Automotive Camshaft Market Outlook:

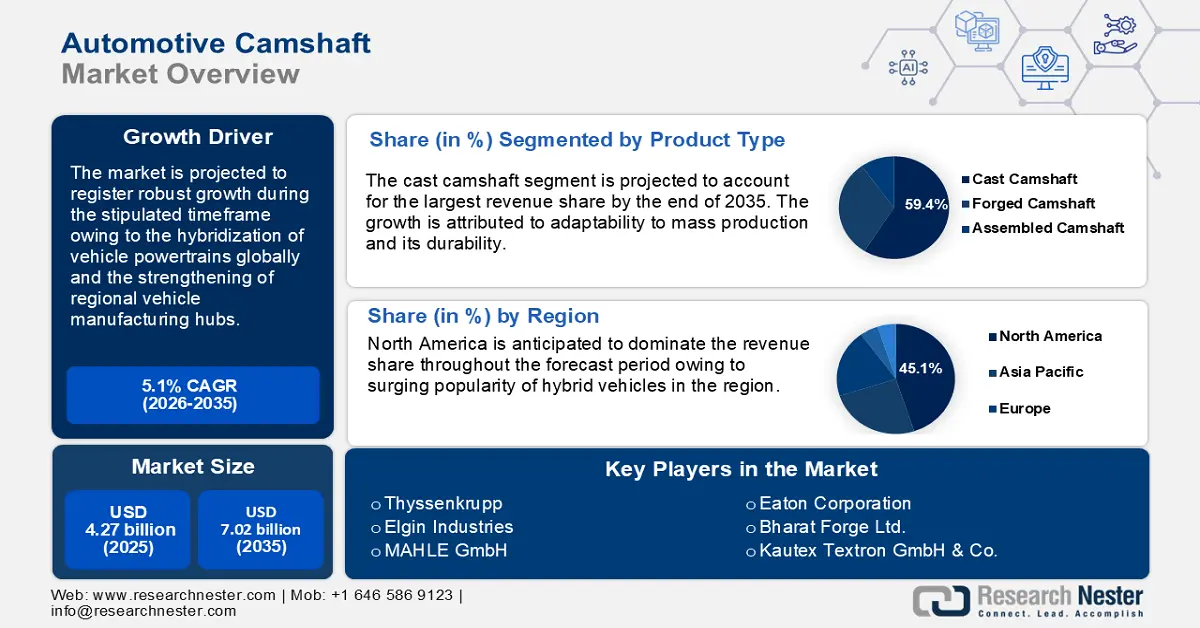

Automotive Camshaft Market size was over USD 4.27 billion in 2025 and is projected to reach USD 7.02 billion by 2035, growing at around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive camshaft is evaluated at USD 4.47 billion.

The automotive camshaft market has witnessed notable advancements in manufacturing processes, particularly in grinding and fine-finishing technologies. This has paved improvements in the performance of camshafts. Furthermore, automotive camshafts are a cornerstone of internal combustion engine (ICE) design. The rising investments to improve fuel economy have a direct bearing on the growth of the automotive camshaft market. For instance, in March 2024, the U.S. Environmental Protection Agency announced the final pollution standards for medium-duty vehicles, light-duty trucks, and passenger cars for model years 2027 through 2032 and beyond, which is poised to reduce 7 billion tons of carbon emissions. The new standards are in the backdrop of over USD 160 billion in investment in U.S. clean vehicle manufacturing and the U.S. auto manufacturing sector. Moreover, manufacturers of camshafts are projected to find greater opportunities in the emerging economies of APAC and Africa, where ICE vehicles have a strong foothold.

The table below highlights the improvements in the U.S. fuel economy over the years, which is poised to create lucrative opportunities for camshaft manufacturers to bolster the production of variable valve timing (VVT) and camless valve actuation to help optimize engine performance across different speeds and loads.

The U.S. Fuel Economy Improvements

|

Particulars |

Details |

|

MY 2023 |

New vehicle fuel economy increased by 1.1 mpg reaching a record high of 27.1 miles mpg |

|

MY 2023 |

New vehicle real-world CO2 emissions decreased to a record low of 319 grams per mile |

|

My 2024 |

CO2 emissions have decreased 31%, or 142 g/mi, and fuel economy has increased 40%, or 7.8 mpg |

|

MY 2024 |

CO2 emissions have improved in 16 of 19 years |

Source: EPA

The camshaft supply chain reflects a complex ecosystem of raw material sourcing and integration with automotive OEMs. High-grade steel and ductile iron, essential for wear resistance, are procured from specialized foundries while production processes leverage digital twin technologies as highlighted by the International Energy Agency’s (IEA) Industrial Roadmap. Emerging opportunities within the market lie in the adoption of additive manufacturing for low-volume custom camshafts to enable rapid iteration for hybrid engine designs. Moreover, localized supply chains in automotive manufacturing hubs such as Southeast Asia and Germany, are poised to reduce lead times for global OEMs.

