Automotive Adhesives & Sealants Market Outlook:

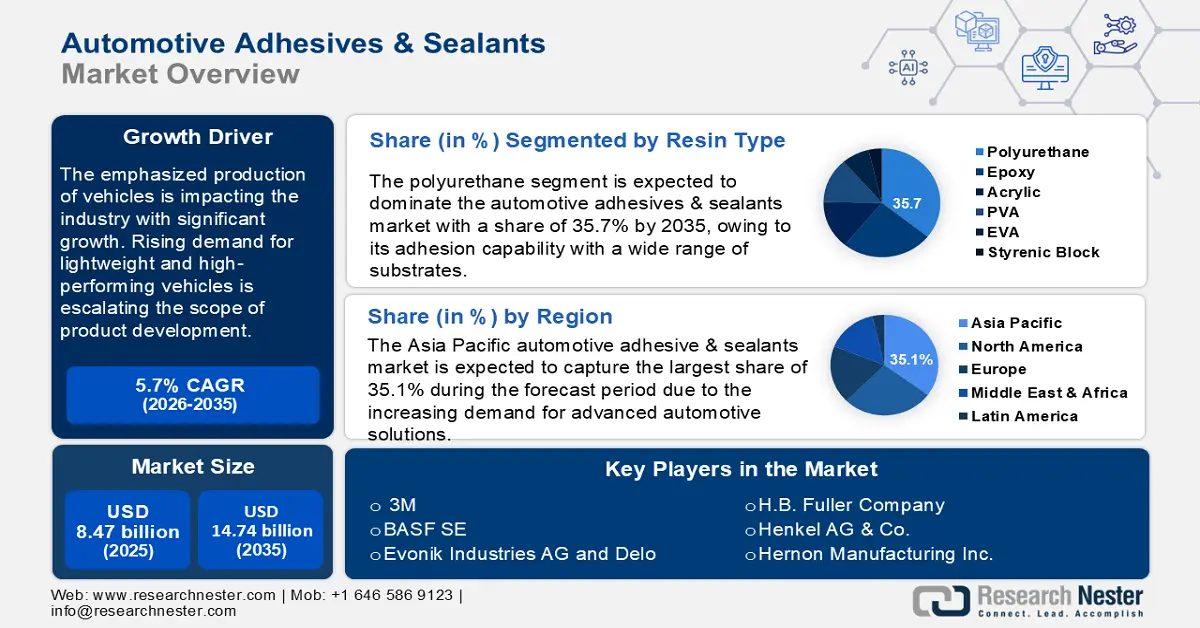

Automotive Adhesives & Sealants Market size was valued at USD 8.47 billion in 2025 and is likely to cross USD 14.74 billion by 2035, expanding at more than 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive adhesives & sealants is assessed at USD 8.9 billion.

The emphasized production of vehicles is impacting the industry with significant growth. Rising demand for lightweight and high-performing vehicles is escalating the scope of product development. Innovations and Strategic partnerships are fueling the researchers to introduce sustainable and efficient adhesive solutions. The consistent requirement for quality additives from repairing and servicing in the automotive sector is securing steady market growth.

Enhanced bonding technologies including UV-curable and thermoset adhesives are bringing versatility in application for the autonomous sector. Further, the enhanced performance is encouraging manufacturers to incorporate these techniques for production. In April 2024, Panacol launched Vitralit, a series of stress-releasing and fast-curing adhesives. The verse application in automotive electronics and e-mobility is intended to produce a high volume of commutators in a short time. Various bonding composites are now being introduced for battery cell sealing, PCB component attachment, optical alignment, and sensor potting. Innovative sealants can offer improved performance and better adhesion for next-generation transportation such as electric vehicles, promoting the automotive adhesives & sealants market.

