Automotive Assembly Market Outlook:

Automotive Assembly Market size was valued at USD 997.3 billion in 2025 and is expected to reach USD 1.8 trillion by 2035, registering around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive assembly is evaluated at USD 1.05 trillion.

The hike in vehicle ownership rates around the globe is driving advancements in the automotive assembly lines. The rapid urbanization trend coupled with the increasing spending power of individuals is boosting the adoption rates of vehicles in developing regions such as Asia Pacific, Latin America, and MEA. Around 42.6 million passenger cars were sold in Asia Pacific including Middle East, in 2023. The International Energy Agency (IEA) report reveals that over 4 million cars were exported by China out of which 1.2 million were EVs. Toyota Motor Corporation, Volkswagen Group, and Daimler Truck are some of the largest automobile manufacturing companies significantly influencing the automotive assembly market growth.

The consumers’ preference for vehicles with advanced features such as autonomous driving capabilities, electric powertrains, and smart infotainment & tracking solutions especially in developed regions such as North America and Europe is encouraging automakers to innovate and invest in advanced assembly technologies, driving the overall market growth. For instance, in December 2024, the Federal Reserve Bank of St. Louis revealed that around 17.01 million vehicles were sold in the U.S. Furthermore, the European Environmental Agency estimates that electric vehicle car registrations surpassed from 2.0 million in 2022 to 2.4 million by 2023.

Key Automotive Assembly Market Insights Summary:

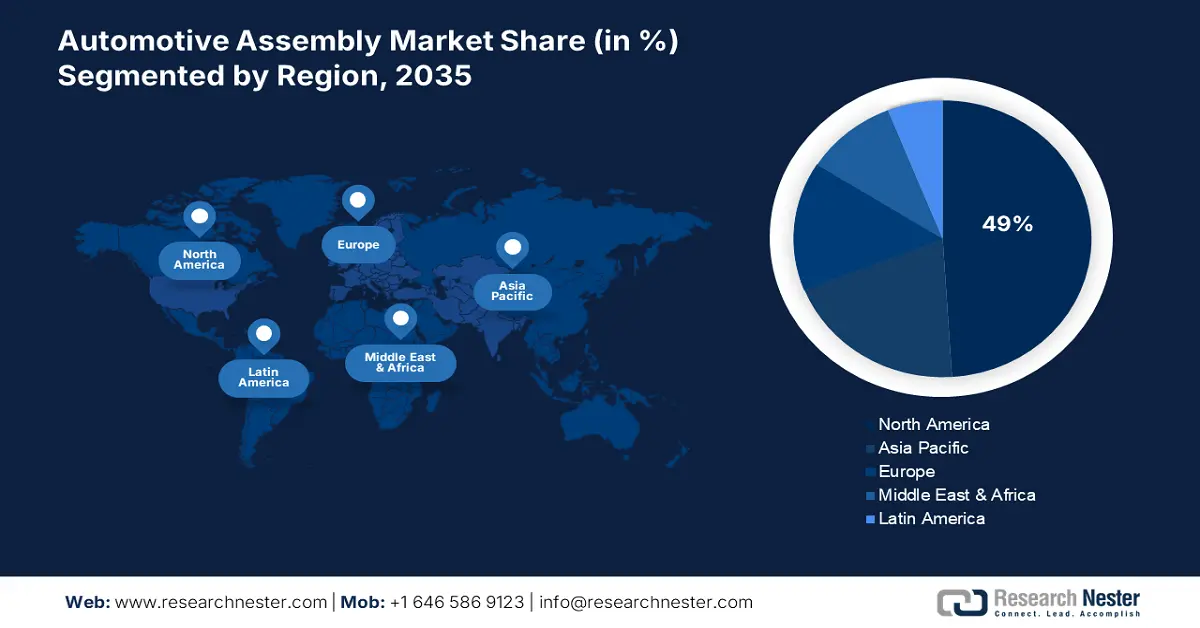

Regional Highlights:

- North America dominates the Automotive Assembly Market with a 49% share, driven by technological advancements, electrification trends, and widespread adoption of industrial robots in automotive assembly, ensuring robust growth through 2026–2035.

