Automotive Collision Repair Market Outlook:

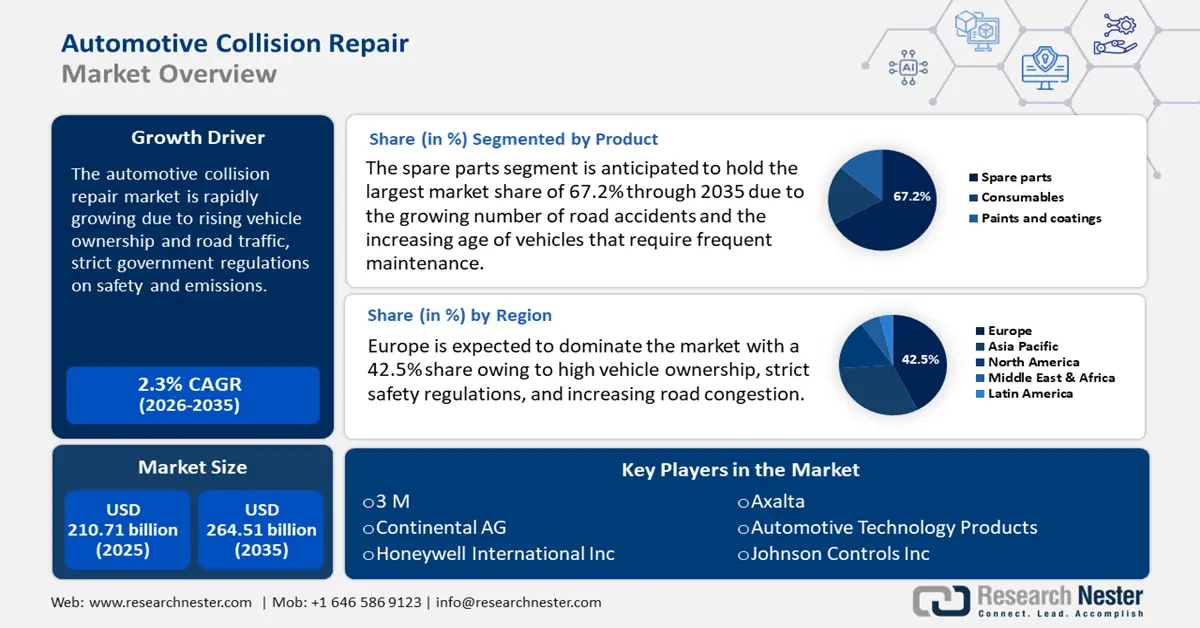

Automotive Collision Repair Market size was valued at USD 210.71 billion in 2025 and is likely to cross USD 264.51 billion by 2035, registering more than 2.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive collision repair is assessed at USD 215.07 billion.

The rising vehicle ownership and road traffic have been a primary reason for the automotive collision repair market growth. With global vehicle ownership on the rise, especially in emerging economies, road congestion has increased leading to higher chances of accidents and minor collisions. Urbanization and higher traffic density contribute to more frequent collisions directly driving demand for repair services.

According to the Society of Indian Automobile Manufacturers, there has been a rise in vehicle density where the industry produced a total of 28.4 million vehicles comprising passenger vehicles, commercial vehicles, three-wheelers, two wheelers, and quadricycles in 2023-24, as compared to 25.9 million vehicles in 2022-23. Additionally, the automobile market in India also witnessed an increase in total passenger vehicle sales recording 4.219 million units in 2023-24. Two-wheeler sales also rose, from 15.9 million to 18 million units during the same year. These rising numbers apprehend the increase of vehicles on roads leading to chances of collision.

