Automation Components Market Outlook:

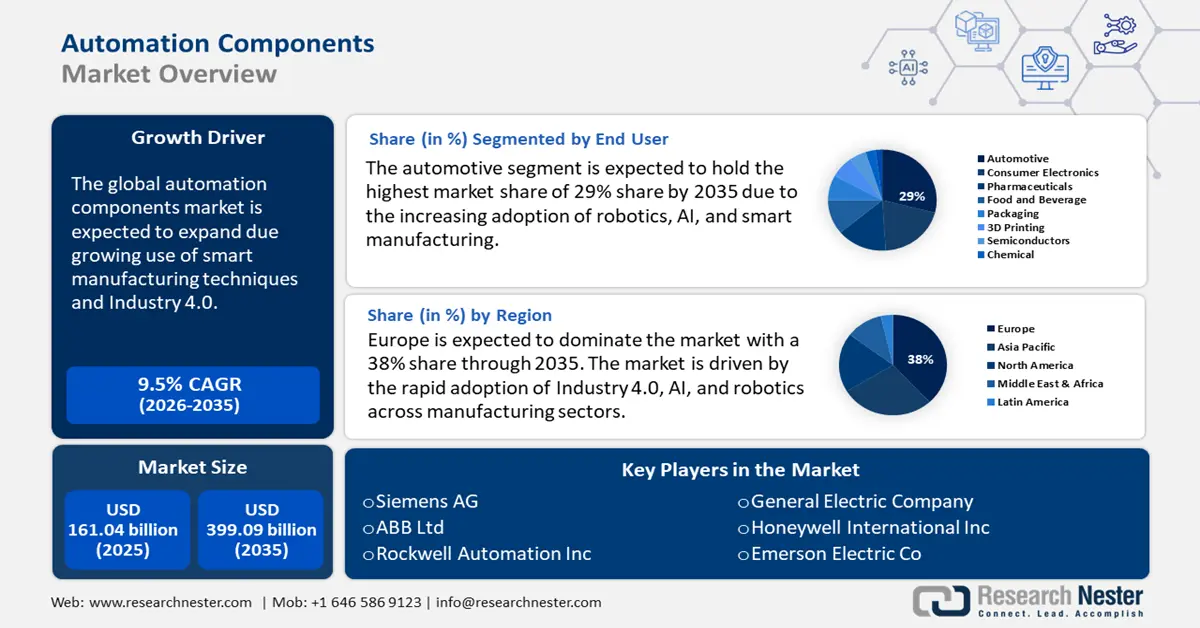

Automation Components Market size was valued at USD 161.04 billion in 2025 and is expected to reach USD 399.09 billion by 2035, registering around 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automation components is evaluated at USD 174.81 billion.

The automation components market is expanding due to the growing use of smart manufacturing techniques and Industry 4.0. The shift to digital factories, IoT-enabled automation, and AI-driven processes is accelerating growth. Industries are integrating sensors, PLCs, motion controllers, and cloud-based monitoring systems to improve efficiency. Moreover, the rise of collaborative robots and autonomous systems is fuelling the need for advanced automation components such as actuators, motion control, and industrial communication systems.

In addition, policies such as Industry 4.0 in Germany, Made in China 2025, and Make in India are boosting the adoption of different types of automation components. Governments are funding smart manufacturing, semiconductor production, and automation R&D to strengthen local industries. For instance, in January 2025, the U.S. under the Biden- Harris Administration announced USD 635 million in awards to expand zero-emission electric vehicle charging and refueling infrastructure. The investment is further anticipated to add more than 11,500 EV charging ports nationwide. Further, tax benefits, subsidies, and automation-friendly policies are encouraging industries to upgrade their production facilities, enhancing the adoption of automation components.

Key Automation Components Market Insights Summary:

Regional Highlights:

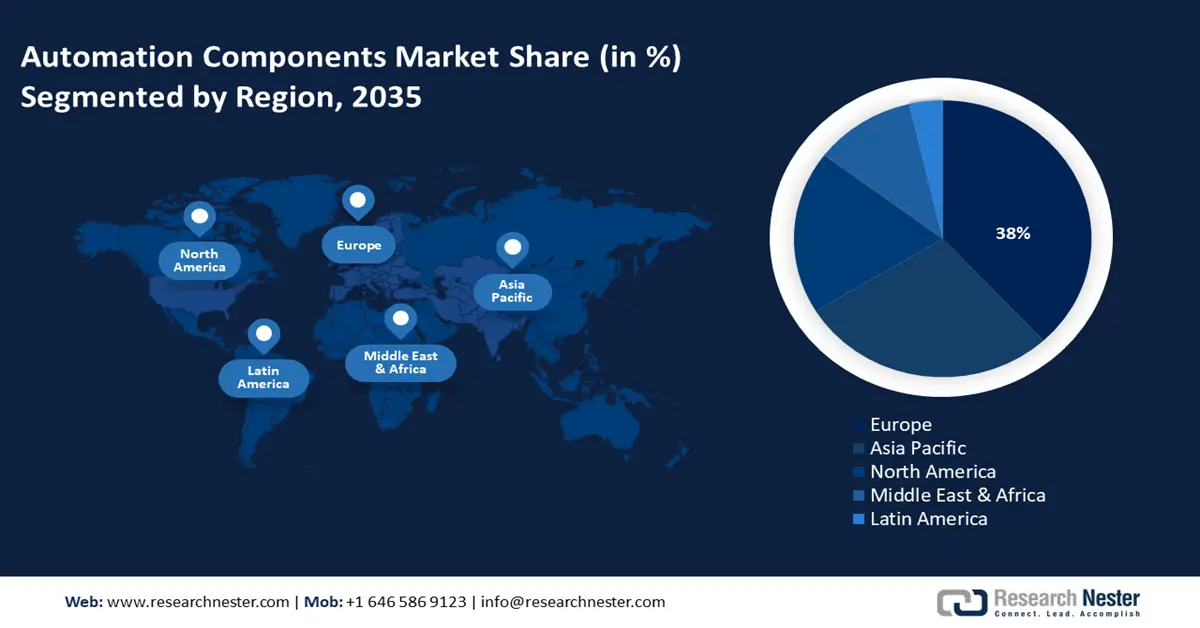

- Europe automation components market will account for 38% share by 2035, attributed to rapid adoption of Industry 4.0 and investments in smart factories.

- Asia Pacific market will account for remarkable revenue share by 2035, driven by industrial growth, rising wages, and automation demand.

Segment Insights:

- The automotive segment in the automation components market is expected to grow significantly by 2035, driven by increasing adoption of robotics, AI, and smart manufacturing in the automotive sector.

Key Growth Trends:

- Increasing demand for energy efficiency and sustainability requirements

- Labor shortages and rising wages

Major Challenges:

- High investment and implementation costs

- Supply chain disruptions and component shortages

Key Players: ABB Ltd, Rockwell Automation, Inc., Emerson Electric Co., Honeywell International Inc., General Electric Company, Bosch Rexroth AG.

Global Automation Components Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 161.04 billion

- 2026 Market Size: USD 174.81 billion

- Projected Market Size: USD 399.09 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 18 September, 2025

Automation Components Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for energy efficiency and sustainability requirements: Companies are adopting energy-efficient motors, variable frequency drives (VFDs), and smart controllers to optimize power consumption. The enforcement of strict energy regulations by the government and incentives lead to the adoption of sustainable manufacturing solutions. The adoption of automation helps reduce waste, optimize resource utilization, and lower carbon footprints. The Association for Advancing Automation 2024 Report reveals 87% of manufacturers aim to be carbon neutral by 2040, and over 80% of manufacturing firms have improved their ESG rating. These companies tend to prioritize using technology to meet the sustainability agenda, with automation being the most commonly adopted technology to achieve the set goals. Additionally, government incentives encourage businesses to adopt technologies that reduce energy consumption and lower carbon emissions.

- Labor shortages and rising wages: As the world is facing labor shortages, automation has emerged to address this challenge. Developed countries face an aging workforce, while emerging automation components markets see rising labor costs. This makes the adoption of automation a cost-effective alternative. Upcoming businesses are investing in automated material handling, AI-based quality control, and unmanned systems to fill labor gaps. Additionally, the rising labor shortages have led to the development of warehouse automation, robotic process automation, and industrial AI applications. For instance, in November 2021, White Castle, a fast-food chain, introduced a chef robot named Flippy, built by Miso Robotics. This automation addresses prevalent shortages and increasing labor costs as the Flippy robot can automatically cook a wide variety of foods. Thus, automation has accelerated the rise of worker robots.

Challenges

- High investment and implementation costs: The automation components market faces a significant challenge due to the high initial investment costs. The cost of purchasing Programmable Logic Controllers (PLCs), industrial robots, sensors, and AI-driven automation systems is high which can be a barrier for small and mid-sized companies. Beyond the hardware costs, businesses must also invest in integration, software development, workforce training, and ongoing maintenance which further increases the total expenditure.

- Supply chain disruptions and component shortages: The automation components market is highly vulnerable to supply chain disruptions and component shortages as they can impact production and costs. Further, semiconductor shortages, fluctuations in raw material prices, and geopolitical tensions impact the availability of automation components. Many manufacturers rely on global suppliers, which makes them susceptible to delays caused by trade restrictions, transportation issues, or pandemics. This dependency on the international supply chain for microchips, actuators, and sensors leads to delays in production. Thus, manufacturers must adopt local sourcing and inventory management solutions to mitigate risks.

Automation Components Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 161.04 billion |

|

Forecast Year Market Size (2035) |

USD 399.09 billion |

|

Regional Scope |

|

Automation Components Market Segmentation:

End user Segment Analysis

Automotive segment is anticipated to account for more than 29% automation components market share by the end of 2035, owing to the increasing adoption of robotics, AI, and smart manufacturing in the automotive sector. Automated systems include robotic welders, motion controllers, and advanced vision sensors to improve production efficiency and quality. The rise of electric vehicles and autonomous cars is further driving demand for high-precision automation components. The rise of automated assembly lines and AI-driven quality inspection in the automobile sector helps manufacturers reduce errors, thereby reducing costs. With the push for mass customization and sustainability, automation is becoming essential in modern automotive production.