Key Automotive Adhesives & Sealants Market Insights Summary:

Regional Highlights:

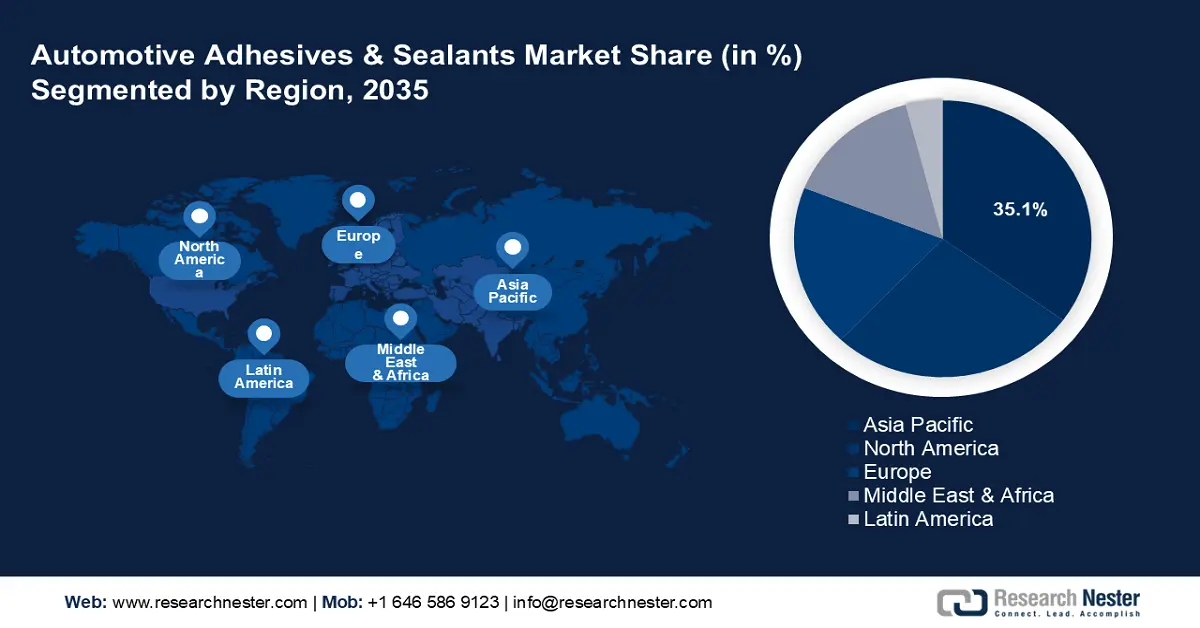

- Asia Pacific dominates the Automotive Adhesives & Sealants Market with a 35.1% share, fueled by increasing demand for advanced automotive solutions, driving robust growth through 2026–2035.

- North America's Automotive Adhesives & Sealants market is projected to boom by 2035, attributed to increasing demand for lightweight vehicles and technological advancements.

Segment Insights:

- The Polyurethane segment is forecasted to experience significant growth by 2035, attributed to its strong adhesion, durability, and wide application in automotive interiors.

Key Growth Trends:

- Increased vehicle production and aftermarket services

- Technological advancements and regulatory acceptance

Major Challenges:

- Expensive production and material unavailability

- Strict environmental and safety regulations

- Key Players: 3M, BASF SE, Evonik Industries AG and Delo, H.B. Fuller Company, Henkel AG & Co., Hernon Manufacturing Inc., Jowat SE, KGaA, Huntsman International LLC, Permabond LLC, PPG Industries, Inc..

Global Automotive Adhesives & Sealants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.47 billion

- 2026 Market Size: USD 8.9 billion

- Projected Market Size: USD 14.74 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 14 August, 2025

Automotive Adhesives & Sealants Market Growth Drivers and Challenges:

Growth Drivers

- Increased vehicle production and aftermarket services: The swelling surge for vehicles is pushing automakers to expand their resources, hence driving the automotive adhesives & sealants market. According to an IBEF report published in September 2024, India produced 23,58,041 units of passenger vehicles, three-wheelers, two-wheelers, and quadricycles. The number is rising each year with the economic growth in such developing countries. Thus, manufacturers are demanding more effective additive solutions for faster assembly. Penetration of automation in manufacturing is evolving mass production for sufficient supply, subsequently, extending the usage of adhesives in automatic robotic machinery. Maintenance and repair stations are also one of the major consumers of the market. The shift towards fuel efficiency is driving the use of lightweight materials. Further, escalating adoption of premium-quality adhesives and sealants.