Key Automotive Collision Repair Market Insights Summary:

Regional Highlights:

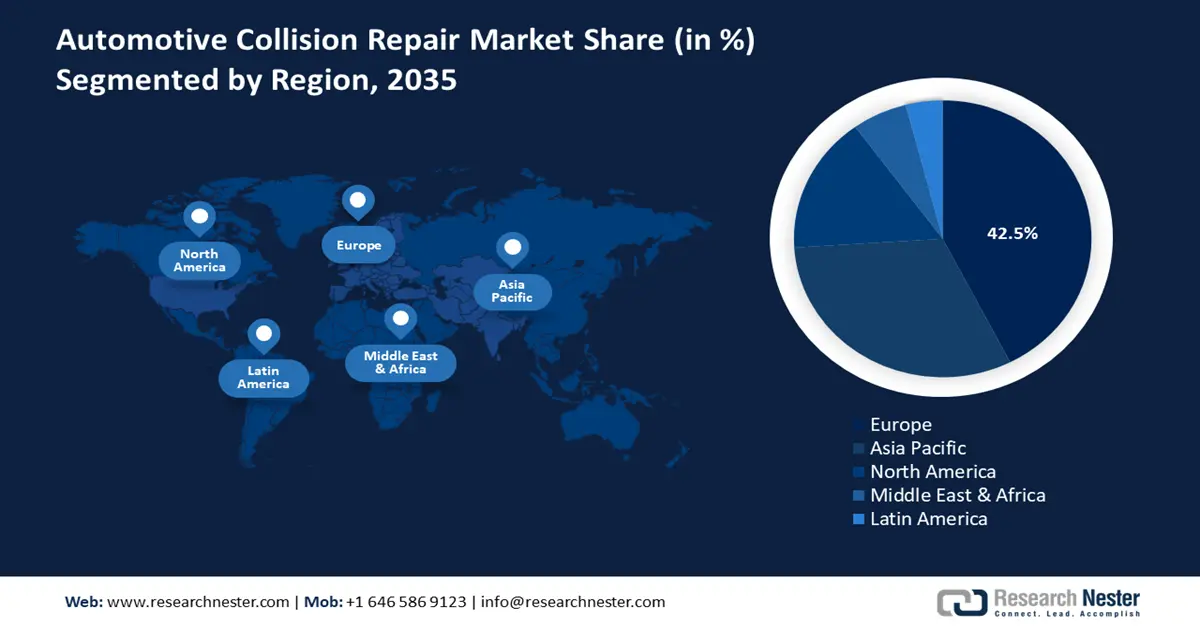

- Europe leads the Automotive Collision Repair Market with a 42.5% share, driven by high vehicle ownership, strict safety regulations, and increasing road congestion, ensuring robust growth through 2026–2035.

Segment Insights:

- The Spare Parts segment is forecasted to experience robust growth from 2026 to 2035, driven by the increasing number of road accidents and the growing need for maintenance in aging vehicles.

- The OE service channel segment is expected to capture a remarkable share by 2035, fueled by increasing vehicle complexity and demand for high-quality manufacturer-approved repairs.

Key Growth Trends:

- Advancements in vehicle technology and materials

- Strict government regulations on vehicle safety and emissions

Major Challenges:

- Shortage of skilled labor

- Increasing costs of replacement parts

- Key Players: 3M, Continental AG, Federal-Mogul LLC, Honeywell International Inc., Johnson Controls Inc., International Automotive Components Group.

Global Automotive Collision Repair Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 210.71 billion

- 2026 Market Size: USD 215.07 billion

- Projected Market Size: USD 264.51 billion by 2035

- Growth Forecasts: 2.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Automotive Collision Repair Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in vehicle technology and materials: Modern vehicles use lightweight materials such as aluminum, carbon fiber, and Advanced driver assistance systems (ADAS) that make repairs complex and expensive. Systems such as automatic emergency braking, lane departure warnings, and blind spot detection require precise recalibration after accidents. In addition, the rising demand for EVs and hybrid electric vehicles requires specialized repair expertise as damage to high-voltage battery systems can be hazardous. This technological shift is directly boosting demand for certified repair centers and investments in high-tech diagnostic tools enhancing the revenue potential of the industry.

