Automotive Coil Spring Market Outlook:

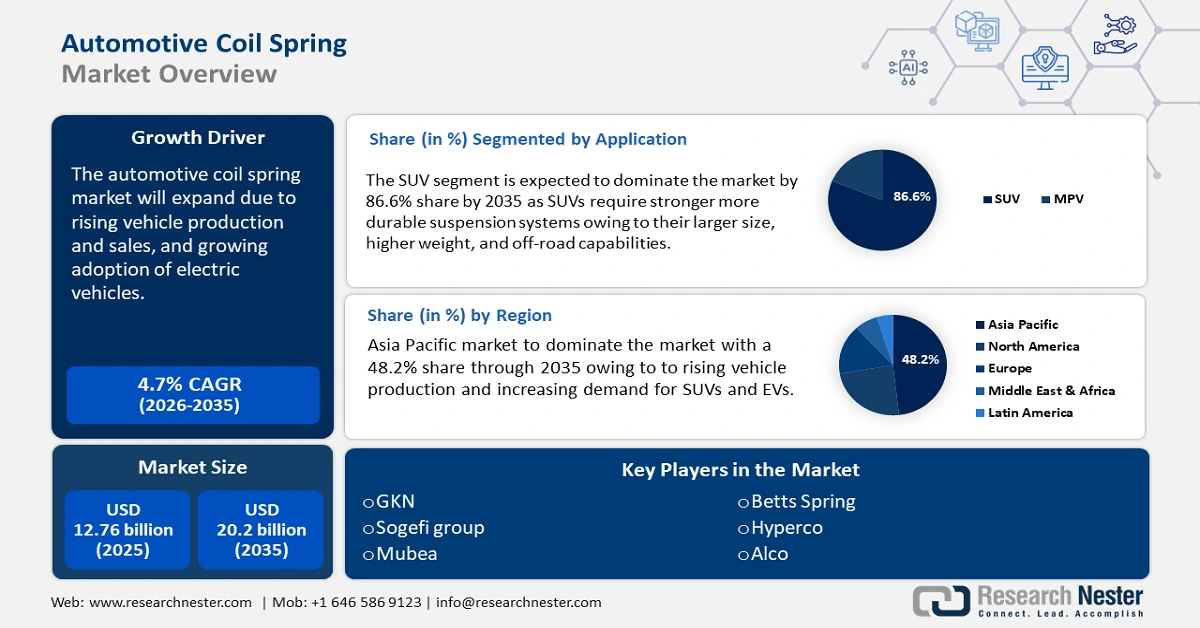

Automotive Coil Spring Market size was valued at USD 12.76 billion in 2025 and is likely to cross USD 20.2 billion by 2035, expanding at more than 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive coil spring is assessed at USD 13.3 billion.

The demand for passenger, commercial, and electric vehicles has been a key factor for growth of automotive suspension components, including coil springs. Countries such as China, India, the U.S., and Germany are the leading producers of vehicles, fueling the demand for coil springs used in suspension systems. A report by the Observatory of Economic Complexity (OEC) suggests that in 2022, cars were the fifth most traded product in the world accounting for a total of USD 782 billion. Additionally, during 2021 and 2022 car exports grew by 7.51%, from USD 727 billion to USD 782 billion. This has resulted in increasing production of coil springs.

The rise in the adoption of electric vehicles (EVs) is a key driver boosting the demand for durable coil springs. Unlike conventional cars, EV’s require stronger lightweight coil springs to support heavier battery packs. Additionally, government subsidies and incentives highly promote EV adoption, leading to increased production of electric passenger cars, buses, and trucks. Additionally, the adoption of electric vehicles is also on the rise as it forms the most important technology to decarbonize road transport. The International Energy Agency mentions that road transport accounts for around one-sixth of global pollution. Thus, a shift to EVs will reduce CO2 emissions and lead to a greener future. Therefore, automakers are investing in innovating light suspension systems to improve ride comfort and efficiency in EV’s creating demand for high-performance coil springs.

