Automotive Acoustic Engineering Services Market Outlook:

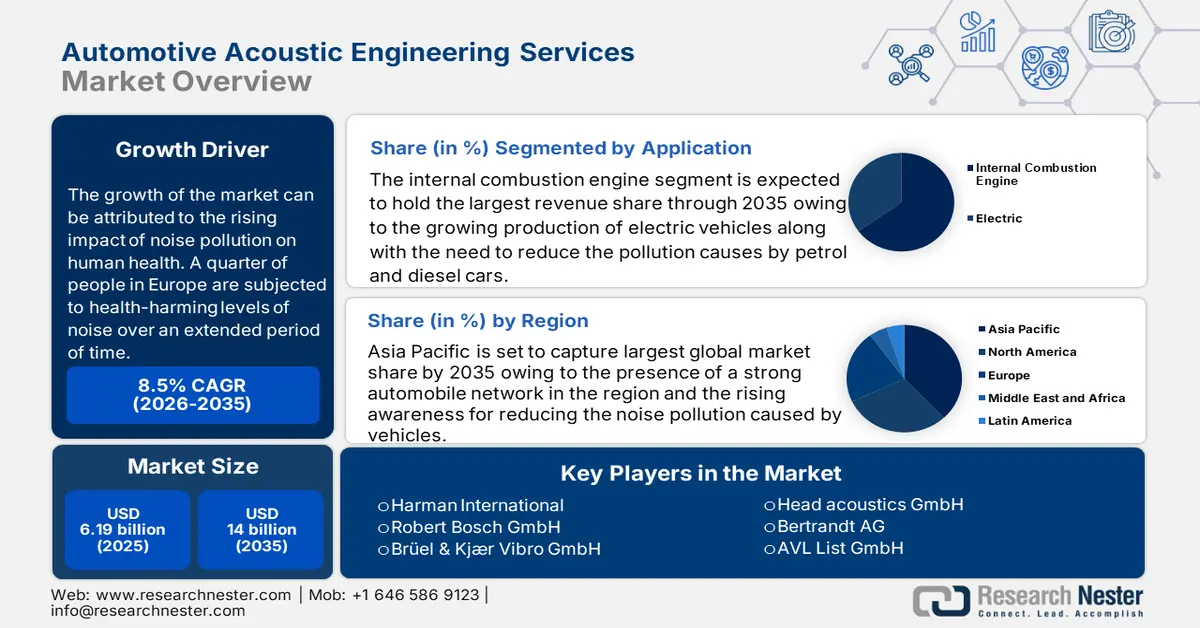

Automotive Acoustic Engineering Services Market size was over USD 6.19 Billion in 2025 and is anticipated to cross USD 14 Billion by 2035, witnessing more than 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive acoustic engineering services is assessed at USD 6.66 Billion.

The growth of the market can be attributed to the rising impact of noise pollution on human health. A quarter of people in Europe are subjected to health-harming levels of noise over an extended period of time. Almost 100 million people in Europe fall within that category. After the effects of air pollution, noise is the second-largest environmental source of health issues.

In addition to these, factors that are believed to fuel the market growth of automotive acoustic engineering services include the rise in the recent advancements in acoustic engineering services as well as rising production of motor vehicles, the demand for automotive acoustic engineering services is on the rise amongst the automobile manufacturers, which in turn, is expected to create massive revenue generation opportunities for the key players operating in the global automotive acoustic engineering services market during the forecast period. For instance, the global motor vehicles production increased by around 1% in 2021, compared to 2020.

Key Automotive Acoustic Engineering Services Market Insights Summary:

Regional Highlights:

