Automatic Transfer Switch Market Outlook:

Automatic Transfer Switch Market size was valued at USD 946.55 million in 2025 and is expected to reach USD 2.5 billion by 2035, registering around 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automatic transfer switch is evaluated at USD 1.03 billion.

The rapid industrial and urban activities across the world are augmenting the high demand for seamless energy systems including automatic transfer switches (ATS). For instance, the United Nations Industrial Development Organization (UNIDO) revealed that in 2023, the industrial sector held 21.3% of the global economy, while the manufacturing sector added a USD 15.5 trillion valuation. The same source also estimates that the industrial sector has major direct and indirect links with all sustainable development goals.

|

Region |

Value Addition of Manufacturing to the Industrial Sector |

|

Asia |

81.0% |

|

Europe |

80.8% |

|

North America |

77.5% |

|

Latin America and the Caribbean |

72.4% |

|

Sub-Saharan Africa |

55.7% |

Source: International Yearbook of Industrial Statistics 2024

Infrastructure development projects such as smart cities also highly employ automatic transfer switches for uninterrupted power supply. The analysis by the Organisation for Economic Co-operation and Development (OECD) estimates that the global smart city market is set to increase from USD 511.6 billion in 2022 to USD 1024.0 billion by 2027. Furthermore, the increasing growth in the adoption of renewable energy systems is fueling the sales of ATS technologies as they offer effective integration between grid power and backup generation.

Eaton Corporation one the leading producer of automatic transfer switches totaled revenue worth USD 23.2 billion in 2023. This revenue growth is entirely driven by organic sales and recorded a 12% hike from the previous year. Furthermore, sustainable solutions amounted to 71% of the total sales. In 2023, Electrical Americas and Electrical Global accounted for 25% of net sales made to 7 large end users.

Key Automatic Transfer Switch Market Insights Summary:

Regional Highlights:

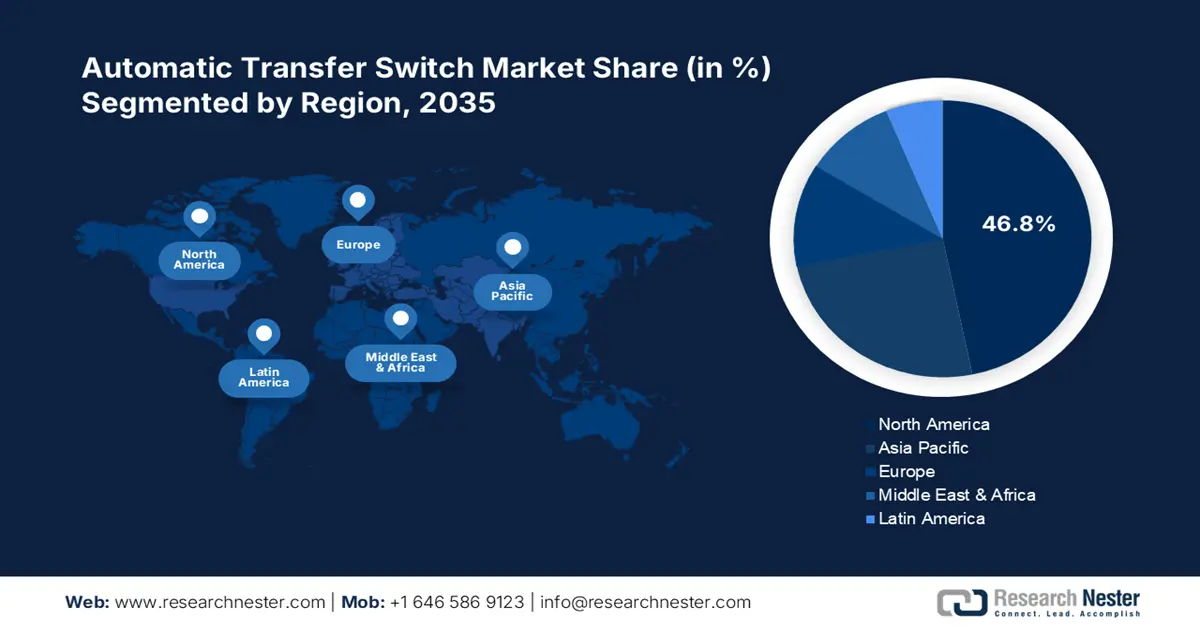

- North America leads the Automatic Transfer Switch Market with a 46.8% share, propelled by data center demand, smart homes, and telecom expansion, ensuring strong growth through 2026–2035.

