Automatic High Beam Control Market Outlook:

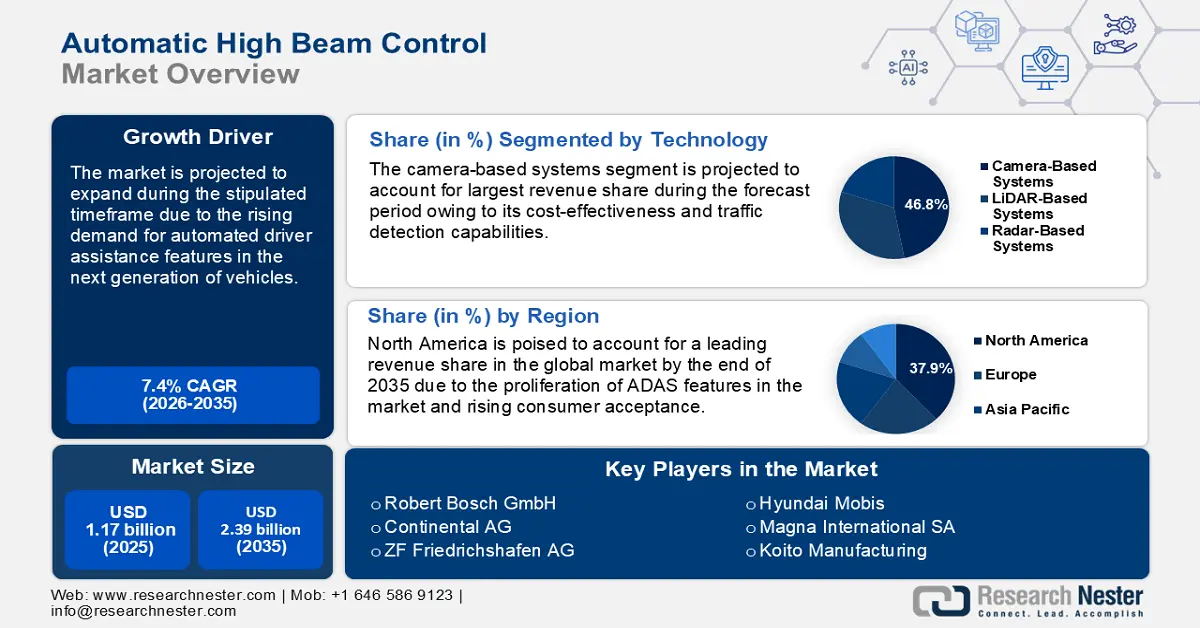

Automatic High Beam Control Market size was over USD 1.17 billion in 2025 and is poised to exceed USD 2.39 billion by 2035, growing at over 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automatic high beam control is estimated at USD 1.25 billion.

The automatic high beam control market’s growth is attributed to rapid advancements in automotive lighting technology and stringent vehicle safety regulations. Automatic high beam control systems improve driving safety by adjusting headlight intensity based on traffic conditions. The system solves the pain point of high glares and reduced visibility which bodes well for a steady rise in demand. Furthermore, the market’s growth correlates with the rising sophistication of vehicles which is poised to bolster the integration of intelligent lighting systems as a standard feature in automobiles. The table below highlights road traffic injuries statistics released by the World Health Organization (WHO).

Road Traffic Injuries Statistics

|

Particulars |

Details |

|

Road Traffic Casualties |

Approximately 1.19 million deaths per year |

|

Road Traffic Crashes Cost |

3% of GDP of most countries is spent on road crashes |

|

Fatality Percentage |

92% of the world’s fatalities occur in middle-to-low-income countries with 60% of the world’s vehicles in these countries |

Source: WHO

The WHO report highlights the financial impact that road crashes have on a country’s economy unless stringent measures are adopted to mitigate them. Moreover, the WHO report identifies unsafe vehicles as a leading cause of crashes. To address these concerns, automatic high beam control solutions are poised to expand their market penetration by offering robust safety solutions. The table below highlights accidents caused by the glare of high beams as per a report published in February 2022 in the International Journal of Environmental Research and Public Health.