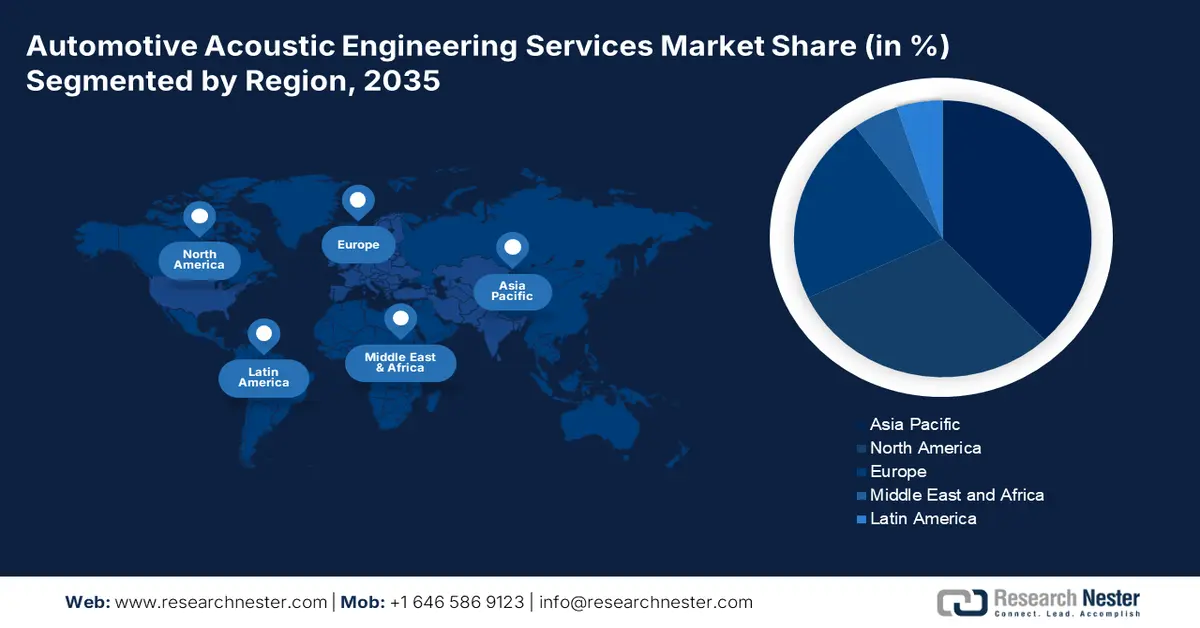

- The Asia Pacific automotive acoustic engineering services market commands the largest share by 2035, driven by the strong automobile network, rising vehicle production, growing awareness of noise pollution reduction, and rising sales of luxury cars.

- The North America market will achieve significant revenue share by 2035, attributed to the proactive government efforts to boost electric vehicle production and adoption, reducing fuel consumption.

Segment Insights:

- The virtual segment in the automotive acoustic engineering services market is projected to secure a significant share by 2035, fueled by the cost efficiency and accuracy of virtual acoustics testing over physical testing.

- The electric segment in the automotive acoustic engineering services market is anticipated to hold the largest share by 2035, driven by the surge in electric vehicle production and the shift away from fossil fuel vehicles.

Key Growth Trends:

- Upsurge in the Demand of Luxury Vehicles

- Increasing Adoption of Electric Vehicles

Major Challenges:

- Increased Usage of Rental Acoustic Testing Equipment

- Restrictive Entry Barriers

Key Players: Schaeffler Group, Harman International, Robert Bosch GmbH, Brüel & Kjær Vibro GmbH, FEV Group Gmbh, EDAG Engineering GmbH, Head acoustics GmbH, Bertrandt AG, AVL List GmbH, Siemens Aktiengesellschaft.

Global Automotive Acoustic Engineering Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.19 Billion

- 2026 Market Size: USD 6.66 Billion

- Projected Market Size: USD 14 Billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, Japan, China, United Kingdom

- Emerging Countries: CHINA, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Automotive Acoustic Engineering Services Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Negative Impact of Noise Pollution - As per an estimation, the environmental noise accounted for 48,000 new cases of ischemic heart disease in the year 2021. Automotive acoustic engineering services are used to minimize and control the level of noise in the vehicles. With the rising negative impact road traffic noise on health, the demand for automotive acoustic engineering services is expected to escalate in the forecasted period.

-

Rising Regulatory Norms to Reduce Noise Pollution- Strict rules and regulation for curbing noise pollution is likely to drive the market growth. according to the Environment Protection Rules 1986 (EPR), the range from 81 dB to 90 dB of noise is permissible for all passenger and commercial vehicles at the manufacturing stage.

-

Growing Penetration of Gas Powertrain - Acoustic engineering services are carried out for different applications such as the powertrain to control and minimize the noise level of the vehicle. It was found that, 94% vehicles registered in United States in 2018, had gas powertrain.

-

Upsurge in the Demand of Luxury Vehicles – The agility, luxurious appeal, and good efficiency of a vehicle are all impacted by improved vehicle acoustic systems. Luxury car sales peaked at over 2,000 units in 2022, and by 2026, they are expected to be close to 202, 000. Moreover, out of total light-vehicle sold in United States in 2021, the luxury brands accounted for 14%.

