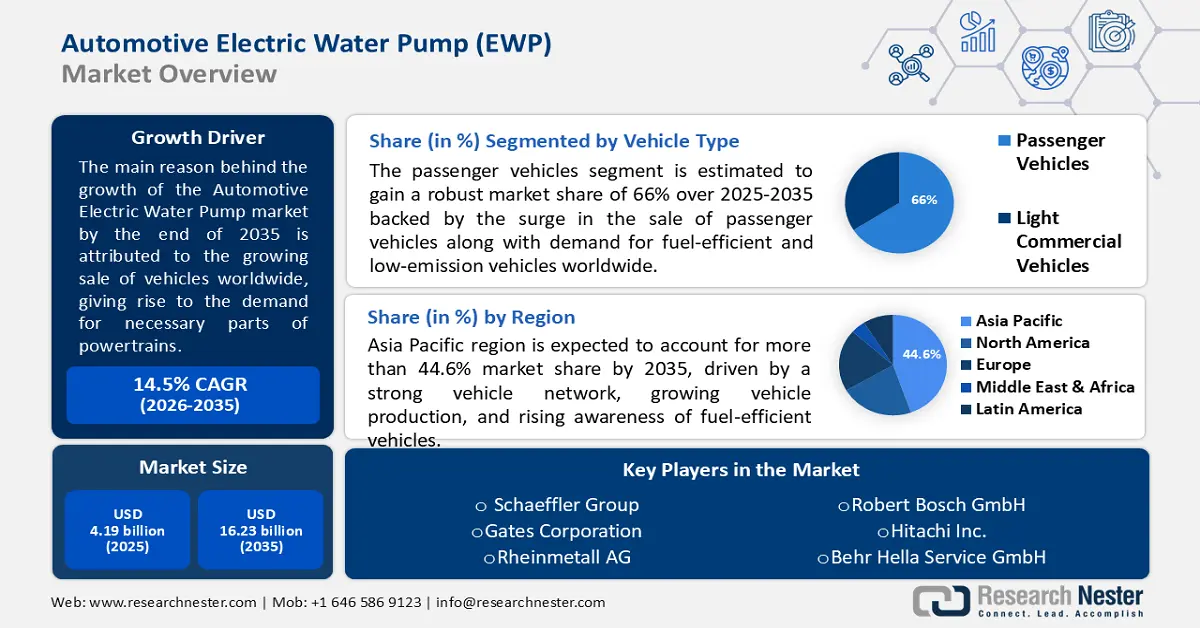

Automotive Electric Water Pump Market size was valued at USD 4.19 billion in 2025 and is likely to cross USD 16.23 billion by 2035, expanding at more than 14.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive electric water pump is assessed at USD 4.74 billion.

The growth of the market can primarily be attributed to the growing sale of vehicles worldwide, giving rise to the demand for necessary parts of powertrains. It was found that the global sales of automobiles were more than 68 million units in 2021. The increasing disposable income of many middle-class people with the rising economic growth of countries is estimated to boost the purchasing capacity of people. Also, vehicle purchasing has become necessary for everyone during the post-pandemic. A personal vehicle is most preferred as it allows for an easy traveling experience. The digitalization technology of vehicles, which automates the driving system, is also raising the demand for vehicle sales. The increase in vehicle sales in turn rises the demand for and use of electric water pumps around the world. Additionally, the availability of second-hand vehicles that are in good condition increases the sales of automobiles during the forecast period.

The rising urbanization across the world is projected to drive market growth as per the market analysis during the forecast period. The rising advancements in technology and the development of infrastructure in all private and public organization increases urbanization. Nearly 4.4 billion people live in cities, which is about 56% of the population across the world, as per the estimations of the World Bank Organization in 2022. Additionally, the growing number of industries, educational institutions, and job opportunities drives rural people to migrate to the cities, which rises the urban population. The rising urban population increases the living standards of people, thereby increasing their spending capacity. The increasing literacy rate led to a social transformation with improved housing, water sanitation, health, and transport services. Moreover, the increasing government initiative to improve public services also leads to urbanization.