Statistics Related to Glare-Related Accidents and Glare Screen Guidelines

|

Particulars |

Details |

|

Accidents in the U.S. |

12% to 15% of all traffic accidents are caused due to glare from high-beam highlights |

|

China’s Anti-Glare Standard |

The height of the anti-glare facility should not exceed 2 m |

|

India’s Anti-Glare Standard |

The height of a glare-reduction device should be set at 1.4–1.5 m |

Source: International Journal of Environmental Research and Public Health

The study highlights the adverse impact of high glare and the need to have an effective management solution for high beams on roads to protect drivers and reduce accidents. Furthermore, the market’s growth is bolstered by the proliferation of advanced driver assistance systems (ADAS). Collaborations between component manufacturers, software developers, and automotive OEMs are strengthening the supply chain for ADAS which is beneficial for the growth of the automatic high beam control market.

Furthermore, the market analysis forecasts rife investment opportunities in regions with stringent vehicle safety regulations and a growing consumer preference for safer vehicles. Moreover, businesses offering specialization in sensor technologies, machine learning algorithms, and adaptive lighting solutions are offering lucrative investment opportunities as critical components of the automatic high beam control systems market. By capitalizing on the favorable trends, the global market is poised to maintain its robust growth by the end of 2037.

Key Automatic High Beam Control Market Insights Summary:

Regional Highlights:

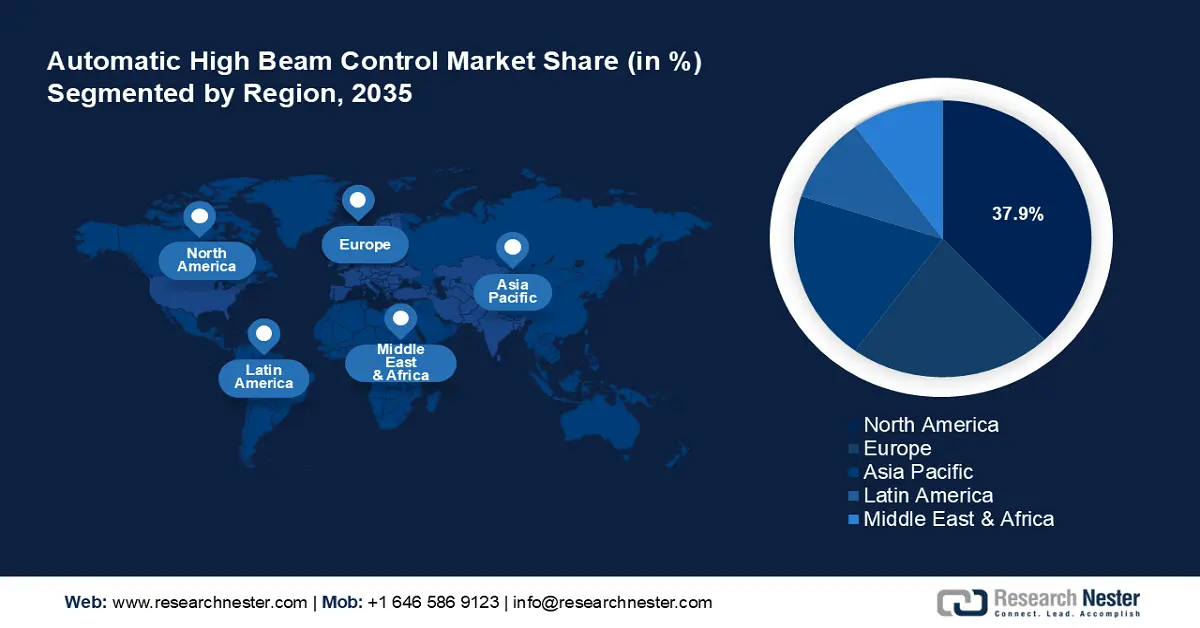

- North America dominates the Automatic High Beam Control Market with a 37.9% share, driven by rapid adoption of ADAS in vehicles and rising consumer awareness of automated beam control solutions, fueling growth through 2035.