-

Increasing Adoption of Electric Vehicles – acoustic engineering services are used to optimize the noise of motor present in the electric vehicle. By 2027, it is anticipated that electric vehicle unit sales would be around 16,000 units. More than 50% of the world's population purchased an electric vehicle in 2022.

Challenges

-

Increased Usage of Rental Acoustic Testing Equipment- The cost of acoustic testing equipment is very high; therefore, people are more inclined to rent the setup. It is challenging for mid-sized and small businesses to acquire and maintain this equipment. As each component has its own unique testing apparatus, which must be tested using varied loads and temperatures.

-

Restrictive Entry Barriers

- Requirement of High Capital Investment

Automotive Acoustic Engineering Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 6.19 Billion |

|

Forecast Year Market Size (2035) |

USD 14 Billion |

|

Regional Scope |

|

Automotive Acoustic Engineering Services Market Segmentation:

Application Segment Analysis

The global automotive acoustic engineering services market is segmented and analyzed for demand and supply by application into internal combustion engine, and electric. Out of the two application of automotive acoustic engineering services, the electric segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the growing production of electric vehicles along with the need to reduce the pollution causes by petrol and diesel cars. For instance, The Net Zero Emissions by 2050 Scenario, predicts an electric car fleet of more than 300 million in 2030. Moreover, in 2022, around 6 million electric vehicles were sold worldwide, and in the first quarter, almost 2 million E-cars were sold.

Offering Segment Analysis

The global automotive acoustic engineering services market is also segmented and analyzed for demand and supply by offering into physical and virtual. Amongst these two segments, the virtual segment is expected to garner a significant share. The segment growth is attributed to the rising need to cut off the cost of vehicle production. In comparison to physical testing, the virtual acoustics testing is cheaper and can significantly reduce the overall production cost. Moreover, for the testing, the mathematic models and software are used that analyze the real time scenarios to detect noise and vibration. However, this time is notably less in virtual testing, thus saves the cost of research and development and quickly detects the fault in the systems. Additionally, it gives precise result in comparison to physical testing.

Our in-depth analysis of the global market includes the following segments:

|

By Process |

|

|

By Software |

|

|

By Offering |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Acoustic Engineering Services Market Regional Analysis:

APAC Market Insights

The Asia Pacific automotive acoustic engineering services market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed majorly to the presence of a strong automobile network in the region, growing production of vehicles, as well as the rising awareness for reducing the noise pollution caused by vehicles. For instance, the vehicle production volume of China in June 2022, hit over 2.4 million units. According to the Government of India's Ministry of Environment and Forest, the acceptable daytime noise levels for cars are 75 dB in industrial regions, 65 dB in commercial areas, 55 dB in residential areas, and 50 dB in quiet zones. Moreover, rising sales of luxurious cars are also expected to boost the market growth. German automakers shipped roughly 840,000 BMW and Mini vehicles to China in 2021. Furthermore, up until March 2022, there were almost 24,000 premium car sales in India.

North American Market Insights

The North America automotive acoustic engineering services market, amongst the market in all the other regions, is projected to hold the significant market share by the end of 2035. Proactive effort by government to boost the production of electric vehicles. In order to expedite the adoption of electric vehicles and reduce fuel consumption, the US government unveiled a new plan in 2021 to boost its Build Back Better investment policy.

Automotive Acoustic Engineering Services Market Players:

- Schaeffler Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Harman International

- Robert Bosch GmbH

- Brüel & Kjær Vibro GmbH

- FEV Group Gmbh

- EDAG Engineering GmbH

- Head acoustics GmbH

- Bertrandt AG

- AVL List GmbH

- Siemens Aktiengesellschaft

Recent Developments

-

Schaeffler Group, the company that has more than 20 years of experience in the acoustic development of vehicle components has created a new sound using real-time sound synthesis. It has developed the car sound of the future by revealing the new sound of the DTM Electric.

-

HARMAN International a wholly-owned subsidiary of Samsung Electronics Co. Ltd., announced the launch of the Fiat New 500 “La Prima by Bocelli”. The premium sound is engineered and designed by JBL and in partnership with Andrea Bocelli.

- Report ID: 4485

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Acoustic Engineering Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.