Automotive Brake Pads Market Outlook:

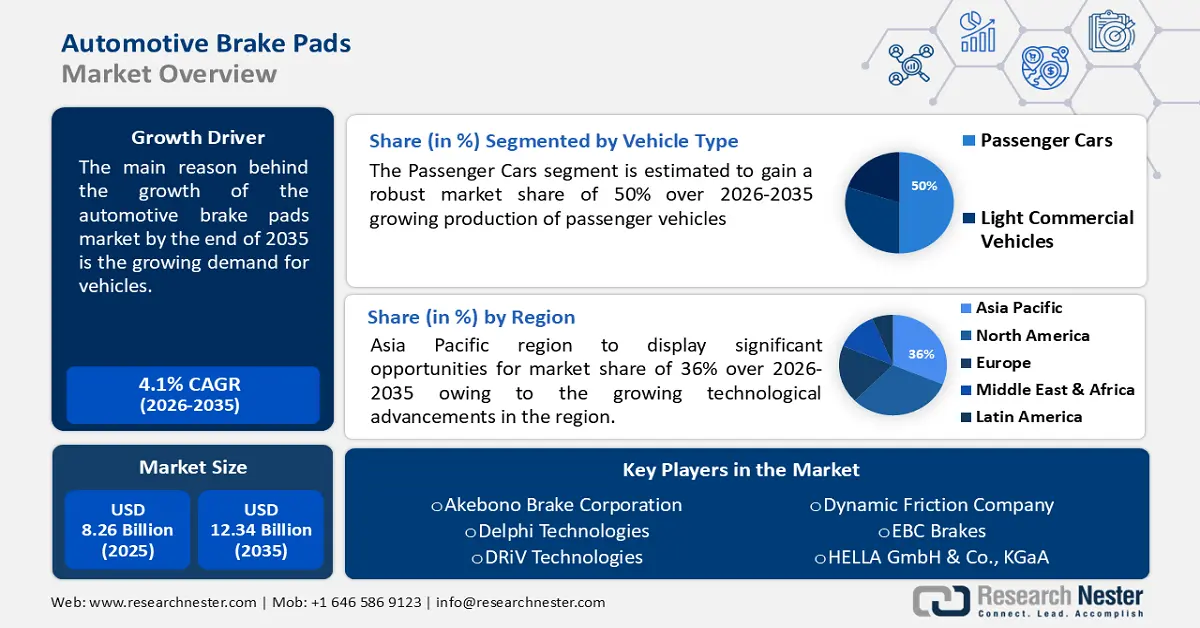

Automotive Brake Pads Market size was valued at USD 8.26 billion in 2025 and is likely to cross USD 12.34 billion by 2035, expanding at more than 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive brake pads is assessed at USD 8.56 billion.

The growing demand for vehicles worldwide is a major factor that has contributed to this growth. In 2023, global vehicles production is estimated to reach around 26,413,029 vehicles as reported by International Organization of Motor Vehicle Manufacturers (OICA). The number of car buyers has increased significantly, which is leading to an increase in demand for brake drums as a result of rising incomes and urbanization.

Key Automotive Brake Pads Market Insights Summary:

Regional Highlights:

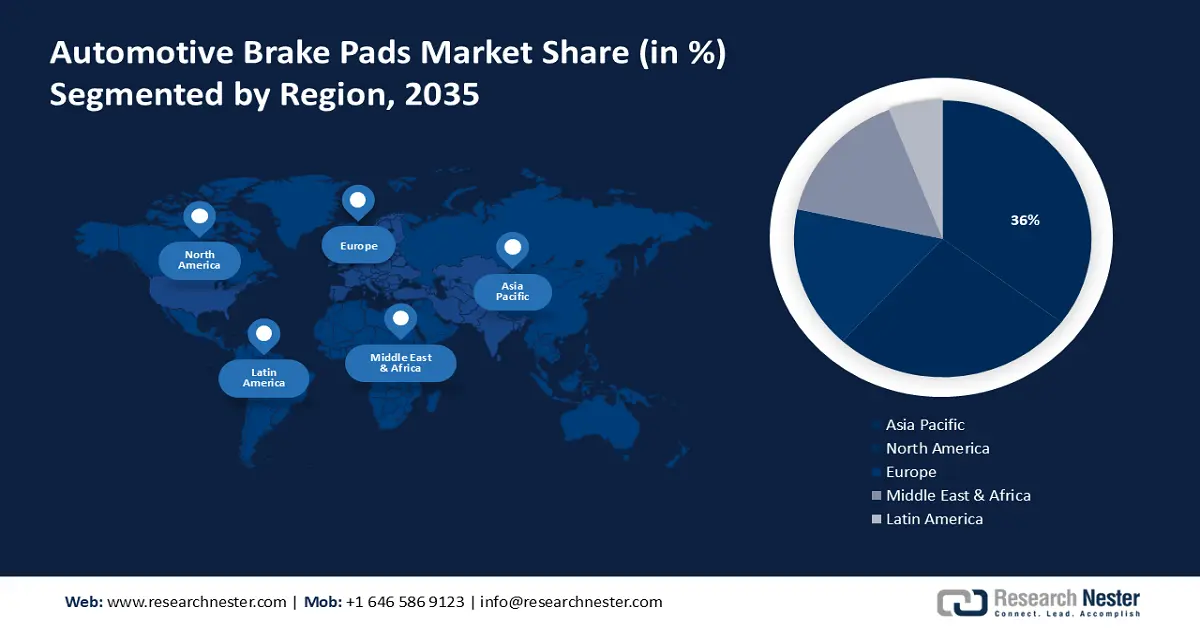

- Asia Pacific automotive brake pads market will dominate around 36% share by 2035, driven by growing technological advancements in the automotive components industry.

Segment Insights:

- The passenger cars segment in the automotive brake pads market is projected to hold a 50% share by 2035, fueled by growing production of passenger vehicles and increasing safety concerns.

- Ceramic segment in the automotive brake pads market is projected to secure the majority share by the forecast year 2035, driven by ceramic pads’ durability, efficiency, and environmental friendliness.

Key Growth Trends:

- Growing incorporation of advanced automotive sensors and software

- Surge in the demand for eco-friendly brake pads

Major Challenges:

- High manufacturing costs

- Growing use of regenerative braking systems

Key Players: Akebono Brake Corporation, Delphi Technologies, DRiV Technologies, Dynamic Friction Company, EBC Brakes, HELLA GmbH & Co., KGaA, Maruti Suzuki India Limited, Masu Brakes, Robert Bosch LLC, Tenneco.

Global Automotive Brake Pads Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.26 billion

- 2026 Market Size: USD 8.56 billion

- Projected Market Size: USD 12.34 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Automotive Brake Pads Market Growth Drivers and Challenges:

Growth Drivers

- Increasing incidences of road accidents - Governments around the world have been implementing strict measures due to an increase in traffic accidents and fatalities. According to the statistics by World Health Organization, road traffic accidents kill around 1.19 million people a year. Governmental rules were put in place with a view to ensuring the safety of drivers and pedestrians, as well as reducing the adverse environmental impact of vehicles. As a result, new players have been given the opportunity to enter the automotive brake pads market.

Smaller manufacturers have been able to take on bigger, existing brands by offering innovation and cost-effective solutions due to the growing demand for higher-quality brake pads. Consequently, consumers and the entire industry have been given a more diversified and competitive market. - Growing incorporation of advanced automotive sensors and software - One of the major emerging trends that is shaping the future of automotive safety and braking systems is integrating advanced sensors and software into brake technology. The use of advanced sensor software in the braking system enables proactive maintenance and early detection of potential problems, improving safety as well as reducing the risk of brake failure.

Key manufacturers are at the forefront of utilizing software to drive innovation in brake system design, development, and performance. For instance, in 2021 Brembo announced the introduction of a new innovative intelligent braking system, SENSIFYTM, integrating the most advanced software based on artificial intelligence with the world-renowned brake components of Brembo. - Surge in the demand for eco-friendly brake pads - Harmful asbestos is a raw material that has been widely used as an additive during the manufacturing process of brake pads. Natural fiber-reinforced composite brake pads are becoming more and more popular since they are biodegradable, have low energy use, and are renewable.

Furthermore, increasing oil usage and environmental concerns encourage the adoption of brake pads composed of naturally occurring resources that are sustainable, including natural fibers. In addition, the use of brake pads based on sustainable natural resources like fibers is promoted by increasing concerns about environment and rising oil consumption.

Challenges

- High manufacturing costs - Advanced electronic braking systems offer the shortest stopping distance and improve vehicle stability, which is widely used in most premium vehicles nowadays. However, for use in economy class vehicles the cost of brake pads is significantly higher. Also, for the development and commercialization of new braking materials like ceramic or steel, considerable capital expenditure is needed.

- Growing use of regenerative braking systems - The majority of hybrid and fully electric cars use regenerative braking. By recovering energy and replenishing batteries, these systems lessen the need for frequent braking, which in turn lessens the amount of wear and strain on the brake pads. In the long term, this might result in fewer people needing replacement brake pads, which may restrain the market growth of automotive brake pads.

Automotive Brake Pads Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 8.26 billion |

|

Forecast Year Market Size (2035) |

USD 12.34 billion |

|

Regional Scope |

|

Automotive Brake Pads Market Segmentation:

Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles)

Passenger cars segment is estimated to dominate automotive brake pads market share of over 50% by 2035. The segment growth can be credited to the growing production of passenger vehicles and increasing safety concerns. According to estimates, more than 68 million passenger cars will be manufactured around the world by 2028. Furthermore, to improve the performance and longevity of the brake pad, the design and material of the brake pad have evolved over the years.

