Automotive Antenna Market Outlook:

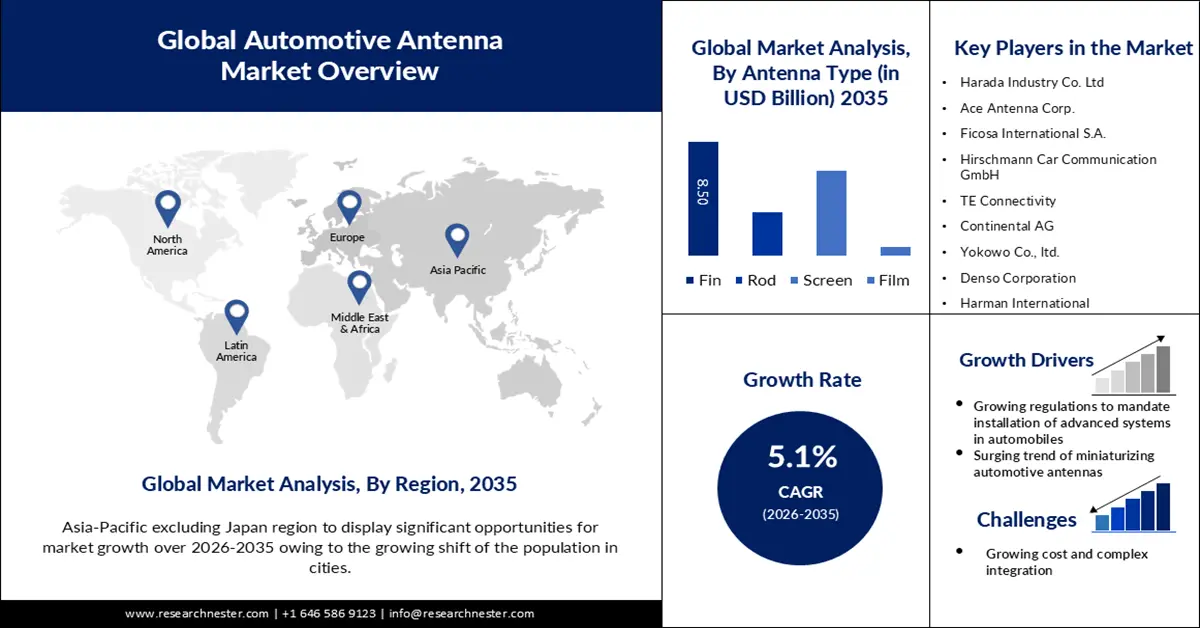

Automotive Antenna Market size was over USD 7.29 billion in 2025 and is anticipated to cross USD 11.99 billion by 2035, witnessing more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive antenna is assessed at USD 7.62 billion.

The surging demand for connected and autonomous vehicles is expected to drive global automotive antenna market growth in the upcoming years. Automotive antennas are used in wireless communication systems such as GPS, Wi-Fi, FM, TV, V2I, V2C, and other devices in connected vehicles. With the V2I type of connectivity, the vehicles exchange data with the road units and share information related to speed limits, accidents, and weather conditions. Thus, automotive antennas are being increasingly used in connected and autonomous vehicles to reduce the number of accidents. As per a 2023 study by the AAA Foundation for Traffic Safety, currently available ADAS technologies in the U.S. are projected to reduce 37 million crashes, 14 million injuries, and 250,000 deaths over the next 30 years (2021-2050). This represents 16% of crashes, injuries, and deaths that would occur on U.S. roads without the deployment of these technologies.

Key Automotive Antenna Market Insights Summary:

Regional Highlights:

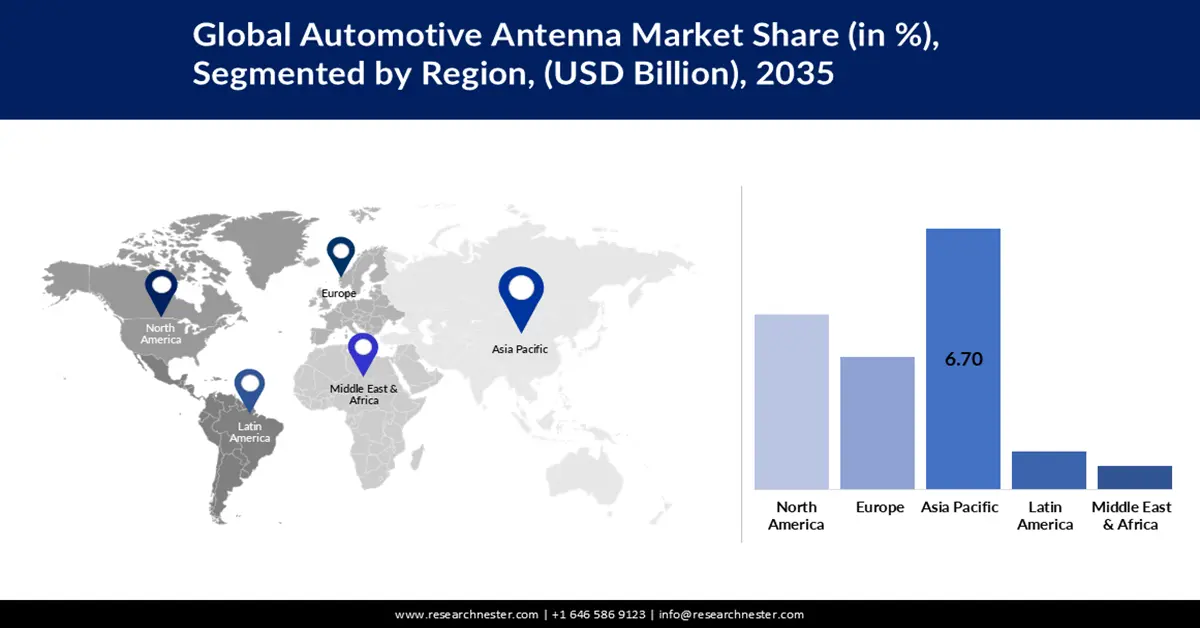

- The Asia Pacific automotive antenna market achieves a 39% share by 2035, driven by the rapidly expanding automotive industry increasing demand for advanced communication technologies.

Segment Insights:

- The passenger cars segment in the automotive antenna market is projected to attain a 70% share by 2035, fueled by the surging demand for connectivity, navigation, and infotainment systems, along with the growing adoption of ADAS in passenger cars.

- The fin segment in the automotive antenna market is projected to capture a 44.70% share by 2035, attributed to the durability, efficiency, and modern design of fin antennas.

Key Growth Trends:

- New safety norms for vehicles

- Surging trend of miniaturizing automotive antennas

Major Challenges:

- Growing costs and complicated integration

- Attenuations of signals in complex environments

Key Players: Laird Connectivity (TE Connectivity), Harada Industry Co., Ltd., Kathrein Automotive GmbH, Ficosa Internacional SA, Amphenol Corporation, Continental AG, TE Connectivity Ltd., Hirschmann Car Communication GmbH, Hella GmbH & Co. KGaA, Molex, LLC.

Global Automotive Antenna Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.29 billion

- 2026 Market Size: USD 7.62 billion

- Projected Market Size: USD 11.99 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Automotive Antenna Market Growth Drivers and Challenges:

Growth Drivers

- New safety norms for vehicles - Many governments are introducing new safety norms with several mandatory safety features in vehicles to ensure the safety of passengers. For instance, the Queensland government launched a Safety Cars campaign in January 2023 to increase awareness and establish measures for vehicle roll-away risks. The campaign mainly targets high-risk vehicles and focuses on the maintenance of brake alerts and automatic braking systems. Such efforts necessitate the integration of cutting-edge communication features, including eCall and V2V communication. On account of this, various initiatives have been launched to innovate the antenna design to incorporate security precautions, adhering the regulations.

- Surging trend of miniaturizing automotive antennas - Researchers have been striving to minimize the physical dimensions of an antenna without significantly affecting its performance. Many approaches to antenna miniaturization have already been put forth over the years. These approaches range from the employing of high permittivity/permeability materials to structure modifications and aggregated component loading.

Automakers are also keen on reducing the size of the electronics to be installed in automobiles. Compact antenna solutions provide automotive designers with greater flexibility at different stages of antenna integration and require smaller space to fit in vehicles. For instance, in June 2024, SpaceX launched a new version of its Starlink satellite internet antenna, known as the Starlink Mini, that’s small enough to fit in a backpack. It has the ability to provide seamless connectivity throughout the journey, and even in remote areas. - Increasing adoption of smart city initiatives - The adoption of smart city infrastructure has increased the need for sophisticated in-car networking solutions. Therefore, various key players in smart cities are improving network efficiency, which might further enhance the connectivity of automobiles. In February 2024, BT Group developed a narrowband Internet of Things network as part of its United Kingdom-wide smart city strategy. Around 97% of the United Kingdom's population is served by this network.

Challenges

- Growing costs and complicated integration - Antenna's complicated design, and vehicle-restricted space render it difficult to include multiple antennas for GPS, Wi-Fi, cellular, and AM/FM radio in a car. In a high-frequency antenna, the wavelength is shorter, whereas in a low-frequency antenna, the wavelength is longer. On the other hand, designing a single automotive antenna with good radiation efficiency for all the systems is a challenging task for antenna designers. Hence, it is anticipated to restrict market growth in the coming years.

