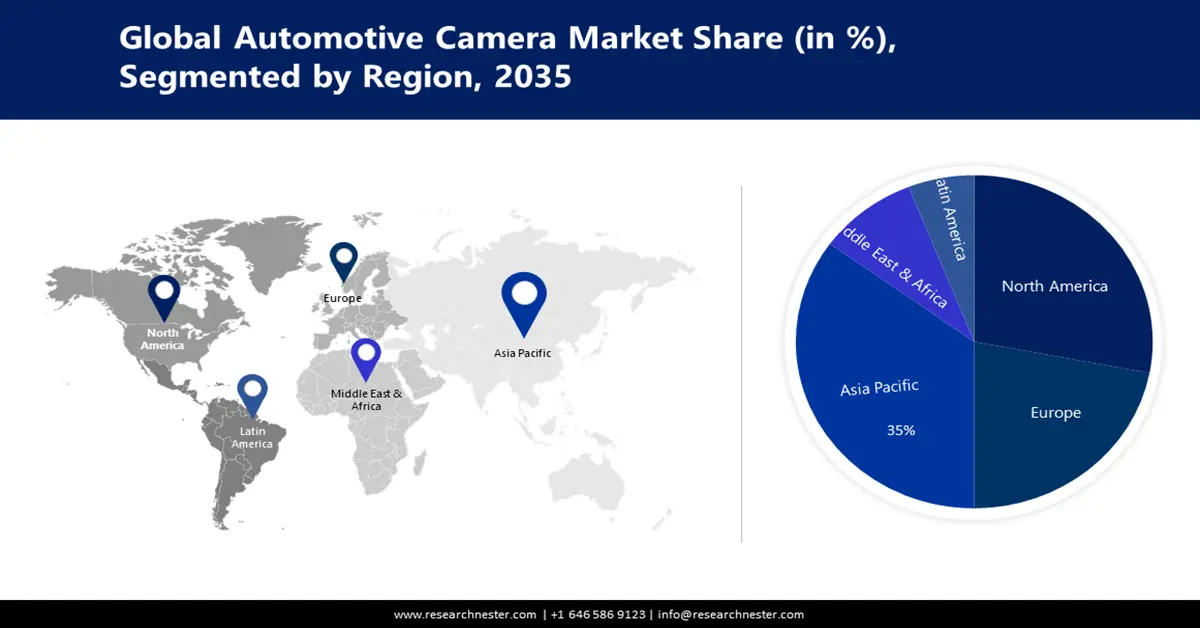

Automotive Camera Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific automotive camera market is estimated to account for a share of over 35% by 2035. This growth is attributed to the accelerated adoption of advanced driver-assistance systems. China, and South Korea along with Japan are creating a rising demand for automotive cameras to improve their vehicle safety regulations. Auto manufacturers are integrating ADAS technologies through camera systems as these cameras enable lane-keeping assist and parking assistance along with collision avoidance features.

The market is experiencing increasing EV output, including intensive production in China, where it is considered to be the largest EV market globally. The expansion of electric and autonomous vehicles is creating a stronger requirement for upgraded camera systems as part of navigation solutions and driver assistance, and safety systems. The rising demand for commercial and EV vehicles is driving automotive manufacturers toward implementing more cameras for vehicles to address consumer expectations and regulatory standards.

Government-imposed stringent road safety regulations are augmenting the growth of the automotive camera market in China. The vehicle manufacturers are introducing ADAS with cameras as these systems enable collision detection, perform lane-keeping assist, and automatic emergency braking. Such regulations are compelling car manufacturers to use additional cameras as they allow them to meet compliance, thus creating new market opportunities. The automotive cameras are exhibiting high demand owing to rising public-private investments. The local manufacturers and tech companies are significantly investing in autonomous driving technologies to establish safe sensing and perception systems for vehicle operation.

North America Market Insights

The North America automotive camera market is set to hold 28% of the global revenue share between 2025 to 2035, due to the surging demand for enhanced safety features in vehicles. Automakers are increasingly embedding camera systems as consumers are emphasizing safety features, which enables them to implement advanced driver-assistance systems such as automatic emergency braking, along with lane departure warning and parking assist. The increasing public focus on road safety is transforming automotive cameras into essential safety components for new car sales and aftermarket solutions. The automotive cameras are gaining traction, with the requirement of additional safety features through mandates in the National Highway Traffic Safety Administration (NHTSA). Manufacturers are adopting camera systems to meet existing regulatory standards, which is positively influencing the overall market growth.

The demand for automotive cameras in the U.S. is projected to increase at a healthy pace during the forecast period, due to the rising demand for advanced systems. Safe driving demands and strict regulations are necessitating consumers to install advanced camera-based systems in vehicles. Automobile cameras are exhibiting wide applications due to their features, such as adaptive cruise control, automatic emergency braking, and lane departure warnings.

The rise in registrations of electric and autonomous vehicles is also accelerating the demand for automotive cameras. The essential safety functions, such as obstacle detection and environmental sensing, and 360-degree visibility, are fueling their applications in EVs and autonomous vehicles.