- Strict government regulations on vehicle safety and emissions: The enforcement of strict vehicle safety and environmental regulations positively impacts the automotive collision repair market. New safety requirements such as mandatory ADAS and safety features increase the complexity of post-accidental repairs. The push for sustainable repair solutions such as eco-friendly paint and recycling damaged parts is reshaping the industry. For instance, in December 2024, Bajaj Allianz General Insurance launched the Exco Assure Repair Protection add-on cover that promotes sustainable repairs using restored parts. This initiative encourages to opt for eco-friendly repair options aligning with environmental goals. Further, the imposition of strict repair guidelines has led to increased demand for OEM-certified repair shops and training programs. These regulations are prompting repair facilities to invest in training and equipment creating new automotive collision repair market opportunities for specialized service providers.

- Expansion of automotive insurance and claims management: The automotive insurance industry also plays a crucial role in shaping the collision repair market. As more vehicles are covered under insurance policies, it increases repair shop revenues. Additionally, the digitalization of claims processes such as AI-driven estimating tools and telematics-based claim settlements streamlines the repair process. Automakers and insurance companies are forming partnerships to promote certified repair networks ensuring that only authorized service providers handle post-accident repairs.

Challenges

- Shortage of skilled labor: The automotive industry struggles to hire and retain trained technicians who can work with advanced vehicle systems. Younger workers prefer careers in tech or engineering leading to an aging workforce in the collision repair industry. Moreover, training programs are expensive, and many independent shops find it challenging to keep up with the evolving technologies.

- Increasing costs of replacement parts: The cost of OEM parts is rising and automakers often limit the use of aftermarket or recycled parts, increasing repair costs. Additionally, global supply chain disruptions have made sourcing of automotive parts tougher, leading to longer repair wait times and customer dissatisfaction.

Automotive Collision Repair Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

2.3% |

|

Base Year Market Size (2025) |

USD 210.71 billion |

|

Forecast Year Market Size (2035) |

USD 264.51 billion |

|

Regional Scope |

|

Automotive Collision Repair Market Segmentation:

Product (Spare Parts, Consumables, Paints & Coatings)

Spare parts segment is anticipated to account for around 67.2% automotive collision repair market share by 2035, due to the growing number of road accidents and the increasing age of vehicles that require frequent maintenance. As cars become more advanced with ADAS, EV components, and lightweight materials, the demand for OEM and specialized aftermarket parts continues to rise. The rising trend of sustainability efforts also encourages the use of remanufactured and recycled parts making repairs cost-effective and environmentally friendly. Additionally, the growth of the global supply chain and e-commerce platforms has improved the availability of spare parts further accelerating market expansion.

Service Channel (OE, DFIM, DIY)

The OE service channel segment in automotive collision repair market is predicted to gain a remarkable share through 2035 owing to the increasing complexity of modern vehicles and the demand for high-quality manufacturer-approved repairs. Automakers and consumers tend to choose OEM-certified repair centers to ensure that repairs fulfill strict safety and performance standards. The demand for OE service channels is gaining popularity, especially for ADAS-equipped and electric vehicles. Additionally, the market is steadily growing as insurance companies and fleet operators prefer OE service networks for reliable, warranty-backed repairs. Rising consumer awareness of genuine parts and factory-trained technicians strengthens this segment. Government regulations and safety inspections also drive demand for OE-authorized repairs, boosting the automotive collision repair market growth.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Service Channel |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Collision Repair Market Regional Analysis:

Europe Market Analysis

Europe automotive collision repair market is set to account for revenue share of around 42.5% by 2035, due to high vehicle ownership, strict safety regulations, and increasing road congestion. The adoption of ADAS and electric vehicles along with stricter EU safety and emissions regulations has made repairs more complex encouraging demand for OEM-certified repair centers. Additionally, the growth of car leasing and insurance-backed repair programs ensures a steady flow of collision repair services across the region.