Segment Insights:

- The OEM segment is expected to experience rapid growth from 2026 to 2035, fueled by the rapid integration of ADAS during vehicle production, ensuring seamless incorporation of automatic high beam control systems.

- Camera-based systems segment are projected to capture a 48.6% share by 2035, driven by their cost-effectiveness and advanced capabilities in detecting ambient light and traffic conditions.

Key Growth Trends:

- Rising demand for improved night driving safety

- Technological advancements in sensor integration

Major Challenges:

- Regulatory variations across regions

- Fluctuations in consumer trust

- Key Players: Robert Bosch GmbH, Continental AG, Denso Corporation, Valeo SA, ZF Friedrichshafen AG, Magna International Inc., HELLA GmbH & Co. KgaA, Aptiv PLC, Hyundai Mobis, Stanley Electric, Gentex, Koito Manufacturing, Texas Instruments Incorporated.

Global Automatic High Beam Control Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.17 billion

- 2026 Market Size: USD 1.25 billion

- Projected Market Size: USD 2.39 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, Japan, United States, China, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Automatic High Beam Control Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for improved night driving safety: Consumer awareness regarding nighttime driving safety has heightened over the years. The rising awareness has bolstered the demand for technologies that improve visibility and safety. For instance, a report by the Consumer Federation of America highlights that safer cars sell better than automobiles with questionable safety certifications. Moreover, nighttime accidents are a major cause of injuries and fatalities with the National Highway Traffic Safety Administration (NHTSA) reporting that nearly 50% of all fatal car accidents occur at night. The trends highlight robust opportunities for the integration of automatic high beam control in the next generation of vehicles.

- Technological advancements in sensor integration: The recent developments in sensor technologies, such as cameras and LiDAR have improved the accuracy and responsiveness of automatic high beam control systems. The advancements enable more precise detection of surrounding vehicles and ambient light conditions leading to optimal adjustment of headlights. The table below highlights two recent advancements in automotive-grade sensors for ADAS.

|

Date |

Particulars |

|

December 2024 |

Aeva announced participation in CES 2025 to demonstrate a new long-range high-resolution 4D LiDAR sensor for automotive applications. |

|

November 2024 |

NOVOSENSE Microelectronics and Continental Automotive Technologies announced collaboration on the development of automotive-grade sensors to advance safety in-vehicle systems. |

The advancements bode well for the integration of automatic high beam control systems in the next generation of vehicle production.

- Increased availability in mid-range vehicles: The automatic high beam control solutions were initially integrated into luxury vehicles but the rising integration in mid-range cars made the technology accessible to a broader consumer base. The expansion in accessibility expands the revenue share of manufacturers. The trend is expanding the market reach and contributing to the widespread adoption of automatic high beam control systems. The table below highlights the penetration rate of ADAS from 2015 to 2023, indicating a surge in the adoption of vehicle safety technologies which augurs well for the automatic high beam control market.

Penetration Rates from 2015 to 2023

|

Particulars |

Details |

|

Automatic High Beam Penetration Rate in 2023 |

90% |

|

Automatic High Beam Penetration Rate |

7.5% in model year 2015 to 89.8% in model year 2023 |

Source: Mitre Corporation

The rising automatic high beam penetration rates in vehicle models are poised to ensure the market’s steady growth with the calls for automatic beam control heightening in the backdrop of the proliferation of increased vehicle automated solutions.