Key Automotive Coil Spring Market Insights Summary:

Regional Highlights:

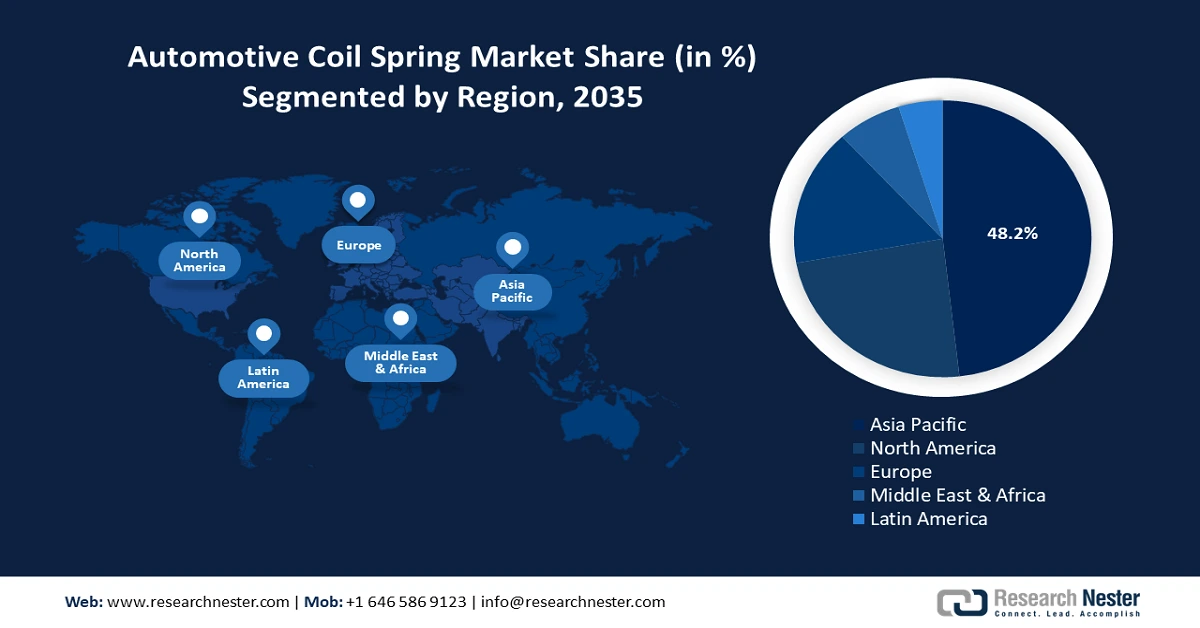

- Asia Pacific leads the Automotive Coil Spring Market with a 48.2% share, driven by rising vehicle production and increasing demand for SUVs and EVs in the Asia Pacific region, ensuring robust growth through 2026–2035.

- North America's automotive coil spring market is poised for the fastest growth by 2035, driven by the rise of electric pick-up vans and SUVs, driving innovation in composite and high-strength steel coil springs.

Segment Insights:

- The SUV Application segment is projected to exceed 86.6% market share by 2035, fueled by increasing demand for SUVs, boosted by their durable suspension needs, motorsports popularity, and their status symbol appeal.

- Commercial Vehicles End Use segment is anticipated to experience rapid growth from 2026-2035, driven by rising demand for heavy-duty trucks and delivery vans requiring durable coil springs.

Key Growth Trends:

- Technological advancements in suspension systems

- Strict safety and emission regulations

Major Challenges:

- Fluctuating raw material prices

- Increasing shift towards alternative suspension technologies

- Key Players: Sogefi Group, NHK Nasco, Mubea, Betts Spring, MSSC, Hyperco, Neapco, Alco, Draco Spring.

Global Automotive Coil Spring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.76 billion

- 2026 Market Size: USD 13.3 billion

- Projected Market Size: USD 20.2 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 13 August, 2025

Automotive Coil Spring Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements in suspension systems: Vehicle manufacturers are focused on developing next-generation suspension systems that require enhanced coil springs for better stability, comfort, and performance. Further, innovations in adaptive damping and air suspension systems are gaining popularity in premium and high-performance vehicles, requiring high-quality coil springs. Lightweight materials such as high-strength steel, aluminum alloys, and composites are increasingly used to improve fuel efficiency and vehicle dynamics. Companies such as Mubea and Audi have developed glass fiber-reinforced polymer (GFRP) coil springs which are up to 40% lighter than traditional steel springs improving fuel efficiency and reducing CO2 emissions.