- The Asia Pacific Automatic Transfer Switch Market is anticipated to achieve the fastest CAGR by 2035, attributed to industrialization, connected technologies, and urban infrastructure upgrades.

Segment Insights:

- The Residential segment is projected to capture over 37% market share by 2035, driven by smart home adoption and hybrid work models requiring continuous power supply.

- The contactor segment of the Automatic Transfer Switch Market is anticipated to maintain a dominating share from 2026-2035, fueled by rising automation and demand for seamless, safe switching solutions.

Key Growth Trends:

- Increasing use in critical infrastructures

- Compact ATS gaining traction

Major Challenges:

- Strict and time-consuming regulatory procedures

- Competition from alternatives

- Key Players: Eaton Corporation, SOCOMEC Group S.A., Siemens AG, Cummins Inc., and Schneider Electric.

Global Automatic Transfer Switch Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 946.55 million

- 2026 Market Size: USD 1.03 billion

- Projected Market Size: USD 2.5 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Automatic Transfer Switch Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing use in critical infrastructures: Critical infrastructure facilities such as healthcare facilities, data centers, telecoms, and IT are significantly augmenting the demand for automatic transfer switches. These businesses are heavily dependent on a seamless power supply to run their daily operations. Thus, automatic transfer switches integrated with advanced technologies such as IoT sensors, artificial intelligence, machine learning, and cloud computing are exhibiting high adoption in automatic transfer switch market. The U.S., Germany, and the U.K. had the largest presence of data centers 5381, 521, and 514, respectively, in Q1 FY24.

- Compact ATS gaining traction: The miniaturization trend is set to augment the automatic transfer switch market growth in the coming years. To grab opportunities from this trend, many manufacturers are investing heavily in research and development activities to introduce compact automatic transfer switches (ATS) with enhanced efficiency. Smaller ATS are gaining widespread applications in the residential sector owing to premium space prices. For instance, in September 2024, SOCOMEC Group S.A. announced the launch of compact automatic transfer switches in India. This latest innovation ATyS a M pre-programmed automatic transfer switching equipment (ATSE) is majorly targeting residential and commercial sectors such as luxury residential complexes, high-rise buildings, and healthcare facilities.

Challenges

-

Strict and time-consuming regulatory procedures: The strict, long, and complex regulatory approval procedures are prime challenges for the sales of automatic transfer switches. To sustain in the competitive landscape, new product launches on time are profitable moves for key players. Time-consuming processes often deter manufacturers from trending opportunities leading to huge profit losses.

- Competition from alternatives: The competition from other technologies such as interlock kits and uninterruptible power supply systems hinders the demand for automatic transfer switches to some extent. The increasing popularity of alternative technologies coupled with cost-effectiveness influences end users to invest in them. Thus, a lack of marketing and competitive pricing strategies is anticipated to hamper the sales of automatic transfer switches in the coming years.

Automatic Transfer Switch Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 946.55 million |

|

Forecast Year Market Size (2035) |

USD 2.5 billion |

|

Regional Scope |

|

Automatic Transfer Switch Market Segmentation:

Switching Mechanism (Contactor, Circuit)

The contactor segment in automatic transfer switch market is foreseen to capture a dominating share throughout the forecast period. The efficient, safe, and reliable switching between power sources is augmenting the sales of contactors. The rising automation trend is pushing the demand for ATS with modern contactors. The commercial and industrial sectors are prime end users of ATS contactors as they are highly dependent on continuous and seamless power connections. Manufacturers are earning high profits from this segment by introducing innovative contactors. For instance, in September 2024, the Schaltbau Group announced the expansion of its high-power contactor portfolio at InnoTrans 24. The CP Series of high-power traction contactors with robust design offers optimal performance under heavy load conditions.

