Automated Sample Storage Systems Market Outlook:

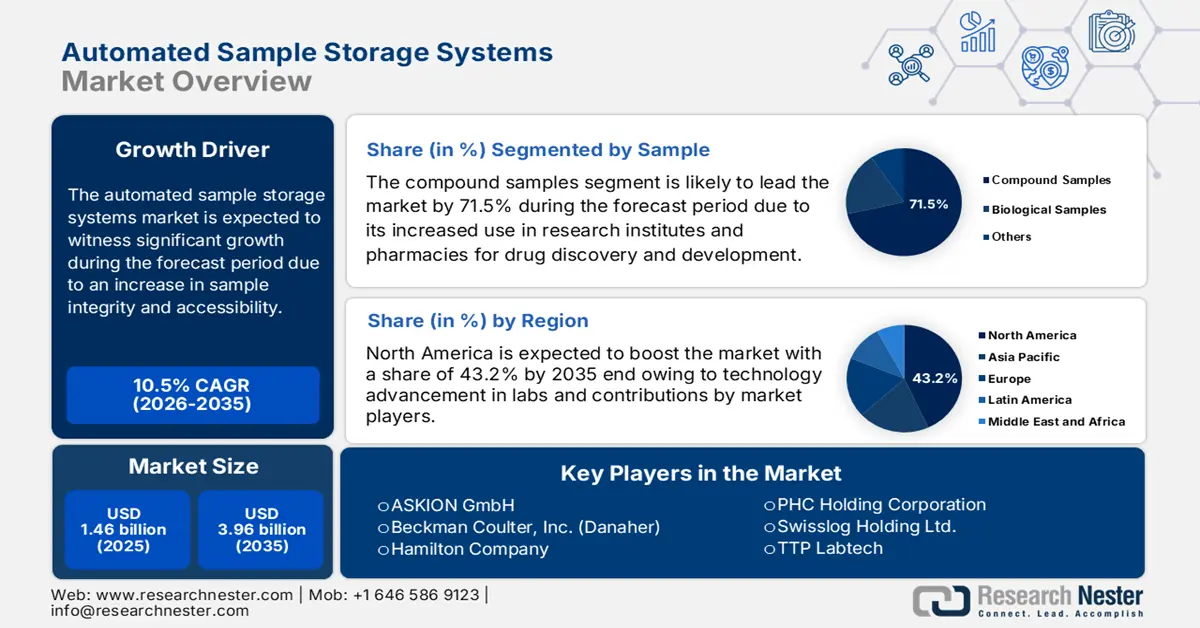

Automated Sample Storage Systems Market size was over USD 1.46 billion in 2025 and is anticipated to cross USD 3.96 billion by 2035, witnessing more than 10.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automated sample storage systems is assessed at USD 1.6 billion.

The efficiency and protection of samples are pivotal aspects in the case of laboratory activities, determined to positively impact the demand for the automated sample storage systems market. Besides, the implementation of a smart inventory management system for medicine management in a hospital supply chain (HSC) is one of the best solutions, as stated by a Computers & Industrial Engineering study in May 2024. HSC has its advantages ensuring the availability of affordable drugs as well as inventory cost reduction.

Moreover, automation in the form of artificial intelligence in healthcare is amplifying the growth of the automated sample storage systems market. As per an analytical study by NLM in December 2022, the payer’s pricing of the AI-based diagnosis method was USD 500 per hour, and its cost-saving in the first year was projected to be USD 1,666.6 per day per hospital and USD 17,881 per hospital for the upcoming ten years. Meanwhile, the model treatment price was USD 1,000 per hour with cost savings of USD 21,666.6 for the first year and USD 289,634.8 per day per hospital for ten years. Therefore, the use of automation in healthcare is cost-effective, thereby boosting the market.