Key Automotive Camshaft Market Insights Summary:

Regional Highlights:

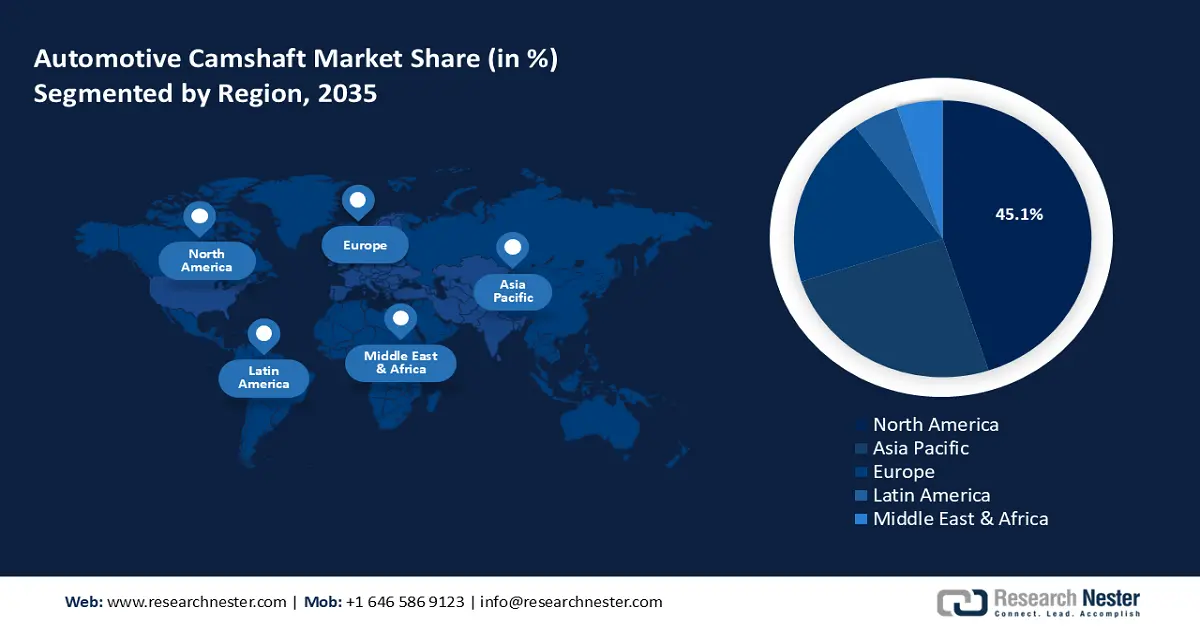

- North America commands a 45.1% share in the Automotive Camshaft Market, driven by the region’s shift toward hybrid powertrains and stringent emissions standards, bolstering growth prospects through 2035.

Segment Insights:

- Cast camshafts segment are forecasted to secure over 59.4% market share by 2035, driven by their adaptability to cost-effective mass production.

Key Growth Trends:

- Hybridization of vehicle powertrains

- Proliferation of regional manufacturing hubs in emerging markets

Major Challenges:

- Transition to electric vehicles:

- Balancing performance and durability in hollow camshaft designs

- Key Players: Thyssenkrupp AG, Elgin Industries, Melling Performance, Eaton Corporation, MAHLE GmbH, Bharat Forge Ltd., Aisin Seiki Co., Ltd., Denso Corporation, Kautex Textron GmbH & Co., KG, Federal-Mogul LLC, Schaeffler AG, Crower Cams & Equipment, Musashi Seimitsu Industry Co., Ltd..

Global Automotive Camshaft Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.27 billion

- 2026 Market Size: USD 4.47 billion

- Projected Market Size: USD 7.02 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Automotive Camshaft Market Growth Drivers and Challenges:

Growth Drivers

- Hybridization of vehicle powertrains: The hybridization of vehicle powertrains that rely on optimized ICE components to complement electric propulsion systems is a major driver of the automotive camshaft market. The IEA’s Net Zero by 2050 report underscores the transitional role of hybrids in decarbonizing transport, necessitating innovations in camshaft to balance performance and energy efficiency. Opportunities are rife in retrofitting older models of ICE vehicles with advanced camshafts to meet emissions norms. The trends highlight a push for sustainable mobility solutions, led by Europe, which drives the development of camshafts tailored for next-gen biofuels and synthetic fuels. The table below reflects hybrid vehicle sales, highlighting an increase in recent years which augurs well for the manufacturers of camshafts.