End use (Residential, Commercial, Industrial)

In automatic transfer switch market, residential segment is poised to capture over 37% revenue share by 2035. The smart home trend is augmenting the use of backup generators, which is directly increasing the demand for automatic transfer switches. Furthermore, the hybrid and remote working trends are increasing the need for continuous power supply, which is directly fueling the sales of generators and automatic transfer switches. As per the survey conducted between April to June 2024 by the Office for National Statistics, around 29% of the U.K. individuals above 30 years of age were following hybrid working models.

Our in-depth analysis of the global automatic transfer switch market includes the following segments:

|

Switching Mechanism |

|

|

Transition Mode |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automatic Transfer Switch Market Regional Analysis:

North America Market Forecast

North America automatic transfer switch market is expected to dominate revenue share of over 46.8% by 2035. The strong presence of data centers & telecom industry, high energy demand, automation trends, and the existence of key players are fueling the sales of automatic transfer switches. The high adoption of smart home ecosystems is directly augmenting the demand for automatic transfer switches, both in the U.S. and Canada.

In the U.S., the rapidly expanding data center facilities are fueling the sales of automatic transfer switches. The growth in new network infrastructure programs is generating lucrative opportunities for automatic transfer switch market. The U.S. Department of Agency estimates that the data centers account for 2.0% of total energy consumption. The same source also reveals that with the rise in information technology use, the data center and server energy is anticipated to grow.

In Canada, the rising adoption of renewable energy sources such as solar, wind, and hydroelectricity is augmenting the demand for automatic transfer switches. The efficiency of these technologies in switching between grid and renewable power sources is uplifting their sales growth. For instance, the Canadian Centre for Energy Information reveals that around 70% of power is sourced from renewable solutions. The country’s 62% of electricity is sourced from hydroelectric technologies.

Asia Pacific Market Statistics

The Asia Pacific automatic transfer switch market is projected to expand at the fastest CAGR throughout the study period. Rapid industrialization, expansion of advanced wireless communication networks, and high adoption of connected technologies in both residential and industrial sectors are pushing the demand for automatic transfer switches. The rise in urban and industrial activities is the prime factor contributing to the sales of automatic transfer switches in China and India. The infrastructure development and upgrade projects are boosting the profits of automatic transfer switch market in Japan and South Korea.

In China, the swift expansion of industrial activities is directly influencing the sales of automatic transfer switches. For instance, in November 2024, the State Council of China revealed that the country’s industrial output expanded by 5.3% YoY in Q4 FY24. The increasing adoption of high-tech manufacturing technologies is driving high energy demand, leading to the growing adoption of automatic transfer switches.

In India, the rising expansion of IT and telecom companies is driving high electricity demand, which is further fueling the sales of generators and automatic transfer switches. The India Brand Equity Foundation (IBEF) report reveals that in the Union Budget 2024-2025 around USD 13.98 billion was allocated for the IT & telecom sector. The country is the 2nd largest market for telecommunications. In the second quarter of FY 24, the wireless subscriber base reached 1,168.95 million.

Key Automatic Transfer Switch Market Players:

- Eaton Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SOCOMEC Group S.A.

- Siemens AG

- Cummins Inc.

- Schneider Electric

- ABB Ltd.

- Generac Power Systems

- General Electric

- Schaltbau Group

- AEG Power Solutions

- Briggs & Stratton Corporation

- Caterpillar Inc.

- Kohler Co.

Leading companies in the automatic transfer switch market are employing various organic and inorganic tactics to uplift their position in the global landscape. New product launches, investments in research and development activities, strategic collaborations & partnerships, mergers & acquisitions, and global expansion are some of the tactics boosting the revenue shares of key market players. Eaton Corporation calculated revenues worth USD 23.3 billion all organically in 2023. Organic marketing is playing a vital role in the enhancement of a company’s position in the global landscape.

Some of the key players in automatic transfer switch market:

Recent Developments

- In June 2024, Nature's Generator introduced first, a 125-amp 24-space / 48-circuit automatic transfer switch (ATS). This ATS solution is compatible with the company’s generators as well as most of the other solar generators.

- In January 2024, Projoy Electric Co., Ltd. announced the launch of the PROJOY CB Class automatic transfer switch. This switch is a perfect match for critical operations power systems, legally required systems, emergency systems, and optional standby systems.

- Report ID: 6934

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automatic Transfer Switch Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.