Key Automated Sample Storage Systems Market Insights Summary:

Regional Highlights:

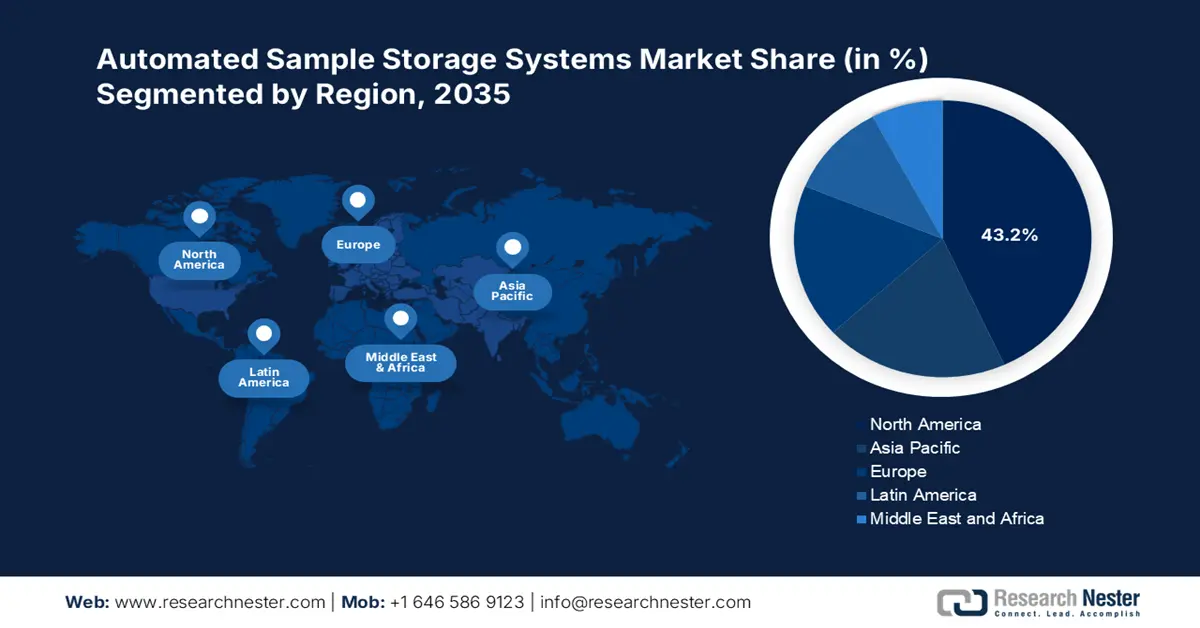

- North America holds a 43.2% share in the Automated Sample Storage Systems Market, fueled by accessibility of automated laboratory solutions and research laboratory automation, driving robust growth by 2035.

- Asia Pacific’s automated sample storage systems market is set for rapid growth by 2035, driven by increase in patients and disease prevalence requiring effective storage systems.

Segment Insights:

- The Compound Samples segment of the Automated Sample Storage Systems Market is expected to secure more than 71.5% share by 2035, driven by increased demand from academic research institutes and biobanks.

- The automated compound storage system segment of the Automated Sample Storage Systems Market is expected to capture more than 56.3% share by 2035, fueled by automation ensuring precision and enhanced accessibility of high-quality samples.

Key Growth Trends:

- Enormous investments

- Rise in demand for digital devices

Major Challenges:

- Huge cost of sample storage

- Poor flexibility for workers

Key Players: ASKION GmbH, Hier Biomedical, MICRONIC, LiCONiC AG, SPT Labtech Ltd.

Global Automated Sample Storage Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.46 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 3.96 billion by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Automated Sample Storage Systems Market Growth Drivers and Challenges:

Growth Drivers

-

Enormous investments: The funding provision for storage facilities is set to bolster the automated sample storage systems market. As per the 2022 IFPMA report, the biopharmaceutical sector has invested the most in research and development with an approximate expense of USD 198 million. In addition, the yearly spending by the sector accounts for 8.1 times more than the defense and aerospace sectors, over 7.2 times the chemical sector, and 1.2 times more than the computer services and software sectors. Hence, the implementation of huge investments is poised to expand the automated sample storage systems market growth.

