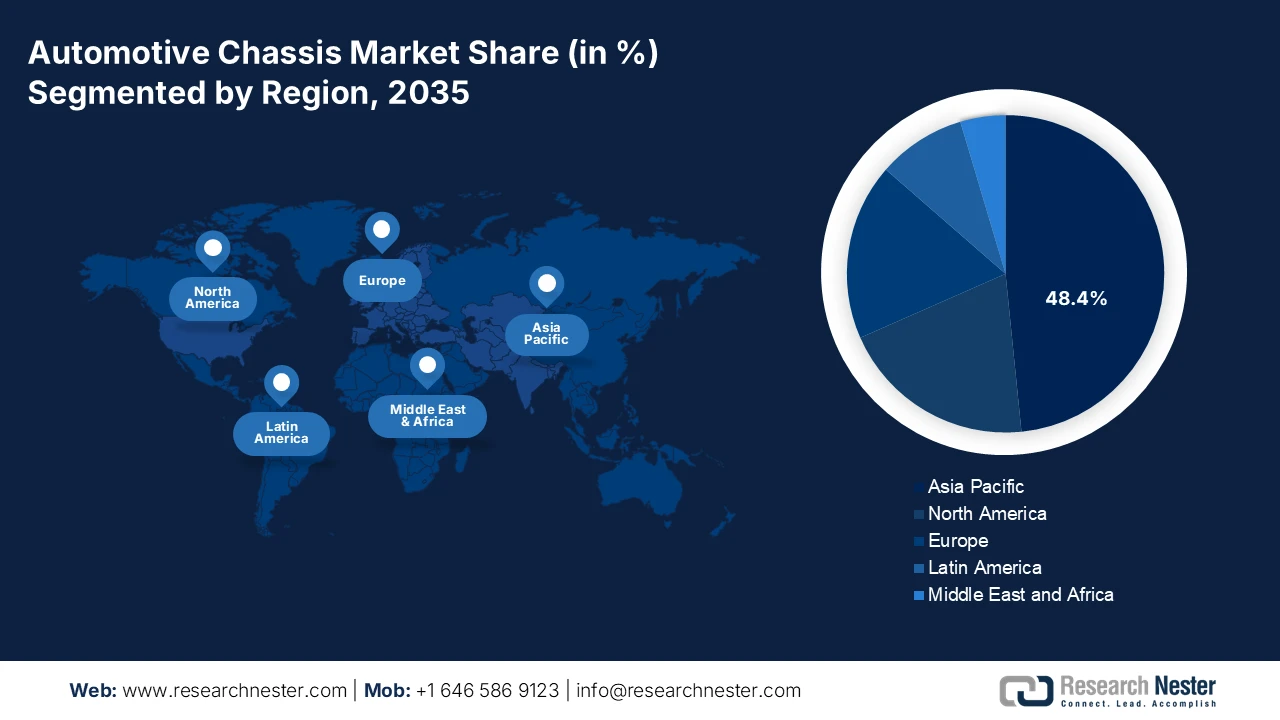

Automotive Chassis Market - Regional Analysis

APAC Market Insights

The Asia Pacific automotive chassis market is dominating and is poised to hold the regional revenue share of 48.4% by 2035. The market is driven by its status as the largest vehicle producer and the most aggressive adopter of electric vehicles. China is the central engine of this growth, with its domestic market and ambitious policies shaping the global supply chains. The primary driver is the potent mix of stringent government mandates for EV adoption, substantial state-backed subsidies for both manufacturers and consumers, and massive private investment in battery technology. A key trend is the rapid vertical integration seen in companies that control everything from battery cells to semiconductors and chassis components, allowing for highly cost-competitive dedicated EV platforms.

China automotive chassis market is defined by the scale, speed, and strategic autonomy. According to the IEA April 2024 data, the government’s New Energy Vehicle mandate targeting a 50% of NEV sales by 2035 creates an unparalleled demand. This is supported by the direct consumer subsidies and a vast state-coordinated charging infrastructure. The market is evolving from adapting internal combustion engine platforms to developing pure EV native architectures. A prime example is BYD’s e-platform 3.0 data in April 2024, a dedicated battery-integrated chassis that sets industry standards for efficiency and space utilization. Government support extends beyond subsidies. The Made in China 2025 initiative prioritizes advanced manufacturing, including lightweight materials such as aluminum alloys for chassis, reducing the dependence on foreign technology.