- Strict safety and emission regulations: Governments worldwide are enforcing stringent fuel efficiency and emission regulations, pushing automakers to focus on weight reduction and energy efficiency. The coil springs made from lightweight and high-strength materials help reduce overall vehicle weight which improves fuel economy and lower emissions. According to the U.S. Department of Energy report, it states that using lightweight materials boosts vehicle efficiency. Thus, a decrease of 10% in vehicle weight can enhance fuel economy by 6%-8%. Moreover, crash safety regulations are driving improvements in suspension components, ensuring better stability and control in high-impact situations. Compliance with safety and environmental standards is driving innovation in coil spring technology.

Challenges

- Fluctuating raw material prices: Coil springs are primarily made from high-strength steel, aluminum alloys, and composite materials. The prices of steel and other raw materials fluctuate due to supply chain disruptions, trade policies, and global economic conditions. Rising material costs increase production expenses, affecting profitability for manufacturers. Therefore, higher costs can lead to price hikes for end consumers and reduced profit margins for manufacturers.

- Increasing shift towards alternative suspension technologies: Advanced air suspension, adaptive damping, and electronic suspension systems are gaining traction, especially in premium vehicles. Some of these technologies can replace traditional coil springs reducing their demand. Alternative spring systems such as torsion bars, leaf springs, and composite suspensions are being explored in certain vehicle categories, thus coil spring manufacturers must innovate to stay competitive and relevant in the evolving suspension systems market.

Automotive Coil Spring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 12.76 billion |

|

Forecast Year Market Size (2035) |

USD 20.2 billion |

|

Regional Scope |

|

Automotive Coil Spring Market Segmentation:

Application (SUV, MPV)

By 2035, SUV segment is expected to capture over 86.6% automotive coil spring market share. Advanced automotive coil springs find wide applications in SUV models owing to their durable suspension system requirements. Key players are investing heavily in research and development activities to introduce innovative coil spring solutions and meet the off-road demands of SUVs. Furthermore, the rising popularity of motorsports is augmenting the sales of sport utility vehicles and driving innovations in coil spring materials and designs. Apart from this, the SUV’s dominance as a status symbol is uplifting its adoption and ultimately the sales of coil springs. According to International Energy Agency (IEA) Report 2024, SUVs accounted for about 48.0% of global car sales in 2023. The growing popularity of SUVs worldwide has led them to have more than one in four cars on the road, comprising mainly conventional internal combustion engines (ICE).

End use (Commercial Vehicles, Passenger Vehicles)

The commercial vehicle segment in automotive coil spring market is anticipated to register rapid growth during the forecast period. Commercial vehicles play a crucial role in the automotive coil spring sector driven by growing demand for heavy duty trucks, and delivery vans. These vehicles require stronger, more durable coil springs to handle heavy loads, rough terrains and long-distance travel. Traditional steel coil rings are generally used, but advancements in high-strength alloys are improving load-bearing capacity and durability.

Our in-depth analysis of the global automotive coil spring market includes the following segments:

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Coil Spring Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific automotive coil spring market is expected to capture revenue share of over 48.2% by 2035, owing to growing rapidly due to rising vehicle production and increasing demand for SUVs and EVs. The increasing demand for automobiles in Asia Pacific also depends on the rising middle-class population and higher disposable income. China, Japan, India and South Korea are the leading countries with the presence of major automakers and suppliers that are focused on innovating technologies for growth. The shift towards electric vehicles and advanced suspension systems is further boosting market demand.

The automotive coil spring market in China is booming as it’s the largest vehicle market in the world. According to the International Trade Administration report, China leads the vehicle market in terms of annual sales and manufacturing output. The domestic vehicle production in China is expected to reach 35 million vehicles by 2025. Leading manufacturers such as FAW Group, Dongfeng Motor Parts, and Baosteel are investing in high-strength and lightweight coil springs for fuel efficiency. Furthermore, government policies supporting local manufacturing and export growth are increasing the demand for the automotive coil spring market.