- Technological advancements and regulatory acceptance: More durable and heat-resistant formulations are upsurging the automotive adhesives & sealants market for automotive manufacturing. Rising concern for environmental safety is prompting developments for eco-friendly solutions. Growth in electric and hybrid vehicles has also opened a new genre for specialized adhesives. Products made from nano-particles offer outstanding mechanical properties. In JEC 2024, Nanopoxy and Nione collaborated to launch nanostructured epoxy resin. They developed this resin through niobium technology, making it a commercially viable solution as a smart composite. Government bodies are implementing regulations to facilitate low-emission and energy-efficient bonding equations for production. Additionally, it inspires market companies to integrate more sustainable bonding solutions in fabrication, boosting market size.

Challenges

- Expensive production and material unavailability: The raw materials and chemicals needed to produce high-quality adhesives are expensive. Implementing advanced technologies in production also acts as an extensive investment to compete with others. With numerous manufacturers vying in the automotive adhesives & sealants market sector, it is hard to retain the optimum product value. Adhesives can fail to comply with various substrates and coatings in modern vehicles, hindering diverse adoption. The ever-changing market requires continuous developments in offerings. Such advancements may restrict the process due to a lack of raw materials. The disruption in global supply and exports can be affected by availability and cost issues.

- Strict environmental and safety regulations: The shift of consumer preferences towards sustainable and eco-friendly composites can become difficult to attain in this industry. Manufacturers are being instructed to adopt environmentally viable materials for production in the market. Such regulatory pressure can make investors refrain from participating in the market. Adhering to the safety measures issued by government bodies can also complicate the process of product development. Regional laws on the export or import of raw materials can create supply chain disruptions. Elongated approval for new launches from every authority results in increased production costs and delays in distribution.

Automotive Adhesives & Sealants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 8.47 billion |

|

Forecast Year Market Size (2035) |

USD 14.74 billion |

|

Regional Scope |

|

Automotive Adhesives & Sealants Market Segmentation:

Resin type (Polyurethane, Epoxy, Acrylic, PVA, EVA, Styrenic Block)

Considering the resin type, the polyurethane segment is expected to dominate the automotive adhesives & sealants market with a share of 35.7% by 2035. The segment is expected to hold USD 3.4 billion by the end of 2025. The significant growth is driven by its adhesion capability with a wide range of substrates. Its cure time and potting lifespan can be extended by using customized formulations. Additionally, the transferred flexibility to the used product makes it suitable for all new vehicles. Its diverse application includes dashboards, chassis components, cable sheathing, headrests, steering wheels, gear knobs, seats, bumpers, and door trims.

The polyurethane adhesives are designated to withstand harsh weather and temperature fluctuations. Such multi-functional features make this segment attractive for automotive adhesives & sealants market companies to invest in. In September 2024, Covestro launched its new range of polyurethane adhesives for automobile interiors. DispercollU can adhere to the lamination of the vehicle interior while making it heat-resistant. Polyurethane additives are now further being formulated from recycled contents to align with sustainability. In February 2024, KRAIBURG TPE launched its new collection of thermoplastic elastomers. This class of polyurethane plastics contains 73% recycled elements and is applicable for various technical aspects.

Our in-depth analysis of the automotive adhesives & sealants market includes the following segments:

|

Resin type |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Adhesives & Sealants Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is estimated to hold largest revenue share of 35.1% by 2035. The regional market size is predicted to be USD 3.3 billion by 2025 due to the increasing demand for advanced automotive solutions. The rapid growth of the vehicle industry in countries such as India, China, Japan, and South Korea has propelled the sector. The transition toward electrification promoted new opportunities, especially in battery assembly and lightweight fabrication. Sustainability initiatives taken by governing authorities are also pushing manufacturers to adopt proficient alternatives. Global leaders are now expanding their footprint by investing in this region. In October 2024, Celanese established ATC (Asia Technology Center) in Shanghai, China. This research facility is equipped with unmatched technical capabilities to accelerate the process of innovation in this region. The ATC will work on material design and development to support the market business.