Challenges

- Regulatory variations across regions: The variations in anti-glare standards in different regions can be challenging for the manufacturers. Despite adaptive driving beam highlights being utilized in Asia and Europe for over a decade, the adoption in the U.S. was delayed due to the stringent NHTSA standards. Moreover, the U.S. regulations demand stricter glare control and response times, necessitating redesigns by manufacturers. The disparity in standards can delay the introduction of new technologies in automatic high beam control market.

- Fluctuations in consumer trust: Despite the proven safety benefits of automatic high beam systems, a certain percentage of drivers in emerging economies are hesitant to adopt the technology owing to lack of trust. A study by the Insurance Institute for Highway Safety (IIHS) highlights that more than 40% of drivers acknowledged automatic high beam assist as a vital safety feature in cars and while the percentage is growing over the years, the number is still concerning in emerging markets where drivers still rely overtly on manual systems. The skepticism can negatively impact market penetration.

Automatic High Beam Control Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 1.17 billion |

|

Forecast Year Market Size (2035) |

USD 2.39 billion |

|

Regional Scope |

|

Automatic High Beam Control Market Segmentation:

Technology (Camera-Based Systems, LiDAR-Based Systems, Radar-Based Systems)

The camera-based systems segment is estimated to dominate automatic high beam control market share of over 48.6% by 2035. The cost-effectiveness and advanced capabilities in detecting ongoing traffic in ambient light conditions benefit the segment’s growth. Moreover, the integration of camera-based high beam assist features in modern vehicles, such as those offered by Ford’s Co-Pilot360 technology highlights the industry’s commitment to improve driver assistance systems. Moreover, regulatory push for improved driver safety, such as the Euro NCAP’s 2025 Roadmap, focuses on the use of advanced technology to improve passenger car safety.

The LiDAR-based systems segment is poised to account for the second-largest revenue share in the automatic high beam control market. LiDAR-based systems offer superior accuracy in distance measurement and object detection in low-visibility conditions. Unlike camera-based systems, LiDAR uses laser pulses to create detailed 3D maps of the surroundings enabling reliable beam control in challenging scenarios. Furthermore, the proliferation of Level 3+ autonomy in vehicles is poised to be a major factor in the adoption of LiDAR-based systems in automatic high beam control sensing.

Sales Channel (OEM, Aftermarket)

The OEM segment of the automatic high beam control market is likely to register a rapid growth throughout the stipulated timeframe. The rapid integration of ADAS during vehicle production is a major driver of the segment’s profitability. The integration ensures that automatic high beam control systems are seamlessly incorporated into the vehicle’s design, offering consumers improved safety features and negating added costs in the aftermarket. The Mitre Corporation reported more than 90% of ADAS features penetration rate by model year 2023 in the U.S. market based on manufacturers data on more than 90 million vehicles and 169 models from 2015 to 2023. The growing adoption rates bode well for OEM to remain the largest sales channel for automatic high beam control with automotive manufacturers able to invest in marketing new models with the feature as an added advantage over competitors.

Our in-depth analysis of the global automatic high beam control market includes the following segments:

|

Technology |

|

|

Sales Channel |

|

|

Vehicle Type |

|

|

Functionality |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automatic High Beam Control Market Regional Analysis:

North America Market Forecast

By 2035, North America automatic high beam control market is set to capture over 37.9% revenue share. The market’s dominance is attributed to the rapid adoption of ADAS in vehicles and rising awareness among consumers regarding the efficacy of automated beam control solutions. Additionally, North America has a vast network of highways where visibility is a challenge at nighttime, and the rising number of road accidents in the U.S. and Canada during nighttime driving has created a pain point that automatic high beam control systems can address. In February 2022, a study published in MDPI highlighted that half of the fatal accidents in the U.S. occurred at night, which creates opportunities for greater adoption of automatic high beam control features in vehicles.

