Automotive Digital Key Market Outlook:

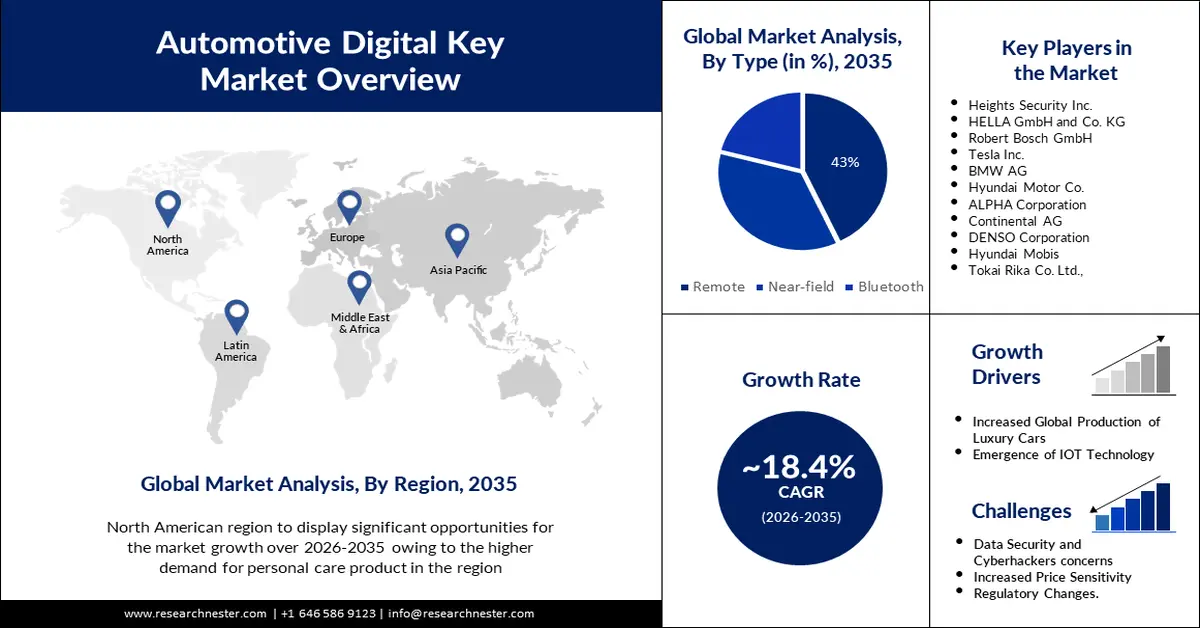

Automotive Digital Key Market size was over USD 2.64 billion in 2025 and is poised to exceed USD 14.29 billion by 2035, growing at over 18.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive digital key is evaluated at USD 3.08 billion.

The automotive digital key market growth is owing to rising preference for keyless vehicle access. Rapid advancements in Near Field Communication (NFC), Ultra-wideband (UWB), Bluetooth, and Radio Frequency Identification (RFID), have significantly enhanced the functionality and security of keyless entry systems. This has increased its adoption in recent years. In addition, advancements in the connectivity of vehicles such as cars to the internet, offer enhanced convenience, comfort, and control to the drivers, allowing them to remotely lock and unlock their cars, track their vehicles, and start and stop the engine. For instance, in 2022, the travel and tourism sector made up over USD 7 trillion USD in direct contributions to the global gross domestic product (GDP).

Key Automotive Digital Key Market Insights Summary:

Regional Highlights:

