Automotive Active Health Monitoring System Market Outlook:

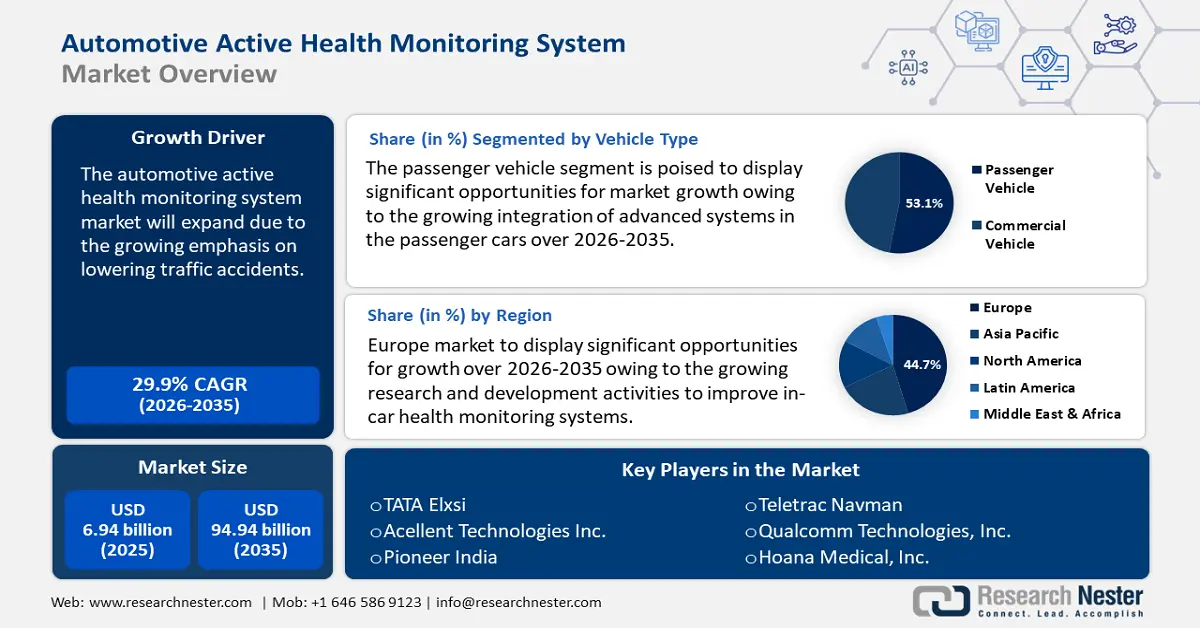

Automotive Active Health Monitoring System Market size was over USD 6.94 billion in 2025 and is anticipated to cross USD 94.94 billion by 2035, growing at more than 29.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive active health monitoring system is assessed at USD 8.81 billion.

The automotive active health monitoring system market is expanding primarily due to the growing emphasis on lowering traffic accidents, legal requirements, and the desire for a more customized driving experience. According to a 2023 report by the World Health Organization (WHO), an estimated 1.19 million people die in traffic accidents yearly. Despite owning over 60% of the world's automobiles, low and middle-income nations account for 92% of all traffic deaths worldwide. Therefore, automotive active health monitoring systems are becoming key features in new vehicles, ensuring that drivers are assisted and monitored by technology. As automation is arising in modern cars, the role of these systems has become crucial in reducing the gap between manual and autonomous driving.

Key Automotive Active Health Monitoring System Market Insights Summary:

Regional Highlights:

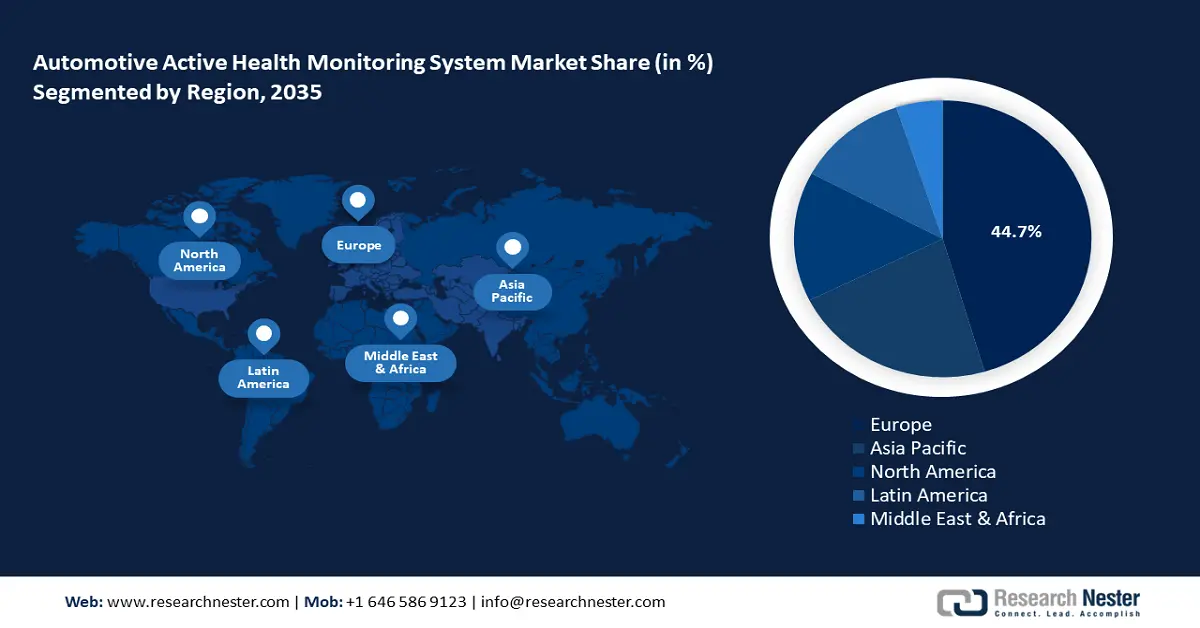

- Europe commands a 44.70% share in the Automotive Active Health Monitoring System Market, driven by the presence of major automotive manufacturers, R&D in in-car health systems, and new EU safety regulations, ensuring robust growth by 2035.

- Asia Pacific's Automotive Active Health Monitoring System Market is projected to see substantial growth by 2035, driven by rapid adoption of advanced electronics and rising demand for safety due to increasing accidents.

Segment Insights:

- Passenger Vehicle segment is projected to hold a 53.1% share by 2035, driven by the integration of active health monitoring systems to enhance safety.

Key Growth Trends:

- Rising electric vehicle adoption rates

- Favorable government policies

Major Challenges:

- Higher costs

- Data privacy & security concerns

- Key Players: TATA Elxsi, Acellent Technologies Inc., Pioneer India, Teletrac Navman, Qualcomm Technologies, Inc., Hoana Medical, Inc., Faurecia SE (FORVIA), Flex Ltd., Hyundai Mobis, VURO Technologies.

Global Automotive Active Health Monitoring System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.94 billion

- 2026 Market Size: USD 8.81 billion

- Projected Market Size: USD 94.94 billion by 2035

- Growth Forecasts: 29.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (44.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: Germany, United States, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 13 August, 2025

Automotive Active Health Monitoring System Market Growth Drivers and Challenges:

Growth Drivers

-

Rising electric vehicle adoption rates: Sales of electric vehicles (EVs) are rapidly increasing as more consumers become aware of government programs and incentives. International Energy Agency (IEA) reported that 14 million new electric cars were registered worldwide in 2023, bringing the total number of electric vehicles on the road to 40 million. In 2023, 3.5 million more electric cars sold than in 2022, a 35% increase from the previous year. Global demand for EVs has increased due to increased awareness of the negative environmental effects of fuel-powered vehicles. Government initiatives like grants and subsidies have accelerated the adoption of EVs. Due to increased sales, manufacturers are responding to the growing demand for EVs by providing increasingly sophisticated active health monitoring system features.

