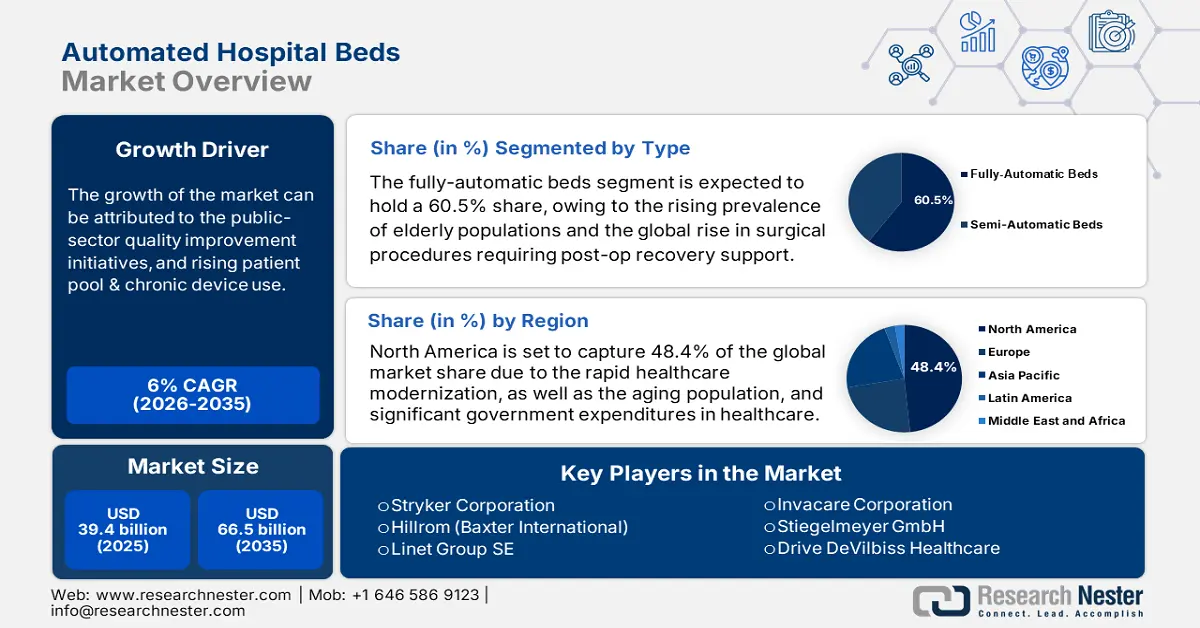

Automated Hospital Beds Market Outlook:

Automated Hospital Beds Market size was valued at USD 39.4 billion in 2025 and is projected to reach USD 66.5 billion by the end of 2035, rising at a CAGR of 6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automated hospital beds is evaluated at USD 41.7 billion.

The primary patient pools of the automated hospital beds market contain geriatric and chronically ill populations worldwide. Particularly, the growing number of hospitalizations due to chronic obstructive pulmonary disease (COPD) and heart failure is creating an urgent need to expand healthcare infrastructure, hence increasing demand in this sector. Besides, rapidly aging demographics across the globe are also contributing to the increasing demand for hospital equipment, including beds. This can be testified by the amplified global trade value of medical furniture, which accounted for USD 5.3 billion in 2023 with a 4.7% annual growth rate, as reported by the Observatory of Economic Complexity (OEC).

The current economic dynamics of the automated hospital beds market indicate a high influence of value-based care models and reimbursement policy upgrades that emphasize cost efficiency and patient outcomes. The cohort of major payers in this sector includes government programs and private insurers, who tend to scrutinize the affordability ratio of automated beds, often linking scale and range of financial backing to patient safety and hospital stays. However, variations in payers’ pricing structures are observed across regional differences, where the trend of public funding and procurement differs. In this regard, a 2022 NLM publication unveiled that the addition of a single bed to the hospital capacity in Sweden holds the potential to deliver 3 quality-adjusted life years (QALYs) at USD 120 thousand.