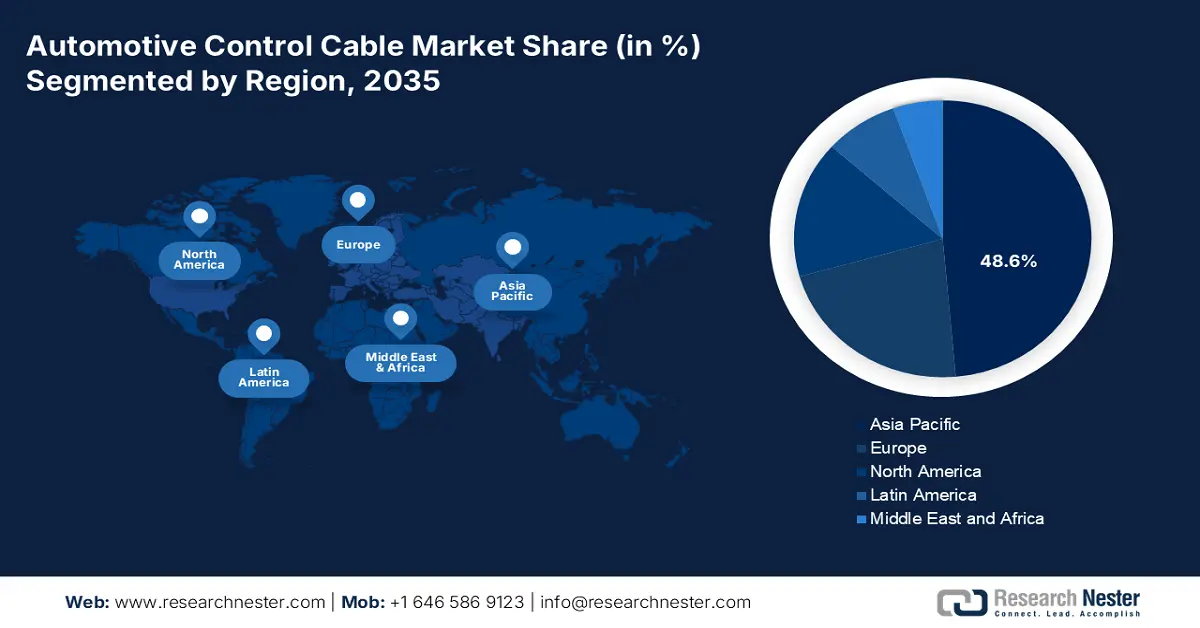

Automotive Control Cable Market - Regional Analysis

APAC Market Insights

The Asia Pacific is dominating the automotive control cable market and is expected to hold the revenue share of 48.6% by 2035. This leadership is driven by the region’s status as the world’s largest vehicle producer, massive domestic markets, and aggressive government-led transitions to electric mobility. China’s commanding position is fueled by its world-leading EV adoption rates and comprehensive supply chain, while emerging economies such as Southeast Asia and India contribute significant growth via rising vehicle production and ownership. Key regional trends include the rapid electrification of vehicle fleets that shifts the demand from traditional mechanical cables to electronic and high voltage variants and intense competition among local suppliers to meet the cost and innovation demands of both domestic and global OEMs.

Japan’s automotive control cable market is defined by its leading manufacturers pivot towards next gen vehicles mainly hybrids and solid-state battery EVs. The automotive control cable market demand is shifting from the high-volume standard cables to specialized, high-value electronic control cables for the advanced transmissions, brake-by-wire systems, and thermal management. According to International Council on Clean Transportation data from June 2023, Japan had 92,000 EV sales in 2022, a 109% increase over the previous year, indicating a fast acceleration in electrification. This transition is aided by the government green innovation funds, which push the domestic suppliers such as Aisin and Hi-Lex to innovate in lightweight materials and electronic integration to maintain their competitive edge in the global supply chain for domestic OEMs and international exports.

China dominates the automotive control cable market in the APAC and is the largest and most dynamically evolving market. The market is driven by the world’s most aggressive electric vehicle adoption. The market is defined by intense competition, rapid innovation cycles, and a complete domestic supply chain for EVs. According to the data from the IEA 2025, China's electric vehicle production in 2024 was 17.3 million, representing a YoY rise. This massive scale is fueled by the sustained government subsidies and purchase tax exemptions, creating an unparalleled demand for the EV-specific control cables for the battery disconnect units, electronic park brakes, while simultaneously causing a decline in the traditional clutch and throttle cable volumes.