The ceramic or semi-metallic brake pad is used by the majority of new passenger cars, to ensure safety, performance, and maintenance of the vehicle, brake pad is a key component. The safety of the driver and passengers is not only ensured, but also contributes to a more effective and environment friendly vehicle by regularly maintaining and replacing brake pads. Therefore, altogether these factors are contributing to the market’s growth in this segment.

Material Type (Semi Metallic, Non-Asbestos Organic (NAO), Low-metallic, Ceramic)

Ceramic segment in the automotive brake pads market is estimated to hold majority share by the end of 2035. The ceramic brake pad is made from a combination of ceramic fibers, filler material, and a binding agent. The ceramic brake pad is highly durable and efficient at stopping a moving vehicle because of its unique composition. Ceramic brake pad has a higher melting point than traditional brake pads, which is made from organic materials such as rubber, carbon, and metal, and can withstand extreme temperatures without losing its effectiveness.

They are one of the most sought-after vehicles by vehicle manufacturers and drivers due to their ability to cope with high temperatures, durability, improvement in performance, low dust production, and environmental friendliness. Therefore, ceramic brake pads are estimated to continue to be a favorite choice in the automotive industry, due to increased demand for higher performance and safety vehicles.

Our in-depth analysis of the market includes the following segments:

|

Material Type |

|

|

Position Type |

|

|

Sales |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Brake Pads Market Regional Analysis:

APAC Market Statistics

APAC region in automotive brake pads market is estimated to dominate revenue share of over 36% by 2035. The market growth in the region is also expected on account of growing technological advancements in the automotive components industry. Also, the growing vehicle production and sales in the automotive sector in the region make it a potential market for brake pads. Moreover, the aftermarket segment plays a substantial role in the APAC automotive brake pad market.

The automotive brake pads market is projected to grow majorly in China. The market growth in the region is impelled by growing vehicle sales. The region maintained its position as the world’s largest automobile seller. As reported by International Trade Administration; By both yearly sales as well as production volume, China is the leading automotive industry in the world, and by 2025, it is predicted that 35 million automobiles will be produced there.

The Japan automotive brake pads market is anticipated to grow at a substantial rate over the forecasted timeframe. As technology advances, automotive brake pad manufacturers will have opportunities to expand their product portfolio and meet the changing needs of consumers in Japan.

The Korean market is anticipated to hold a significant share between 2024 to 2035. Numerous industry participants are investing extensively in the establishment of new manufacturing facilities in the country in order to meet increased demand for local and international markets while also increasing their profitability and market share.

North America Market Analysis

The North America region will also observe huge growth for the automotive brake pads market in the projection period and will hold the second position owing to the increased innovation and full use of the upcoming brake pad technology. Also, the need for commercial vehicles is being driven by an expansion in trade operations that require longer travel lengths, which is fostering market growth in North America.

Increased regulation by the United States’ government agencies such as the EPA to make copper-free brakes is also driving the vehicle brake pad market to reclaim its prominence in the United States. For instance, in 2015, the EPA, states, and the automobile industry reached an agreement to minimize the use of copper and other materials in motor vehicle brake pads. The agreement aims to reduce copper in brake pads to less than 5% by weight in 2021 and 0.5% by 2025.

Automotive Brake Pads Market Players:

- Akebono Brake Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Delphi Technologies

- DRiV Technologies

- Dynamic Friction Company

- EBC Brakes

- HELLA GmbH & Co., KGaA

- Maruti Suzuki India Limited

- Masu Brakes

- Robert Bosch LLC

- Tenneco

The automotive brake pad market is highly conquered by major key players. These industry leaders are continuously releasing improved products to keep their competitive advantage, and they are actively spending in R&D to incorporate cutting-edge technology into their products.

Recent Developments

- Delphi Technologies announced the launch of a new line of BEV brake pads to meet specific requirements for BEV application. This range is one of the most comprehensive in the world based on detailed comparisons and covers a large number of models which are popular with independent retailers. Vehicles include the Nissan Leaf and Tesla Model S/Model 3, in addition to the newest models such as the BMW i4/iX, Mercedes EQC/EQEE/QS, and Porsche Taycan/Cross Turismo.

- Tenneco leverages its deep material science expertise to introduce advanced OE hybrid brake material compounds that simultaneously meet the demands of braking performance and comfort in both internal combustion engine (ICE) and electric vehicle (EV) applications. The innovative new hybrid friction material combines the advantages of low-grade steel (LS) and non-asbestos-organic (NAO) compounds in one brake pad concept.

- Report ID: 6041

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Brake Pads Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.