Biopharmaceutical Industry R&D Investments

|

Investment Factors |

Billion/Percentage/Million |

|

1-year change |

10.0% |

|

Net sales |

€1,043.9 billion (USD 1,089.1 billion) |

|

R&D intensity |

15.4% |

|

Operating profits |

€143.1 billion (USD 149.2 billion) |

|

Profitability |

12.8% |

|

Employees |

2.7 million |

Source: IFPMA 2022

- Rise in demand for digital devices: The implementation of digital tools tends to reduce the administrative burden on medical personnel. Besides, as per the January 2025 WeForum Organization report, there is a shortage of health workers globally. In the U.S., the shortage of physicians and nurses is expected to reach 187,000 and 63,000. To combat this, agentic AI is set to assist workers in carrying out high-fidelity activities, which are responsive, adaptable, and dynamic for regular usage. Its combination with current automation technology can streamline administrative tasks, thus a positive outlook for the automated sample storage systems market.

Challenges

-

Huge cost of sample storage: The cost of storage systems is continuously rising due to advancements in technology and process type, which is negatively impacting the growth of the automated sample storage systems market. For instance, the cost of carbon capture and storage (CCS) ranges between CAD 27 to CAD 48/tCO2 (USD 19 to USD 33.7), as stated in the September 2023 IISD Organization report. Such a cost structure is attributed to high design complexity and requires customization to limit the deployment of CCS, thus a restraint for market growth.

-

Poor flexibility for workers: The aspect of complex design and user challenges are limiting the development of the automated sample storage systems market. The storage systems are manufactured in such a way as to respond to defined and specific requirements. Besides, if there are any changes in the demand for stored products, then there will be modifications in storage processes. This modification is usually time-consuming and there is a possibility to negatively affect the system owing to poor adaptability, thus a challenge for the market expansion.

Automated Sample Storage Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 1.46 billion |

|

Forecast Year Market Size (2035) |

USD 3.96 billion |

|

Regional Scope |

|

Automated Sample Storage Systems Market Segmentation:

Sample (Compound Samples, Biological Samples)

Based on the sample, the compound samples segment is predicted to account for automated sample storage systems market share of more than 71.5% by the end of 2035. Its demand is increasing, especially for academic research institutes and biobanks. In January 2022, Hamilton Storage Technologies, Inc., a global manufacturer of automated storage systems for both compound and biological samples, notified the expansion of its Verso® Q50 and Verso Q75 automated sample storage systems to ensure compact storage facilities, and access to reduce manual labor as well as enhance holistic laboratory efficiency, thus an optimistic approach for the market development.

Product (Automated Compound Storage System, Automated Liquid Handling Systems)

In automated sample storage systems market, automated compound storage system segment is expected to account for revenue share of more than 56.3% by the end of 2035. Automation in compound storage systems ensures precision and accuracy for the storage of large sample quantities on a long-term basis. For instance, the Azenta Life Sciences Space Efficient SampleStore is an automated storage system comprising a temperature range from ambient to -20ºC. It is an ideal solution for small sample collections along with the requirement of reliable, easier, and rapid access to high-quality samples, thus uplifting the market growth.

Our in-depth analysis of the global market includes the following segments:

|

Sample |

|

|

Product |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Sample Storage Systems Market Regional Analysis:

North America Market Analysis

North America automated sample storage systems market is poised to account for revenue share of more than 43.2% by the end of 2035. Factors including the accessibility of automated laboratory solutions, adoption of research laboratory automation, and inauguration of newer solutions are driving the market growth. For instance, in January 2025, ABB Robotics and Agilent Technologies signed a collaborative deal to provide automated laboratory solutions for pharmaceutical facilities. The purpose was to ensure laboratory operations transformation by making research and quality control more rapid and efficient.

The U.S. automated sample storage systems market is gaining traction due to the presence of strong refrigeration for sample protection. As per the January 2023 Phys Organization report, researchers at the Department of Energy's Lawrence Berkeley National Laboratory developed ionocaloric cooling to provide effective heating and cooling, utilizing gases along with refrigerant storage capacities. This tends to eliminate the risk of gases escaping into the atmosphere by swapping them with liquid and solid apparatuses. Therefore, refrigeration as an automated storage system is positively impacting the market growth.