Component Segment Analysis

The motors segment in automation components market is anticipated to register rapid revenue growth during the forecast period due to rising demand for high-efficiency and precision-driven motion control in industries. Servo motors, stepper motors, and AC/DC motors are widely used in robotics, conveyors, and machinery. In addition, the push for energy-efficient solutions is driving the adoption of smart motors with variable frequency drives. Industries such as automotive, electronics, and packaging rely on more advanced motors for automation and productivity. In July 2023, Electrified Motors launched a new range of next-generation electric motors, the EA 193 Series, to support a variety of applications, from two-wheel-on-the-road to industrial.

Our in-depth analysis of the global market includes the following segments:

|

End user |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automation Components Market Regional Analysis:

Europe Market Insights

Europe automation components market is predicted to capture revenue share of over 38% by 2035, driven by the rapid adoption of Industry 4.0, AI, and robotics across manufacturing sectors and increasing investment in smart factories, IoT-enabled automation, and energy-efficient solutions. According to the World Robotics 2024 Report released by the International Federation of Robotics, Europe has a robot density of 219 units per 10,000 employees, which reflects an increase of 5.2%. This reflects the region’s focus on automation and smart manufacturing demand leading to a rise in automation components.

Germany is expanding its automation components market due to its strong focus on Industry 4.0, smart manufacturing, and AI-driven automation. The demand is rising as industries adopt robotics, IoT-enabled systems, and predictive maintenance to enhance efficiency and reduce costs. Government support, labour shortages, and the need for energy-efficient solutions are further driving automation adoption. Additionally, Germany’s role in automotive, electronics, and machinery manufacturing is accelerating the need for advanced automation technologies. As Europe’s largest industrial robot user, Germany has over 28,355 operational robots in the automobile and manufacturing sectors.

The UK automation components market is growing due to the increasing adoption of AI-driven robotics, industrial IoT, and smart manufacturing solutions. The demand for automation is rising as businesses seek to counter labour shortages, boost productivity, and improve supply chain functions. Further, government initiatives, including the Made Smarter Programme, are accelerating digital transformation in the automotive, aerospace, and logistics industries. This programme, launched in 2019, funds businesses and researchers to enable manufacturers to develop a resilient, more productive, and environmentally sustainable UK. The push for net-zero targets is driving investment in energy-efficient automation technologies.

Asia Pacific Market Insights

Asia Pacific is anticipated to garner a remarkable automation components market share from 2026 to 2035 due to high industrial growth, rising wages, and increasing factory automation. Countries such as China, Japan, South Korea, and India are investing heavily in smart manufacturing, robotics, and AI-powered automation to stay competitive. The demand is growing due to the need for mass production, improved quality control, and reduced reliance on manual labor. Additionally, government initiatives, rapid urbanization, and the rise of e-commerce are accelerating automation adoption across industries.

The automation components market in China is driven by the country’s push for self-sufficiency in technology and advanced manufacturing capabilities. Government initiatives like Made in China 2025 are accelerating automation adoption, especially in semiconductor, automotive, and electronics manufacturing. Additionally, the country’s focus on smart factories and localized supply chains is fuelling the need for high-tech automation components. According to IFR Report 2024, China is the world´s largest market, with 276,288 industrial robots installed in 2023, representing 51% of the installations worldwide. The demand is rising as industries adopt robotics, AI-driven automation, and industrial IoT to overcome high labor costs and maintain global competition.

The automation components market in India is poised to rise due to rapid industrialization, infrastructure growth, and digital transformation across key sectors. As India is the fastest-growing emerging economy in Asia Pacific, the total robot installations in 2023 increased by 59%, accounting for 8,510 units. The demand for automation components is rising as businesses embrace robotics, AI, and IoT-driven technologies to enhance efficiency and reduce reliance on manual labor.

Automation Components Market Players:

- Siemens AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent developments

- Regional Presence

- SWOT Analysis

- ABB Ltd

- Rockwell Automation, Inc.

- Emerson Electric Co.

- Honeywell International Inc.

- General Electric Company

- Bosch Rexroth AG

- Parker Hannifin Corporation

- Schneider Electric SE

The automation components market is highly competitive as key players focus on innovation, product reliability, and integration with industry 4.0 technologies. Top companies are investing in R&D to enhance efficiency, reduce downtime, and meet evolving industrial demands. Given below are some leading players dominating the automation components market:

Recent Developments

- In April 2024, Rockwell Automation launched new centralized motor control solutions at Hannover Messe 2024. The new FLEXLINE 3500 motor control delivers real-time data that helps manufacturers increase productivity and save energy.

- In December 2023, DwyerOmega acquired Automation Components, Inc., further extending DwyerOmega's sensor and instrumentation expertise in the building automation and environmental markets.

- Report ID: 7326

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automation Components Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.