- Favorable government policies: Favorable government and international laws on passenger safety have encouraged automotive active health monitoring system market companies to incorporate health monitoring technologies into the automotive sector. As a result, numerous healthcare groups and automotive titans are partnering to improve passenger safety in vehicles. A crucial development in this arena occurred in October 2024, when a new United Nations Regulation on Driver Control Assistance Systems (DCAS) was implemented. This regulation, which emerged from discussions during the UNECE World Forum for the Harmonization of Vehicle Regulations in March 2024, classifies DCAS as Automated Driving Systems, akin to SAE Level 2. Under these regulations, while drivers can utilize these advanced systems, they remain responsible for the control of the vehicle and must continuously monitor both their surroundings and the performance of the car or system, ensuring timely intervention if necessary.

- Integration of key technologies: One of the major trends in automotive active health monitoring system market is the integration of advanced driver-assistance systems (ADAS) to deliver an enhanced safety package. Vehicles can provide drivers with greater safety and support by integrating these systems with automatic emergency braking and lane-keeping assist systems. Also, an increased focus on developing emotion recognition and personalized driver coaching to help drivers manage stress and fatigue, promoting safer driving practices. Moreover, the implementation of biometric sensors to monitor vital signs, including heart rate and blood pressure, provides critical insights into the driver’s health and well-being, further enhancing safety measures on the road.

Challenges

-

Higher costs: The high cost of implementing active health monitoring systems in cars is impeding the market's expansion. Additional hardware and software, including cameras, sensors, and other peripherals, are needed for this system to function, raising the system's total cost. Therefore, this will hinder the widespread adoption of automotive active health monitoring systems.

- Data privacy & security concerns: The automotive active health monitoring system market for cars is severely hampered by privacy and security issues with the gathering and handling of personal health information from drivers and passengers. Development and execution become more complicated and expensive when strict laws like GDPR are followed. In a delicate regulatory environment, these obstacles hinder customer adoption and trust, affecting the market's potential for growth.

Automotive Active Health Monitoring System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

29.9% |

|

Base Year Market Size (2025) |

USD 6.94 billion |

|

Forecast Year Market Size (2035) |

USD 94.94 billion |

|

Regional Scope |

|

Automotive Active Health Monitoring System Market Segmentation:

Vehicle Type (Passenger Vehicle, Commercial Vehicle)

Passenger vehicle segment is set to capture over 53.1% automotive active health monitoring system market share by 2035. The segment is growing owing to the integration of passenger cars with automotive active health monitoring systems, which are beneficial for preventing traffic fatalities and collisions. Currently, the majority of manufacturers are focusing only on passenger cars. Among the top automakers that have used active health monitoring systems are Volvo, Audi, BMW, Ford, Volkswagen, and Mercedes; these companies primarily produce passenger cars. For instance, in February 2024, Volvo Cars' industry-first connected safety technology, which debuted in 2016, uses real-time data from the company's cloud. It enables Volvo vehicles to interact with one another and notify drivers of surrounding slippery road conditions and risks. Similarly, drivers can now be notified of impending accidents at any time of day.

Location (Dashboard, Car Seat)

The dashboard segment in automotive active health monitoring system market is expected to garner a notable share in the forecast period. The segment growth can be attributed to the use of AI and machine learning for face detection, gesture recognition, fatigue, and driver distraction to reduce accidents. Autonomous automobile technology uses these sophisticated technologies to detect the driver's emotions and other emotions, which helps it change the driving mode to the safe mode if the driver is not in a healthy driving condition. Major companies are integrating advanced technologies which is escalating the demand for this segment. For instance, in September 2023, Honda Cars India Ltd. (HCIL), a leading luxury car manufacturer in India, introduced a slew of new features, including a personalized dynamic dashboard with a shortcut widget on the screen, digitalized pick-up and drop-off service, additional reward points on Fuel Pay through the HPCL network, buy and sell pre-owned cars, and the integration of accessories - TPMS (Tyre Pressure Monitoring System) and DVR (Drive View Recorder) in the Honda Connect application for an improved connected experience for the user.

