Automotive Data Cables Market Outlook:

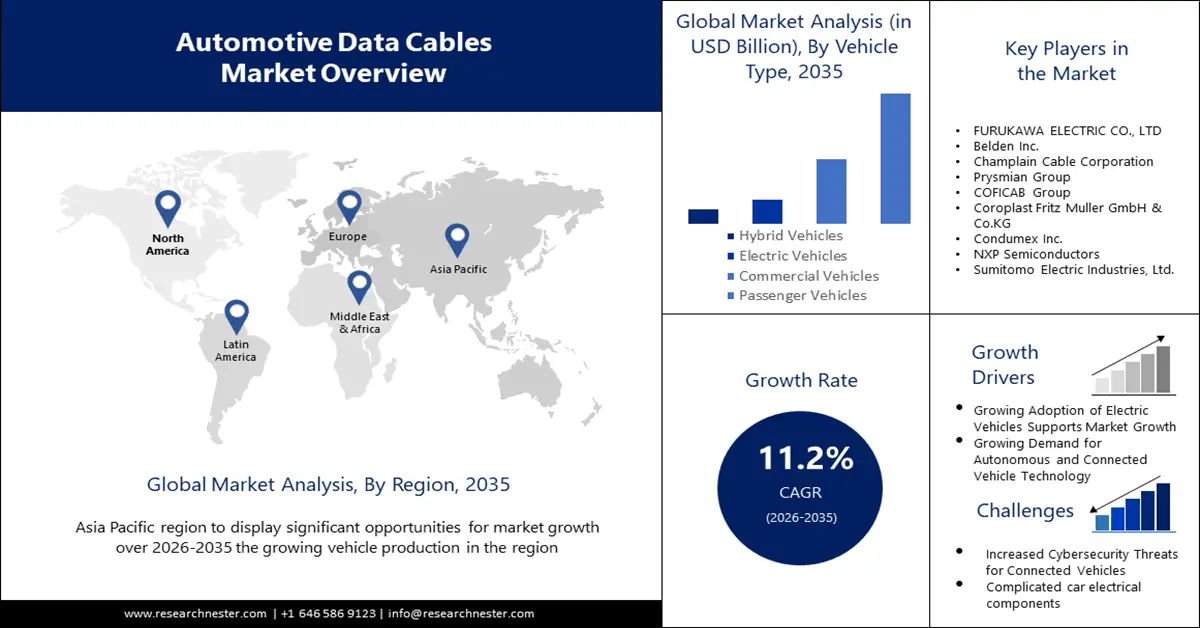

Automotive Data Cables Market size was valued at USD 9.81 billion in 2025 and is likely to cross USD 28.36 billion by 2035, registering more than 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive data cables is assessed at USD 10.8 billion.

The growing requirement for automotive cables across a range of vehicle types and the modern car's increasing need for economy and lower energy usage are driving the automotive data cables market expansion. Electronic control unit (ECU) communication has gotten more complex due to increased software capabilities in cars, and network throughput has increased bandwidth. An Ethernet-based connection offers more flexibility and capacity for combining consumer goods and cloud services. Moreover, there is an increasing demand for autos to be energy-efficient. Increases in engine and transmission efficiency, as well as improvements in material and aerodynamic design, have the potential to greatly increase the average fuel economy of the US car fleet. Various estimates suggest that a full adoption of currently available technology might yield benefits of up to 40%.

In addition to these, the primary companies in the automotive data cables market are developing more innovative and high-quality car data cable products, which is driving the industry's growth. For example, it was announced in 2021 that NXP Semiconductors' TJA146x CAN Signal Enhancement Capability (CAN SIC) transceivers will be productively ramped up into Changan's newest car platform. With NXP's may SIC technology, CAN FD networks may operate in larger, more complex networks and continuously improve the CAN signal to boost data rates. This expands the promise and adaptability of CAN FD as an affordable networking solution that can handle the challenges posed by next-generation automobiles. The first car manufacturer to use NXP's CAN SIC technology for commercialization is Changan Automotive.