Key Automotive Electric Water Pump Market Insights Summary:

Regional Highlights:

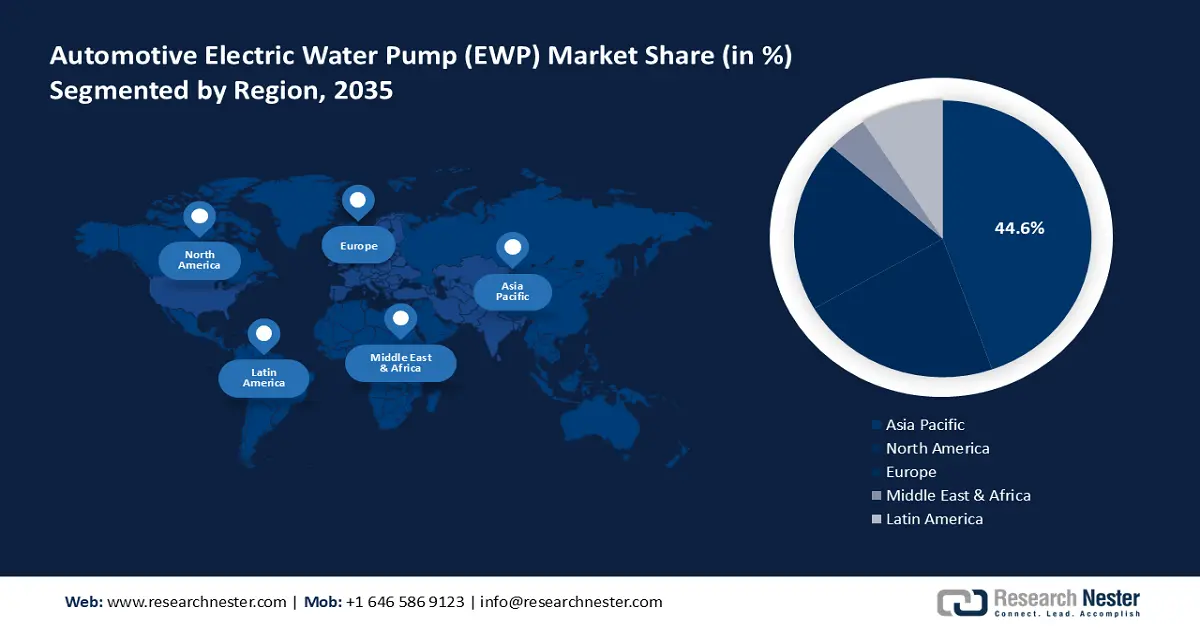

- Asia Pacific automotive electric water pump (ewp) market is predicted to capture 44.6% share by 2035, driven by a strong vehicle network, growing vehicle production, and rising awareness of fuel-efficient vehicles.

Segment Insights:

- The passenger vehicles segment in the automotive electric water pump market is anticipated to secure the largest share by 2035, driven by increased demand for fuel-efficient vehicles and cab services.

- The 12v segment in the automotive electric water pump market will hold the largest share, driven by increasing use of 12V pumps in fuel-efficient passenger vehicles over the forecast period 2026-2035.

Key Growth Trends:

- Growing Sales of Electric Vehicles with Rising Fuel Prices Around the World

- Increasing Penetration of Turbochargers to Increase Efficiency of Engines

Major Challenges:

- Concern about EWP Failure

- Huge Cost Involved in Automotive Manufacturing

Key Players: Schaeffler Group, Gates Corporation, Rheinmetall AG, Robert Bosch GmbH, Hitachi Inc., Behr Hella Service GmbH, Magna International Inc., ZF Friedrichshafen AG, Continental AG, BLDC Pump Co., Ltd.

Global Automotive Electric Water Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.19 billion

- 2026 Market Size: USD 4.74 billion

- Projected Market Size: USD 16.23 billion by 2035

- Growth Forecasts: 14.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Automotive Electric Water Pump Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Sales of Electric Vehicles with Rising Fuel Prices Around the World – An electric water pump uses a motor to send coolant from the cooling system to the engine internals in electric cars. The rising sales of electric vehicle are expected to propel the automotive electric water pump market in the forecasted period. For instance, the sales of electric vehicles increased to 6.6 million in the year 2021 across the globe.

-

Increasing Penetration of Turbochargers to Increase Efficiency of Engines – for instance, the revenue of air turbochargers for internal combustion engines or diesel engines is estimated to amount to more than USD 790 million in Brazil by 2025.