Our in-depth analysis of the global automotive active health monitoring system market includes the following segments:

|

Location |

|

|

Component |

|

|

Vehicle Type |

|

|

Deployment |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Active Health Monitoring System Market Regional Analysis:

Europe Market Statistics

In automotive active health monitoring system market, Europe region is expected to capture over 44.7% revenue share by 2035. The market in the region is poised for growth, largely driven by the presence of numerous automotive companies. This concentration of manufacturers is mainly focused on incorporating advanced safety features and driver-assistance systems into their vehicles. Furthermore, these automakers focus on research and development (R&D) to improve in-car health monitoring systems. Moreover, the government introduced new regulations regarding general vehicle safety that were applied to all new motor vehicles sold in the EU on 7 July 2024. These rules, which have been in effect for new vehicle types since July 2022, aim to enhance road safety by incorporating advanced driver assistance systems in all new vehicles.

In the UK, the need for automotive active health monitoring system market is fueled by growing consumer and fleet operator awareness of the significance of road safety. Prominent players such as JLR, are driving awareness initiatives for these systems. According to a JLR survey, 41% of drivers in the UK are unsure of how their ADAS, such as automated braking, operate and are unable to discover the ADAS sensors on their vehicle. Therefore, to raise awareness, JLR has been collaborating with the Driver and Vehicle Standards Agency (DVSA), which has updated its driver guides and other publications with details regarding ADAS systems and is releasing public guidelines.

There is a surge in demand for dual-channel dashboard cameras in Germany to record front and rear footage. Dashboard cameras transmit remote diagnostic data to operators and are integrated with car telematics systems. This makes virtual training, driver health state monitoring, accident avoidance and monitoring, effective fleet management, and work-hour computations possible. Businesses are introducing sophisticated dashcams to improve vehicle safety by utilizing AI and IoT technology.

APAC Market Analysis

Asia Pacific automotive active health monitoring system market for automotive active health monitoring systems will garner a substantial share during the projected period. The market is growing in the region owing to the automotive industry's rapid adoption of cutting-edge electronic components. Furthermore, the region's need for active health monitoring systems is fueled by the sharp rise in demand for cutting-edge safety measures due to increasing accidents. The government has also required that health monitoring devices be incorporated into new cars to improve driver safety and lower fatalities and property damage due to traffic accidents.

In India, there is now more focus on implementing ADAS features such as driver tracking due to rising road safety awareness and the number of traffic incidents. The National Crime Records Bureau of India reports that over 155,600 people died on Indian roads in 2021. Therefore, Indian automakers and passengers are looking for and incorporating ADAS technology, such as adaptive cruise control, lane departure warning, and automated emergency braking, among others, to improve vehicle safety. Also, the demand for luxury and high-end cars with cutting-edge safety and convenience features is rising as people's purchasing power increases.

Additionally, there is a significant need for automotive active health monitoring system market in South Korea and Japan. The governments of these nations have made the installation of health monitoring systems mandatory to increase driver safety and reduce the number of fatalities and property damage brought on by traffic accidents.

Key Automotive Active Health Monitoring System Market Players:

- TATA Elxsi

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Acellent Technologies Inc.

- Pioneer India

- Teletrac Navman

- Qualcomm Technologies, Inc.

- Hoana Medical, Inc.

- Faurecia SE (FORVIA)

- Flex Ltd.

- Hyundai Mobis

- VURO Technologies

Since the automotive active health monitoring system market is still in its infancy, there are several chances for industry players to innovate and create compelling vehicle health monitoring technology. Consequently, they are investing much in research and development. Leading companies are concentrating on technology advancements, mergers, and acquisitions.

Recent Developments

- In August 2024, Pioneer India, introduced a cutting-edge line of Dash Cameras from its Mobility AI portfolio, specifically tailored for India. Pioneer's new smart Dash Cameras, equipped with advanced capabilities such as AI Night Vision, ADAS Alerts, and Enhanced Parking Monitoring, will provide enhanced automobile safety, security, and simplicity via a mobile app to every vehicle on the road.

- In January 2021, Teletrac Navman, a leading global telematics software-as-a-service provider that uses cutting-edge location-based technology to manage mobile assets, today announced the launch of its AI Dual Dashboard Camera, a powerful AI-enabled smart dashcam with forward- and driver-facing cameras that fully integrates with the company's TN360 platform.

- Report ID: 6814

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Active Health Monitoring System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.