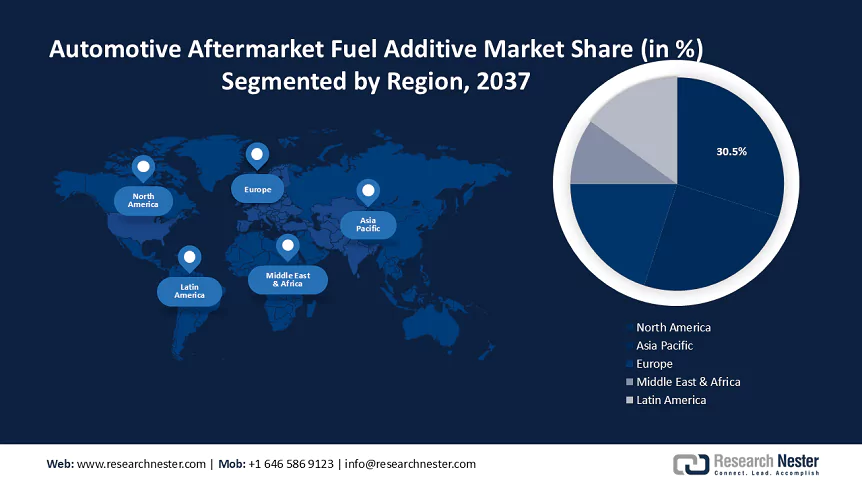

Automotive Aftermarket Fuel Additives Industry - Regional Synopsis

North America Market Statistics

North America is projected to hold largest market share by the end of 2037, backed by environmental regulations aimed at reducing greenhouse gas emissions and protecting the environment, increased automobile production, and the increase in per capita income. Additionally, the higher acceptance of additive rates and increasing production of biofuels are anticipated to drive the regional market. With a large number of aging vehicles, the demand for fuel additives continues to rise in the region.

The U.S. automotive aftermarket fuel additives market is driven by a rise in consumer awareness in terms of vehicle maintenance, growing concerns about fuel quality, and the adoption of biofuels. In June 2023, the EPA announced a final rule to establish biofuel volume requirements and associated percentage standards for cellulosic biofuel, biomass-based diesel (BBD), advanced biofuel, and total renewable fuel for 2023–2025. For instance, cellulosic biofuel requires 1.38 billion RINs as per volume targets, and biomass-based diesel requires 3.35 billion RINs. Stricter environmental regulations, supported by advancements in additive technologies are influencing the market growth further.

APAC Market Forecasts

Asia Pacific automotive aftermarket fuel additives market is projected to grow the fastest through 2037, owing to large and fast-growing population. Furthermore, factors such as rising disposable incomes, and urbanization are some of the most prominent driving factors in the region. The adoption of cleaner technologies is also boosting market expansion. For instance, in December 2021, Clean Edge Asia was launched to produce sustainable and secure energy markets. the total global increase in primary energy demand is projected to increase up to 60% by 2040, according to the International Energy Agency, requiring nearly USD 1 trillion in energy infrastructure investment annually for developing countries.

India automotive aftermarket fuel additives market is impelled by rising penetration of premium and high-performance vehicles, which require advanced fuel treatments for optimal performance. Leading companies are leveraging innovation to expand their product portfolios to meet the rising consumer demand in the country. Furthermore, focusing on optimizing fuel performance and reducing emissions are two of the most prominent trends witnessed in the country. Cummins Group in India showcased high-power, fuel-efficient technologies, the Legend L10 and M15, and its Hydrogen Internal Combustion Engine (H2ICE), at EXCON 2023, driving the demand for complementary fuel additives to maintain energy efficiency and compatibility with innovative systems.