Automotive Ceramics Market Outlook:

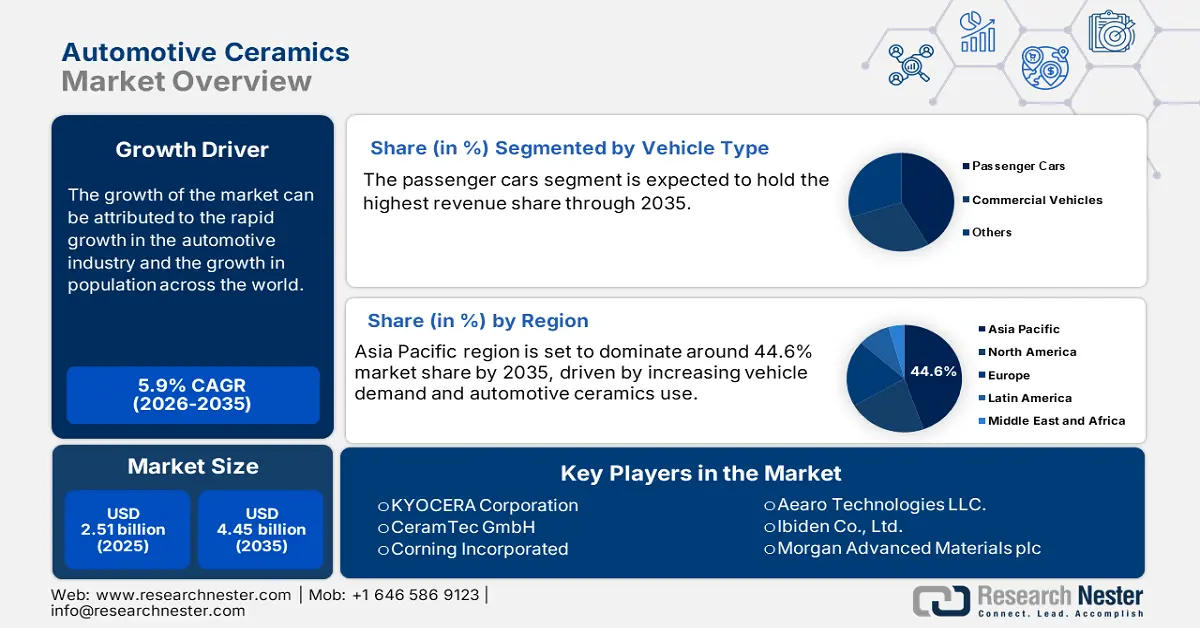

Automotive Ceramics Market size was valued at USD 2.51 Billion in 2025 and is expected to reach USD 4.45 Billion by 2035, registering around 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive ceramics is evaluated at USD 2.64 Billion.

The primary factor attributed to the growth of the automotive ceramics is attributed to the rapid growth in the automotive industry during the past years. The recent statistics reveal that the global automotive industry is expected to reach approximately USD 9 trillion by 2030.

Automotive ceramics are being heavily utilized in varied processes in car manufacturing processes owing to their unique properties. As comparative to the conventional materials such as plastic and metal, automotive ceramics are lighter in weight, durable, corrosion-resistant, and other advantages. Owing to this trend, key players are increasing the employment rate in automotive sector that is expected to raise the adoption rate of automotive ceramics in varied purposes. A latest report found that in fiscal year 2018, the Indian automotive industry employed approximately 2 million people.

Key Automotive Ceramics Market Insights Summary:

Regional Highlights:

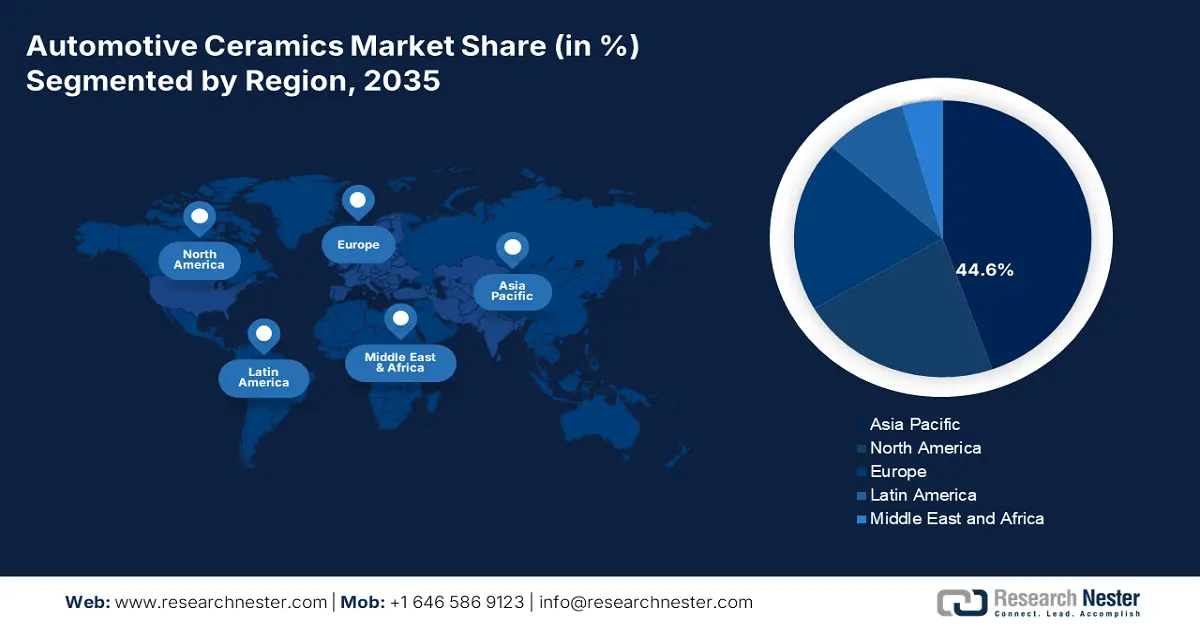

- Asia Pacific automotive ceramics market will hold over 44.6% share by 2035, driven by increasing vehicle demand and automotive ceramics use.