- Attenuations of signals in complex environments - The performance of antennas is significantly affected by signal loss in complex environments, especially in urban areas, tunnels, and areas with high population density. This outcome can result in decreased signal strength, deteriorated connectivity, and obstacles.

Automotive Antenna Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 7.29 billion |

|

Forecast Year Market Size (2035) |

USD 11.99 billion |

|

Regional Scope |

|

Automotive Antenna Market Segmentation:

Antenna Type Segment Analysis

Fin segment in the automotive antenna market share is estimated to exceed 44.7% by the end of 2035. Fin, also referred to as shark fin antennas, are constructed in such a way that they can withstand several hazards such as tree branches, car washes, and bad weather. It is popular in vehicles for its efficiency, stylish design, and getting along with modern vehicle technologies. Shark fin antennas are also frequently found in commercial cars and taxi fleets owing to their adaptability to voice, mobile data, WLAN, public safety, and asset tracking applications. Moreover, the need to install multiple antenna is reduced as the fin antenna alone performs various functions. This also lowers the expense of deploying the antenna. In January 2022, Mitsubishi Electric launched the world’s smallest antenna for high-precision satellite-based positioning in four frequency bands. This antenna is expected to be installed in drones, and diverse vehicles for autonomous driving.

Vehicles Type Segment Analysis

By 2035, passenger cars segment share in the automotive antenna market is expected to exceed 70%. This growth is attributed to the growing demand for better connectivity, navigation and infotainment systems in passenger cars. These cars have gained immense popularity among consumers across the globe due to features such as compact size, stylish design, and economic value. According to the data published by the International Organization of Motor Vehicle Manufacturers (OICS) in 2024, the sales of passenger vehicles worldwide stood at 65.27 million units in 2023. The surging sales of luxury and premium vehicles and swift adoption of ADAS in passenger cars are other key factors expected to boost the segment growth during the forecast period.

Our in-depth analysis of the global automotive antenna market includes the following segments:

|

Antenna Type |

|

|

Frequency Range |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Antenna Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 39% by 2035. The market in this region is booming due to the rapidly expanding automotive industry in emerging countries such as India, and China. Growth in the automotive sector is further increasing the need for advanced communication technologies, leading to a surging demand for automotive antennas. These advanced communication technologies receive and transmit signals between the infrastructure and vehicles with the help of antennas.

Surging investment in smart cities in China is estimated to influence the automotive antenna market revenue generated in this country. Smart cities require vehicles to interact with infrastructure such as smart traffic lights and smart traffic management.

North America Market Insights

North America automotive antenna market is set to register lucrative growth till 2035. This growth can be driven by rising growing need for safety features in modern automobiles and rapid adoption of advanced technologies.

Surging production of advanced system buses is estimated to boost the automotive antenna market growth in the United States. Additionally, the growing importance of AI and IoT devices in vehicles is fostering market expansion.

The automotive antenna market in Canada is predicted to expand at a significant CAGR through 2035 due to presence of major technological firms and automotive manufacturers that continuously support the research and development in antenna technologies. This has further driven the production and sales of modern vehicles in the country.

Automotive Antenna Market Players:

- Ezurio

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Harada Industry Co. Ltd

- Ace Antenna Corp.

- Ficosa International S.A.

- Hirschmann Car Communication GmbH

- TE Connectivity

- Continental AG

- Yokowo co., ltd.

- Denso Corporation

- Harman International

- Antenova Ltd

Businesses across the globe are focusing on research and development to meet the changing preferences of their users. The key players in the automotive antenna market are rigorously adopting advanced technologies to dominate their presence in the market. Partnerships, product launches, acquisitions, and collaborations are a few of the strategies adopted by the key players in the automotive antenna market. For instance, in June 2024, Yokowo Co., Ltd., announced the launch of world’s smallest class compact private 5G MIMO antenna releasing high speed, and large capacity data communication. Some of the major key players include in the market include:

Recent Developments

- In February 2024, Antenova Ltd and 2J Antennas established a strategic alliance under DiscoverIE Group PLC. This collaboration brings together Antenova's competence in high-performance internal antennas and RF modules with 2J Antennas' proficiency in external antenna solutions.

- In May 2023, Linx Technologies, currently part of TE Connectivity, implemented a new line of cellular adhesive flexible printed circuit (FPC) antennas for 5G New Radio, LTE, and cellular IoT (LTE-M, NB-IoT) applications.

- Report ID: 6282

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Antenna Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.