China Motor Vehicle Production

|

Year |

Units |

|

2019 |

25 750 650 |

|

2021 |

26 121 712 |

|

2022 |

27 020 615 |

|

2023 |

30 160 966 |

|

2024 |

31 281 592 |

Source: OICA 2025

Europe Market Insights

Europe is growing rapidly in the automotive control cable market and is poised to grow at a CAGR of 4.1% during the forecast period, 2026 to 2035. The market is shaped by the strong regulatory environment and a rapid technology-driven transition to electric vehicles. The region is a leader in premium and luxury vehicle manufacturing that demands high-performance, durable control cables. The primary market driver is the European Union’s de facto ban on the new internal combustion engine car sales, stimulating OEM investments in the EV platforms. This shift is minimizing the demand for the traditional throttle and clutch cables but generating a significant growth for the electronic shift-by-wire systems, advanced brake controls, and thermal management cables. The market is also influenced by strong supply chain legislation and competition from low-cost Asian manufacturers, pushing European suppliers to compete on innovation, quality, and integration.

Germany is projected to hold the highest revenue share in Europe by 2035 and is driven by its position s the continent’s automotive manufacturing hub. The growth is fueled by the massive investment from the domestic OEMs, such as BMW and Volkswagen, into electrification. For example, Germany’s Federal Ministry for Economic Affairs and Climate Action reports that the share of electric vehicles in the new registrations is high in 2023. Further, the report from the European Environment Agency data in 2024, Germany holds the share of 13.9% of electric vehicle adoption in the region. This rapid adoption is supported by a dense network of Tier 1suppliers creating a concentrated demand for high-value electronic control cables. The key trends include the integration of control cables with the ADAS and automated driving features, requiring fail-safe performance and compliance with strict EU safety standards set by bodies such as the European Commission.

France is set to be a leader in the automotive control cable market in Europe, and the growth is anchored by the strong government industrial policy and a successful domestic EV manufacturing base, notably from Stellantis and Renault. The French government’s France 2030 plan includes €4 billion to decarbonize industry, directly supports the production of EVs and their components, as per the IEA January 2024 report. Further, the policy-driven market expansion ensures a sustained demand for the control cables. A major trend focuses on a vertically integrated European battery supply chain that necessitates compatible, high-performance cable systems for battery management and vehicle safety, aligning with the EU's strategic autonomy goals.

North America Market Insights

The North America automotive control cable market is projected to hold a significant revenue share by 2035. The market is driven by the technologically advanced automotive sector. The key drivers include a robust U.S. fuel economy standard, compelling lightweight cable solutions, and the rapid electrification of the vehicle fleet that demands specialized control cables for battery disconnect and thermal management systems. The reshoring of automotive manufacturing, supported by policies such as the U.S. Inflation Reduction Act and the complementary Canadian incentives, strengthens the regional supply chain. Further, the high consumer demand for feature-rich vehicles with advanced transmissions and safety systems ensures a steady demand for the high-value durable control cables, offering lower volume growth.

The automotive control cable market in the U.S. is driven by the strategic pivot to electric vehicle production and stringent regulatory standards. The Environmental Protection Agency’s revised Multi Pollutant Emissions Standards for 2027 to 2032 are surging the transition, pushing automakers to electrify and lightweight their fleet, thereby increasing the demand for electronic and composite control cables. According to the IEA data in 2024, the U.S. has sold over 1.4 million EVs in 2023, and the need for specialized cables for battery management and shift-by-wire systems is escalating. Furthermore, the Bipartisan Infrastructure Law's support for national EV charging infrastructure is a critical demand catalyst, boosting consumer confidence and long-term EV adoption that secures the market for advanced control cable solutions. This regulatory and investment landscape is compelling suppliers to localize production and form strategic partnerships with domestic EV manufacturers.

Electric Car Sales Share in the U.S.

|

Year |

Share Percentage |

|

2018 |

2 |

|

2019 |

2 |

|

2020 |

2 |

|

2021 |

5 |

|

2022 |

7 |

|

2023 |

10 |

Source: IEA 2024

Canada’s automotive control cable market is shaped by its federal zero-emission vehicle mandate requiring 100% light-duty vehicle sales to be ZEVs by 2035. This policy is detailed by the Environment and Climate Change Canada, creates a guaranteed long-term demand pipeline for EV-specific control cables. As per the government of Canada data in November 2023, the iZEV program, which has allocated an additional CAD 1.7 billion via budget in 2022 nd has already supported over 200,000 ZEV incentive claims, which continues to shape the country’s vehicle production mix. With ZEV reaching 9.5% of new registrations by the third quarter in 20233, OEMs and Tier 1 suppliers are adjusting the control cable specifications for non-powertrain applications, maintaining a stable procurement despite reduced use in traditional combustion systems. Canada’s strategic focus on its critical mineral supply chain, essential for EV batteries, further integrates its automotive sector with the North America production, ensuring domestic control of cable suppliers is anchored to a resilient future-oriented manufacturing ecosystem.