The U.S. automatic high beam control market is poised to expand during the stipulated timeframe. The market in the U.S. is characterized by federal and state-level safety regulations and innovations in automotive automation. The NHTSA has actively promoted greater adoption of ADAS technology to prevent road accidents. Moreover, In January 2021, the Association for the Advancement in Automotive Medicine reported that half of the road crash fatalities in the U.S. occurred at nighttime. To mitigate the impact of low visibility during nighttime driving, vehicles integrated with automatic high beam control systems in the U.S. provide lucrative opportunities to bolster sales. Furthermore, the U.S. automotive industry has gradually shifted towards autonomous and electric vehicles, creating ample opportunities in the market.

The Canada automatic high beam control market is projected to register robust growth during the stipulated timeframe. The country’s rapid adoption of automotive technologies is a key driver of growth. Transport Canada’s commitment to reducing traffic facilities, particularly in rural and northern regions of the country with limited lighting infrastructure creates ripe opportunities for the aftermarket demand for automatic high beam control systems. Furthermore, the surging popularity of SUVs and pickup trucks in the country equipped with automated high beam control systems as standard or optional features highlights the profitability of the domestic market.

Europe Market Forecast

The Europe automatic high beam control market is poised to expand during the stipulated timeline of the market’s analysis. The Euro NCAP 2025 roadmap highlights the focus on using advanced technology to improve safety and provide automated driving assessment creating ample opportunities for the manufacturers of automatic high beam control solutions. A key facet of the market is the high awareness of consumers regarding road safety which incentivizes OEMs to integrate automatic high beam control systems into newer models and promote the feature to a wide consumer base favorable to enhanced safety in vehicles.

The Germany automatic high beam control market is poised to exhibit robust growth throughout the forecast period. The country’s leadership in the manufacturing of premium vehicle and its commitment to road safety are the cornerstones of the domestic market. German automakers such as BMW, Mercedes-Benz, and Audi are pioneers in integrating automated high beam control in their vehicles, often combining it with advanced ADAS features such as lane-keeping assist. Moreover, the government’s push to reduce fatalities in the Autobahn has created opportunities for further integration of the AHBC systems. The German Federal Ministry for Digital and Transport Affairs (BMDV) published a strategy for Autonomous Driving in Road Traffic in a bid to establish the country as a leader in autonomous vehicle production. The trends reflect a supportive regulatory ecosystem which bodes well for the integration of AHBC systems as an additional ADAS features in vehicles sold and manufactured in Germany.

The France automatic high beam control market is estimated to expand during the stipulated timeframe. The market is supported by the country’s emphasis on road safety characterized by the rising adoption of ADAS features. The Vision Zero initiative aiming to eliminate road fatalities is favorable to the integration of AHBC systems in the new generation of vehicle models. Furthermore, the EV penetration in France offers opportunities for ABHC systems manufacturers to expand their revenue shares.

Key Automatic High Beam Control Market Players:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental AG

- Denso Corporation

- Valeo SA

- ZF Friedrichshafen AG

- Magna International Inc.

- HELLA GmbH & Co. KgaA

- Aptiv PLC

- Hyundai Mobis

- Stanley Electric

- Gentex

- Koito Manufacturing

- Texas Instruments Incorporated

The automatic high beam control market is poised to expand during the forecast period. The key players in the sector are investing in R&D to improve AHBC's performance in low-visibility conditions. The integration of artificial intelligence (AI) and machine learning algorithms in camera and LiDAR-based systems is poised to improve the scope of the solutions. Additionally, cost-optimization will make AHBC systems more accessible for mid-range and economy vehicles. Here are some key players in the automatic high beam control market:

Recent Developments

- In April 2024, Luminar achieved the global start of production for Volvo Cars and began delivering production LiDAR sensors for the Volvo EX90. The announcement kicks off the conversion of nearly $4 Billion Order Book to revenue.

- In March 2024, Stellantis Ventures announced an investment in SteerLight, the developer of cost-effective LiDAR technology for advanced driver assistance systems. The SteerLight LiDAR senses the surrounding environment in three dimensions with higher resolution and precision, and at a lower volume production cost

- Report ID: 7215

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automatic High Beam Control Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.