Hybrid Vehicles Sales Data

|

Particulars |

Details |

|

Hybrid Electric Vehicle Sales in the U.S. |

|

|

Plug-in Hybrid Electric Vehicles Sales |

|

|

Hybrid Electric Vehicles and Plug-In Hybrid Electric Vehicle Sales in January 2025 |

|

Source: The U.S. Energy Information Administration

- Proliferation of regional manufacturing hubs in emerging markets: Governments in emerging economies are prioritizing localized automotive production to reduce import dependency and boost employment. Initiatives such as India’s National Automotive Policy 2022 and Vietnam’s Automotive Industry Development Strategy 2030. The policies incentivize domestic manufacturing of critical engine components, including camshafts to support the growing regional demand for affordable passenger and utility vehicles. Furthermore, flagship projects such as the African Union’s Agenda 2063 are poised to drive investments in local machining facilities to produce cost-optimized camshafts.

- Rising integration of advanced sensor technologies for real-time engine diagnostics: The modern ICEs are increasingly incorporating sensor-equipped camshafts to enable real-time monitoring of valve timing and wear. The rise of predictive maintenance with the proliferation of smart vehicles creates opportunities for smart camshafts embedded with microsensors to provide data to onboard diagnostics systems. Moreover, the shift towards alternative fuels such as biofuels and hydrogen is creating new engineering requirements for camshafts. Opportunities are rife in markets pushing for a transition to hydrogen, such as the Hydrogen Society Promotion Act in Japan. The dual focus on hydrogen and biofuel adaptability positions camshaft manufacturers at the forefront of the transition to sustainable fuels.

Challenges

- Transition to electric vehicles: The global push for electrification is a major challenge for the automotive camshaft market. Numerous governments have passed mandates to phase out ICE vehicles with varying target years, and such trends are detrimental in causing a declining demand for ICE components including camshafts. For instance, Germany plans to phase out ICE vehicles by 2035 while Mexico’s target year is 2040. Furthermore, the steady sales of EVs worldwide challenge the market as EVs do not require camshafts.

- Balancing performance and durability in hollow camshaft designs: Trends within the automotive sector reflect a growing push to reduce engine weight and improve fuel efficiency. While the trends provide favorable opportunities for manufacturers, they also pose structural integrity challenges in commercial vehicles that require durability in extreme conditions. Stress fractures can make it challenging for manufacturers to mass-produce hollow camshafts without compromising strength.

Automotive Camshaft Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 4.27 billion |

|

Forecast Year Market Size (2035) |

USD 7.02 billion |

|

Regional Scope |

|

Automotive Camshaft Market Segmentation:

Product Type (Cast Camshaft, Forged Camshaft, Assembled Camshaft)

The cast camshaft segment is anticipated to hold automotive camshaft market share of over 59.4% by the end of 2035, attributed to its adaptability to mass production. Cast iron and ductile iron variants dominate the segment owing to their wear resistance and the ability to dampen engine vibrations. The demand from high-volume budget-conscious vehicle markets is expected to ensure continued profitable investment opportunities in the segment. Additionally, the rise of hybrid powertrains leverages cast camshafts for their balance of performance and scalability. In July 2023, Melling Performance released 14 new camshafts specifically designed for the GM LS engine highlighting the push by key players to expand their revenue share.

The forged camshaft segment is anticipated to maintain its revenue share during the stipulated timeframe of the automotive camshaft market’s analysis. The demand is projected to remain steady in high-performance and heavy-duty applications. Moreover, luxury automakers seek components that can withstand higher RPMs and prolonged operational cycles, creating opportunities for manufacturers of forged camshafts. Promising collaborations that can further the segment include BMWs partnership with Thyssenkrupp on ultra-high-strength steel that has the production potential of forged camshafts with tailored grain structures for fatigue resistance.

Vehicle Type (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles)

The passenger car segment in automotive camshaft market is estimated to experience the largest application of camshafts throughout the forecast timeline. The segment’s growth is shaped by urbanization, evolving emission standards, and rising disposable incomes. Hybrid-electric passenger vehicles in lucrative markets such as China and Japan rely on camshafts engineered for seamless transitions between ICE and electric modes. Furthermore, the trend toward turbocharged downsized engines in Europe and North America is projected to amplify the demand for camshafts that can support higher combustion pressures.