- Asia Pacific’s automotive assembly market is projected to see rapid growth by 2035, driven by rising vehicle ownership, EV adoption, and expansion of manufacturing units adopting advanced automation technologies.

Segment Insights:

- Passenger Vehicles segment are anticipated to hold a 71.70% share by 2035, fueled by rising urban activities, personalization trends, and road infrastructure developments.

Key Growth Trends:

- Automation & robotics

- Vehicle electrification

Major Challenges:

- Limited budgets

- Regulatory complexity

- Key Players: Assemco, Stellantis N.V., Volkswagen Group, Cummins Inc., and Atlas Copco AB.

Global Automotive Assembly Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 997.3 billion

- 2026 Market Size: USD 1.05 trillion

- Projected Market Size: USD 1.8 trillion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 August, 2025

Automotive Assembly Market Growth Drivers and Challenges:

Growth Drivers

- Automation & robotics: The rising adoption of automation and robotics in automotive assembly lines is significantly augmenting production efficiency, precision, and safety. Robots and cobots are effective in performing tasks such as welding, painting, material handling, and assembling parts. For instance, in March 2023, the International Federation of Robotics (IFR) revealed that around one million robots are employed in automotive manufacturing across the world. South Korea ranks first in the world with over 2800 industrial robots per 1o,000 employees, followed by Germany (1500) and the U.S. (1457). Thus, the increasing robot density is set to boost the efficiency of the automotive assembly lines in the coming years.

- Vehicle electrification: The electrification trend is majorly contributing to the automotive assembly market growth. The swift shift towards the adoption of electric vehicles is transforming the automotive assembly process. Electric powertrains, battery systems, and related components require different assembly techniques, directly leading to the modification of assembly lines. The International Energy Agency (IEA) estimated that EV sales reached around 14.0 million in 2023, where China, Europe, and the U.S. holding dominating shares. The European Union’s aim to end the sales of air-polluting vehicles by 2035, the U.S. initiative to acquire a 50% share of the EV sales by 2030, and the new energy requirements for vehicles sold by 2035 in China are collectively creating a lucrative prospect for automotive assembly market players.

Challenges

- Limited budgets: The integration of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) increases both the capabilities and cost of the final product. Smaller automotive manufacturers often find it challenging to compete with industry giants due to budget constraints. More focus on manufacturing conventional automotive components and technologies restraints smaller companies from tapping lucrative opportunities.

- Regulatory complexity: The time-consuming and complex regulatory procedures often limit key players from earning profits from trending aspects. Also, meeting regulatory requirements for safety, emissions, and environmental sustainability is highly challenging, which drives automakers to invest heavily to comply with ever-evolving regulatory requirements, raising operational costs and production flexibility.

Automotive Assembly Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 997.3 billion |

|

Forecast Year Market Size (2035) |

USD 1.8 trillion |

|

Regional Scope |

|

Automotive Assembly Market Segmentation:

Vehicle Type (Passenger Vehicles, Commercial Vehicles)

Passenger vehicles segment is anticipated to account for automotive assembly market share of around 71.7% by 2035. The rising urban activities worldwide are major factors influencing the sales of passenger vehicles. The personalization trend coupled with healthy demand for advanced cars is also contributing to the segmental growth. The road infrastructure developments further drive the passenger car adoption rates. The revenue from the passenger car market is poised to rise from USD 2340.0 billion in 2024 to USD 3437.0 billion by 2029. The passenger car unit sales are also anticipated to reach 90.32 million by 2029. Thus, the increasing adoption of passenger cars is augmenting the overall automotive assembly market growth.

Assembly Line (Automated, Semi-automated)

By 2035, automated segment is expected to account for remarkable automotive assembly market share. Automation significantly reduces labor costs and improves the overall efficiency of the assembly process. Also, the ability to perform repetitive tasks without error for longer durations augments the use of automated assembly solutions in vehicle manufacturing. For instance, in September 2024, the IBM Corporation leader in innovative technologies revealed that the U.S. accounted for around 33% of all industrial robot installations. Furthermore, in December 2024, the Massimo Motor Group announced the installation of the new robotic assembly line at its Texas facility. The company states that the integration of advanced technologies including cobots is improving the production efficiency of the unit.