-

Upsurge in the Production of Medium and Heavy-Duty Trucks with Increasing Transportation – the global production of which reached more than 3 million units by 2021.

-

Rising Demand for Key Battery Minerals with Rising Electric Vehicles Demand – for instance, the demand for graphite and lithium is projected to amount to about 2 million metric tons by 2028 around the world.

-

Growing Penetration of Hydrogen-Powered Vehicles with Increasing Greenhouse Gases – As per the estimated data, the use of hydrogen vehicle, as of 2022, was found to be approximately 15,000 units on United States roads.

Challenges

- Concern about EWP Failure – which is mostly caused by the simple age and wear of its electric motor. With time, most parts in the automotive industry, including auxiliary pumps, start to break down owing to constant wear and tear, which hinders the market growth.

- Huge Cost Involved in Automotive Manufacturing

- Requires High Investment in Research & Development

Automotive Electric Water Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.5% |

|

Base Year Market Size (2025) |

USD 4.19 billion |

|

Forecast Year Market Size (2035) |

USD 16.23 billion |

|

Regional Scope |

|

Automotive Electric Water Pump Market Segmentation:

Vehicle Type Segment Analysis

The global automotive electric water pump market is segmented and analyzed for demand and supply by vehicle type segment into passenger vehicles, light commercial vehicles, heavy-duty trucks, buses, and coaches. Amongst these segments, the passenger vehicles segment is anticipated to garner the largest revenue by the end of 2035, backed by the surge in the sale of passenger vehicles along with demand for fuel-efficient and low-emission vehicles worldwide. For instance, India saw an increase of approximately 14% in passenger vehicle sales in the financial year 2022. The autos, cars, sports vehicles, minivans, motorcycles, bicycles, lightweight trucks, and pickup trucks come under passenger vehicles, which are used for public transport. The passenger vehicle segment is increasing owing to the rising number of cab services. These passenger vehicle services help people traveling out of the city where they do not own any vehicles. The rising traffic in metropolitan cities rises the demand for these vehicles as they help to reach their destination within time without stopping at every station.

Voltage Type Segment Analysis

The global automotive electric water pump market is also segmented and analyzed for demand and supply by voltage type into 12V and 24V. Out of these, the 12V segment is estimated to share the largest market share owing to the increasing use of pumps in passenger cars. The increasing preference for fuel-efficient vehicles increases the adoption of these voltage-type segments and drives the growth of the market segment. The 12V pump used in passenger cars comes at a lower price, a smaller size, flexible working, less fuel consumption, and a longer shelf life, which increase its popularity in the market. The 12V pump is an electric coolant pump that can also be used in electric vehicle engine cooling systems, hybrid vehicle motor cooling systems, motorcycles, pure electric vehicle battery circulation refrigeration, and preheater.

Our in-depth analysis of the global market includes the following segments:

|

By Voltage Type |

|

|

By Application |

|

|

By Propulsion Type |

|

|

By Vehicle Type |

|

|

By Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Electric Water Pump Market Regional Analysis:

APAC Market Insights

Asia Pacific region is expected to account for more than 44.6% market share by 2035, driven by a strong vehicle network, growing vehicle production, and rising awareness of fuel-efficient vehicles. It was found that in 2021, around 32% of global vehicles had been manufactured in China. Heavy-duty truck sales are increasing as a result of increased imports and exports of high-capacity loads. Also, an increasing number of construction sectors employ only heavy-duty drugs to carry debris, raw materials, cement, sand, and rocks. The rising use of trucks in mining, infrastructure development, energy plants, the construction sector, and the shipping industry rises the demand for automotive water pumps. The electric water pump provides a pressurized flow to all parts of the engine, allowing a fast and better cooling effect.

Automotive Electric Water Pump Market Players:

- Schaeffler Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Gates Corporation

- Rheinmetall AG

- Robert Bosch GmbH

- Hitachi Inc.

- Behr Hella Service GmbH

- Magna International Inc.

- ZF Friedrichshafen AG

- Continental AG

- BLDC Pump Co., Ltd.

Recent Developments

-

Schaeffler Group developed high-performance electric motors for commercial vehicles that are over 97 percent efficient.

-

Gates Corporation launched its next-generation technology for electric water pumps (EWP) used in automotive.

- Report ID: 4617

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.