Our in-depth analysis of the global automotive camshaft market includes the following segments:

|

Product Type |

|

|

Vehicle Type |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Camshaft Market Regional Analysis:

North America Market Forecast

North America automotive camshaft market is anticipated to dominate revenue share of over 45.1% by 2035. The market’s dominance is attributed to the region’s shift toward hybrid powertrains coupled with stringent emissions standards under the U.S. EPA Tier 3 regulations and Canada’s Clean Fuel Standard. Moreover, a robust regional supply chain benefits the market’s growth by bolstering production efficiency.

The U.S. automotive camshaft market is anticipated to account for a significant share in North America. The rising sales of hybrid vehicles in the U.S. over the years is a major factor in the market’s expansion. Detroit’s legacy automakers and Silicon Valley’s tech firms collaborating on the next generation of ICE and hybrid systems has led to demand for advanced camshafts that can support Ford’s EcoBoost engines and Tesla’s range-extender hybrids. Moreover, NASCAR racing’s popularity has driven demand for forged, high-stress camshafts tailored to extreme conditions.

The Canada automotive camshaft market is shaped by the emphasis on sustainable mobility. The increase in the production of passenger vehicles equipped with modern ICE engines necessitates the use of high-quality camshafts. Furthermore, Canada has mandated the new car sales to have zero emissions by 2035 which highlights opportunities to supply camshafts for hybrid vehicles which are expected to peak consumer interest by the end of 2035. Additionally, the proximity to the U.S. OEMs fosters niche production of low-volume camshafts for luxury hybrids with range-extender engines.

APAC Market Forecast

The APAC automotive camshaft market is anticipated to register the second-largest revenue share globally. The market’s growth is due to the rising production and sales of passenger and commercial vehicles in China, India, and Japan. Additionally, ICE vehicles remain popular in various economies in APAC, creating lucrative opportunities for manufacturers to supply camshafts. Trends indicate a growing popularity of hybrid vehicles in the region, and the requirements are poised to become the hallmark of the next generation of camshaft productions.

The China automotive camshaft market is bolstered by the country’s position as a global leader in vehicle production. The surge in demand for passenger cars supplements the growing disposable income in China, which is evident by the increase in GDP per capita. Moreover, China’s market is characterized by the dual facet as the world’s largest producer of ICE vehicles and a leader in hybrid-electric innovation which are major drivers of the market. The stringent China VI emission standards create niche opportunities for manufacturers to produce low-friction, ceramic-coated camshafts, and the ambitious Belt & Road infrastructure projects are estimated to lead in lucrative prospects to supply forged camshafts for long-haul operations.

The India automotive camshaft market is estimated to exhibit robust growth throughout the forecast period. The growth of alternative fuel vehicles and the rising consumer demand for hybrid vehicles are major drivers of the regional market. The push for ethanol blending, i.e., E20 by 2025 necessitates camshafts resistant to biofuel corrosion. The rapid growth of CNG-powered commercial vehicles further drives the demand for camshafts capable of withstanding higher combustion pressures, positioning the India market as a burgeoning hub for the proliferation of affordable camshaft solutions.

Key Automotive Camshaft Market Players:

- Thyssenkrupp AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Elgin Industries

- Melling Performance

- Eaton Corporation

- MAHLE GmbH

- Bharat Forge Ltd.

- Aisin Seiki Co., Ltd.

- Denso Corporation

- Kautex Textron GmbH & Co., KG

- Federal-Mogul LLC

- Schaeffler AG

- Crower Cams & Equipment

- Musashi Seimitsu Industry Co., Ltd.

The automotive camshaft market is slated to expand during the forecast period. Key players are expanding their market position by investing in advanced manufacturing technologies to produce high-quality camshafts. Strategic partnerships and long-term agreements with major automobile manufacturers can outline the competitive market to further solidify their market presence.

Here are some key players in the automotive camshaft market:

Recent Developments

- In February 2025, BorgWarner expanded its long-standing partnership with a major OEM from East Asia by supplying its Variable Cam Timing (VCT) for the latest hybrid and gasoline engines.

- In January 2025, Elgin Industries announced the introduction of 5 precision-matched performance camshaft kits to assist racing and street-performance engines. CK-1838A, CK-1840A, CK-1841A, CK-1250A, and CK-1251A are the new camshafts by Elgin.

- In February 2024, Brian Tooley Racing released new GEN III Hemi camshafts. The BTR Truck Norris camshaft is poised to improve engine performance for off-roading in RAM trucks or Chargers and Challengers.

- Report ID: 7239

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Camshaft Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.