Automated Material Handling Equipment Market Outlook:

Automated Material Handling Equipment Market size was over USD 48.06 billion in 2025 and is poised to exceed USD 108.66 billion by 2035, growing at over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automated material handling equipment is estimated at USD 51.74 billion.

The market growth is attributed to the growing need for automation in the manufacturing industry to improve productivity and reduce labor costs. In the manufacturing industry, the production, storage, and movement of the product is crucial and the use of automated material-handling equipment is essential for smooth flow of operation. According to a recent report, in 2020, material handling equipment sales amounted to about 1.75 million units

Key Automated Material Handling Equipment Market Insights Summary:

Regional Highlights:

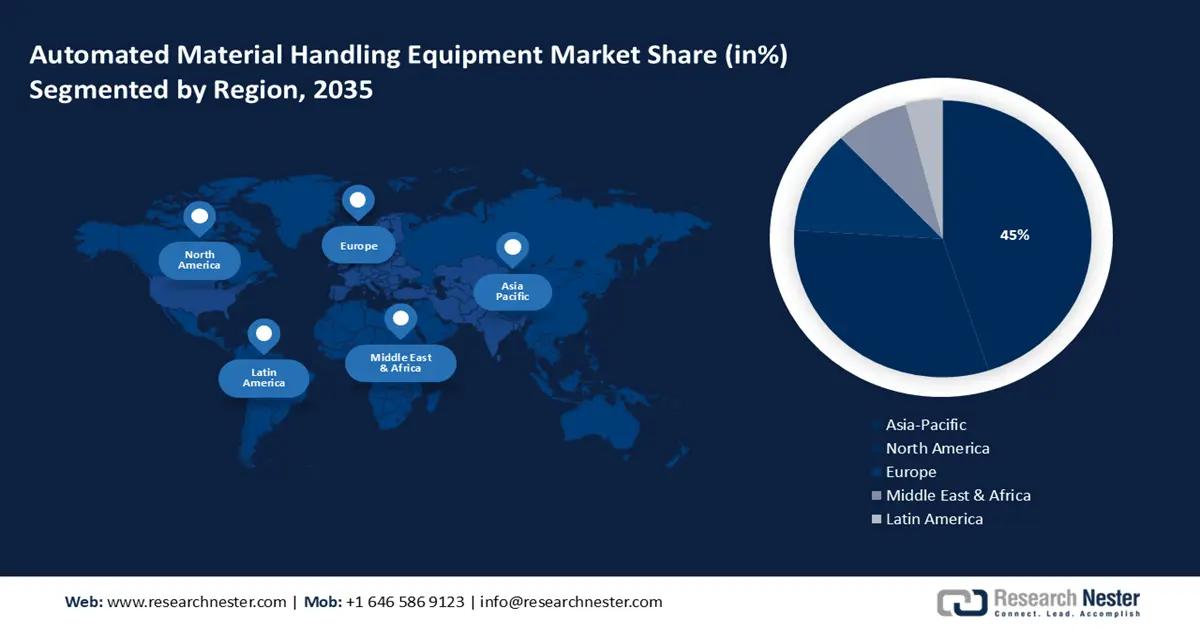

- Asia Pacific automated material handling equipment market will dominate around 45% share by 2035, driven by economic growth and large adoption of automated solutions in various industries.

- North America market will secure the second largest share by 2035, driven by digitalization of supply chains and increasing labor costs stimulating automation.

Segment Insights:

- The hardware segment in the automated material handling equipment market is forecasted to achieve significant growth till 2035, attributed to the widespread use of hardware such as cranes and lifting equipment in various end-use industries.

- The unit load segment in the automated material handling equipment market is expected to capture a 51% share by 2035, attributed to its effective handling, storing, and distribution of products and preventing damage.

Key Growth Trends:

- Integration of IoT devices

- Growth of the e-commerce sector

Major Challenges:

- The high initial installation cost of AMHE

- Technical challenges related to the sensing element

Key Players: Linamar, Crown Equipment Corporation, Fives Group, Cargotec Corporation, TGW Logistics Group, Murata Machinery, Ltd., XCMG Group, Liebherr Group, HAULOTTE Group, Terex Corporation.

Global Automated Material Handling Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 48.06 billion

- 2026 Market Size: USD 51.74 billion

- Projected Market Size: USD 108.66 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Automated Material Handling Equipment Market Growth Drivers and Challenges:

Growth Drivers

- Integration of IoT devices - The integration of IoT devices such as sensors in automated material handling equipment help in assessing the condition and monitoring the performance of the equipment. AMHE with the help of IoT-enabled devices ensures proactive maintenance and collects the performance data such as energy consumption and temperature. This further increases equipment efficiency and reduces downtime and it helps in dealing with potential failures and preparing in advance for the maintenance of AMHE.

Furthermore, IoT-enabled automated material handling equipment is easily monitored remotely from anywhere which boosts the growth. According to a report, there are approximately 15.14 billion connected IoT devices as of 2023. - Growth of the e-commerce sector - The surge in the e-commerce sector has increased the demand for automated material handling equipment to deliver products fast and meet consumers’ expectations. The use of automated material handling equipment ensures efficient product packaging, better storage without any defects, and effective order picking to improve customer experience.

