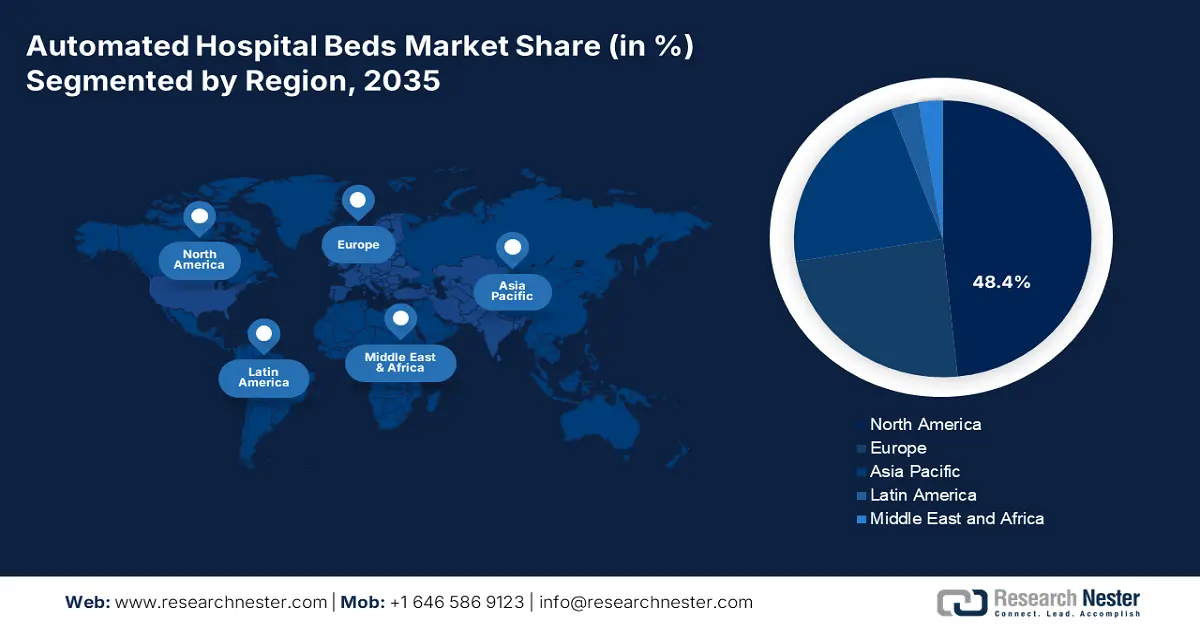

Automated Hospital Beds Market - Regional Analysis

North America Market Insights

North America is anticipated to register the highest share of 48.4% in the automated hospital beds market by the end of 2035. The presence of a progressive and adaptive medical system is the primary growth factor in this region. On the other hand, the strict regulations for patient safety and the massive nurse workload collectively garner a large demand base in North America for these advanced infrastructural solutions. Furthermore, the region’s internationally dominating emphasis on MedTech evolution and AI integration is solidifying its position in this sector.

According to the 2022 National Hospital Ambulatory Medical Care Survey, approximately 17.8 million emergency department visits in the U.S. resulted in hospital admission. Besides, the U.S. Bureau of Labor Statistics unveiled that the country is predicted to demand more than 275,000 additional nurses from 2020 to 2030. These figures reflect the urgent need for workload reduction solutions in nationwide healthcare facilities. In response, the combined support from federal, state, and local industry programs is highlighting the effectiveness of automated hospital systems, securing a stable cash inflow in this landscape.

The Canada market is following a consistent pace of growth with promising federal commitments and provincial infrastructural reinforcements. As evidence, between 2022 and 2023, support and nursing inpatient services accounted for 33.6-50.1% of the total hospital spending across provinces in the country, as per the C.D. Howe Institute. Besides, in July 2024, the government of Canada dedicated USD 25 billion of its USD 200 billion over 10 years funding to quenching unique health system needs, including workforce empowerment and modernization through digital equipment.

APAC Market Insights

Asia Pacific is expected to become the fastest-growing region in the automated hospital beds market during the analyzed tenure. The accelerated growth of the region is attributed to the robust digital transformation of healthcare infrastructure, which is further accompanied by the aging population and increased government expenditures in healthcare. Besides, technological advances in medical devices are also gaining traction in APAC, empowering the incorporation of sensor-based mobility tracking and automated patient management features in the beds used across hospital settings.

Japan is one of the prominent innovation hubs in the APAC market, which is accomplished through the country’s strong emphasis on the development and utilization of AI-powered medical infrastructure. On the other hand, the nation’s enlarging geriatric population fosters a substantial consumer base for the merchandise. In this regard, a 2022 study from the Journal of Aging and Health Research predicted more than 1.6 million deaths to take place every year in Japan between 2030 and 2065 due to old age. This is pushing the governing authorities to accommodate more cutting-edge equipment in nationwide hospitals.

India is emerging as a growth engine for the Asia Pacific automated hospital beds market on account of rapid healthcare infrastructure development and increasing public investments. Testifying to the capital influx, the IBEF reported that government-led budget allocation to the development, maintenance, and enhancement of the country's healthcare system increased by 9.7% from 2024 to 2025. Additionally, the country presents a demand for an additional 3.6 million hospital beds by 2034 to meet global healthcare standards, reflecting the potential of this landscape as a lucrative investment opportunity.

Country-wise Export Data for Medical or Surgical Furniture (2023)

|

Country |

Export Value (in USD) |

|

Vietnam |

58.7 million |

|

Japan |

40.3 million |

|

Australia |

39.4 million |

|

Indonesia |

21.3 million |

|

India |

20.3 million |

|

Thailand |

7.2 million |

|

Korea, Rep. |

6.1 million |

|

Malaysia |

5.6 million |

Source: WITS

Europe Market Insights

The Europe automated hospital beds market is estimated to garner a notable industry value over the timeline between 2026 and 2035. The region’s consistent performance in this category is primarily backed by the aging populations, rising admissions to intensive care units (ICUs), and national policies for the modernization of healthcare infrastructures. Further, the European Health Data Space (EHDS) and EU4Health Programme are equally contributing to this cohort as accelerators in the automation of technologies by placing sufficient funds.

The National Health Service (NHS) in the UK is continuing to extend the coverage of financial backing for recovery from surgery and long-term care, which is enabling a continuous flow of cash in the automated hospital beds market. As evidence, the gross expenditure on medical infrastructure in the country rose from USD 3.5 trillion to USD 4.0 trillion between 2022 and 2023, as per the 2025 report from the Office for National Statistics. Other government initiatives aimed at modernizing healthcare equipment and integrating smart technologies are also fueling growth in this landscape.

The nationwide implementation of the Hospital Future Act is the major driving factor in the Germany automated hospital beds market. Besides, high standards for medical service and equipment quality in the country set a benchmark for infrastructural reinforcement, which creates a surge in continuous advances in the MedTech industry. On the other hand, an aging population and increasing occurrence of chronic diseases create sustained demand in this sector, shaping both domestic supply and international trade dynamics.

Country-wise Export Data for Medical or Surgical Furniture (2023)

|

Country |

Export Value (in USD) |

|

Netherlands |

245.1 million |

|

Poland |

220.5 million |

|

France |

144.3 million |

|

Italy |

129.3 million |

|

UK |

112.2 million |

|

Turkey |

83.8 million |

|

Spain |

82.6 million |

Source: WITS