Segment Insights:

- The passenger cars segment in the automotive ceramics market is expected to hold the highest market share by 2035, influenced by the high demand for personal vehicles by the burgeoning population.

Key Growth Trends:

- Growth in Population Across the World

- High Number of Vehicles on the Roads

Major Challenges:

- Increased Concerns Regarding Capital Intensive Development

- High Final Costs of the Product

Key Players: KYOCERA Corporation, CeramTec GmbH, NGK Spark Plug Co., Ltd, CoorsTek, Inc., Morgan Advanced Materials plc, Saint-Gobain Ceramics & Plastics, Inc., Ibiden Co., Ltd., Corning Incorporated, Murata Electronics North America, Inc., Aearo Technologies LLC.

Global Automotive Ceramics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.51 Billion

- 2026 Market Size: USD 2.64 Billion

- Projected Market Size: USD 4.45 Billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, China, United States, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Germany

Last updated on : 10 September, 2025

Automotive Ceramics Market Growth Drivers and Challenges:

Growth Drivers

- Growth in Population Across the World - The rapid multiplication of population along with recent modernization is generating the need of vehicles worldwide. Thus, an increase in demand of vehicles is expected to escalate the need of automotive ceramics for increasing the durability, upgrading the looks and enhancing on-road performance. Thus, the rapid growth in the population is expected to fuel the automotive ceramics market growth in the assessment period. As per World Bank, it is estimated that the world population stood at 7.84 billion in 2021, an increase from 7.09 billion in 2021. This number is anticipated to rise to 9.8 billion in 2050 and 11.2 billion in 2100, as per United Nations, Department of Economic and Social Affairs.

- High Number of Vehicles on the Roads – The recent urbanization has led the number of vehicles on the roads to increase. As a result, the utilization of automotive ceramics is expected to also surge considerably. As per the calculations, it was forecasted that were approximately 2 billion vehicles on roads across the globe by the end of first quarter of 2022.

- Rapid Production Rate of Vehicles - International Organization of Motor Vehicle Manufacturers (OICA), released the global sales of vehicles statistics which revealed that it rose to 56 million in 2021 from 53 million in 2020. Whereas, the global production of vehicles calculated to be 57 million in 2021.

- Growing Electric Vehicle Sales and Production - In 2021, one out of every ten new cars sold was an electric vehicle. The rate has increased from one in forty in 2019 and is currently higher. There are 15.9 million electric cars on the road right now.

- Increasing Need of Luxury Cars - A latest report suggested that the global sales of luxury cars are anticipated to stand at 200K vehicles in 2026, a rise from 190K vehicles in 2022.

Challenges

- Increased Concerns Regarding Capital Intensive Development

- High Final Costs of the Product

- Strict Government Limits Regarding Carbon Dioxide Emission - In December 2021, the Environmental Protection Agency of the United States (EPA) established new national greenhouse gas (GHG) emissions regulations for model years 2023–2026 of passenger cars and light trucks. GHG emissions and other criteria pollutants would be significantly reduced as a result of the final recommendations.

Automotive Ceramics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 2.51 Billion |

|

Forecast Year Market Size (2035) |

USD 4.45 Billion |

|

Regional Scope |

|

Automotive Ceramics Market Segmentation:

The automotive ceramics market is segmented and analyzed for demand and supply by vehicle type into passenger cars, commercial vehicles and others. Out of these, the passenger cars segment is attributed to garner the highest market share by 2035, owing to the high demand of personal vehicles by the burgeoning population. International Organization of Motor Vehicle Manufacturers (OICA) stated that the global passenger vehicles sales rose from 53,917,153 units in 2020 to 56,398,471 units in 2021, whereas, the production rose from 55,908,989 in 2020 to 57,054,295 in 2021.

Our in-depth analysis of the global automotive ceramics market includes the following segments:

|

By Material |

|

|

By Application |

|

|

By Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Ceramics Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific automotive ceramics market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035, owing to the increased demand of vehicles by the growing population. The total production of vehicles in the region was 46 million in 2021, whereas, the total sales in the region was 42 million in 2021 as per statistics released by International Organization of Motor Vehicles. Another factors that are attributed to the increase the utilization of automotive ceramics is the presence of major key players and leading exporters and importers of vehicles in the region. In 2021, China exported around 402,000 commercial vehicles and around 2 million passenger vehicles. Also, the growing Gross Domestic Product (GDP) level along with the rising employment rate and rising income levels are another factors for increased adoption rate of automotive ceramics in the assessment period.

Automotive Ceramics Market Players:

- KYOCERA Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CeramTec GmbH

- NGK Spark Plug Co., Ltd

- CoorsTek, Inc.

- Morgan Advanced Materials plc

- Saint-Gobain Ceramics & Plastics, Inc.

- Ibiden Co., Ltd.

- Corning Incorporated

- Murata Electronics North America, Inc.

- Aearo Technologies LLC.

Recent Developments

-

KYOCERA Corporation has proceeded to acquire the advanced ceramics operations of Friatec, a manufacturer of ceramic and plastic components based in Mannheim, Germany.

-

CeramTec GmbH has launched ROCAR 3D, a new technical ceramics material. The silicon carbide (SiSiC) material for Additive Manufacturing is suitable for the development and production of single or multiple prototypes or components.

- Report ID: 4493

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Ceramics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.