Government-led manufacturing incentives and accelerated adoption of advanced vehicle technologies are driving the India automotive chassis market. The data from the Ministry of Heavy Industries in January 2026 states that the production-linked incentive auto scheme was launched in 2021 with a budget of ₹25,938 crore for FY2022 to 2023 to FY2026 to 2027. This scheme incentivizes domestic manufacturing of advanced automotive technology products, including the electric and safety-critical vehicle platforms that require redesigned and reinforced chassis systems. By encouraging localization of EVs, advanced powertrains, and component manufacturing, the PLI auto scheme directly increases the OEM investment in modular and lightweight chassis architectures. In parallel, India’s expanding vehicle production base and alignment with global safety norms amplify structural compliance requirements. These policy measures collectively create sustained government-backed demand for the automotive chassis systems across passenger, commercial, and electric vehicle segments.

North America Market Insights

The North America automotive chassis market is the fastest-growing and is expected to grow at a CAGR of 8.5% during the forecast period 2026 to 2035. The U.S. Inflation Reduction Act is the primary catalyst creating strong domestic manufacturing incentives for electric vehicles and their components, including battery-integrated skateboard chassis. This drives massive investment in new EV platforms from Detroit automakers and Tesla, increasing the demand for lightweight aluminum and high-strength steel components to optimize the range. The shift towards advanced driver assistance systems and automated driving necessitates more advanced software-controlled chassis systems for precise vehicle dynamics. A parallel trend is supply chain nearshoring as IRA content requirements and USMCA rules compel suppliers to establish local production for chassis parts, moving away from Asia imports.

The U.S. automotive chassis market is strongly supported by the federal transportation spending, vehicle safety regulation, and fleet renewal program. The U.S. Department of Transportation confirms that budget allocation for roads and bridges by IIJA is surging the demand for new commercial vehicles and municipal fleets that require structurally durable chassis platforms. In parallel, the National Highway Traffic Safety Administration continues to tighten crashworthiness and structural integrity standards, increasing OEM investment in reinforced and lightweight chassis architecture. From the production point, the U.S. Bureau of Economic Analysis in February 2024 reports that the motor vehicle and parts output contributed USD 179.0 billion, indicating the scale of domestic manufacturing tied to the chassis systems. These combined infrastructure safety and production dynamics position the U.S. as a structurally stable and regulation-driven chassis demand market.

Canada automotive chassis market is supported by the federal transit and mobility investments that translate into downstream vehicle procurement and fleet renewal. According to the Water Canada January 2026 report, the federal investment is delivered via multiple funding streams, including over USD 12.4 billion allocated for 413 projects under the Public Transit Stream. This funding supports the acquisition and modernization of buses, paratransit vehicles, and municipal fleets, all of which require heavy-duty and medium-duty chassis systems designed for high structural durability and extended service life. In addition, the Government of Canada report in August 2025 states that the Active Transportation Fund, which has committed USD 33 million across 62 projects, supports urban mobility infrastructure that indirectly increases the demand for service vehicles, electric shuttles, and maintenance fleets reliant on standardized chassis platforms.

Europe Market Insights

The Europe automotive chassis market is undergoing a transformative shift driven by the continent’s stringent transition to electric vehicles and digitalization. The primary driver is the EU’s de facto ban on new internal combustion engine car sales by 2035, which pushes the massive investment in dedicated EV platforms. This has stimulated the development of an integrated skateboard chassis architecture that houses batteries and electric drivetrains. A key trend is the heavy investment in giga factories for battery cells, which dictates the design and sourcing of surrounding structural chassis components. Concurrently, the push towards software-defined vehicles and advanced driver-assistance systems (ADAS) is integrating more sensors and electronic control units directly into the chassis, elevating its role from a structural element to a central, intelligent vehicle system.

Germany automotive chassis market is increasingly influenced by the federal electrification policy, transport investment, and vehicle production activity. In response to a parliamentary inquiry, the federal government confirmed that the battery research funding increased from 111 million euros in 2021 to 145 million euros in 2024, highlighting the national support for advanced electric vehicle development. This funding stimulates battery innovation, directly increasing the structural integration requirements for the EV platforms and reinforcing the demand for redesigned load-bearing chassis systems. In parallel, the VDIK January 2025 data states that the new passenger car registration reached 242,728 vehicles, sustaining the baseline chassis demand across passenger and commercial vehicle segments. Germany’s alignment with the EU safety and emissions regulation further pushes the OEMs to invest in optimized chassis architecture capable of supporting heavier electrified powertrains while meeting crash and durability standards.

The government-backed transport funding vehicle safety oversight and the production-linked replacement demand are driving the UK automotive chassis market. According to the Government of the UK report in July 2025, the government committed investment for rail and road infrastructure supporting the logistics efficiency and public transport fleet modernization. This investment drives the procurement of bus service vehicles and freight fleets that require compliant and durable chassis systems. further the Government of the UK data in June 2024 states that nearly 1.9 million new cars were registered in 2023, sustaining baseline demand for chassis platforms across passenger and light commercial segments. The UK’s continued alignment with UNECE vehicle safety regulations ensures a consistent set of structural compliance requirements for the OEMs, reinforcing steady chassis demand tied to regulatory and infrastructure spending.