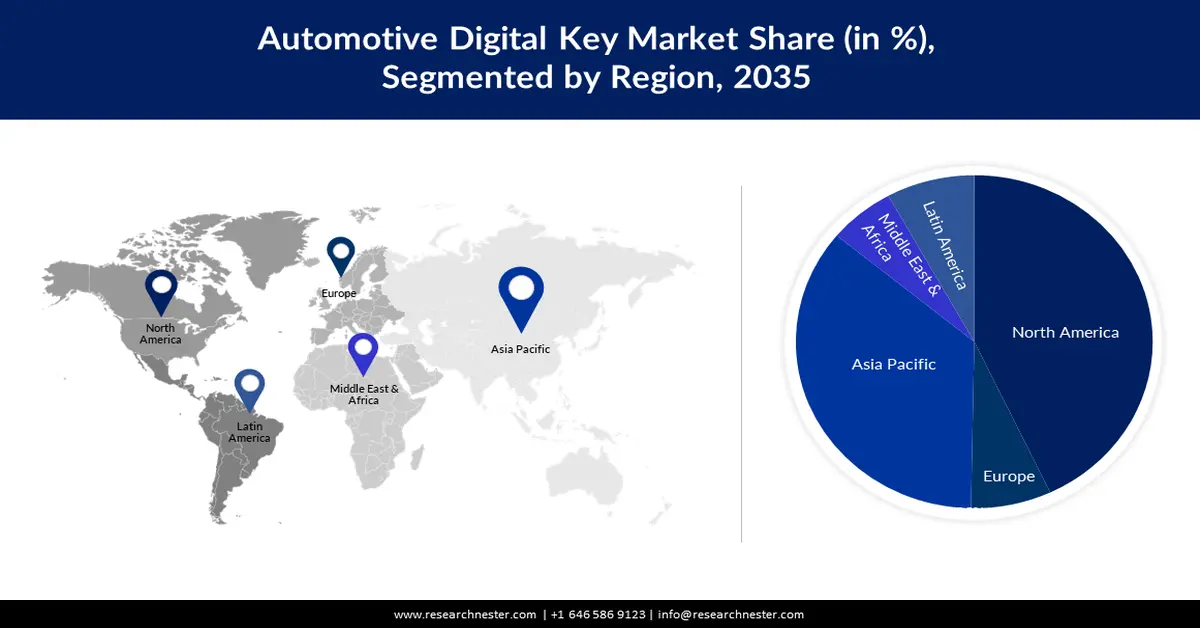

- North America automotive digital key market will dominate over 43% share by 2035, driven by rising adoption of connected vehicles and advanced digital key solutions.

- Asia Pacific market will grow rapidly by 2035, driven by increasing adoption of electric vehicles and rising disposable income.

Segment Insights:

- The remote segment in the automotive digital key market is anticipated to capture a 43% share by 2035, influenced by high preference for remote connectivity and growing popularity of app-based vehicle control.

- The passenger segment in the automotive digital key market is projected to hold a massive market share by 2035, driven by increasing passenger vehicle sales and rising adoption of connected car technologies.

Key Growth Trends:

- Changing consumer preferences

- Shifting preference towards vehicle sharing and mobility-as-a-service

Major Challenges:

- Rising concerns about data security and high implementation costs

- Limited adoption of smartphones in many developing economies

Key Players: Heights Security Inc., HELLA GmbH and Co. KG, Robert Bosch GmbH, Tesla Inc., BMW AG, Hyundai Motor Co., ALPHA Corporation, Continental AG, DENSO Corporation, Hyundai Mobis, Tokai Rika Co. Ltd..

Global Automotive Digital Key Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.64 billion

- 2026 Market Size: USD 3.08 billion

- Projected Market Size: USD 14.29 billion by 2035

- Growth Forecasts: 18.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Germany

Last updated on : 8 September, 2025

Automotive Digital Key Market Growth Drivers and Challenges:

Growth Drivers

- Changing consumer preferences: Consumers are steadily becoming tech-savvy and are willing to adopt new technologies, including digital key systems, due to rising concerns about vehicle safety. Consumers these days value personalized experiences such as driver-specific settings for seat position, climate, and music that can be configured automatically with a digital key. This has resulted in increasing demand for digital keys and industry giants are heavily investing in R&D activities to develop and launch secure digital keys, preventing unauthorized access to the vehicle.

- Shifting preference towards vehicle sharing and mobility-as-a-service: In recent years, there has been a rapid increase in shared mobility services such as car rentals and ride-sharing platforms. This has resulted in increasing demand for digital keys for contactless, remote operations. In addition, increasing demand for premium vehicles is expected to boost global automotive digital key market growth. These cars are equipped with advanced features and technologies, including digital keys.

Challenges

- Rising concerns about data security and high implementation costs: As vehicles become more connected, these face vulnerabilities to hacking, and trust issues among consumers. Digital technology collects personal data from users which can cause concerns, hampering the widespread adoption of digital keys. In addition, the development, testing, and integration of digital key systems involves high investments, making it challenging for mid-tier OEMs and end users.

- Limited adoption of smartphones in many developing economies: Though automotive digital keys are rapidly gaining traction, the limited adoption of smartphones and advanced technology, especially in developing economies can restrain automotive digital key market growth. Moreover, dependency on battery-powered smartphones or connectivity for digital key functionality can lead to device failure, hampering market expansion.

Automotive Digital Key Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18.4% |

|

Base Year Market Size (2025) |

USD 2.64 billion |

|

Forecast Year Market Size (2035) |

USD 14.29 billion |

|

Regional Scope |

|

Automotive Digital Key Market Segmentation:

Connectivity (Remote, Near-field, Bluetooth)

Based on connectivity, the remote segment in the automotive digital key market is estimated to gain a robust revenue share of 43% by 2035 owing to high preference for remote connectivity to unlock/lock the car at a distance and the growing popularity of remote digital keys for enhanced convenience, safety, versatility, and efficiency. In addition, high demand for app-based vehicle control is expected to boost segment growth between 2025 and 2035. To cater to this demand, key players are investing in R&D activities. For instance, in June 2021, HELLA announced the launch of a digital, smartphone-based car key that offers completely hands-free vehicle access. Innovations like these are expected to support market growth going ahead.