The automated sample storage systems market in Canada is witnessing significant growth owing to the launch of CGM devices by key players. For instance, in July 2024, Tandem Diabetes Care, Inc. and Dexcom, Inc. declared the compatibility of slim X2 insulin pump software for both Dexcom G7 and Dexcom G6 CGM devices and is approved for sale by Health Canada. This integration allowed users with control-IQ technology, the topmost automated insulin delivery (AID) system in the country to manage diabetes. Thereby, with such development of medical products, the need for automated storage systems is poised to enhance.

APAC Market Statistics

The automated sample storage systems market in APAC is the fastest-growing region and is expected to observe lucrative growth during the forecast timeline. The increase in number of patients resulting in the prevalence of diseases is the ultimate factor driving the market. As per the forecast analysis by The Lancet Regional Health - Western Pacific in August 2024, crude cardiovascular mortality is projected to increase by 91.2% despite a 23.0% reduction in the age-standardised cardiovascular mortality rate (ASMR). To combat this, calculator tools such as pooled cohort equations (PCE), Framingham risk score (FRS), and systemic coronary risk estimation (SCORE) are used which require effective storage systems for safety.

The automated sample storage systems market in India is expecting substantial growth due to the availability and high adoption of medical devices. As per a study conducted by AdvaMed in February 2022, efforts were initiated to deliver medical technology to 1,300 people in the country, out of which 72% readily use medical devices and 89% are unfamiliar with such equipment. Medical devices such as thermometers, blood pressure monitors, pulse oximeters, blood glucose monitors, and pedometers and weighing scales are highly utilized by the population in the country. Therefore, to preserve these, suitable and standard automated sample storage systems are effectively in huge demand in the country which ensures a positive impact on the market.

The automated sample storage systems market in China is gaining exposure owing to the formation of significant strides in the management of medical services and expansions in public health accessibility. The presence of suitable inventory control, improved ergonomics, and contributions by logistics-based organizations are driving market upliftment. For instance, in September 2023, ESR Group Limited partnered with Chinachem Group to develop a prime cold storage and logistics facility in Kwai Chung. This is estimated to be completed by 2027 to pioneer future logistics, which in turn will positively boost the market in the country.

Key Automated Sample Storage Systems Market Players:

- ASKION GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hier Biomedical

- MICRONIC

- LiCONiC AG

- SPT Labtech Ltd

- MEGAROBO

- Azenta, US, Inc.

- Hamilton Company

- Beckman Coulter, Inc. (Danaher)

- Thermo Fischer Scientific, Inc.

- Oxford Instruments

- B Medical Systems

- Kardex Group

- LabWare

- Swisslog Holding Ltd.

- TSUBAKIMOTO CHAIN CO.

- Biotron Healthcare

- PHC Holding Corporation

- Angelantoni Life Science

- TTP Labtech

- Brooks Automation, Inc.

- Hamilton Company

Companies dominating the automated sample storage systems market are gaining rapid exposure due to the introduction of strategic initiatives to uplift their business avenues globally. For instance, in February 2025, OPEX® Corporation launched significant enhancements for its Infinity® Automated Storage and Retrieval System (AS/RS). It comprises exclusive features with the inclusion of a 15% increase in the system’s storage payload, along with the latest storage slotting capabilities. The purpose is to cater to warehouse automation barriers in omni-channel distribution, store replenishment and e-commerce, and micro-fulfillment, thus driving market growth.

Here's the list of some key players:

Recent Developments

- In January 2025, Azenta, Inc. stated its selection as the technology provider by UK Biocentre to escalate their large-scale sample storage in support of the safeguarding of internationally significant sample collections.

- In May 2024, Hamilton Storage Technologies, Inc. declared the installation of four high-capacity Hamilton BiOS® automated storage systems in UK Biobank’s new Manchester Science Park headquarters.

- Report ID: 7237

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.