The automotive coil spring market in India is expanding due to the growing production of passenger vehicles, SUVs, and electric vehicles. According to the India Brand Equity Foundation (IBEF) report 2024, the global EV market was valued at USD 250 billion in 2021 and is expected to reach USD 1,318 billion by 2028. The government’s initiatives and investments in EV adoption also influence growth in the suspension market in India. For instance, to boost EV adoption in India, the government launched the PM E-DRIVE scheme from 1st October 2024 to 31st March 2026 allocating a budget of USD 1.30 billion. This initiative aims to accelerate the adoption of EVs, build an EV manufacturing ecosystem, and establish charging infrastructure in India.

North America Market Analysis

North America is anticipated to grow the fastest from 2025 to 2035. The automotive coil spring market in North America is shaped by the demand for high performance, light weight and adaptive suspension systems. The rise of electric pick-up vans and SUVs is driving innovation in composite and high strength steel coil springs. The presence of leading automotive suspension manufacturers such as Tenneco and Eibach supports continuous R&D in advanced suspension technologies. The region’s strict safety and emission regulations further encourage the adoption of energy efficient coil springs.

The automotive coil spring market in the U.S. is driven by the strong demand for passenger vehicles, SUVs, and electric vehicles from brands such as Ford and Tesla. Innovations in progressive and performance coil springs are enhancing vehicle handing and comfort in rides. Leading suppliers such as MW Industries and Hyperco are developing high strength and light weight suspension solutions. The push for off road and rugged vehicle suspension in U.S. is creating demand for durable high load bearing coil springs.

Canada is the second-largest automotive market in North America which automatically drives the need for coil springs in automobiles. Canada’s automotive coil spring market benefits from its strong manufacturing base, with companies such as Ford, General Motors, Stellantis, Toyota, Honda and Magna International supplying OEM and aftermarket suspension parts. The growth of aftermarket and replacement in suspension components also helps the automotive coil spring market to rise. In 2023, Magna announced an investment of USD 470 million to expand its operations across Ontario, Canada. Additionally, it is also expanding its presence in Guelph, Belleville, Newmarket, Windsor, and Penetanguishene. The company’s expansion will strengthen its production capability increasing usage of lightweight and corrosion-resistant coil springs. In addition, Canada is focused on achieving net-zero emissions by 2050. Thus, the International Trade Administration report states that the government of Canada aims to deliver 60% of new vehicles as zero-emission vehicles by 2030 and 100% by 2035. The rise in sales of electric vehicles is a key driver for the growth of the automotive coil spring market.

Key Automotive Coil Spring Market Players:

- GKN

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sogefi Group

- NHK Nasco

- Mubea

- Betts Spring

- MSSC

- Hyperco

- Neapco

- Alco

- Draco Spring

- UNI AUTO PARTS

The leading companies dominating the automotive coil spring market include NHK Spring, Sogefi Group, and Mubea known for their high performance and light weight suspension solutions. Tenneco and Eibach specialize in performance coil springs for both OEM and aftermarket applications. Jamna Auto Industries and Baosteel are the key players in Asia supplying durable coil springs for commercial and passenger vehicles. These companies are driving innovation in composite materials, corrosion resistance and adaptive suspension technologies to meet global demand.

Here are some leading players in the automotive coil spring market:

Recent Developments

- In April 2024, ClearMotion and Porsche AG partnered to collaborate in the development of advanced chassis systems. The objective of the agreement is to increase the high performance of the dynamic chassis in Porsche models. Under this agreement, Porsche and ClearMotion collaborated on both ClearMotion which is a high-bandwidth active suspension technology, and RoadMotion, a road surface fingerprinting software for proactive chassis control.

- In January 2024, Mercedes-Benz invested USD 24.04 million in India and is aiming to release more than a dozen new cars, including EVs.

- In October 2023, McLaren Automotive and Tenneco announced Monroe as their intelligent suspension supplier for the McLaren range of road cars. Tenneco, a top electronic suspension systems supplier, supplied under the Monroe Intelligent Suspension brand, to McLaren Automotive. The advanced suspension is important in providing precise and amusing driving experience to McLaren’s customers.

- Report ID: 7240

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Coil Spring Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.