India is opening its doorways for investors to grab greater opportunities in the automated adhesives & sealants market. With the rising demand for cost-effective bonding solutions, the country has gained the focus of international players. The economy of local manufacturers in the automotive adhesives & sealants market is growing through government campaigns such as Made in India. Such initiatives have reduced its dependence on external resources, utilizing the domestic reservoir of raw materials. Companies from this country, including Pidilite Industries Ltd and Asian Paints are partnering with global leaders to expand their portfolio in the market. In September 2024, Pidilite collaborated with CollTech to acquire their distribution line in India. This collaboration will solidify both parties' position in this country's adhesives market.

China is also showcasing its growth in the automotive adhesives & sealants market. Increasing demand for passenger and commercial vehicles is influencing the additives market. Its massive production facility and raw material resources are bolstering domestic manufacturers. The implementation of electric and hybrid cars in transportation is demanding better insulators for battery assembly. Companies are now expanding their portfolio in this country through strategic moves. In March 2024, Jowat launched its new manufacturing unit in China. This expansion will enhance its innovation capabilities and will consolidate its leadership in China market.

North America Market Analysis

The automotive adhesives & sealants market in North America is booming due to increasing demand for lightweight vehicles. Technological advancements are evolving additives into more durable and temperature-resistant solutions. They are also developing production methods to meet the demand for personalized bonding solutions. Modern automotive applications are showing a broader range of required fields for adhesives. Water-based and solvent-free compositions are serving to align with regulatory standards. Automotive adhesives & sealants market leaders such as 3M are investing heavily in research and development in this sector. The shift of federal energy regulations is increasing the cost of operation for automotive coatings manufacturers. Such change in economic infrastructure may become a burden for companies, refraining them from future investments.

The U.S. is poised to hold a leading position as one of the major consumer bases of the market. The companies are focusing on developing new technologies to introduce more convenient solutions. In March 2024, Adhesive Research launched a series of ARclad, which works as easy-to-apply foam tapes. These PSA tapes are designed to support reliable and cost-effective solutions for automotive structures. More improved bonding strength and durability are driving a surge in innovation in the automotive adhesives & sealants market. Growing demand for custom formulation is also propelling the diversity of applications. Adhesives and other bonding solutions are now playing a major role in vehicle assembly, repair, and maintenance.

Canada is predicted to witness a boom in the market due to continued investment in research and development of products. These advancements offer enhanced alignment with industry trends. Focus on sustainability is also driving the demand for premium quality additive solvents. The country’s established parts supply chain has facilitated an efficient distribution channel for the automotive adhesives & sealants market. The aftermarket growth is contributing to the demand for diverse applications in vehicle manufacturing and repair. The push for fuel efficiency is building a surge for lightweight materials and advanced additive solvents. Additionally, numerous OEMs and suppliers are raising the market size of adhesives.

Key Automotive Adhesives & Sealants Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Sika Group

- Evonik Industries AG and Delo

- H.B. Fuller Company

- Henkel AG & Co.

- Hernon Manufacturing Inc.

- Jowat SE

- KGaA, Huntsman International LLC

- Permabond LLC

- PPG Industries, Inc.

In this highly competitive industry, market leaders are associating with frequent innovation to stand out. They are investing in research facilities to introduce advanced products. In October 2024, Covestro invested USD 0.1 billion in innovation in the global automotive adhesives & sealants market. Such initiatives are introducing more effective solutions such as silicon-based adhesives and conductive additive solutions. Moreover, the trend towards automated manufacturing processes is enhancing the efficiency of adhesive applications. Some of the key players in the automotive adhesives & sealants market include:

Recent Developments

- In October 2024, ATP announced the acquisition of NESCHEN to uphold their production of sustainable adhesives. This integration will strengthen ATP’s supply chain of eco-friendly and solvent-free products for the automotive industry.

- In May 2024, Permabond launched its new ultra-fast curing UV adhesive. UV643 contains photoinitiators, allowing it to cure through various wavelengths between 365 and 420nm. The durability and resistance capacity make it stand out from the competition in the market.

- Report ID: 6571

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.