Vehicle Type (Passenger, Commercial)

Based on vehicle type, the passenger segment is expected to register massive automotive digital key market share during the forecast period led by increasing sales of passenger vehicles, growing consumer demand for connected car features, and rising adoption of advanced technologies and ADAS in modern passenger cars. According to data released by the International Council on Clean Transportation (ICCT), around 66 million passenger cars were sold globally in 2020. This has resulted in a growing need for advanced digital technologies, including digital keys.

Our in-depth analysis of the automotive digital key market includes the following segments:

|

Connectivity |

|

|

Key Type |

|

|

Application |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Digital Key Market Regional Analysis:

North America Market Insights

The North America automotive digital key market is expected to account for the largest revenue share of 43% by the end of 2035 impelled by rising adoption of connected vehicles with advanced features such as keyless entry and app-based vehicle control, rapid advancements in digital key solutions, and presence of robust key players. Moreover, high reliance on smartphones for daily activities, rising concerns about passenger safety and vehicle security, and supportive norms for vehicle safety are other factors expected to boost market growth in this region.

The awareness of vehicle safety is a key driver for the automotive digital key market in the U.S., as digital keys are gaining popularity amongst rental fleet owners as they can receive or deliver the vehicle without any physical meeting. Increasing penetration of EVs in the U.S., high focus on enhancing driver experience, and rising investments in developing advanced secure digital key solutions are expected to boost market revenue growth.

In Canada, the market is likely to account for significant growth due to rising adoption of connected technology, increasing adoption of EVs with advanced features, including digital keys, and high preference for car sharing and car rentals in areas such as Toronto, Vancouver, and Montreal. According to a recent survey, more than 43% of Canadians have a connected car and the number is expected to drastically increase in the coming years. The market growth is also expected to fuel as automakers and technological firms are collaborating to develop and deploy digital key solutions in the Canada market.

APAC Market Insights

The Asia Pacific automotive digital key market is estimated to register rapid revenue growth through 2035, propelled by increasing adoption of electric vehicles in countries such as China, India, Japan, and South Korea, rising collaborations between OEMs and tech giants, and growing penetration of digital key solutions. Moreover, rising disposable income in this region fuels the demand for premium vehicles with advanced features, including digital keys.

China is one of the largest automotive industries in the world and key players are heavily investing in connected and smart car technologies. Local automotive players in China such as BYD, Great Wall Motors, and Geely are focused on integrating these technologies to cater to the rising demand. According to a study conducted by Research Nester, in 2021, more than 2 million passenger cars in China were equipped with digital keys, and the number is expected to reach 7.8 million cars by 2025.

Automotive giants in India are focused on incorporating modern technologies like digital keys in vehicles. This is expected to fuel market growth. In addition, the growth of ride-sharing platforms such as Ola, Uber and car subscriptions, and favorable government initiatives to support the adoption of vehicles with advanced digital technologies will impel market size.

Automotive Digital Key Market Players:

- Daimler AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Heights Security Inc.

- HELLA GmbH and Co. KG

- Robert Bosch GmbH

- Tesla Inc.

- BMW AG

- Hyundai Motor Co.

- ALPHA Corporation

- Continental AG

- DENSO Corporation

- IDEMIA

The automotive digital key market is highly competitive, comprising key players operating at global and regional levels. Automotive manufacturers like Hyundai Mobis, Volkswagen AG, BMW AG, and Telsa Inc. are focused on integrating digital key technologies into their vehicles to enhance user experience and stay competitive, while firms such as Samsung Electronics, Valeo SA, and Continental AG provide essential components and systems for digital key functionalities. In addition, many industry giants are developing digital keys that allow vehicles to operate via smartphones and other electronic gadgets. Manufacturers and technological firms are often seen adopting strategic partnerships and alliances to meet evolving consumer demands and enhance vehicle functionality. Here is a list of key players operating in the global market:

Recent Developments

- In July 2024, Keysight Technologies, Inc. announced the completion of the first Car Connectivity Consortium (CCC) Digital Key Certification for NXP Semiconductors. This CCC Digital Key Certification Program aims to provide enhanced security for next-generation vehicles.

- In August 2024, LG Innotek announced the expansion of its automotive communication component segment with the launch of its next-generation digital key solution that can open, lock, and start a car using a smartphone.

- Report ID: 2892

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Digital Key Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.