The automotive collision repair market in the UK is growing due to rising road traffic density and frequent road accidents, particularly in congested city areas. A surge in luxury and electric vehicle adoption has driven demand for specialized repair services and OEM-certified parts. The presence of a strong insurance sector and direct repair programs (DRPs) certify a steady flow of business for repair centers. The market in the UK is open to opportunities for automated repair technologies due to high labor costs and a shortage of skilled technicians. Thus, investments in smart repair technologies and AI-driven diagnostics are improving efficiency and reducing repair times. For instance, in January 2024, Oakley Capital, a major private equity investor invested in Steer Automotive Group, the UK’s largest and fastest-growing independent collision repair company. The company has established over 100 repair centers representing 5% of the UK market.

The automotive collision repair market in Germany is expanding due to the country’s high vehicle density and strong automotive manufacturing base. Automakers in Germany focus on premium and technologically advanced vehicles increasing the demand for OEM-certified repair shops and specialized technicians. The rise of mobility as a service and corporate fleet leasing has driven consistent repair needs, especially for commercial vehicles. Germany’s push for digitalization in workshops including AI-based diagnostics and automated repair solutions is transforming the industry.

Asia Pacific Market Analysis

Asia Pacific automotive collision repair market is anticipated to grow at the fastest rate from 2026 to 2035 owing to rapid urbanization and a surge in vehicle ownership in emerging economies. Increasing road congestion and higher accident rates are fueling the demand for affordable and efficient repair services. The rise of ride-hailing and delivery fleets has created a steady need for collision repairs. Additionally, government initiatives promoting EV adoption are pushing repair shops to upgrade with EV-specific tools and training accelerating market expansion.

The automotive collision repair market in China is expanding due to the country’s massive vehicle population and increasing road congestion in megacities. The country’s push for new energy vehicles including EVs has created demand for specialized repair infrastructure and battery technology. Automakers are expanding OEM-certified repair networks to maintain vehicle quality and safety standards. Additionally, the growth of online platforms for car servicing and insurance-backed repair networks is making collision repair services more efficient and accessible to consumers.

The automotive collision repair market in India is poised to grow speedily due to rising vehicle sales and increasing road accidents in densely populated metro cities. A surge in two-wheeler and compact car ownership has driven demand for affordable and quick repair solutions. India has a thriving aftermarket sector that offers budget-friendly spare parts and services as consumers prefer local garages and multi-brand workshops for affordable repairs. However, the industry is becoming more organized with the rise of digital insurance claims and AI-powered damage assessments which help streamline repair approvals and cost estimates. Additionally, the government’s push for road safety regulations and stricter vehicle inspections is encouraging higher quality repair standards fueling automotive collision repair market expansion.

Key Automotive Collision Repair Market Players:

- Automotive Technology Products LLC (ATP)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M

- Continental AG

- Federal-Mogul LLC

- Faurecia

- Honeywell International Inc.

- Johnson Controls Inc.

- International Automotive Components Group

- Magna International Inc.

- Martinrea International Inc.

- Mann+Hummel Group

- Takata Corporation

- Robert Bosch GmbH

The global automotive collision repair market is highly competitive with 3M, Bosch, Axalta, and Denso Corporation leading through innovative repair solutions and OEM partnerships. Companies are expanding digital space, AI-based damage assessment and automated repair solutions to enhance efficiency. Additionally, mergers, acquisitions, and strategic alliances are shaping the industry as companies aim to strengthen their global presence. For instance, in September 2024, Melbourne-based Genuine Parts Company (GPC) acquired Australia’s automotive collision repair parts company Auto Parts Group (APG) for genuine, certified, and aftermarket automotive collision repair parts. As of 2024, APG supplied 47,000 different product lines to nearly 3,500 collision repairers. Here are some leading players in the automotive collision repair market:

Recent Developments

- In November 2024, 3M and Axalta announced a partnership to develop free training courses for the collision repair industry, focusing on automotive refinishing. These courses aim to help repair shops improve their processes and results.

- In November 2024, 3M and BASF’s Coatings division partnered to develop standard operating procedures (SOPs) and training materials for the collision repair industry. These new guidelines help body shops to become more sustainable and efficient. The SOPs and training content are set to be introduced in 2025 at the SEMA Show in Las Vegas.

- Report ID: 7400

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Collision Repair Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.