Our in-depth analysis of the automotive assembly market includes the following segments

|

Vehicle Type |

|

|

Component |

|

|

Assembly Line |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Assembly Market Regional Analysis:

North America Market Forecast

In automotive assembly market, North America region is likely to dominate over 49% revenue share by 2035. Continuous technological advancements, electrification trends, and high adoption of industrial robots are augmenting the overall market growth. To enhance overall productivity, the automakers both in the U.S. and Canada are widely installing advanced and automated assemblies in their facilities.

In the U.S., high-tech manufacturing and automotive engineering trends are driving the adoption of automated solutions in automotive assembly lines. In April 2024, the International Federation of Robotics (IFR) revealed that around 14,678 robots are installed in the U.S. automotive sector. Furthermore, the car and component makers accounted for 33% of all industrial robot installations in 2023.

In Canada, supportive government policies expanding the production of electric vehicles are driving advancements in automotive assembly lines. The iZEV program offers up to USD 3472.58 at point of sale to businesses and individuals on the purchase or lease of light-duty ZEVs. Furthermore, the automation trend is augmenting the use of robots in automotive manufacturing. For instance, IFR estimates that Canada's automotive sector held around 55.0% of robot installation in 2023.

Asia Pacific Market Statistics

The Asia Pacific automotive assembly market is foreseen to expand at the fastest CAGR during the projected period. The swift rise in vehicle ownership, supportive policies on the adoption of EVs, and expansion of manufacturing units of key players are collectively contributing to the automotive assembly market growth. South Korea, Japan, and China are ahead of adopting industrial robots in the automotive assembly lines. The electrification trend in India is further propelling the Asia Pacific automotive assembly market growth.

In China, as per the analysis by the International Federation of Robotics (IFR) the robot installations in the automotive sector doubled to 61,598 units in 2021 owing to a swift rise in automobile manufacturing activities. The EV trend is also fueling the adoption of advanced manufacturing technologies in the automotive sector. The International Energy Agency (IEA) report reveals that EV sales in China totaled 8.1 million in 2023, a 35% rise compared to the previous year.

In India, the EVs market is expanding at a CAGR of 66.52% and is set to hold a top position in the global market in the coming years, according to the India Brand Equity Foundation (IBEF) report. Around 25.0% of the automotive components and parts are exported across the world annually from the country. The total production of two-wheelers, three-wheelers, and passenger vehicles was poised at 23,58,041 units in April 2024. The increasing production of automobiles coupled with technological innovations in manufacturing techniques is set to propel the overall automotive assembly market growth in the foreseeable period.

Key Automotive Assembly Market Players:

- Advanced Assembly

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BMW Group

- Daimler Truck

- Ford Motor Company

- General Motors Company

- Hyundai Motor Company

- SAIC Motor Corp., Ltd

- Assemco

- Stellantis N.V.

- Volkswagen Group

- Cummins Inc.

- Atlas Copco AB

- Magna International Inc.

Key players in the automotive assembly market are employing several organic and organic tactics to earn high profits and reach a wider consumer base. They are employing new product launches and technological innovation strategies to expand their portfolios. Strategic collaborations and partnerships are further supporting them to stand out in the crowd. Industry giants are also adopting global expansion tactics to grab untapped opportunities in high-potential markets. Mergers & acquisitions strategies are also aiding them in expanding their customer base and product offerings.

Some of the key players include:

Recent Developments

- In June 2024, BMW Group announced that its BMW 7 Series is the world’s first to be equipped with level 2 and 3 functions. BMW Highway Assistant and Personal Pilot L3 offers greater comfort on short and long motorway journeys

- In February 2023, Cummins Inc. announced the introduction of the X10 engine, the next in the fuel-agnostic series. This advanced and versatile engine for medium and heavy-duty applications is set to be commercialized in diesel form in North America by 2026.

- Report ID: 6892

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Assembly Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.