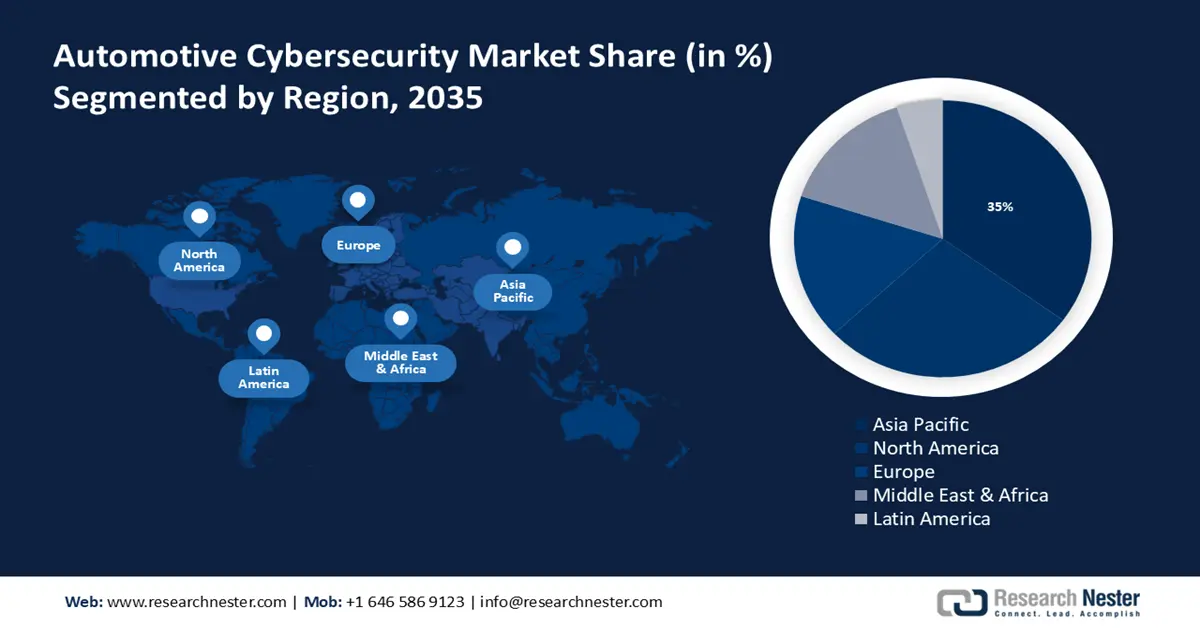

Automotive Cybersecurity Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to hold largest revenue share of 35% by 2035. The market expansion in the region is propelled by the increasing government initiatives against cybersecurity threats. The APAC area is witnessing a significant surge in cyberattacks in contrast to other parts of the world, therefore the government is taking actions that mostly address concerns related to national security, cyber security threat perceptions, and risks to vital information infrastructure.

For instance, to protect cars from cyberattacks, the Ministry of Road Transport and Highways (MoRTH) a ministry of the Government of India, has proposed standardizing Cyber Security and Management Systems (CSMS) requirements for passenger and freight carriers since it is imperative to implement laws that set strict automotive cybersecurity guidelines to guarantee that OEMs, automakers, and service providers in the connected vehicle ecosystem follow strong security protocols.

Additionally, on January 5, 2023, China published the "Auto data security compliance and practice guidance to maintain the safety and security of the autonomous vehicle industry, which emphasizes how crucial cybersecurity and data protection are to the creation of intelligent transportation systems.

Besides this, cloud computing, or simply "cloud," is quickly becoming popular in Japan, and this is good for the country's economy and society in many ways. As connected and automated guided vehicles become more common, automakers there have already begun working with cloud service providers, which may increase the demand for automotive cybersecurity.

North American Market Insights

The North American automotive cybersecurity market will also register a massive CAGR and will hold the second position led by the increasing personal disposable income. As a result, there is an increased ability to purchase cars, leading to robust demand for automobile cybersecurity in the region.

Regulations and best practices for vehicle cyber security are being released by the United States which addresses training, product development, incident response, and other cybersecurity-related topics. For instance, the National Highway Traffic Safety Administration (NHTSA) of the United States has updated its Cybersecurity Best Practices for the Safety of Modern Vehicles to encourage manufacturers of vehicles and equipment to review the guidance and decide whether to apply it to their particular systems.

In addition, cybersecurity and the safety of motor vehicles are shared in Canada by the commercial sector, all governmental levels, and individual citizens by staying up to date with how the automotive cyber landscape is changing to successfully manage and mitigate cyber security risks and related vulnerabilities.