Moreover, the rising trend of online retail boosts the demand for AMHE in warehouse and distribution centers to handle large quantities of orders which further expands the market size of AMHE. According to recent information, US e-commerce sales accounted for 15.4% of total sales in 2023, and 14.7% of total sales in 2022. - Increasing use of AMHE in various industries - The growing demand for automated material handling equipment in various industries such as transportation, food and beverage, and metal & heavy machinery. It enhances the safety and efficiency of material handling operations of various industries which boosts the market growth of automated material handling equipment.

Moreover, the quick delivery of raw materials and tracking of goods in factories and storage facilities have become easy only with the use of automated material handling equipment technology.

Challenges

-

The high initial installation cost of AMHE - The high initial cost of installing, purchasing, and software integration of automated material handling equipment hinders market growth. Moreover, smaller businesses face challenges in adopting AMHE due to their limited finance and it increases extra expenditure on maintenance of AMHE.

-

Technical challenges related to the sensing element - The uncertain technical challenges in AMHE related to the sensing element may stop the entire process and cause interruption. All AMHEs are connected to sensors to operate efficiently and automatically, technical errors in AMHE’s hamper their market growth.

Automated Material Handling Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 48.06 billion |

|

Forecast Year Market Size (2035) |

USD 108.66 billion |

|

Regional Scope |

|

Automated Material Handling Equipment Market Segmentation:

By Component Segment Analysis

Hardware segment is projected to dominate automated material handling equipment market share of over 55% by 2035. The segment growth can be attributed to the widespread use of hardware such as cranes and lifting equipment in various end-use industries such as manufacturing, construction, and automobiles. According to recent information, the use of mobile cranes has increased in recent years in construction sites.

Furthermore, as compared to traditional handling equipment, the continuous handling technology ensures smooth picking and packaging of goods. It also saves labor costs and reduces the delivery time.

By System Segment Analysis

In automated material handling equipment market, unit load segment is likely to dominate revenue share of around 51% by the end of 2035. The segment growth can be attributed to its effective handling, storing, and distribution of products in various areas and load weights easily and also preventing any damage by restricting individual handling.

Moreover, single goods are combined into one unit which further allows for simple transfer. Various consumer goods are stored and shipped as unit loads while handling a single item. Industries are adopting AMHE due to its various benefits of handling several goods together by reducing the overall cost of handling.

Our in-depth analysis of the market includes the following segments:

|

Component |

|

|

System |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Material Handling Equipment Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 45% by 2035. The market growth in the region is also expected on account of the economic growth and the large adoption of automated solutions in various industries due to its advantages.

The rising production due to rapid industrialization in the China has increased the demand for automated material-handling equipment solutions in the electronic and automotive sectors.

The ongoing infrastructural development projects in India such as the construction of airports, bridges, and logistic centers have increased the need for better material handling equipment. According to a recent report, for the financial year 2021, the proportion of infrastructure investments to the GDP was estimated to be nearly 4%. Moreover, the use of AMHE in infrastructural projects facilitates transportation and cargo handling processes which boosts the market growth of AMHE.

North America Market Insights

The North American region will also encounter huge growth for the automated material handling equipment market during the forecast period and will hold the second position owing to the digitalization of supply chain processes by the integration of IoT-enabled AMHE.

In the US, the growing concerns related to rising labor costs and the increasing presence of start-up companies that provide robotic solutions for warehouse automation stimulate the market growth of AMHE. According to a report, labor costs in the United States increased to 119.99 points in the fourth quarter of 2023 from 119.88 points in the third quarter of 2023.

Canada provides solutions for automated factories, warehouses, and storage facilities as it has the availability of many key players who offer automated material handling equipment technology to various industries which further expands the market size of AMHE.

Automated Material Handling Equipment Market Players:

- Linamar

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Crown Equipment Corporation

- Fives Group

- Cargotec Corporation

- TGW Logistics Group

- Murata Machinery, Ltd.

- XCMG Group

- Liebherr Group

- HAULOTTE Group

- Terex Corporation

The various key players in the automated material handling equipment market are Linamar, Fives Group, XCMG Group, Terex Corporation, and Cargotec Corporation among others.

Recent Developments

- Crown Equipment Corporation - Crown Equipment Corporation, a leader in material handling equipment, launched the new C-DX series IC Counterbalance Pneumatic Forklift. It is cost-effective and provides better performance in various industrial applications. This series comes with reliable safety features and enhanced visibility. The C-DX series features have resulted in diesel engine lift trucks that are comfortable to use in various ranges of environments. The series is available in the capacity range of 2,000 to 3,000 kilograms.

- Murata Machinery, Ltd. - Murata has introduced the world’s smallest High-Q 100 MLCC for consumer electronics and industrial equipment. Murata has developed GJM022 series with a size of 0.4 mm into 0.2mm LW which enables electronic engineers to overcome packaging limitations. Furthermore, the GJM022 series is a preferred choice for a variety of applications such as DC cutting applications within RF modules for base stations. The company has created an advanced capacitor that does not compromise performance.

- Report ID: 6120

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automated Material Handling Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.